Outline ·

[ Standard ] ·

Linear+

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

vanitas

|

Aug 26 2020, 04:30 PM Aug 26 2020, 04:30 PM

|

|

QUOTE(lucifah @ Aug 26 2020, 04:25 PM) u do know that historically, ASNB dividends announced are in quarters... i.e. 0.25 so u can have 3.75, 4.00, or 4.25 there has never been 4.10 yet... or 3.90 it's always in 0.25%. it ends in .00 or .25 or .50 or .75  Misleading info, https://www.myasnb.com.my/Got 6.10 (asm3 2016) Even got 7.05 (asb2 2016) |

|

|

|

|

|

vanitas

|

Aug 28 2020, 05:08 PM Aug 28 2020, 05:08 PM

|

|

|

|

|

|

|

|

vanitas

|

Aug 30 2020, 12:23 PM Aug 30 2020, 12:23 PM

|

|

QUOTE(brando_w @ Aug 30 2020, 11:23 AM) Good Sunday Morning, 1. On the topic of ‘Risk’: Risk can be perceived rather differently depending on the age group. Today, for a baby boomer, Fixed Income Investments is definitely a low risk and liquid investment. The dwindling rates should not be too much of a concern taking into account the capital amassed over the years. Considering the average lifespan, for a baby boomer, Fixed Income Investment seems a fair bet. On the other hand, for the Gen X/Y/Z, keeping or ‘Investing’ solely on fixed income instruments can actually be risky. MYR currency depreciation and inflation will significantly lower their purchasing power in the years to come. Did you know asnb is not "fixed income" investment? It was fixed price equity fund that invest in both local and foreign stocks (lately), with little exposure to fixed income investment. Same to EPF although it looks like a "fixed income" investment. Historically speaking, both of them able to beat inflation so far, but future can't be guaranteed though. |

|

|

|

|

|

vanitas

|

Sep 1 2020, 11:56 AM Sep 1 2020, 11:56 AM

|

|

QUOTE(mushigen @ Sep 1 2020, 11:50 AM) I must be one of the unlucky ones. Got big fat zero since this morning. Try smaller amount, been able to top up 4 times (each low number 4 digits only) since morning so far. This post has been edited by vanitas: Sep 1 2020, 11:59 AM |

|

|

|

|

|

vanitas

|

Sep 1 2020, 01:00 PM Sep 1 2020, 01:00 PM

|

|

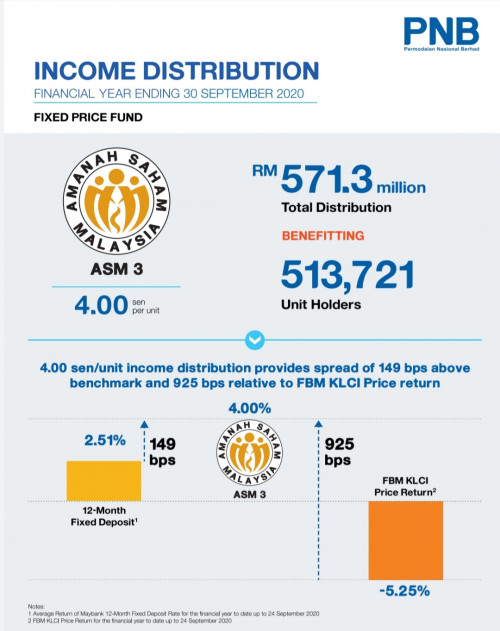

QUOTE(mushigen @ Sep 1 2020, 12:01 PM) Didn't exceed RM1k per attempt, mostly below RM500. QUOTE(KCY3701 @ Sep 1 2020, 12:02 PM) I can't even get 100 leh. Then it is really bad luck. QUOTE(mroys@lyn @ Sep 1 2020, 12:22 PM) Wouldn't SSPN is more attractive than ASM and easier to get? SSPN 2019 dividends are 4%+1%(loyalty, tnc). One reason is not eligible. Other reason is ASM historically pay better dividend except this year. |

|

|

|

|

|

vanitas

|

Sep 1 2020, 03:35 PM Sep 1 2020, 03:35 PM

|

|

QUOTE(citymetro @ Sep 1 2020, 03:20 PM) Sistem sedang diselenggara Baki unit sedang dikemaskini, maaf jika terdapat sebarang kesulitan. Sistem akan kembali seperti biasa selepas waktu : 7:30 Malam hingga 12:00 Pagi. --- Terima kasih kerana menggunakan myASNB. Untuk memudahkan transaksi ASNB melalui pelbagai saluran kami di masa hadapan, sila kunjungi mana-mana cawangan ASNB atau ejen kami di seluruh negara untuk pengesahan maklumat anda menerusi MYKAD. --- System can't handle the load? Getting weird pop ups now... It is okay now. |

|

|

|

|

|

vanitas

|

Sep 3 2020, 08:18 PM Sep 3 2020, 08:18 PM

|

|

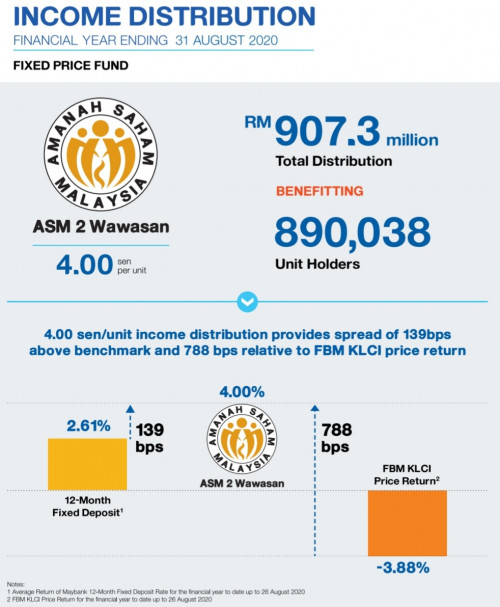

QUOTE(nexona88 @ Sep 3 2020, 03:01 PM) nothing to be surprised about it... 4% only.. with risk of going lower next year..... invest / play with bursa also can get even better $$$... I wonder why ASNB with such huge $$$ cannot just ride on the momentum  or it's just for ASB only? others series FP funds consider as third class products which don't needed any attention (auto mode enough)  One of the reasons why ASB always better... https://www.malaymail.com/news/malaysia/202...puteras/1899847 |

|

|

|

|

|

vanitas

|

Sep 30 2020, 08:09 PM Sep 30 2020, 08:09 PM

|

|

TOS, MUM, and 3 others liked this post

|

|

|

|

|

|

vanitas

|

Dec 29 2020, 11:58 AM Dec 29 2020, 11:58 AM

|

|

QUOTE(dawsonyap @ Dec 29 2020, 11:39 AM) Hi  when I get the units via myasnb website, when transaction is successful, it automatically loads into a blank page and says transaction accepted. Though the units is credited, I need to wait for 15 minutes before next transaction because the website deems that I did not logout properly. Does anyone else have the same issue?  Having this issue with Chrome. Firefox doesn't have this issue. |

|

|

|

|

|

vanitas

|

Jan 19 2021, 11:55 AM Jan 19 2021, 11:55 AM

|

|

QUOTE(avinlim @ Jan 19 2021, 11:54 AM) Now ASNB can withdraw money directly from the MyASNB website by "Jualan balik"??? Yes but RM 500 per month only. |

|

|

|

|

|

vanitas

|

Feb 12 2021, 09:34 AM Feb 12 2021, 09:34 AM

|

|

QUOTE(Unkerpanjang @ Feb 12 2021, 08:58 AM) Happy New Year to all, I'm just very negative with the direction of our country's wealth n prosperity. I cap my asnb to, $2500K, use the dividends to just buy physical gold (>2.5Kg, as I stopped counting) n more recently bitcoin/ethereum. Our RM is F€©®×§, just keep enuf RM for your expenses. Maintain a foreign bank account, if u intend to send child overseas education. If really smart kids, then scholarship. Thanks, for allowing to share my views n real concerns. No insidious intentions. Uncle may invest into US, China funds or ETF. For cryptocurrency, hopefully uncle understand the risks associated, not only volatility but chances of lose everything there. I personally also stopped top up ASNB, as it is getting difficult and not worth the time due to poor economy performance of our country. |

|

|

|

|

|

vanitas

|

Feb 12 2021, 11:41 AM Feb 12 2021, 11:41 AM

|

|

QUOTE(Unkerpanjang @ Feb 12 2021, 10:54 AM) Good point, As Is, my gold holdings based on current RM is 5%, crypto is 0.5 net worth. Strategy in place to build it to 10% n 2% respectively. Unless, some incident happens n I get 10x-20x windfall from such investments. Don't jump all in, always allocate what u can afford accordingly..its to preserve wealth. Malaysia with so much personal n household debt cannot increase FD n Loan rates too high, there'll be riots in the streets. Similarly, MY stocks continue to be weak, asnb will be sub 4% dividends. Sorry, we digress, thats my new year msg n caution. Thank you, all. Yup, diversify is the key to preserve wealth. I am trying to reduce my RM exposure to 50% currently, or at least not more than 70%. Windfall or not, can always rebalance later. |

|

|

|

|

|

vanitas

|

Jun 30 2023, 03:10 PM Jun 30 2023, 03:10 PM

|

|

|

|

|

|

|

|

vanitas

|

Jun 2 2024, 02:49 PM Jun 2 2024, 02:49 PM

|

|

To be fair,

The EPF is certainly comparable to ASM.

Maybank, while low-risk, can still incur losses in certain years.

Foreign MMF and FD carry currency risk, but holding all assets in ringgit also poses a risk. I consider the US dollar to be safer than the ringgit, and it has been offering an interest rate of over 5% on FD/MMF for quite some time now.

|

|

|

|

|

Aug 26 2020, 04:30 PM

Aug 26 2020, 04:30 PM

Quote

Quote

0.0431sec

0.0431sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled