QUOTE(ironman16 @ Mar 4 2021, 06:15 PM)

Currently hovering 0.44 so it’s the lowest so when inflations hits it will rise quicker than you think Buy small won’t kill you one

Wahed Invest Malaysia, Good, Ok2, Bad?

|

|

Mar 4 2021, 06:19 PM Mar 4 2021, 06:19 PM

Return to original view | Post

#21

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Mar 4 2021, 06:26 PM Mar 4 2021, 06:26 PM

Return to original view | Post

#22

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Mar 5 2021, 08:33 PM Mar 5 2021, 08:33 PM

Return to original view | Post

#23

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Mar 6 2021, 01:20 AM Mar 6 2021, 01:20 AM

Return to original view | Post

#24

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Mar 24 2021, 03:05 AM Mar 24 2021, 03:05 AM

Return to original view | Post

#25

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(chidori @ Mar 23 2021, 01:24 PM) Hello there, Unless HLAL ETF is dropping to 27.70 then the is time to reenergiseIt seems that there has been not many discussion regarding Wahed. After 1 year+ DCA in Wahed, I have withdraw all my funds last year. Just wondering and would like to get your opinion if I should re-enter Wahed, Have a nice day! CUrrently at 34 forget about it |

|

|

Mar 27 2021, 02:58 PM Mar 27 2021, 02:58 PM

Return to original view | Post

#26

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Mar 27 2021, 03:06 PM Mar 27 2021, 03:06 PM

Return to original view | Post

#27

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(fms21 @ Mar 27 2021, 03:01 PM) Ok noted..just try my luck on this portfolio (VC) since GOLD not moving this week..hope it will bounce back this year with good capital appreciated and dividend.. Bonds are gone case already with so much stimulus and buy backs all over the worldYou better off buying gold ETF to hedge the inflation coming faster than ever fms21 liked this post

|

|

|

Apr 3 2021, 03:12 AM Apr 3 2021, 03:12 AM

Return to original view | Post

#28

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Apr 3 2021, 09:06 PM Apr 3 2021, 09:06 PM

Return to original view | Post

#29

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Apr 3 2021, 09:07 PM Apr 3 2021, 09:07 PM

Return to original view | Post

#30

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(rubrubrub @ Apr 3 2021, 03:19 AM) forget about all these shitty funds since most of you guys here are going for aggresive portfolio anyway. Ive invested in stashaway, wahed and mytheo and they all had negative return when the whole world's stocks were/ are going up. Try defi. I'll willingly teach you guys how to do it just so you guys can stay away from these stupid funds You should a start a thread on that now |

|

|

Apr 4 2021, 07:16 AM Apr 4 2021, 07:16 AM

Return to original view | Post

#31

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(myroy @ Apr 3 2021, 10:06 PM)  tired of this... last year using aggressive, after covid hit.... i loss abit now just because want to safe a bit, i moved to moderate... anddddd loss even more.... If you stay the course probably would have break even Anything less than 8% loss consider yourself lucky could be worse |

|

|

Apr 4 2021, 01:02 PM Apr 4 2021, 01:02 PM

Return to original view | Post

#32

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(myroy @ Apr 4 2021, 12:47 PM) i need advice I would hold because Sukuk will recover soon so what you think the best for me right now? can sukuk recover back? or just withdraw everything now rather than i loss more Unless if you have SA then i would consolidate it for better returns Wahed unless HLAL ETFs can hit 40usd which I highly doubt so in comparison to IVV But difficult to see unless you can show me what portfolio weightage on Sukuk and the buy price |

|

|

Apr 9 2021, 03:08 AM Apr 9 2021, 03:08 AM

Return to original view | Post

#33

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Apr 9 2021, 03:08 AM Apr 9 2021, 03:08 AM

Return to original view | Post

#34

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Hoshiyuu @ Apr 8 2021, 12:53 PM) Just a personal advice, if you are only buying gold to hold, it's probably better to register a simple cash account in stock brokers like M+/Rakuten and buy GOLDETF https://tradeplus.com.my/gold-tracker directly, less fees incurred. Yeah plus with promo in FSM this month save on 0% commission |

|

|

Apr 11 2021, 04:37 PM Apr 11 2021, 04:37 PM

Return to original view | Post

#35

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Apr 11 2021, 08:25 PM Apr 11 2021, 08:25 PM

Return to original view | Post

#36

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Apr 11 2021, 10:32 PM Apr 11 2021, 10:32 PM

Return to original view | Post

#37

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

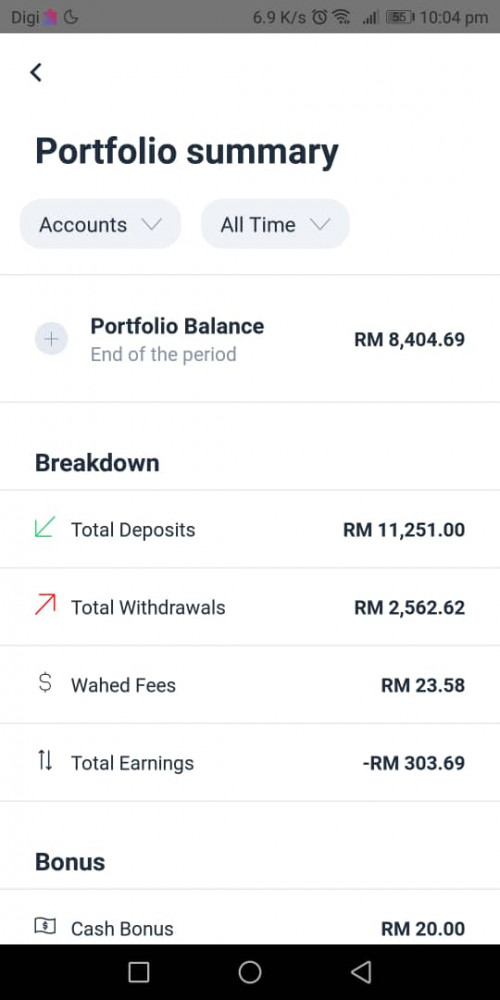

QUOTE(CPURanger @ Apr 11 2021, 09:24 PM) Nope. The other 1% gain is through Forex gain in your case in HLAL ETFOK, under Portfolio summary, Wahed Fees RM is 10.69. I am not sure if is fees per month. Let's just say, RM10 fees per month I started from August to March, it's 8 months 8 months * 10 = RM 80 ((203.26 + 80.0) / 4001.0) * 100.0 = 7.07% Probably some other fee involve or fees is different every month You better check when you invest lumpsum or DCA the entire amount is actually invested because i think they the cash portion should be calculated as gain Hence the actual invested out of 4001 should be 3961 invested Actual gain after fees is 6.14 with 0.8 as fees and 1% cash on hand plus 0.2 a small forex gain CPURanger liked this post

|

|

|

May 5 2021, 05:21 PM May 5 2021, 05:21 PM

Return to original view | Post

#38

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

May 6 2021, 01:05 AM May 6 2021, 01:05 AM

Return to original view | Post

#39

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(zstan @ May 5 2021, 09:07 PM) How much can this RM1 cover? Probably many of their users doing deposit every minute maybe. Really turn away customers. If you don’t think it is a lot in fact it is a lot For every deposit assuming rm100 each it itself 1% you can’t guesstimate Just like BigPay to reload in 711 2% on top on charges which already close 3% They already turning the customer and whatever their marketing gonna do it is waste of money and time |

|

|

May 6 2021, 05:59 PM May 6 2021, 05:59 PM

Return to original view | Post

#40

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(zstan @ May 6 2021, 11:15 AM) money is money regardless of amount. 1 cent is still money. for example, if stashaway can do it in 3 days why should i park my money in wahed which needs 5 days? unless wahed can guarantee higher returns for this extra 2 days of delay. Agreed unless Wahed can give 2 day so interest then it’s will be a game changer Otherwise better off buying into the one with fastest settlement because the 2 days can impact buy and sell price which a lot if ppl need don’t understand coupled FX loss or gain upon settlement for overseas equities particularly |

| Change to: |  0.0763sec 0.0763sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 09:13 AM |