26 pages ingat ada apa interesting racing vroom vroom dna

manatau see this kind of shit

is it better to keep money in FD, or take the money out to buy property

is it better to keep money in FD, or take the money out to buy property

|

|

Dec 9 2019, 11:55 PM Dec 9 2019, 11:55 PM

Show posts by this member only | IPv6 | Post

#521

|

Junior Member

30 posts Joined: Dec 2008 From: Caer Darrow |

26 pages ingat ada apa interesting racing vroom vroom dna

manatau see this kind of shit |

|

|

|

|

|

Dec 10 2019, 12:01 AM Dec 10 2019, 12:01 AM

Show posts by this member only | IPv6 | Post

#522

|

Senior Member

1,275 posts Joined: Nov 2007 |

|

|

|

Dec 10 2019, 12:05 AM Dec 10 2019, 12:05 AM

Show posts by this member only | IPv6 | Post

#523

|

Senior Member

817 posts Joined: Oct 2006 |

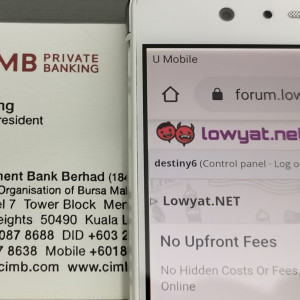

QUOTE(timidandslow @ Dec 9 2019, 08:38 PM) QUOTE(timidandslow @ Dec 9 2019, 09:59 PM) don't talk kok la 2feihai. faster share your RM contact here, I want to place big deposit/investment with him. you RM will be happy with your referral . Why you so interested wanna see RM contact..... Nahhh I give you my private banking RM la Adik bossku  |

|

|

Dec 10 2019, 12:20 AM Dec 10 2019, 12:20 AM

Show posts by this member only | IPv6 | Post

#524

|

|

Elite

3,249 posts Joined: Oct 2011 |

fuhh this tered belum die down

|

|

|

Dec 10 2019, 12:20 AM Dec 10 2019, 12:20 AM

Show posts by this member only | IPv6 | Post

#525

|

Senior Member

7,847 posts Joined: Sep 2019 |

|

|

|

Dec 10 2019, 12:24 AM Dec 10 2019, 12:24 AM

Show posts by this member only | IPv6 | Post

#526

|

Senior Member

817 posts Joined: Oct 2006 |

|

|

|

|

|

|

Dec 10 2019, 12:37 AM Dec 10 2019, 12:37 AM

|

Junior Member

80 posts Joined: Nov 2019 |

|

|

|

Dec 10 2019, 12:39 AM Dec 10 2019, 12:39 AM

|

Junior Member

80 posts Joined: Nov 2019 |

QUOTE(2feidei @ Dec 9 2019, 04:25 PM) davez89 kam in, so fast oledi TS claim represent u oledi i search and read all his post, nothing mentioned also..... QUOTE(destiny6 @ Dec 10 2019, 12:05 AM) Why you so interested wanna see RM contact..... already 20 pages ago but still not a shred of proof from self professed banking expert 2feidei. faster show your RM contact.Nahhh I give you my private banking RM la Adik bossku  This post has been edited by timidandslow: Dec 10 2019, 12:55 AM |

|

|

Dec 10 2019, 01:10 AM Dec 10 2019, 01:10 AM

|

Junior Member

82 posts Joined: Oct 2011 |

FD may be the best option now. KLSE dropping every day. Property stagnant.

|

|

|

Dec 10 2019, 01:13 AM Dec 10 2019, 01:13 AM

|

Senior Member

1,275 posts Joined: Nov 2007 |

|

|

|

Dec 10 2019, 05:18 AM Dec 10 2019, 05:18 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

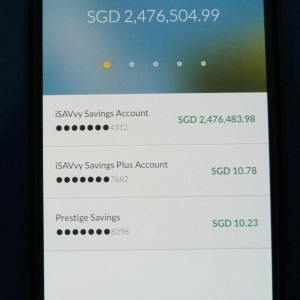

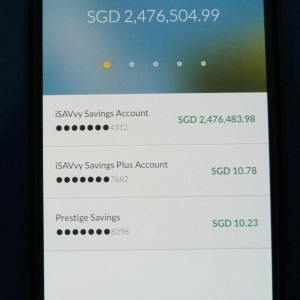

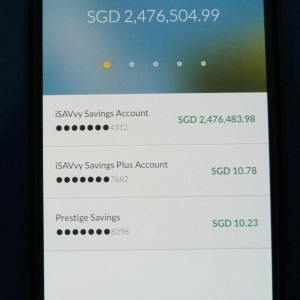

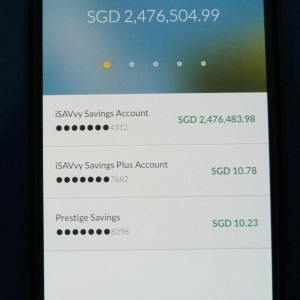

QUOTE(destiny6 @ Dec 10 2019, 12:24 AM) Thank you! It worked! I learnt something new! Thank you very much.Anyway, coming back to timidandslow’s question, you could also do something like this with you RM300,000:  I used a simple digital camera to take a photo of my iPhone X, showing my accounts summary page of the Maybank2U (Singapore) mobile banking App. I could also show you the accounts summary pages of the mobile banking Apps for my DBS, UOB, OCBC, HSBC, NAB or Citibank accounts, but those show the account number details in full and I’m not comfortable with broadcasting them in a largely anonymous forum like this one. I also don’t want to use any editing software as there’ll be many who would then have their maruah t’challa moment and shriek and howl in protests (and that will be another 50 pages of ceaseless barking). Maybank2U automatically masks the full details of my accounts and I’m ok with that. Anyway, I get offered a preferential rate of 2.25% to keep my money with Maybank. The App does not show the total AUM I have with them as my Bond purchases, Foreign FDs and stocks are kept separate. All I have to do is to toggle between my iSavvy, iSavvy Plus and my Prestige accounts once every few months, and I will continue enjoying 2.25% p.a. That works out to around $4,000 a month which, by Singapore standards, isn’t too bad as far as bank rates go. You could perhaps try to consolidate your different FDs to bargain for a better % - as it is, Malaysian banks already pay higher rates than Singaporean ones. You can also see a few points here: 1. I’m not with Maybank Private Banking. Because I’m very happy with my RM. She’s actually Malaysian and if I converted to Maybank Private Banking, I would lose her and get someone that I may not feel as comfortable with, when it comes to rejecting or agreeing to any of his/her Bond recommendations. 2. The Maybank2U mobile banking App only summarises the total value of my SGD cash deposits with them. My AUD FD deposits and my Bond holdings are not tabulated automatically. This is not the same with some of the other mobile banking Apps. UOB actually tabulates my Bond holdings together with my savings but again, does not include my AUD deposits. Anyway, I’ve since moved my Bond holdings previously with UOB over to UOB KayHian when my previous RM left UOB to join UOB KayHian. I tend to stick with one RM for a long time, unless they cock up badly. 3. I’m quite open and transparent. I do try to back up what I say, whenever I can. Easier to carry a consistent conversation with people that way. Thanks again to destiny6 for your help. |

|

|

Dec 10 2019, 07:27 AM Dec 10 2019, 07:27 AM

Show posts by this member only | IPv6 | Post

#532

|

Senior Member

817 posts Joined: Oct 2006 |

QUOTE(hksgmy @ Dec 10 2019, 05:18 AM) Thank you! It worked! I learnt something new! Thank you very much. You are welcome....I better masuk gua first, tag me when this thread reach V2Anyway, coming back to timidandslow’s question, you could also do something like this with you RM300,000:  I used a simple digital camera to take a photo of my iPhone X, showing my accounts summary page of the Maybank2U (Singapore) mobile banking App. I could also show you the accounts summary pages of the mobile banking Apps for my DBS, UOB, OCBC, HSBC, NAB or Citibank accounts, but those show the account number details in full and I’m not comfortable with broadcasting them in a largely anonymous forum like this one. I also don’t want to use any editing software as there’ll be many who would then have their maruah t’challa moment and shriek and howl in protests (and that will be another 50 pages of ceaseless barking). Maybank2U automatically masks the full details of my accounts and I’m ok with that. Anyway, I get offered a preferential rate of 2.25% to keep my money with Maybank. The App does not show the total AUM I have with them as my Bond purchases, Foreign FDs and stocks are kept separate. All I have to do is to toggle between my iSavvy, iSavvy Plus and my Prestige accounts once every few months, and I will continue enjoying 2.25% p.a. That works out to around $4,000 a month which, by Singapore standards, isn’t too bad as far as bank rates go. You could perhaps try to consolidate your different FDs to bargain for a better % - as it is, Malaysian banks already pay higher rates than Singaporean ones. You can also see a few points here: 1. I’m not with Maybank Private Banking. Because I’m very happy with my RM. She’s actually Malaysian and if I converted to Maybank Private Banking, I would lose her and get someone that I may not feel as comfortable with, when it comes to rejecting or agreeing to any of his/her Bond recommendations. 2. The Maybank2U mobile banking App only summarises the total value of my SGD cash deposits with them. My AUD FD deposits and my Bond holdings are not tabulated automatically. This is not the same with some of the other mobile banking Apps. UOB actually tabulates my Bond holdings together with my savings but again, does not include my AUD deposits. Anyway, I’ve since moved my Bond holdings previously with UOB over to UOB KayHian when my previous RM left UOB to join UOB KayHian. I tend to stick with one RM for a long time, unless they cock up badly. 3. I’m quite open and transparent. I do try to back up what I say, whenever I can. Easier to carry a consistent conversation with people that way. Thanks again to destiny6 for your help. |

|

|

Dec 10 2019, 09:10 AM Dec 10 2019, 09:10 AM

|

Junior Member

90 posts Joined: Jul 2019 |

QUOTE(hksgmy @ Dec 10 2019, 05:18 AM) Thank you! It worked! I learnt something new! Thank you very much. so imba one.Anyway, coming back to timidandslow’s question, you could also do something like this with you RM300,000:  I used a simple digital camera to take a photo of my iPhone X, showing my accounts summary page of the Maybank2U (Singapore) mobile banking App. I could also show you the accounts summary pages of the mobile banking Apps for my DBS, UOB, OCBC, HSBC, NAB or Citibank accounts, but those show the account number details in full and I’m not comfortable with broadcasting them in a largely anonymous forum like this one. I also don’t want to use any editing software as there’ll be many who would then have their maruah t’challa moment and shriek and howl in protests (and that will be another 50 pages of ceaseless barking). Maybank2U automatically masks the full details of my accounts and I’m ok with that. Anyway, I get offered a preferential rate of 2.25% to keep my money with Maybank. The App does not show the total AUM I have with them as my Bond purchases, Foreign FDs and stocks are kept separate. All I have to do is to toggle between my iSavvy, iSavvy Plus and my Prestige accounts once every few months, and I will continue enjoying 2.25% p.a. That works out to around $4,000 a month which, by Singapore standards, isn’t too bad as far as bank rates go. You could perhaps try to consolidate your different FDs to bargain for a better % - as it is, Malaysian banks already pay higher rates than Singaporean ones. You can also see a few points here: 1. I’m not with Maybank Private Banking. Because I’m very happy with my RM. She’s actually Malaysian and if I converted to Maybank Private Banking, I would lose her and get someone that I may not feel as comfortable with, when it comes to rejecting or agreeing to any of his/her Bond recommendations. 2. The Maybank2U mobile banking App only summarises the total value of my SGD cash deposits with them. My AUD FD deposits and my Bond holdings are not tabulated automatically. This is not the same with some of the other mobile banking Apps. UOB actually tabulates my Bond holdings together with my savings but again, does not include my AUD deposits. Anyway, I’ve since moved my Bond holdings previously with UOB over to UOB KayHian when my previous RM left UOB to join UOB KayHian. I tend to stick with one RM for a long time, unless they cock up badly. 3. I’m quite open and transparent. I do try to back up what I say, whenever I can. Easier to carry a consistent conversation with people that way. Thanks again to destiny6 for your help. |

|

|

|

|

|

Dec 10 2019, 10:15 AM Dec 10 2019, 10:15 AM

|

Senior Member

3,158 posts Joined: Oct 2013 |

QUOTE(timidandslow @ Dec 9 2019, 09:59 PM) don't talk kok la 2feihai. faster share your RM contact here, I want to place big deposit/investment with him. you RM will be happy with your referral . topkek....now mau mintak free contact from me pulak.....RM no need to cari one, when u reach the level they will automatically come see u one, just like class, no matters how u pretend, if you don't have it, no matters how hard u tried also people will not entertain u. let me gip u another free lesson again, i don't usually carry my RM namecard and to show off as if like some amulet to fight against ghost Sorry, Destiny6, not directed at u, but to TS, he thought got RM name card is like got amulet to fight evil or ghost, for his comprehension is just that, RM name card, ambank logo = 6 figures liquid assets QUOTE(Davez89 @ Dec 9 2019, 10:04 PM) he only choose to accept what he want to accept jer QUOTE(redoxon @ Dec 9 2019, 11:21 PM) bro, can add in JP Morgan, BOC, Deutsche Bank, Royal Scotland Bank, etc QUOTE(hksgmy @ Dec 10 2019, 05:18 AM) Thank you! It worked! I learnt something new! Thank you very much. sifu sudah masuk liou.....wonder should ayam post ayam punya statement or not.......sifu, ayam post, u don't flame me ok......ayam just fraction of your networth jer, maybe 0.00001% jer. Just to teach this dupe with his imaginary first started off with 300k FD, then, 200k FD, then becum 6 figures liquid assets, supported with ambank logo and phailed photochopped affin bank Anyway, coming back to timidandslow’s question, you could also do something like this with you RM300,000:  I used a simple digital camera to take a photo of my iPhone X, showing my accounts summary page of the Maybank2U (Singapore) mobile banking App. I could also show you the accounts summary pages of the mobile banking Apps for my DBS, UOB, OCBC, HSBC, NAB or Citibank accounts, but those show the account number details in full and I’m not comfortable with broadcasting them in a largely anonymous forum like this one. I also don’t want to use any editing software as there’ll be many who would then have their maruah t’challa moment and shriek and howl in protests (and that will be another 50 pages of ceaseless barking). Maybank2U automatically masks the full details of my accounts and I’m ok with that. Anyway, I get offered a preferential rate of 2.25% to keep my money with Maybank. The App does not show the total AUM I have with them as my Bond purchases, Foreign FDs and stocks are kept separate. All I have to do is to toggle between my iSavvy, iSavvy Plus and my Prestige accounts once every few months, and I will continue enjoying 2.25% p.a. That works out to around $4,000 a month which, by Singapore standards, isn’t too bad as far as bank rates go. You could perhaps try to consolidate your different FDs to bargain for a better % - as it is, Malaysian banks already pay higher rates than Singaporean ones. You can also see a few points here: 1. I’m not with Maybank Private Banking. Because I’m very happy with my RM. She’s actually Malaysian and if I converted to Maybank Private Banking, I would lose her and get someone that I may not feel as comfortable with, when it comes to rejecting or agreeing to any of his/her Bond recommendations. 2. The Maybank2U mobile banking App only summarises the total value of my SGD cash deposits with them. My AUD FD deposits and my Bond holdings are not tabulated automatically. This is not the same with some of the other mobile banking Apps. UOB actually tabulates my Bond holdings together with my savings but again, does not include my AUD deposits. Anyway, I’ve since moved my Bond holdings previously with UOB over to UOB KayHian when my previous RM left UOB to join UOB KayHian. I tend to stick with one RM for a long time, unless they cock up badly. 3. I’m quite open and transparent. I do try to back up what I say, whenever I can. Easier to carry a consistent conversation with people that way. Thanks again to destiny6 for your help. don't click, it only for TS » Click to show Spoiler - click again to hide... « |

|

|

Dec 10 2019, 10:17 AM Dec 10 2019, 10:17 AM

|

Senior Member

3,158 posts Joined: Oct 2013 |

|

|

|

Dec 10 2019, 10:31 AM Dec 10 2019, 10:31 AM

Show posts by this member only | IPv6 | Post

#536

|

Senior Member

817 posts Joined: Oct 2006 |

QUOTE(2feidei @ Dec 10 2019, 10:15 AM) topkek....now mau mintak free contact from me pulak.....RM no need to cari one, when u reach the level they will automatically come see u one, just like class, no matters how u pretend, if you don't have it, no matters how hard u tried also people will not entertain u. TS so want RM contact, I tried to find but can't find so I WhatsApp him come uphill deliver me next year 2020 punya calendar and planner at the same time ask for a new business card je....it's just a business card nothing special je he told me , he spill his drinks when I told him I wanna post at /K "Boss ah you at uphill to free till nothing to do liao ah , not even gambling few hundred thousand also cannot give the adrenaline rush d ah? " He asked let me gip u another free lesson again, i don't usually carry my RM namecard and to show off as if like some amulet to fight against ghost Sorry, Destiny6, not directed at u, but to TS, he thought got RM name card is like got amulet to fight evil or ghost, for his comprehension is just that, RM name card, ambank logo = 6 figures liquid assets he only choose to accept what he want to accept jer bro, can add in JP Morgan, BOC, Deutsche Bank, Royal Scotland Bank, etc sifu sudah masuk liou.....wonder should ayam post ayam punya statement or not.......sifu, ayam post, u don't flame me ok......ayam just fraction of your networth jer, maybe 0.00001% jer. Just to teach this dupe with his imaginary first started off with 300k FD, then, 200k FD, then becum 6 figures liquid assets, supported with ambank logo and phailed photochopped affin bank don't click, it only for TS » Click to show Spoiler - click again to hide... « |

|

|

Dec 10 2019, 10:40 AM Dec 10 2019, 10:40 AM

Show posts by this member only | IPv6 | Post

#537

|

Junior Member

42 posts Joined: Aug 2017 |

borrow 80% loan la..!!! the balance put at FD just incase u need money urgently in future..!! when u have extra just put it in loan to help settle early of coz if all ur money is declared then you got ntg to afraid of LHDN..!!

