QUOTE(responsible poster @ May 16 2020, 11:39 AM)

early 30s and for life insurance i see that most are at MYR500k which is quite standard? for medical i have company medical card as well so it would be an add on.

ok then let me just assume you are 30 this year. I used online life insurance

Fi Life (underwritten by Tokio Marine) to do this comparison with a simple ILP life insurance.

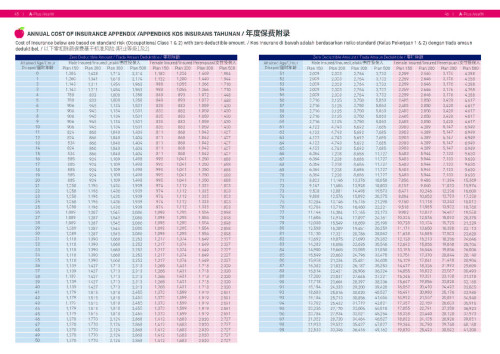

1. Fi Life Yearly Renewable Term (YRT) is the one that pays lesser now and premium will increase according to age (refer future premium rate).

2. Fi Life Level Term (LT) whereby premium is fixed for the following 20 years.

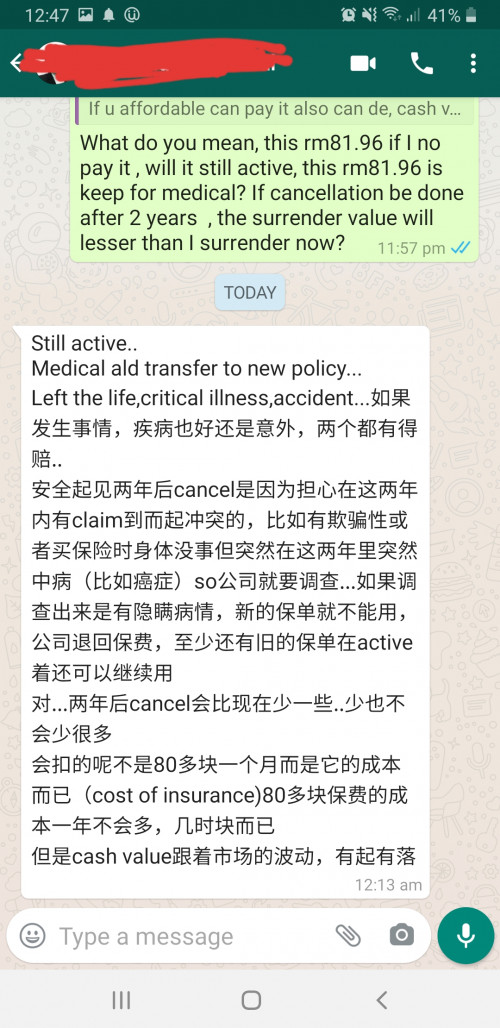

3. ILP whereby premium is non-guaranteed (yes for all ILP premium is non-guaranteed due to non-guaranteed fund performance).

Based on 500k life insurance for 20 years assuming you buy at the age of 30. The total cost for

1. Fi Life Yearly Renewable Term (YRT): RM34,316

2. Fi Life Level Term (LT): RM31,188

3. ILP: RM31,200 (have an estimation of cash value of RM25k at the end of 20th year)

The above cost also assumed if you don't do any investment. So i factored if you have RM35k now and you are investing in a 6% p.a investment vehicle and at the same time you are using the amount here to pay for the yearly premium. End of the 20th year, you will have more if you bought an ILP.

1. Fi Life Yearly Renewable Term (YRT)

2. Fi Life Level Term (LT)

3. ILP

do let me know if there are other online life insurance products that you are looking at so i can analyze for you

This post has been edited by ckdenion: May 16 2020, 04:38 PM

This post has been edited by ckdenion: May 16 2020, 04:38 PM

May 1 2020, 04:14 PM

May 1 2020, 04:14 PM

Quote

Quote

0.1630sec

0.1630sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled