QUOTE(cybpsych @ Nov 11 2021, 09:16 AM)

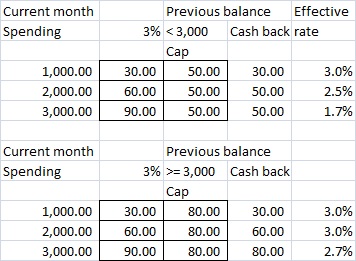

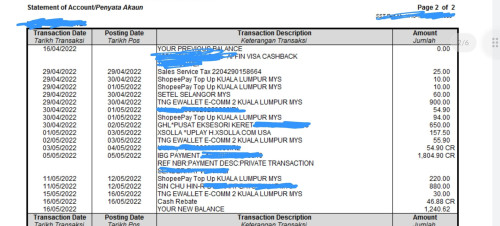

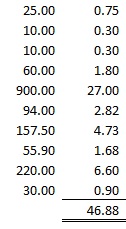

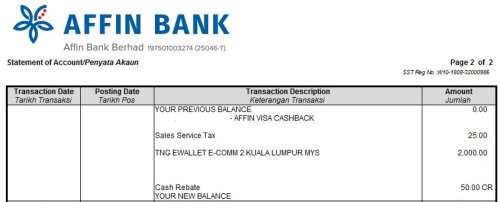

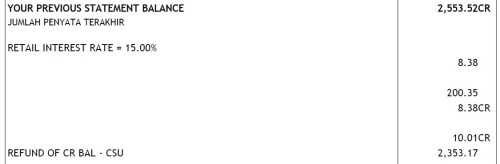

1) of course! rm3000 balance is for WHOLE statement balance, not just transactions. that means, advance payments, cashback, reversals/refunds, BTs, etc would affect the statement balance.

2) maximize the card feature lor. what was the real reason(s) you applied Duo?

ya, i guess what he meant was how to entitle RM 802) maximize the card feature lor. what was the real reason(s) you applied Duo?

when u have no previous statement balance due to new to card

Nov 11 2021, 09:46 AM

Nov 11 2021, 09:46 AM

Quote

Quote

0.1947sec

0.1947sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled