QUOTE(slee03 @ Nov 11 2020, 07:07 PM)

Hello Neighbours,

Some already signed SPA since late Sep or early Oct 2020 and have the stamped document (CTC) collected. Now just wait for developer's letter for progress interest payment? Bank also got auto debit some charges right?

This is my first underconstruction property purchase 😅

Ini you have to read your bank's letter of offer for loan.Some already signed SPA since late Sep or early Oct 2020 and have the stamped document (CTC) collected. Now just wait for developer's letter for progress interest payment? Bank also got auto debit some charges right?

This is my first underconstruction property purchase 😅

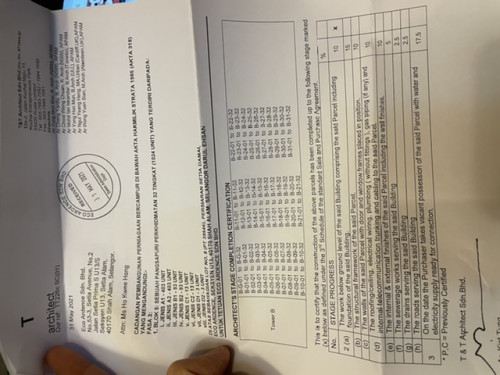

Usually for under-contruction property, banks will charge progressive interest payment once developer send bill to bank to release loan based on Schedule G/H completion. Certain administrative fees might be deducted as well.

If your loan margin is less than 90% of SPA price, then you'll be in charge of paying up the first few % of the Schedule G/H that is completed before developer will bill to bank.

This post has been edited by DragonReine: Nov 11 2020, 07:18 PM

Nov 11 2020, 07:17 PM

Nov 11 2020, 07:17 PM

Quote

Quote

0.0522sec

0.0522sec

1.57

1.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled