QUOTE(Ziet Inv @ Oct 30 2020, 10:41 PM)

Hmm...the rep from TSG replied that no inactivity if net asset (incl. cash) is above US$ 1,000 at all times.

Did I opened the correct TSG? All I need now is just open CIMB SG FastSavers - Transferwise (RM to SGD), then SGD wire to USD right?

Ah yes, the minimum $1000 portfolio/cash equivalents, forgot about that.

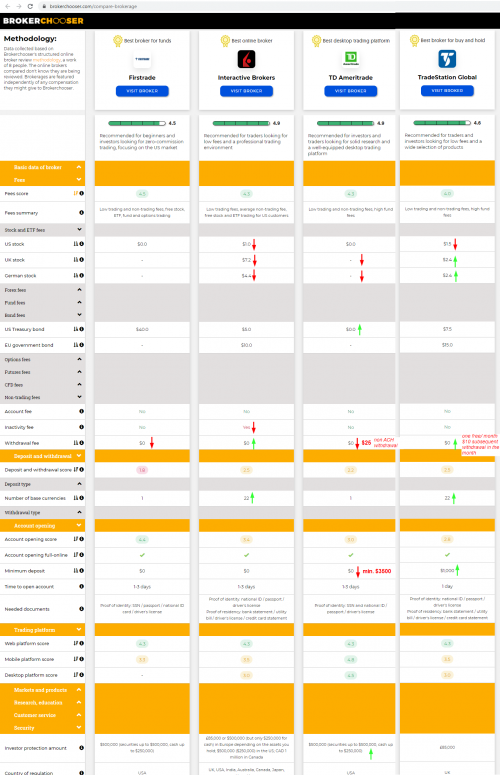

Still relatively easy to achieve compared to other approaches (like IBKR PRO requires min. 10/month commission for accounts with $100,000 or less, otherwise $10 inactivity fee)

If TradeStation Global did contact you, then yes, it's the correct TSG. Like

Ramjade (and many others here) I also ended up using only IBKR apps/website, I find it much more easier to use than the pro-desktop application

In terms of monies flow, it's wrong.

[own name transfer]:

MY Bank to Transfer Wise (RM to SGD)

Transferwise to SG Bank (SGD to SGD)

SG Bank to IBKR Local SG Bank (SGD to SGD)

IBKR Currency Exchange @ Spot-rate with $2 commissions (SGD to whatever you want)

Or just do this, many forummers here does it this way to cut one step:

[3rd party transfer under Transferwise Ltd.]:

MY Bank to Transfer Wise (RM to anything other than USD. Example SGD)

Transferwise to IBKR Local SG bank(SGD to SGD) -

potentially flagged for 3rd party verification to prove your money trailIBKR Currency Exchange @ Spot-rate with $2 commissions (SGD to whatever you want)

I just want to avoid the hassle altogether and since there's no charges for Local-to-Local transfer, I only use Fintech to transfer to

myself and only myself - at least the money trail is already captured by CRS so it'll save me lots of headache in case if I get audited for money trail in the future, rather than printing statements here and there trying to match the transactions. I have Offshore HK and SG account under my name so I use both based on my mood (or based on particular stock I want to buy, e.g. if I wanna buy HK stock, I'll always go through HK route so I don't need to double-conversion)

This post has been edited by polarzbearz: Oct 30 2020, 11:17 PM

Oct 18 2020, 06:44 PM

Oct 18 2020, 06:44 PM

Quote

Quote

0.2819sec

0.2819sec

1.16

1.16

7 queries

7 queries

GZIP Disabled

GZIP Disabled