QUOTE(CharmaineLee80 @ Jan 24 2022, 11:58 AM)

For me, not with Ameritrade Singapore but for Interactive Brokers US. Works like a charm for ACH transfers.Wise (Transferwise) Malaysia Discussion, v1.0

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Jan 24 2022, 05:17 PM Jan 24 2022, 05:17 PM

Return to original view | IPv6 | Post

#21

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(CharmaineLee80 @ Jan 24 2022, 11:58 AM) For me, not with Ameritrade Singapore but for Interactive Brokers US. Works like a charm for ACH transfers. TOS liked this post

|

|

|

|

|

|

Jan 24 2022, 05:19 PM Jan 24 2022, 05:19 PM

Return to original view | IPv6 | Post

#22

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(yungkit14 @ Jan 24 2022, 12:01 PM) BigPay is still behind in terms of international payments, you cannot hold foreign currency and don’t even have banking account details if you want people to transfer money to you. I suggest you get Wise if you do a lot of travelling and international transfers. |

|

|

Jan 24 2022, 05:21 PM Jan 24 2022, 05:21 PM

Return to original view | IPv6 | Post

#23

|

Junior Member

230 posts Joined: Nov 2021 |

|

|

|

Jan 24 2022, 10:55 PM Jan 24 2022, 10:55 PM

Return to original view | IPv6 | Post

#24

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(dwRK @ Jan 24 2022, 06:23 PM) yeah... I pick normal because don't need it... lol Yeah at this point, I spent a lot of money using Wiseget for testing... but so far spent RM 500 using it liao... hahaha loaded with foreign currencies too. .. gonna test online orders soon... Like buying goods in USD, funding my IBKR account and most recently testing the Wise card for contactless payments. I plan to use this card when I travel to Singapore. |

|

|

Jan 25 2022, 01:56 PM Jan 25 2022, 01:56 PM

Return to original view | IPv6 | Post

#25

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(Justmua @ Jan 25 2022, 01:49 PM) Anyone tried receiving money from Sg bank account with the Wise SGD bank details? Not yet, I have a Singaporean friend that could try; it should work like normal. I actually tried doing bank transfer from my Malaysian bank account to my Wise MYR Balance. It worked, just make sure you put JP Morgan Chase Bank Berhad (Wise’s partner bank) and account number; you should receive it within a day. I assume it would be similar in Singapore.Thanks for sharing. This post has been edited by The1stHumanBeing: Jan 25 2022, 01:57 PM |

|

|

Jan 25 2022, 07:20 PM Jan 25 2022, 07:20 PM

Return to original view | IPv6 | Post

#26

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(jack2 @ Jan 25 2022, 06:44 PM) can foreigner use personal wise to send fund to Malaysia business bank account which is under business / company name? Yes lol, you can use your personal Wise account to transfer money to your own account, family/friends & businesses. However, you can’t hold more than RM20k (includes all currency holdings) unless you have a SSM certificate.This post has been edited by The1stHumanBeing: Jan 25 2022, 07:24 PM |

|

|

|

|

|

Jan 25 2022, 07:28 PM Jan 25 2022, 07:28 PM

Return to original view | IPv6 | Post

#27

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(jack2 @ Jan 25 2022, 07:04 PM) Yes, there are two ways, you can send SGD thru Wise and directly transfer it back to your MYR bank account (based on their forex rate and fees). Or send SGD to your Wise SGD balance; convert your SGD to your MYR balance (based on their forex rate and fees), then finally transfer back to your MYR bank account (Which has a small fee, I tried it before). |

|

|

Jan 25 2022, 10:01 PM Jan 25 2022, 10:01 PM

Return to original view | IPv6 | Post

#28

|

Junior Member

230 posts Joined: Nov 2021 |

|

|

|

Jan 25 2022, 10:05 PM Jan 25 2022, 10:05 PM

Return to original view | IPv6 | Post

#29

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(TOS @ Jan 25 2022, 07:43 PM) First time trying CHF transfer from SGD bank account via Wise currency balance to IBKR. Not sure if they will question anything. Yeah I use Wise to fund my IBKR US account. Usually the fee would be ~$0.5 to convert and free to transfer to my trading account via ACH.There is a deduction of 0.5 CHF for the transfer though. Keeping my fingers crossed. |

