Standby for Roche and Nestle.

This post has been edited by TOS: Jan 25 2022, 09:07 PM

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Jan 25 2022, 08:53 PM Jan 25 2022, 08:53 PM

Return to original view | Post

#21

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Confirmed CHF entered account. Just a little more than one hour!

Standby for Roche and Nestle. This post has been edited by TOS: Jan 25 2022, 09:07 PM |

|

|

|

|

|

Jan 25 2022, 10:17 PM Jan 25 2022, 10:17 PM

Return to original view | Post

#22

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(The1stHumanBeing @ Jan 25 2022, 10:05 PM) Yeah I use Wise to fund my IBKR US account. Usually the fee would be ~$0.5 to convert and free to transfer to my trading account via ACH. USD is ok because the Wise account is under your name. CHF is a whole different story. The Wise account for CHF is not under our name, but that of Wise. A simple tutorial for those who want to fund IBKR with CHF via Wise multicurrency account: 1. Set up deposit notice in IBKR via Bank Wire (for bank name, just type "Wise" without quotation marks " ", then they will give you the Credit Suisse account IBAN number and SWIFT code) 2. Open CHF account balance in Wise, then transfer money to fund CHF account in Wise (usually convert from other currencies like MYR, SGD, USD etc.) (Step 1 and 2 can be reversed, done in either order is fine since they are independent of one another.) 3. Now transfer the money from your CHF currency balance to Wise, just send the money from your currency balance like you did with USD/SGD etc. Points to note: You don't need to fill up the email address column, just enter the recipient name Interactive Brokers LLC and the IBAN number (Wise will automatically verify it's a Credit Suisse account after you fully enter the account number), complete the transfer process by verifying with a TAC SMS, then just wait for one hour to one hour and 15 minutes for the transaction to go through. A fee of 0.5 CHF will be deducted from the currency balance. So if you fund your currency balance with 900 CHF, you can only send out a maximum of 899.5 CHF. 4. 1-1.25 hours later the CHF money should reflect in your IBKR currency balance. Note that you should not have more than 50k CHF in your IBKR account, otherwise you will be charged negative interest rates, which means money will be deducted from your Swiss account (you are paying the broker "free" money). Swiss benchmark rates are around -0.75% https://www.interactivebrokers.com/en/accou...erest-rates.php Another point to note is as the transfer is in the name of Wise (unlike USD ACH transfer under your name), you should be prepared for potential AMLA actions from the broker in the future, should one arise. This post has been edited by TOS: Jan 25 2022, 10:29 PM |

|

|

Mar 2 2022, 12:18 AM Mar 2 2022, 12:18 AM

Return to original view | Post

#23

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 2 2022, 10:41 AM Mar 2 2022, 10:41 AM

Return to original view | Post

#24

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 2 2022, 02:10 PM Mar 2 2022, 02:10 PM

Return to original view | Post

#25

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(~~5ive~~ @ Mar 2 2022, 12:11 PM) Hi all, can i confirm that WISE cannot transfer money to taiwan bank account? I check the currency list and TWD is not listed there. Yes, no NTD available for transfer for now. Taiwan has strict capital control measures, unlike SG or HK.This post has been edited by TOS: Mar 2 2022, 06:09 PM |

|

|

Mar 15 2022, 01:05 PM Mar 15 2022, 01:05 PM

Return to original view | Post

#26

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Mar 25 2022, 08:47 PM Mar 25 2022, 08:47 PM

Return to original view | Post

#27

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hoshiyuu @ Mar 25 2022, 07:30 PM) Official email from Wise that I received today - only on the fee portion, so it's not as bad as it sound, and only when remitting from these currencies to MYR (which I believe CIMB SG->MY still offering better rates). Yup, I received the same email too.Still, any more cost is cost, always feel bummed about it, hahaha.  |

|

|

Jun 19 2022, 11:25 PM Jun 19 2022, 11:25 PM

Return to original view | Post

#28

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Aug 30 2022, 08:50 PM Aug 30 2022, 08:50 PM

Return to original view | Post

#29

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Wise user alert!

Wise Wise fined by Abu Dhabi over anti-money laundering failures Payment fintech under pressure as economic conditions worsen and chief probed in UK by Siddharth Venkataramakrishnan and Emma Dunkley in London (2 HOURS AGO) » Click to show Spoiler - click again to hide... « |

|

|

Sep 5 2022, 09:42 PM Sep 5 2022, 09:42 PM

Return to original view | Post

#30

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Revolut news, but no revolut thread, so post at its closest competitor's thread...

