Hi friends, just to share some info from my experiment:

I've set up recurring investment for VWRA, a LSE listed ETF denominated in USD.

Contrary to the information provided by IBKR:

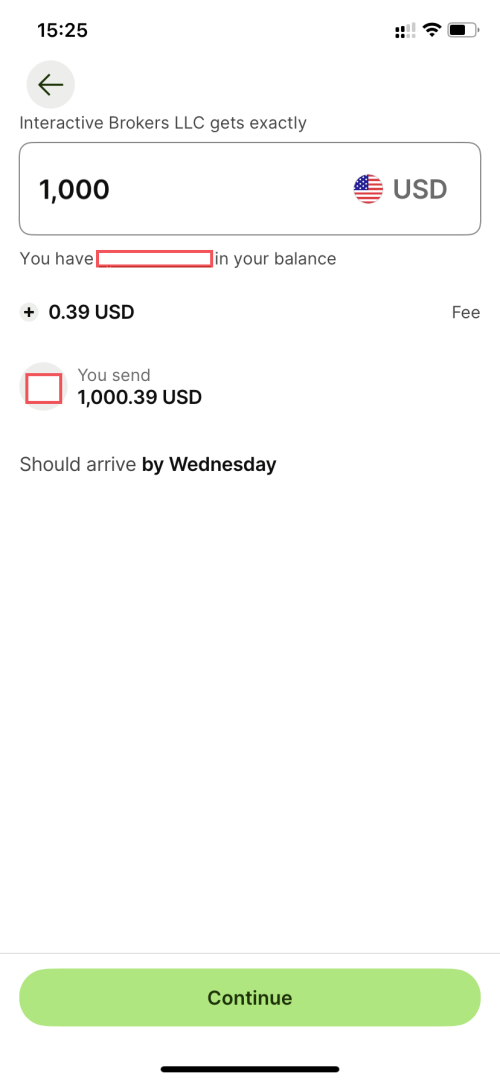

1. If you don't have enough USD, it will convert from your other currency balances. This conversion is free.

2. It trades at the end of the trading day.

3. It charges minimal commission where possible. (0.35 USD instead of the usual 1.70+ USD) The ongoing theory is that it's an internal trade within IBKR where possible and it saves cost.

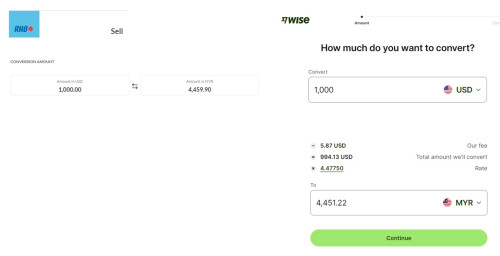

The cheapest route to invest at any amount now for me is:

1. Remit SGD to SG Bank. (MoneyMatch -> CIMB SG, <2 hour during working hours)

2. Deposit from SG Bank to IBKR SG (CIMB SG -> IBKR, <2 hour before funds are made tradable)

3. Set up recurring investment, it's possible to set to buy for exactly 1 time to mimic normal buying.

4. SGD automatically converted to USD without 2USD commission on trade with IBKR's great spot rate.

5. Trade is done at cheapest possible broker commissions.

Not only this makes weekly DCA viable, it also basically eliminates my minimum investment amount per trade. (Used to be RM3000+ for better rates on SunwayMoney and keeping TX cost at around 0.5%)

Obviously, if your stock has shit spread, do not do this. But this is a great boon for investors like me.

Is auto currency conversion applicable to recurring investment transactions only in margin account ? What about adhoc non-recurring transactions ?

Jan 6 2022, 05:50 PM

Jan 6 2022, 05:50 PM

Quote

Quote

0.0301sec

0.0301sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled