QUOTE(buffa @ Jan 13 2024, 06:46 PM)

Avoid at all cost. For now the best rate is duitnow and moneymatch (office hour time)Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Jan 13 2024, 08:35 PM Jan 13 2024, 08:35 PM

Return to original view | Post

#721

|

All Stars

24,388 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jan 13 2024, 09:14 PM Jan 13 2024, 09:14 PM

Return to original view | IPv6 | Post

#722

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(shawnme @ Jan 13 2024, 08:54 PM) Last I got, cross border DuitNow for CIMB ain't working yet. Unless I misunderstood again.... which I won't be surprised. Haha. Cimb sg -> CIMB my no problem. I'm not even sure of CIMB MY or SG that's not working. Didn't have time to investigate further at the time of enquiry. But in terms of CIMB MY rates.. Whoa.. You're right. I think Maybank, ocbc, uob functioning. I got no duitnow so canot check. QUOTE(joeblow @ Jan 13 2024, 09:05 PM) What's this duitnow? New APP or via bank? I am using WISE now, direct to IBKR. Rate around 0.5 to 0.75% higher than Google or XE rate. If convert to sgd then move to IBKR convert to USD (usd2 costs), depending on bank. Duitnow is to sg banks. Saw some people posted here better rates than moneymatch. Downside is RM3k. |

|

|

Jan 14 2024, 07:02 PM Jan 14 2024, 07:02 PM

Return to original view | IPv6 | Post

#723

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(privatequity @ Jan 14 2024, 06:46 PM) Hi guys, if i have capital in my malaysian brokerage a/c - thinking to diversify - as in holding less MYR, also diversify globally - is transfer to IBKR a good option? Tiger uses ibkr in the background. Tiger have access to USD mmf which is giving 5%p.a. You don't get access to USD mmf with ibkr.May go for safer investment, or hold cash in these brokerage. Thinking bout Tiger Brokers too. Can keep in USD/SGD, but seems like holding USD gives interest, which SGD gives minimal. Love to get opinions. For me, no brainer to go with ibkr. |

|

|

Jan 16 2024, 10:00 PM Jan 16 2024, 10:00 PM

Return to original view | IPv6 | Post

#724

|

All Stars

24,388 posts Joined: Feb 2011 |

|

|

|

Feb 1 2024, 12:30 AM Feb 1 2024, 12:30 AM

Return to original view | Post

#725

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(TOS @ Jan 31 2024, 04:15 PM) It's nearing the end of January 2024, I still don't see IBKR refund my 30% WHT deducted out of my BIL holdings. Can anyone confirm the exact date of WHT refund for last year/previous years? Thanks. QUOTE(Yggdrasil @ Jan 31 2024, 06:35 PM) I haven't received mine too. Heard hearsay that it will usually be refunded around 1 Jan - 15 Feb. I guess we can only wait. Wait for their tax filling season first la.QUOTE(skyvisionz @ Jan 31 2024, 11:56 PM) Only buy US etf if you want to do options. If you don't want options stick with Ireland based etf to save on the dividend tax. |

|

|

Mar 4 2024, 12:47 AM Mar 4 2024, 12:47 AM

Return to original view | Post

#726

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(diffyhelman2 @ Mar 4 2024, 12:22 AM) As long as your cash is positive, no interest will be charged by IBKR. diffyhelman2 liked this post

|

|

|

|

|

|

Mar 14 2024, 02:15 PM Mar 14 2024, 02:15 PM

Return to original view | Post

#727

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(diffyhelman2 @ Mar 14 2024, 02:07 PM) This also applies to Swiss or japanese China etc ADR dividends right? Swiss is 35%😁for eg I search swiss dividend tax on malaysia and get 15% witholding for individuals. so if I buy Nestle ADR I should get the 85% of the dividend amount: https://phl.hasil.gov.my/pdf/pdfam/Switzerland.pdf and China dividend withholding taxs are 10%, so if I buy BABA I should get 90% of the dividend. so far what I posted correct? |

|

|

Mar 14 2024, 02:47 PM Mar 14 2024, 02:47 PM

Return to original view | Post

#728

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(diffyhelman2 @ Mar 14 2024, 02:28 PM) got it. I was just confused for a moment because of the post from 2021 that said ibkr is smart enough to apply the correct withholding rate according to our malaysian tax status! They are smart enough. Form my experience. Canada, Europe, US all with hold correctly.QUOTE(Medufsaid @ Mar 14 2024, 02:41 PM) QUOTE(diffyhelman2 @ Mar 14 2024, 02:44 PM) I’m also confused. But no. I think it’s 10% regardless adr or sehk. Because that’s the standard wht rate for China for everyone All baba will always be 10%. It doesn't matter where you are listed. It's where your HQ is. But baba uses Cayman island. But my guess is it still 10% |

|

|

Mar 14 2024, 04:26 PM Mar 14 2024, 04:26 PM

Return to original view | Post

#729

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(diffyhelman2 @ Mar 14 2024, 02:49 PM) But that’s against what you said re: Swiss stock. Because due to our tax treaty with swiss the correct wht rate is 15% not 35%… Last I saw was swiss tax is 35%. I don't think we have treaty with swiss.Sorry not meant to be confrontational just not a lot of clarity on ADRs wht for Non resident aliens Ask TOS. He invest in swiss stocks. I don't bother with Swiss stocks |

|

|

May 11 2024, 04:06 PM May 11 2024, 04:06 PM

Return to original view | IPv6 | Post

#730

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(damien5119 @ May 10 2024, 01:32 AM) Yea i saw that, let me do a quick compare tomorrow. Although , remit thru SG is too much work for me. Prefer set and forget, maybe do transfers to top up once in a while if using the IB RSP. You want to save on cost or you want convenience? It's not too much work. It's just few clicks. Not asking you to go queue at banks and wait your turn. All can be done while you are in the train or getting stuck in traffic. Is whether you want to give yourself excuse not to do something. I have been manually transferring money into IBKR via sg banks for years.I give you an example. Last time people give me all sort of excuses cannot open sg bank account. I decided to safeguard my future purchasing power, so I took a train down to Singapore, spend one whole day there just to open account and come back. It's all about giving excuses or taking action. Excuses get you no where. QUOTE(damien5119 @ May 10 2024, 12:29 AM) hi qq, currently using FSM for monthly DCA into some ETF's You can transfer. You need to contact IBKR to initiate the transfer. Fsm function for me is only buy PRS or invest my EPF money. lol.Just opened a IB account. Looks like Wise fees are high , would it make sense to keep using FSM for the purpose of DCA? If i were to ever abandon FSM , i can just transfer the securities to IB right for a small fee? My FSM SG contains zero money and not use at all. This post has been edited by Ramjade: May 11 2024, 05:18 PM |

|

|

May 12 2024, 07:38 PM May 12 2024, 07:38 PM

Return to original view | Post

#731

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(Singh_Kalan @ May 11 2024, 10:53 PM) FSMOne RSP buy in fees is so low, its almost the same as IBKR. Ya the cost is higher when you want to sell, but its just a one time cost. Plus FSMOne have autosweep that pay u interest. Not sure how is their exchange rate. I know IBKR give the best exchange rate. |

|

|

May 12 2024, 08:25 PM May 12 2024, 08:25 PM

Return to original view | Post

#732

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(melondance @ May 12 2024, 07:46 PM) Now that Wise increased their transfer fee for ACH (USD local to USD international), if FSMOne do let us access LSE ETF (to avoid paying 30% WHT), it wouldn't make much sense to use IBKR anymore... Just use the old school way.Furthermore, after doing currency conversion MYR > USD > MYR, it seems like Wise only a tiny bit cheaper than FSMOne. Malaysian banks -> moneymatch or Sunway money -> SG banks -> IBKR -> convert currency inside IBKR at real time market rate. Takudan liked this post

|

|

|

May 14 2024, 02:34 PM May 14 2024, 02:34 PM

Return to original view | IPv6 | Post

#733

|

All Stars

24,388 posts Joined: Feb 2011 |

|

|

|

|

|

|

May 16 2024, 06:35 AM May 16 2024, 06:35 AM

Return to original view | IPv6 | Post

#734

|

All Stars

24,388 posts Joined: Feb 2011 |

|

|

|

May 17 2024, 10:45 PM May 17 2024, 10:45 PM

Return to original view | IPv6 | Post

#735

|

All Stars

24,388 posts Joined: Feb 2011 |

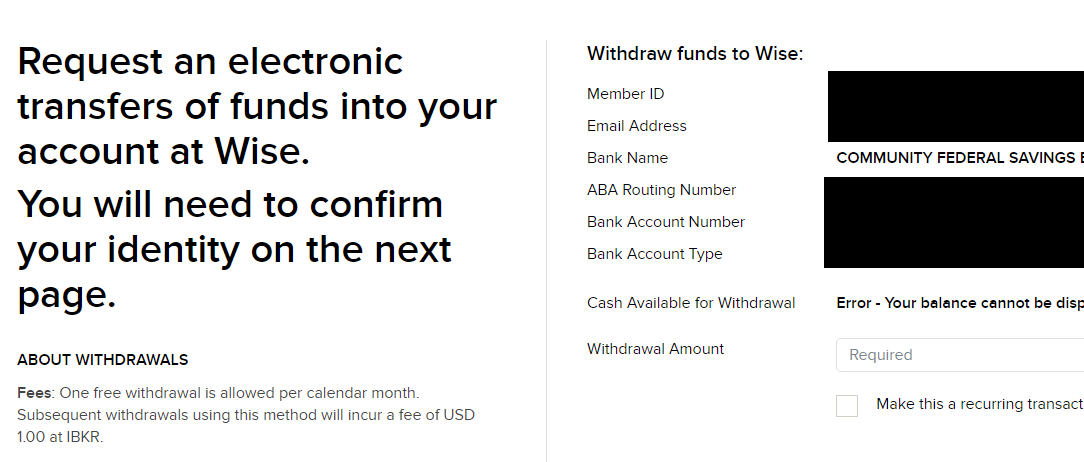

QUOTE(hedfi @ May 17 2024, 10:27 PM) Tried withdraw USD10k from IBKR to Moomoo SG but the fees is USD35! Is there any cheaper methods to to do it? Am trying to move some money to Moomoo instead of concentrating in IBKR IBKR give you one free withdrawal a month. 2nd withdrawal cost money.Used Wise and no cost were shown, hope it'll be free and subsequent withdrawal cost USD1 at IBKR hedfi liked this post

|

|

|

May 18 2024, 11:44 AM May 18 2024, 11:44 AM

Return to original view | IPv6 | Post

#736

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(hedfi @ May 18 2024, 09:24 AM) I don't think it USD 1 for subsequent withdrawal. USD1 is for ACH. Wise is lousy bank to ACH as BNM only mandate RM20k limit only.https://www.interactivebrokers.com/en/pricing/other-fees.php |

|

|

May 18 2024, 06:56 PM May 18 2024, 06:56 PM

Return to original view | IPv6 | Post

#737

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(Medufsaid @ May 18 2024, 12:00 PM) $1.00 is correct Yup that's right. Community bank that partner with wise. hmm. looking at how IBKR withdraws out to Wise, seems like there is no direct IBKR->Wise method. they have to withdraw out to a local US bank that partners with Wise. so the same limitation will apply for Moomoo SG which doesn't have any partnership with US banks (all USD in Moomoo SG is parked with DBS) |

|

|

Jul 19 2024, 08:25 PM Jul 19 2024, 08:25 PM

Return to original view | IPv6 | Post

#738

|

All Stars

24,388 posts Joined: Feb 2011 |

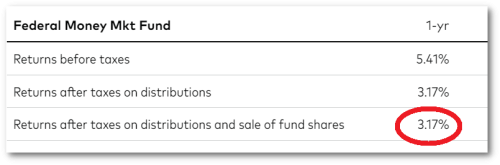

QUOTE(Eugenet @ Jul 19 2024, 05:57 PM) Error: The min cashOrderQty for money market fund is 10000 You can buy stuff like VMFXX. It's money market funds. I just found out about it.I store idle USD at a money market fund. Returns should be similar to ETFs like BILL, SGOV or IB01. The benefit is you don't have to deal with transaction costs when buying/selling. Also, there are no withholding tax. I have made additional unit purchases as little as US$37 (yes, just thirty seven dollars). But today I found that IBKR has imposed a purchase minimum of US$10,000. Here's a Reddit discussion on this subject. https://www.reddit.com/r/interactivebrokers...market_fund_is/ Cash management is an important tool at a brokerage and IBKR has been weak at it. Today they have just made themselves that much worse. This post has been edited by Ramjade: Jul 19 2024, 08:25 PM |

|

|

Jul 22 2024, 11:57 AM Jul 22 2024, 11:57 AM

Return to original view | IPv6 | Post

#739

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(Eugenet @ Jul 20 2024, 02:06 PM) This week I have $139 left after a trade. I can probably buy 1 share of BIL but it'll incur $0.35. Then use CSOP USD money market fund. Need access tiger or moomo sg. Not moomoo Malaysia.Previously I can just buy $139 of my money market fund. No taxes and no transaction cost. If I receive $30 dividends, I can just add $30 to the fund. But now I can't because of the $10,000 minimum. VMFXX appears to incur taxes. It doesn't look pretty after tax. See below. Anyway, IBKR now requires $10,000 for any money market buy transaction so it won't work.  QUOTE(cweng93 @ Jul 21 2024, 12:44 PM) Money match -> sg banks -> deposit SGD into IBKR -> concert SGD into USD using IBKR. |

|

|

Jul 30 2024, 04:22 PM Jul 30 2024, 04:22 PM

Return to original view | IPv6 | Post

#740

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(langstrasse @ Jul 30 2024, 03:50 PM) Hi guys Like how all dividends are paid in IBKR. Paid your account inside IBKR. IBKR can hold multiple currency under one account.For holders of dividend stocks from SGX (e.g. DBS) purchased via IBKR, how is the dividend paid out? langstrasse liked this post

|

| Change to: |  1.4034sec 1.4034sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 08:10 AM |