I can't speak for everyone, as each person's financial standing will obviously be different, but here's how we did it for our biggest property purchase (a $6,500,000 freehold landed house nestled within District 10, in Singapore). This is our background:

1. Cash/FD holdings (at that point - this was about nearly 8 or 9 years ago): $3,000,000 - this was money that we had set aside for the purchase of this particular property. We did have other sources of funds, but those were in less liquid instruments (mainly bonds and blue chips)

2. The developer was willing to absorb the buyer's stamp duty (3%) & also to offer us a "renovation rebate" of nearly $150,000

3. FD rates were a measly 1.5% (that was back in the days of Quantitative Easing & furious greenback printing by the US Fed Reserve)

4. Mortgage loans rates were even more laughable, at 0.8% (floating) - lock in period 2 or 3 years

The "smart" thing to do, so all our relatives told us (and if I had known about lowyat.net back then, I reckon quite a few of the gurus here would have said the same thing) was to keep the cash in the FD, generating 1.5% interest, while maximizing the loan tenure & amount (back then, there was no TDSR (total debt service ratio) and we could borrow up to 90%). As a Malaysian PR, I cannot legally buy a landed freehold property in Singapore, but since my wife had taken up Singapore citizenship, she could - and I could act as a co-guarantor for the loan. This way, we were already making money, by earning the 1.5%, while the bank was charging us at 0.8%.

On closer scrutiny, a few issues cropped up:

1. 1.5% per annum is on $3,000,000

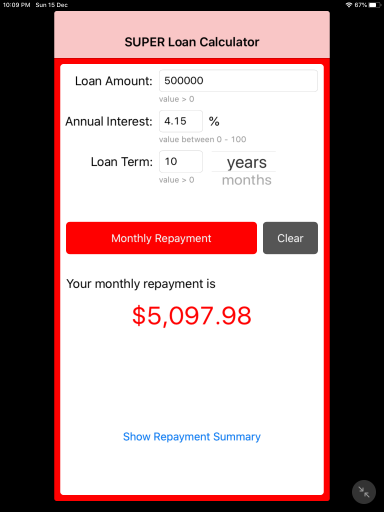

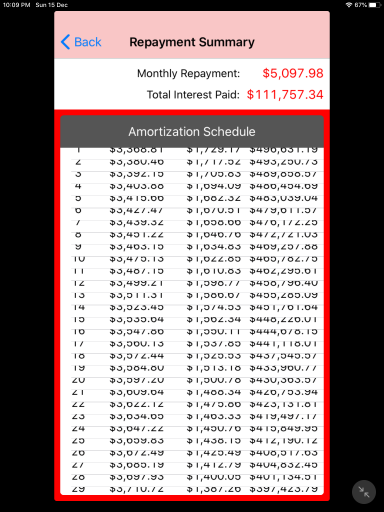

2. 0.8% per annum translates to a higher "effective interest rate" because of amortization, which front loads quite a bit of interest repayments in the INITIAL repayment periods, before the capital gets repaid

3. And the 0.8% is on a $5,850,000 total loan

4. Edited to add this important point: I didn’t think I was financially savvy to risk the $3,000,000 on instruments with higher returns, seeing how the money was initially earmarked for the house purchase

Immediately, that should tell you that I'd end up paying far more interest than I'd be making interest.

So, thanks but no thanks, we bit the bullet and used our $3,000,000 to offset the purchase price, thus taking out a loan on the $3,150,000 over 20 years. We then continued to pare down the principal with capital pre-payments (this was a floating rate), and paid off the entire mortgage the minute we were able to do so without penalty (If I'm not mistaken, we managed to clear the whole lot within 5 or 6 years).

For those who are not acquainted with our backgrounds, I'll take this opportunity to rehash: I'm a medical specialist in private practice (have been for the past 15 years) and my wife is a chartered accountant who used to work in a senior role for one of the big firms, so financially, we were upper middle class. Again, I reiterate, what we did may not be applicable to everyone - but in my humble opinion, the principles of calculation can be universally applied.

I can see parallels in TS' question, compared to our own situation, and it is in the interest of sharing that I post the above. Good luck with your decision, however and whichever you decide.

in general, it stands to reason that banks will certainly lend out money (mortgage) at a higher rate than they pay on deposits (FD). else how would the bank profit?

and this is in addition to miscellaneous costs like legal fees and mrta which depend on the loan amount.

Dec 4 2019, 05:35 PM, updated 7y ago

Dec 4 2019, 05:35 PM, updated 7y ago

Quote

Quote

0.0227sec

0.0227sec

0.36

0.36

5 queries

5 queries

GZIP Disabled

GZIP Disabled