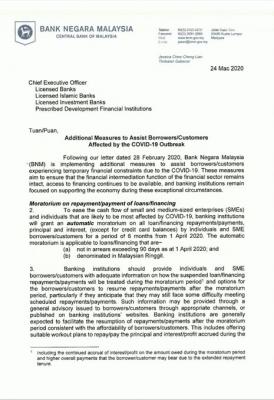

Refer to this attachment, very clear already.

Hire purchase, no need worry about interest and accrued interest. So just opt in don't reject. You pay same instalment 6 month later and loan extended 6 month

Mortgage, interest will be calculated on daily basis, Yes, with interest on interest. The amount will not be small.. So this one if your monthly repayment only paying less than 40% of the principal, better opt out if you can. Can rack up minimum 6k of interest in 6 month assuming the mortgage balance is above 250k.

After 6 month, there are 2 possibility, either bank allowed you to pay same instalment and extend the repayment period beyond 6 month, and the repayment backtrack to 6 months ago before the moratorium where the payment will allocated more to paid off interest than principle or bank increase the monthly instalment amount to cover for the 6 month accrued interest and repayment structure still backtrack to 6 month ago before moratorium where % paid to interest portion is higher than to principles balance.

Based on Summary on loan info, it look like the latter, instalment amount increases to cover new Balance.

Either way is not good.

BTW, above attachment sources is not from bnm but from uni suite, and the official letter from bnm clearly stated the acrued interest will be calculated and total balance will be adjusted and it look like for all loan not only limited to mortgage. So will need to verify the above source where they get the summary and most importantly which official bnm communication says no interest for hire-purchase as I can't find any online.

This post has been edited by wanted111who: Mar 26 2020, 06:15 AM

Attached thumbnail(s)

Mar 26 2020, 05:51 AM

Mar 26 2020, 05:51 AM

Quote

Quote

0.0275sec

0.0275sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled