KUALA LUMPUR (April 29): Bank Negara Malaysia (BNM) has announced the five successful applicants for the digital bank licences as approved by the Minister of Finance (MoF).

The following applicants are to be licensed under the Financial Services Act 2013 (FSA):

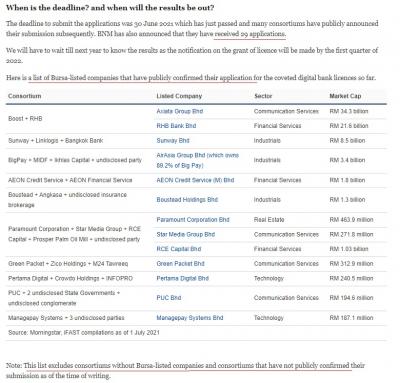

• a consortium of Boost Holdings Sdn Bhd. and RHB Bank Bhd;

• a consortium led by GXS Bank Pte Ltd. and Kuok Brothers Sdn Bhd; and

• a consortium led by Sea Ltd and YTL Digital Capital Sdn Bhd.

The following applicants are to be licensed under the Islamic Financial Services Act 2013 (IFSA):

• a consortium of AEON Financial Service Co Ltd, AEON Credit Service (M) Bhd and MoneyLion Inc and

• a consortium led by KAF Investment Bank Sdn Bhd.

Three out of the five consortiums are majority-owned by Malaysians namely Boost Holdings and RHB Bank, Sea and YTL Digital Capital and KAF Investment Bank, said BNM in a statement on Friday.

Sources:

https://www.theedgemarkets.com/article/flas...sea-aeon-credit

https://fintechnews.my/31002/virtual-bankin...laysia-winners/

This post has been edited by Kadaj: Apr 29 2022, 03:31 PM

Banking BNM announced 5 digital bank licences

May 15 2020, 07:47 AM, updated 4y ago

May 15 2020, 07:47 AM, updated 4y ago

Quote

Quote

0.1641sec

0.1641sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled