QUOTE(MystiqueLife @ Feb 1 2023, 12:01 AM)

Quick question, does Wise charge incoming TT to Wise accounts, if yes; how do you minimise the charges?

TT from where to where? Why not use Wise app for the transfer instead?Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Feb 1 2023, 07:21 AM Feb 1 2023, 07:21 AM

Return to original view | IPv6 | Post

#41

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

|

|

|

Feb 1 2023, 06:31 PM Feb 1 2023, 06:31 PM

Return to original view | IPv6 | Post

#42

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Feb 1 2023, 09:47 PM Feb 1 2023, 09:47 PM

Return to original view | Post

#43

|

Senior Member

2,193 posts Joined: Feb 2012 |

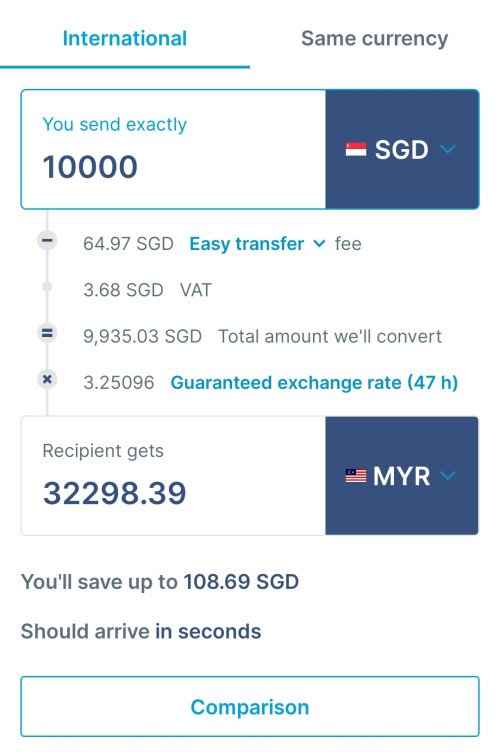

QUOTE(MystiqueLife @ Feb 1 2023, 09:14 PM) The only charges incurred is displayed below, WYSIWYG...Having said that, specifically for SG to MY remittance, the cheapest method is to transfer from your own CIMB SG account to your own CIMB MY account, provided you have those accounts. Else Wise is usually close enough.  |

|

|

Feb 2 2023, 09:17 AM Feb 2 2023, 09:17 AM

Return to original view | Post

#44

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(ideaplus @ Feb 2 2023, 08:55 AM) Yes, I know no extra features except 0% foreign exchange conversion mark-up You will need to check actual amount charged for those two cards vs. Wise and make your own comparison on which is better...Only wondering which method can bring more benefit if spending at oversea using Wise MY and these 2 CC |

|

|

Feb 19 2023, 09:25 AM Feb 19 2023, 09:25 AM

Return to original view | IPv6 | Post

#45

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(datolee32 @ Feb 19 2023, 07:55 AM) Then I should keep it in my Wise EU wallet, I have been using method 2 for quite some time, a lesson learned! Thanks for all the information, it is really helpful. Your method one is just delaying the fees incurred when finally moving your money to the Malaysian bank account. Wise makes money from forex and from transfers. One way you can save money is to just spend the MYR in your Wise wallet, to avoid the transfer fee. datolee32 liked this post

|

|

|

Feb 19 2023, 05:18 PM Feb 19 2023, 05:18 PM

Return to original view | IPv6 | Post

#46

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Boy96 @ Feb 19 2023, 02:22 PM) I have just calculated, for 1000 usd, send straight from usd wallet to bank account is the same value as converting it to MYR wallet first and then transfer to bank QUOTE(MystiqueLife @ Feb 19 2023, 04:41 PM) Yes, tested this already. Good to keep around 4500 USD in wallet to take advantage of the exchange rate when MYR becomes cheaper There are two fees from Wise, one is to exchange currency, and another is to move your money. Whether doing it both at once or separately doesn't change the fee being charged. |

|

|

|

|

|

Mar 15 2023, 12:13 PM Mar 15 2023, 12:13 PM

Return to original view | IPv6 | Post

#47

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(kons @ Mar 15 2023, 11:53 AM) now i'm using wise in sweden on daily basis. Malaysian Wise card can use Apple Pay now? Someone mentioned only those cards issued to Singaporean users can use .. hmm.just that cannot use wave. have to insert the card into the machne and use pin. but using apple pay (using my mbb, hsbc, ambank card) can go through. |

|

|

Mar 15 2023, 12:13 PM Mar 15 2023, 12:13 PM

Return to original view | IPv6 | Post

#48

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Mar 15 2023, 02:02 PM Mar 15 2023, 02:02 PM

Return to original view | IPv6 | Post

#49

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Apr 15 2023, 09:44 AM Apr 15 2023, 09:44 AM