Financial services Revolut under pressure after UK regulators find audit flaws Financial Reporting Council said failures created ‘unacceptably high’ risk of misstatement for $33bn fintech by Laura Noonan, Michael O’Dwyer and Siddharth Venkataramakrishnan in London 10 HOURS AGO » Click to show Spoiler - click again to hide... « |

|

|

Sep 10 2022, 09:25 PM Sep 10 2022, 09:25 PM

Return to original view | Post

#31

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Sep 10 2022, 10:04 PM Sep 10 2022, 10:04 PM

Return to original view | Post

#32

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Sep 10 2022, 10:52 PM Sep 10 2022, 10:52 PM

Return to original view | Post

#33

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ziling60 @ Sep 10 2022, 09:51 PM) Declare before the transfer, or after the transfer was made? You do not need to worry about submit applications etc for inward remittance to Malaysia. Transfer money into Malaysia usually they won't ask question. (They would more than welcome it, especially now! I think this is kinda a normal procedures where the bank will ask for reason and proof of the sources before releasing the money to us right? Is that what you refer to? By the way, based on your SG-> MY example, it's most likely Wise will deal with this AML stuffs before releasing the money to your MY bank account. Just make sure you prepare proof of source of fund if Wise asks. Prepare bank account statements for the past 3 months, for example, if Wise wants to check transaction source/frequency etc. They will email you if they want to know about the necessary documents. I recently had trouble with paying uni tuition fees in HK with Instarem too. They withheld the fund for a few days and required bank account statements to release the money. I rarely use Instarem, so probably the large amount alerted them, but if you transfer a few ks often between your own bank accounts, it shouldn't be an issue with Wise/Instarem. This post has been edited by TOS: Sep 10 2022, 10:53 PM |

|

|

|

|

|

Sep 10 2022, 11:01 PM Sep 10 2022, 11:01 PM

Return to original view | Post

#34

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ziling60 @ Sep 10 2022, 10:57 PM) How abt ard 20k sgd? Do u think that will trigger any alarm at bnm or malaysia side? Wise confirm will ask tonnes of ques too i suppose? 20k SGD is a lot, high chance Wise/Instarem will ask. If you have done a few ks transfer with Wise/Instarem before, it should be fine. Anyway, just spare some documents in case Wise/Instarem asks. If the proof of fund is legal you will be fine. |

|

|

Sep 11 2022, 09:16 AM Sep 11 2022, 09:16 AM

Return to original view | Post

#35

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Sep 11 2022, 12:20 PM Sep 11 2022, 12:20 PM

Return to original view | Post

#36

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ziling60 @ Sep 11 2022, 12:16 PM) Oh no no ... i am not wanting to keep money in the Wise account. It is purely a bank A in overseas to bank B in malaysia transfer using Wise thats all. Will that be any issue? lol use Wise or CIMB SG for SG -> MY transfer, whichever gives the best rates.I quoted Instarem as an example only. Ram is right that Instarem only allows transfer from MYR to other currencies, so it's not applicable to your case. If you are very scared, can split the transactions into multiple tranche, say 5k SGD each time for a total of 4 transactions. Then it's much more unlikely to trigger any attention compared to a big 20k SGD in one go. This post has been edited by TOS: Sep 11 2022, 12:38 PM |