|

|

|

Dec 10 2019, 12:22 PM Dec 10 2019, 12:22 PM

|

Senior Member

3,158 posts Joined: Oct 2013 |

QUOTE(destiny6 @ Dec 10 2019, 10:31 AM) TS so want RM contact, I tried to find but can't find so I WhatsApp him come uphill deliver me next year 2020 punya calendar and planner at the same time ask for a new business card je....it's just a business card nothing special je he told me , he spill his drinks when I told him I wanna post at /K "Boss ah you at uphill to free till nothing to do liao ah , not even gambling few hundred thousand also cannot give the adrenaline rush d ah? " He asked soli boss....ayam mau masuk gua liou......tarak brani tag u here liou QUOTE(Jon_123 @ Dec 10 2019, 10:40 AM) borrow 80% loan la..!!! the balance put at FD just incase u need money urgently in future..!! when u have extra just put it in loan to help settle early of coz if all ur money is declared then you got ntg to afraid of LHDN..!! 80% loan based on imaginary 300k fd, then, 200k fd and finally 6 figures liquid assets? Which bank willing to lend ah? Ohwai....Ambank, bossku bank, coz it related to 1MDB.....disclaimer first b4 ambank LOD ayam......ayam troll TS jer, not kutuk ambank....i hereby sincerely apologise and retract my statement to ambank, and my statement directed to TS jer for his stupidity and bragging |

|

|

Dec 10 2019, 01:13 PM Dec 10 2019, 01:13 PM

Show posts by this member only | IPv6 | Post

#539

|

Junior Member

80 posts Joined: Nov 2019 |

QUOTE(2feidei @ Dec 10 2019, 10:15 AM) topkek....now mau mintak free contact from me pulak.....RM no need to cari one, when u reach the level they will automatically come see u one, just like class, no matters how u pretend, if you don't have it, no matters how hard u tried also people will not entertain u. sau pei la boyboy, ask you many times for RM also can't show. some more want to show photochop alliance statement here let me teach you how to show prooflet me gip u another free lesson again, i don't usually carry my RM namecard and to show off as if like some amulet to fight against ghost Sorry, Destiny6, not directed at u, but to TS, he thought got RM name card is like got amulet to fight evil or ghost, for his comprehension is just that, RM name card, ambank logo = 6 figures liquid assets he only choose to accept what he want to accept jer bro, can add in JP Morgan, BOC, Deutsche Bank, Royal Scotland Bank, etc sifu sudah masuk liou.....wonder should ayam post ayam punya statement or not.......sifu, ayam post, u don't flame me ok......ayam just fraction of your networth jer, maybe 0.00001% jer. Just to teach this dupe with his imaginary first started off with 300k FD, then, 200k FD, then becum 6 figures liquid assets, supported with ambank logo and phailed photochopped affin bank don't click, it only for TS » Click to show Spoiler - click again to hide... « hidup bossku. tenkiu 1mdb. say no to photochopped alliance statement This post has been edited by timidandslow: Dec 10 2019, 01:14 PM Attached thumbnail(s)

|

|

|

Dec 10 2019, 01:26 PM Dec 10 2019, 01:26 PM

Show posts by this member only | IPv6 | Post

#540

|

Junior Member

80 posts Joined: Nov 2019 |

ratloverice is the only smart one here among all you dimwits.

hidup bossku. tenkiu 1mdb minimum requirements deposits/ investment 200k QUOTE(ratloverice @ Dec 9 2019, 07:52 PM) QUOTE(Davez89 @ Dec 9 2019, 11:02 PM) Stop tagging me la poor boi go open a new thread or something so u can boost ur imaginary richness lol QUOTE(destiny6 @ Dec 10 2019, 10:31 AM) TS so want RM contact, I tried to find but can't find so I WhatsApp him come uphill deliver me next year 2020 punya calendar and planner at the same time ask for a new business card je....it's just a business card nothing special je he told me , he spill his drinks when I told him I wanna post at /K "Boss ah you at uphill to free till nothing to do liao ah , not even gambling few hundred thousand also cannot give the adrenaline rush d ah? " He asked Attached thumbnail(s)

|

| Change to: |  0.0357sec 0.0357sec

1.47 1.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 03:27 AM |