Return to original view | IPv6 | Post

#50

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Jul 15 2023, 09:27 AM Jul 15 2023, 09:27 AM

Return to original view | IPv6 | Post

#51

|

Senior Member

2,193 posts Joined: Feb 2012 |

What's the withdrawal limit these days? What's the max amount of THB that I can withdraw from Thai bank ATMs without fees? It's free withdrawal for the first RM1k, correct?

|

|

|

Aug 30 2023, 08:41 PM Aug 30 2023, 08:41 PM

Return to original view | Post

#52

|

Senior Member

2,193 posts Joined: Feb 2012 |

Just to share I sent money from my brokerage in USA via ACH to Wise, and it was completely free. However, it took 3 business days to reach my Wise USD account. Thereafter, I checked the cost to transfer from the US account to my Malaysian bank, and it was at 4.64 exchange rate today, and there were no additional fees (wire fees, swift fees, etc.) imposed, and charges were only about $6+ for each $1000.

But it did make me wonder, if I wire $10,000 over it would incur a flat $25 wire fee only, rather than $62 using Wise. Need to keep exploring the different ranges and fees. This post has been edited by gooroojee: Aug 30 2023, 08:42 PM |

|

|

Sep 7 2023, 12:29 PM Sep 7 2023, 12:29 PM

Return to original view | IPv6 | Post

#53

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(richtrons @ Sep 7 2023, 12:20 PM) Hi, i would like to transfer USD from alliance online foreign currency account to my wise USD account. But alliance requires beneficiary bank name. Let me know if this works. Plan to do the same next monthDoes anyone know how i can get the bank name for wise usd account? |

|

|

|

|

|

Sep 7 2023, 09:29 PM Sep 7 2023, 09:29 PM

Return to original view | IPv6 | Post

#54

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(richtrons @ Sep 7 2023, 05:23 PM) In the Wise app there is only Account Holder name, routing number, swift code, Account number and Wise's address. From WISE FAQ:there is no bank account name tho. QUOTE When your sender enters your account details in their bank's system, they might see Community Federal Savings Bank (CFSB) if the routing number starts with 026, or Evolve Bank and Trust (EVOLVE) if the routing number starts with 084. This is because Wise's USD accounts are with both CFSB, and EVOLVE. Your sender's bank may ask for e-teller ID, but we won't have this information. When setting up the transfer, your sender should add your account details manually instead of selecting Evolve or CFSB from a list of available banks. If you have any questions about your account, always talk to Wise support team — CFSB or EVOLVE won’t be able to give you any information, because you don't have an account directly with them. For International transfers of USD from outside USA to Wise USD account (which has a USA bank account): If you have a SWIFT code, you can receive USD from anywhere in the world. Your sender should go to their bank to set up a SWIFT transfer using your USD account details. This can take 4–5 working days to reach Wise. When setting up the SWIFT transfer, they should choose 'checking' as the account type. If someone sends you money using a SWIFT transfer, we'll charge a 4.14 USD fee. CMFGUS33 is the SWIFT code for COMMUNITY FEDERAL SAVINGS BANK, which is the SWIFT code used by Wise USD accounts. Doesn't matter which bank it ends up in, as Wise processes the inbound transfer and into your specific account based on your account number. iamloco liked this post

|

|

|

Sep 7 2023, 09:41 PM Sep 7 2023, 09:41 PM

Return to original view | IPv6 | Post

#55

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Sep 7 2023, 10:15 PM Sep 7 2023, 10:15 PM

Return to original view | IPv6 | Post

#56

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Sep 8 2023, 12:03 AM Sep 8 2023, 12:03 AM

Return to original view | IPv6 | Post

#57

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(leo2010 @ Sep 7 2023, 11:51 PM) Ah then all good. I just can't remember, but my card PIN is my favorite number, so I know I've changed it before. Just wasn't sure if it was via app (when it was still possible) or via ATM... way back when.. |

|

|

Sep 18 2023, 09:56 PM Sep 18 2023, 09:56 PM

Return to original view | IPv6 | Post

#58

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Medufsaid @ Jul 12 2023, 09:43 AM) SMRT will charge a daily surcharge of S$0.60 if your card is foreign registered (Wise card is based on your registered address), so if have to fallback to another foreign credit/debit card, better to not use Wise https://www.finextra.com/newsarticle/42960/...ise-partnershipSwift partnering with Wise... |

|

|

Sep 20 2023, 11:47 AM Sep 20 2023, 11:47 AM

Return to original view | Post

#59

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Sep 23 2023, 07:27 AM Sep 23 2023, 07:27 AM

Return to original view | IPv6 | Post

#60

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

| Change to: |  0.0846sec 0.0846sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 02:38 AM |