|

|

Jan 25 2022, 10:09 PM Jan 25 2022, 10:09 PM

Return to original view | IPv6 | Post

#30

|

Junior Member

230 posts Joined: Nov 2021 |

|

|

|

Jan 26 2022, 12:16 PM Jan 26 2022, 12:16 PM

Return to original view | IPv6 | Post

#31

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(TOS @ Jan 25 2022, 10:17 PM) USD is ok because the Wise account is under your name. CHF is a whole different story. The Wise account for CHF is not under our name, but that of Wise. Appreciate the deals, you are right for the Swiss balance; there are no account details. Meaning, your funds are under Wise’s name and not your name. That’s why I ultimately picked IBKR with a USD balance as I mainly focus on the US stock market and Wise has USD bank details. A simple tutorial for those who want to fund IBKR with CHF via Wise multicurrency account: 1. Set up deposit notice in IBKR via Bank Wire (for bank name, just type "Wise" without quotation marks " ", then they will give you the Credit Suisse account IBAN number and SWIFT code) 2. Open CHF account balance in Wise, then transfer money to fund CHF account in Wise (usually convert from other currencies like MYR, SGD, USD etc.) (Step 1 and 2 can be reversed, done in either order is fine since they are independent of one another.) 3. Now transfer the money from your CHF currency balance to Wise, just send the money from your currency balance like you did with USD/SGD etc. Points to note: You don't need to fill up the email address column, just enter the recipient name Interactive Brokers LLC and the IBAN number (Wise will automatically verify it's a Credit Suisse account after you fully enter the account number), complete the transfer process by verifying with a TAC SMS, then just wait for one hour to one hour and 15 minutes for the transaction to go through. A fee of 0.5 CHF will be deducted from the currency balance. So if you fund your currency balance with 900 CHF, you can only send out a maximum of 899.5 CHF. 4. 1-1.25 hours later the CHF money should reflect in your IBKR currency balance. Note that you should not have more than 50k CHF in your IBKR account, otherwise you will be charged negative interest rates, which means money will be deducted from your Swiss account (you are paying the broker "free" money). Swiss benchmark rates are around -0.75% https://www.interactivebrokers.com/en/accou...erest-rates.php Another point to note is as the transfer is in the name of Wise (unlike USD ACH transfer under your name), you should be prepared for potential AMLA actions from the broker in the future, should one arise. |

|

|

Jan 26 2022, 04:02 PM Jan 26 2022, 04:02 PM

Return to original view | Post

#32

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(jack2 @ Jan 26 2022, 12:21 PM) WISE business account needs to be verified like sending SSM documents? At first you don't need to verify your SSM documents immediately, however they would ask the nature of your business in the future. Best you give them as much details upfront to prevent any inconveniences in the future.How to pay the setup fee of RM113 if there is no MYR money in the account? As I don't have a business account, I'm not very sure; but like the personal account you need to deposit RM101 before being able to use the Wise Card. I assume you would also have to do the same with your Wise Business account. You can either transfer MYR from your Wise Personal account to your new business account or just top-up your Wise Business account via FPX. |

|

|

Jan 27 2022, 08:14 AM Jan 27 2022, 08:14 AM

Return to original view | Post

#33

|

Junior Member

230 posts Joined: Nov 2021 |

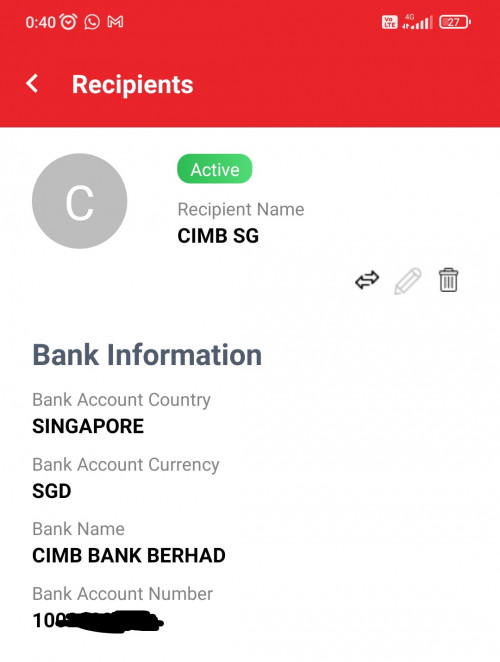

QUOTE(Hoshiyuu @ Jan 27 2022, 12:45 AM) Er, I'm sorry if I misunderstood, but have you checked your CIMB SG to see if your money is there? Yeah agree with Hoshiyuu, if I understood you correctly Davidtcf.Reading back your post, I think your intention is to send money to CIMB SG right? Then, the customer service support said your money is sent to CIMB SG (bank code 7986) and the recipient number starts with 1 right? And you think that you got it wrong because the recipient bank said CIMB Berhad? Just FYI CIMB SG official name is CIMB Bank Berhad (Singapore Branch). As you mentioned, transfer validity refers only to the account number itself, which you have not entered wrongly. Again, sorry if I got the situation wrong.  Your intention was to transfer money from your CIMB MY account to your CIMB SG account via Wise. So far, you have asked CIMB MY and Wise regarding the transaction you made. Maybe consider getting in touch with CIMB SG regarding your funds. Since CIMB SG are also part of the transaction process. According to my search, CIMB SG is legally named CIMB Bank Berhad (Singapore Branch) from the website link I found below. https://www.cimb.com/en/who-we-are/our-pres.../singapore.html Trying to save a recipient's details on Wise, CIMB SG is legally named CIMB Bank Berhad and it gives a bank code of 7986; when I wanted to check back on my recipient's details. I suggest you also communicate with CIMB SG just to be sure; financial institutions are highly regulated in order to prevent money laundering and funding terrorism. There is no way your money can just get lost in a transaction . This post has been edited by The1stHumanBeing: Jan 27 2022, 08:23 AM |

|

|

|

|

|

Jan 27 2022, 04:39 PM Jan 27 2022, 04:39 PM

Return to original view | IPv6 | Post

#34

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(Davidtcf @ Jan 27 2022, 12:05 PM) resolved already money is in my SG CIMB.. I did not realize it coz account not yet activated couldn't see. Bruh, you worry yourself for nothing. At least, you know your money is safe in your new CIMB SG account. Wish you the best in your SG account expenses Called CIMB SG they confirmed with me the money is there. |

|

|

Jan 29 2022, 06:32 PM Jan 29 2022, 06:32 PM

Return to original view | IPv6 | Post

#35

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(wkkm007 @ Jan 29 2022, 06:01 PM) Can, but you need at least RM200 balance, as they would hold the RM200 before returning to you the unused amount so like you refuel RM50, they would return RM150. wkkm007 liked this post

|

|

|

Jan 30 2022, 05:35 PM Jan 30 2022, 05:35 PM

Return to original view | IPv6 | Post

#36

|

Junior Member

230 posts Joined: Nov 2021 |

QUOTE(wkkm007 @ Jan 30 2022, 04:07 PM) What is the courier service or normal postage for free delivery option for wise card? Thank you If you chose the normal postage, it would originally start with SingPost in Singapore then be transferred to Pos Malaysia once it arrives in Malaysia. My assumption since I used DHL express but inside the packaging it had SingPost envelope.Apply on 19/01/22 wkkm007 liked this post

|

|

|

Feb 5 2022, 09:52 AM Feb 5 2022, 09:52 AM

Return to original view | IPv6 | Post

#37

|

Junior Member

230 posts Joined: Nov 2021 |

|

|

|

Feb 5 2022, 09:55 AM Feb 5 2022, 09:55 AM

Return to original view | IPv6 | Post

#38

|

Junior Member

230 posts Joined: Nov 2021 |

|

| Change to: |  0.0855sec 0.0855sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:52 AM |