Outline ·

[ Standard ] ·

Linear+

BNM Cut Rate Again But Not Benefit For New Loan, BNM Cut Rate Again But Not Benefit For N

|

Zwean

|

May 7 2020, 01:49 AM May 7 2020, 01:49 AM

|

|

QUOTE(icemanfx @ May 7 2020, 01:39 AM) Only those in denial or in transition to anger stage couldn't accept history, facts and data, still wanted to argue over it. you can argue until the cows come home, facts remain unchanged. by accepting the facts as it is will make you easier to face the reality and future. There we have the answer again, you should really do your homework first before coming online to copy paste comments to rack up on your post count. |

|

|

|

|

|

Zwean

|

May 10 2020, 05:57 PM May 10 2020, 05:57 PM

|

|

QUOTE(warface @ May 10 2020, 05:31 PM) i can still remember 2018 uob 4.45%. really syok oh below 3.3% 2014... 4.65 |

|

|

|

|

|

Zwean

|

May 10 2020, 05:57 PM May 10 2020, 05:57 PM

|

|

QUOTE(warface @ May 10 2020, 05:32 PM) if yesterday bought at future inflated price also gg.com That’s the issue during the bull run, everyone blinded by greed. Fortunately sufficient cooling measures were put in place. |

|

|

|

|

|

Zwean

|

May 10 2020, 06:09 PM May 10 2020, 06:09 PM

|

|

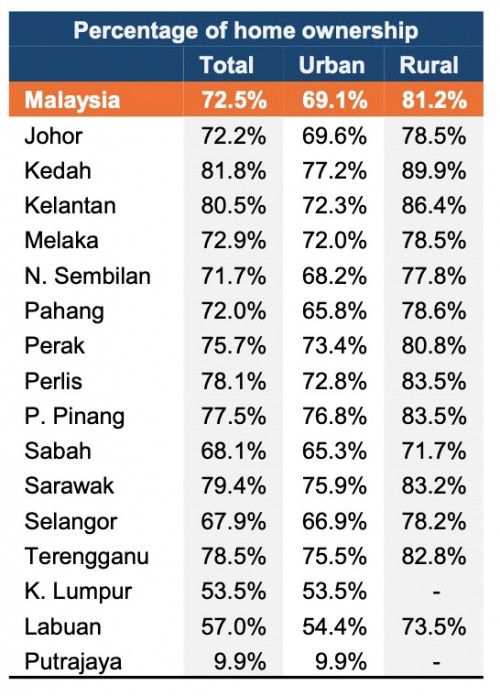

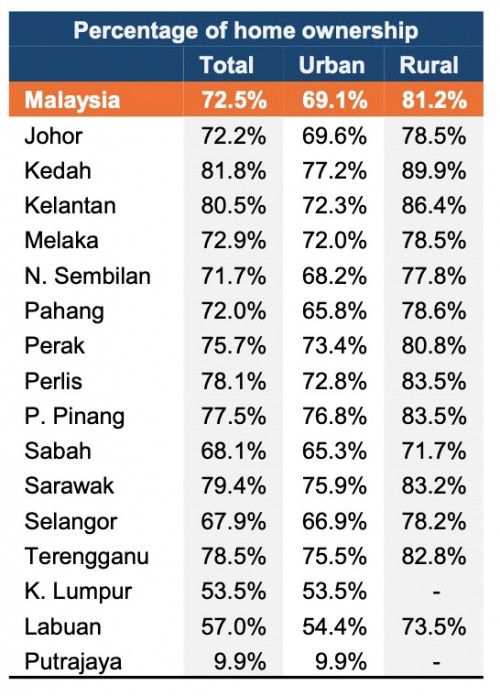

QUOTE(icemanfx @ May 10 2020, 06:02 PM) If cooling measures were sufficient, overhang won't be expanding. If insufficient, then you’ll see new projects priced at 700k instead of 400k now. Just measure with other countries as a yardstick. Perhaps you should study the numbers, majority of the overhang is in Johor. Launched prices are way above median. Also, FYI  |

|

|

|

|

|

Zwean

|

May 10 2020, 07:04 PM May 10 2020, 07:04 PM

|

|

QUOTE(icemanfx @ May 10 2020, 06:15 PM) Johor may top the overhang chart, numbers in kv is still substantial and widening. Our disposable income and economy is not comparable with other countries, is syok sendiri to compare. Even when you compare price to income ratio with our peers? Eg Thailand. Cause Bangkok is way more expensive than KL. |

|

|

|

|

|

Zwean

|

May 10 2020, 08:31 PM May 10 2020, 08:31 PM

|

|

QUOTE(icemanfx @ May 10 2020, 08:06 PM) Bangkok population is much larger, have many more professionals than kl. those expensive property along sukhumvit you read are mostly for farang, and farang preferred thailand than bolehland. thai won't buy kl property because it is cheaper than bkk. and you conveniently ignore first batch of china investors in kl are still below water. Never mind. You’re missing the point again. |

|

|

|

|

|

Zwean

|

Jul 7 2020, 05:00 PM Jul 7 2020, 05:00 PM

|

|

QUOTE(wualalala @ Jul 7 2020, 04:50 PM) it is opposite... people usually spend more as a result of lower interest rates as profit not as much as it seen to be moving forward. Businesses might take this opportunity to reassess the opportunities going to have by borrowing more to expand their capacity and to conduct viable investment as loan rates are lower than before. Corporate debt will go up to fund expansions. |

|

|

|

|

|

Zwean

|

Jul 8 2020, 10:17 AM Jul 8 2020, 10:17 AM

|

|

QUOTE(blanket84 @ Jul 8 2020, 09:53 AM) Yes. I do understand that BR doesn't necessarily drop according to OPR drop. But BR for a single bank would be the same across the board for all right? So, if an old client of a bank is paying 3.2% interest, and the new client also being offered 3.2%, shouldn't it mean that for both of them BR+spread is the same? So far BR all drop in tandem Spread is fixed |

|

|

|

|

|

Zwean

|

Jul 8 2020, 10:27 AM Jul 8 2020, 10:27 AM

|

|

QUOTE(cy91 @ Jul 8 2020, 10:25 AM) BR is depends on bank negara interest. Spread is depends on your credit worthiness. BR depends on the bank's cost of funds. If their cost of fund increase so will their BR whether OPR is adjusted or not. The fixed spread is the key factor here, so get as low of a spread as possible. |

|

|

|

|

|

Zwean

|

Jul 8 2020, 11:35 AM Jul 8 2020, 11:35 AM

|

|

QUOTE(kochin @ Jul 8 2020, 11:18 AM) i wonder if anyone still have those blr - x.x% package. if got those then the loan damn cheap. imagine many many years ago, there were those blr - 1% package. fast forward now if blr is 2.5% then including the negative spread means only 1.5%? BR and BLR is different. BLR is higher than BR Internally they still have BLR |

|

|

|

|

|

Zwean

|

Jul 8 2020, 02:03 PM Jul 8 2020, 02:03 PM

|

|

QUOTE(shaoching @ Jul 8 2020, 01:59 PM) I am now dilemma which bank to took for house loan. priority is HLB which offer me 2.88 (BR)+0.32 (SR) however, heard HLB has the right not follow Bank negara to drop the 0.25% BR. which will occasionally make my loan higher then others later on. any sifu pls advice You "heard".. Wait for confirmation then decide if not in a big rush. |

|

|

|

|

|

Zwean

|

Jul 8 2020, 05:10 PM Jul 8 2020, 05:10 PM

|

|

QUOTE(bestgiler @ Jul 8 2020, 05:07 PM) just wanna ask all sifus here, im considering taking a new home loan (1st property) and currently have two offers from Muamalat (offering 3.45%) and UOB (waiting for official offer). is 3.45% rate is good considering the situation now? Those are about 0.2 higher than the best rates offered before the cut. |

|

|

|

|

May 7 2020, 01:49 AM

May 7 2020, 01:49 AM

Quote

Quote

0.0268sec

0.0268sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled