QUOTE(Solskjaer66 @ Nov 4 2020, 11:17 PM)

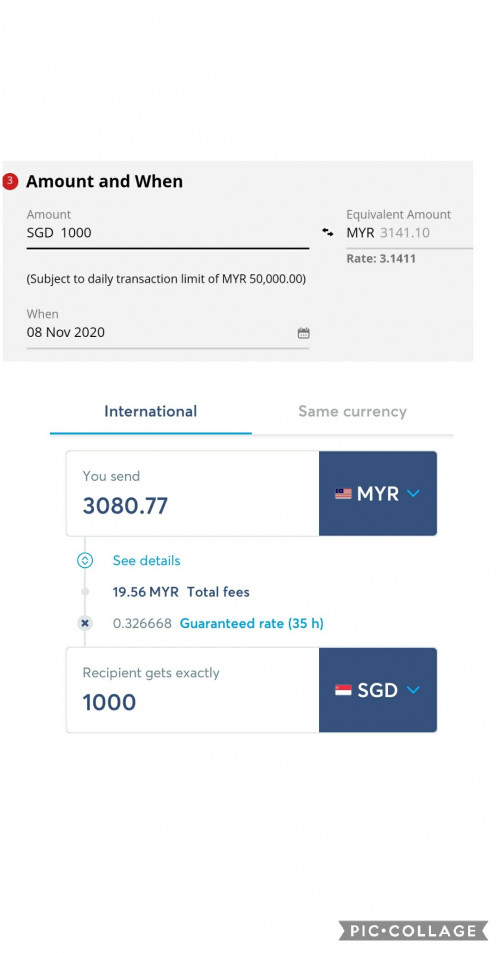

This is the part where I don understand... from cimb MY to cimb Sg should be LOCAL? Local means FOC? Is that really possible when transfer RM to SGD without charges? If it really works that way.... why still require Transferwise? then I better transfer more than SGD 1k since it is considered LOCAL foc. Might as well I transfer sgd 10k... right? Sorry my understanding could be wrong. I’m so confused. Please correct me if I am wrong. Thanks.

QUOTE(Yggdrasil @ Nov 5 2020, 12:06 AM)

Wait, I thought you MUST fund the first transfer from your CIMB Malaysia account?

Btw, this thread out topic already.

Better continue in SG Bank account thread... I linked above... Btw, this thread out topic already.

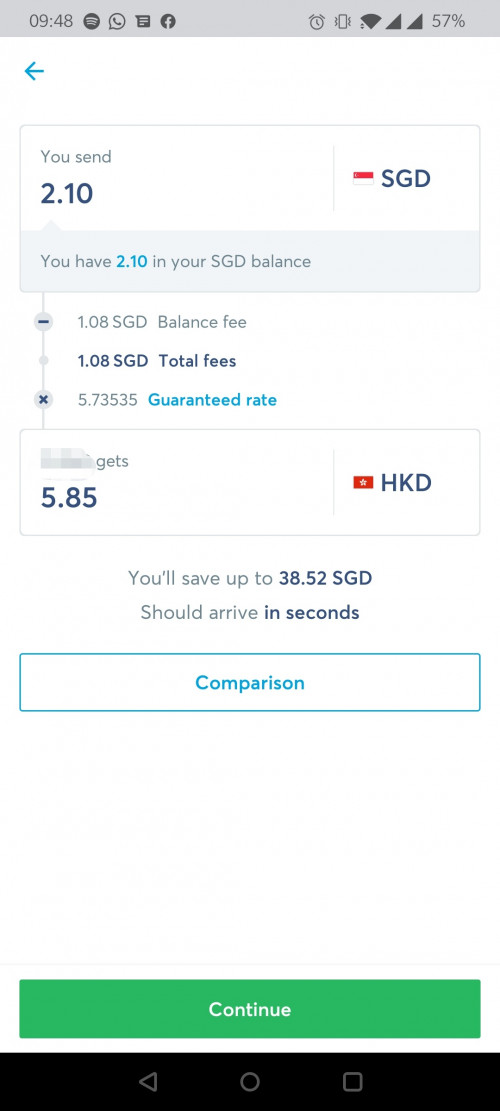

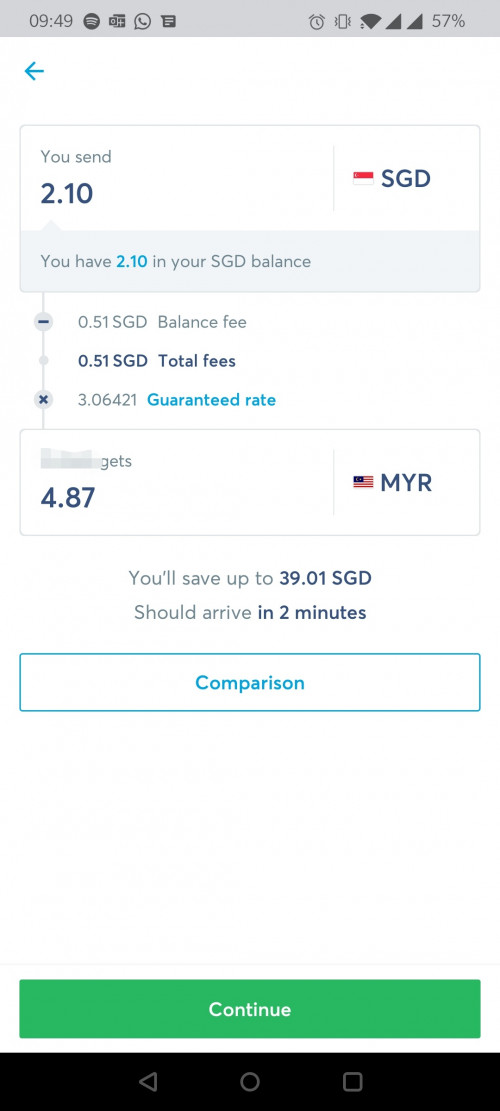

Long story short, "local" as in "OWN ACCOUNT TRANSFER" meaning no fees charged. But doesn't mean that the exchange rate is not crazy. Hence, transferwise (or any other alternatives) are still important.

When you perform TT, you get charged twice - once for "Fees" and another for "Exchange Rate".

Remember, fees are not the only thing that eat up your TT transfer, exchange rate does too.

CIMB MY funding to CIMB SG must only be done AFTER ACCOUNT LINKAGE (takes 1~3 days). You cannot do "OWN ACCOUNT" transfer before linkage is done - the only option is TT, which doesn't help with your E-KYC verification. E-KYC funding can be $1 for all it matters.

Nov 5 2020, 01:35 AM

Nov 5 2020, 01:35 AM

Quote

Quote

0.2652sec

0.2652sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled