QUOTE(kenji1903 @ Jan 7 2024, 09:37 PM)

Cash advance is only applicable to credit cards, the same action on a debit card is just called a withdrawal

Wise charges a 1.75% if not mistaken for overseas ATM withdrawal if you have reached your monthly withdrawal limit of RM 1000.

I just reread your message and I think we are talking about something different, your concern is more on the loading of money into the Wise card rather than the usage, I personally used direct bank transfer because it doesn’t incur any card fees

My worried is about loading money to the card with Cr Card

- replied from wise as below

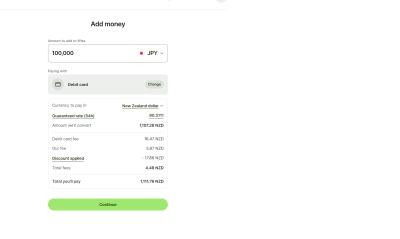

When you set up a transfer and choose a payment method - credit card, on the review you will see the total fee we are going to charge you.

However, the bank that issued your card might charged an extra fee — often called a ‘cash advance’.

Some banks charge an extra fee when you use your card for a transfer. It works like this:

When you pay for your transfer, Wise assigns a number called a Merchant Category Code (MCC) to your payment. MCCs help financial institutions categorise the kind of payment they’re processing.

Wise passes this MCC on to your bank — it’s always 4829 or 6012, which indicates that your payment is a ‘wire’ or ‘money order’.

Once the MCC we’ve assigned reaches your bank, they can choose how to charge for it. Some banks charge a fee for certain MCCs.

For instance, banks sometimes charge your transfer as a ‘cash advance’ or ‘cash withdrawal’. And this could come with an extra charge.

Wise doesn’t support this practice. But unfortunately, we have no control over it. It’s totally at the discretion of the bank that issued your card.

To check, whether this applies to you please call your bank and check how they charge for the MCC assigned to your payment.

If they’ve charged it as a cash advance or cash withdrawal, ask them why — and explain that the payment was not cash-related. They may be able to help.

Oct 4 2023, 09:12 AM

Oct 4 2023, 09:12 AM

Quote

Quote

0.0274sec

0.0274sec

0.99

0.99

7 queries

7 queries

GZIP Disabled

GZIP Disabled