|

|

Sep 17 2022, 08:09 PM Sep 17 2022, 08:09 PM

Return to original view | Post

#37

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

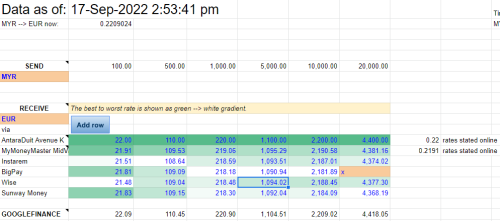

QUOTE(Takudan @ Sep 17 2022, 05:46 PM) I have a business trip to Europe soon, so I've just gotten my Wise card, paid RM13.70 and looks like it will be delivered to me in 10 working days. Do not forget that cash option requires you to travel to Mid-Valley etc. Some opportunity costs are not immediately obvious. ...but I'm still trying to understand how the borderless account works... Now I also compared several rates, and to my surprise, the cash option is way cheaper, assuming the advertised rates on their websites are true and without surcharge:  Another point to note is that Wise has the shittiest rate if it's a small amount (100 or below). So here are my questions, assuming the same rate holds: 1. What if I deposit into my EUR account at one go, and then I swipe Wise card when in Europe? Please confirm my example: - load 218 EUR (pay slightly less than RM1000) - swiped 10 transactions with Wise card, each at 21.48 EUR > my EUR account is now left with 3.2 EUR 2. What if I deposit into my MYR account, and do the same? Please confirm example: - load RM 1000 - swiped 10 transactions with Wise card, each at 21.48 EUR > my MYR account is deducted RM 100 each, resulting in 0 money left. If my examples are correct, then I'm planning to load my EUR account before travelling, then I have the freedom to either swipe my card directly, or just ATM to get some cash if I don't have enough. Now another follow up question: suppose I have excess EUR after the trip - will I be allowed to deposit to my IBKR broker via this EUR account? Note: I also see that it is possible to get IBAN/SWIFT code or something if I deposited some money first... does that give me a proper "bank account number" that the IBKR can flag as an account I own, rather than 3rd party? Petrol, highway jam, traffic, time, they all cost money. The online fintech total cost might be worse but it's direct and straightforward. The rates may change over time. Last time Wise is better than Instarem, but these days, Instarem seems to truimph Wise in total cost. It's hard to draw a conclusion based on one day observation. The best way is to compare just before you want to transfer. And your examples are highly theoretical. What makes you think it must be exactly 21.84 EUR every transaction? -------------------------- I have not tried depositing EUR to IBKR from Wise before. I only tried CHF (without account details). So far no issues from IB for CHF despite not having any account details. Wise's EUR balance has account details, so you can transfer money from there theoretically. https://wise.com/help/articles/2827505/how-...account-details Be mindful of outgoing transfer charges of 0.37 EUR for SEPA (EUR-EUR transfer). https://wise.com/gb/pricing/send-money?sour...etCcy=EUR&tab=0 As IBKR accepts SEPA transfer, you should be fine using the EUR account balance details from Wise. » Click to show Spoiler - click again to hide... « This post has been edited by TOS: Sep 17 2022, 10:04 PM Takudan liked this post

|

|

|

Sep 18 2022, 01:27 PM Sep 18 2022, 01:27 PM

Return to original view | Post

#38

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Takudan @ Sep 18 2022, 12:40 PM) Last 2 questions about account opening: Yes, the minimum deposit is required for just one time and thereafter you can get account details for the eligible account balances, including USD, SGD, EUR, MYR etc. You can withdraw the 101 MYR or send the money thereafter and restore your balance to 0 (but be mindful of transfer out charges).1. It requires me to deposit like RM 101 -- is that a permanent amount to park there, just like how we need to park a minimal amount in our bank accounts to prevent closure? 2. It warned that any amount entering the EUR account needs to be of my own name, to prevent money laundering yadayada, kinda like IBKR. Have you tried using different fintech to transfer into Wise account? (Relevant if Wise offers worse rate) Thank you all for very detailed answers. I am inclined to proceed with EUR account on Wise as I like that I can channel the excess into IBKR as investment, without another round of forex loss. Most likely you will deposit MYR or other currencies and convert to EUR within Wise. I think it's best not to transfer money into Wise from another fintech (except Wise itself) but I am not sure how strict Wise's regulation is. I have not transferred in from another fintech before. If the other fintech (e.g. Revolut) has account details like Wise, maybe you can try, but no guarantees of any consequences as a result. Takudan liked this post

|

|

|

Sep 28 2022, 08:58 AM Sep 28 2022, 08:58 AM

Return to original view | Post

#39

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ Sep 28 2022, 08:47 AM) hi TOS, Hi bro. First time transfer straightaway hit limit probably might trigger some alarm, but if you have good reasons (e.g. pay kids tuition fees etc.) then it will be fine. i understand Wise has a limit of RM30k for overseas transactions. Is this right? i presume if i do a RM30k transaction as a first, it will be flagged? In the worst case they will just email you to ask for bank account stataments (recent month) and related documents (e.g., kids uni documents). When my transaction was withheld by Instarem few weeks ago, one of their staffs even checked my LinkedIn profile to verify my identity. Not sure if Wise do the same. But back then it's 30k +20k transaction in consecutive days so too big an amount surely alerted them. This post has been edited by TOS: Sep 28 2022, 09:00 AM |

|

|

Sep 28 2022, 09:08 AM Sep 28 2022, 09:08 AM

Return to original view | Post

#40

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ Sep 28 2022, 09:01 AM) Let me teach you another pyschology trick. If you are afraid the transaction can't go through even after submitting the documents, you can mention at the end of your email to them that after submitting all these documents and if Wise/Instarem still can't approve, ask them to refund you the money and you shall use another service provider. Add pressure to the compliance team. That can help a lot since you have the pricing power with so many fintech service providers out there. This post has been edited by TOS: Sep 28 2022, 09:09 AM |

| Change to: |  0.0745sec 0.0745sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 11:41 AM |