QUOTE(nicholaswkc @ Mar 30 2022, 04:09 AM)

He means this: https://finance.yahoo.com/quote/NQ=F/Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Mar 30 2022, 08:13 AM Mar 30 2022, 08:13 AM

Return to original view | Post

#341

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Mar 30 2022, 08:32 AM Mar 30 2022, 08:32 AM

Return to original view | Post

#342

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Knives Out in India: Zomato Needs to Expand the Menu, Quickly: https://www.wsj.com/articles/knives-out-in-...share_permalink

|

|

|

Mar 30 2022, 12:30 PM Mar 30 2022, 12:30 PM

Return to original view | Post

#343

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 30 2022, 06:48 PM Mar 30 2022, 06:48 PM

Return to original view | Post

#344

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

dwRK

https://www.reuters.com/business/finance/us...019-2022-03-29/ Does the yield curve inversion tell you anything from "TA" point of view? This post has been edited by TOS: Mar 30 2022, 10:54 PM |

|

|

Mar 30 2022, 09:53 PM Mar 30 2022, 09:53 PM

Return to original view | Post

#345

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dwRK @ Mar 30 2022, 08:06 PM) these are mostly noise... Which bond index are you watching? From FA point of view, stocks are priced in large part due to risk premium over the risk-free yield. So knowing the bond markets movementcan give a lot of hints actually.few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol quite sure a recession will come... just dunno when... usually needs a trigger for the meltdown... like the subprime last time... I was hoping covid n ukraine be it but no... lol... right now US bonds are sitting on trend line support... if it breaks and drops further, then market is ok... if it starts going back up, then big players are in risk off mode and buying bonds...and we should be very carefully... usually the news and analysts will be especially bullish to reassure market is good and healthy... this is the sign to run... If you look at Russell 2000... it's not that pretty compared to S&P, Nasdaq, Dow... this means only a few big companies are "supporting" the market now... with cpi all time high... let's see... Let me guess. You are watching the UST 10 year? From my experience, most professionals price stocks using the 10-year yield as the risk free rate (since you usually hold stocks for that long, hence bearing risk for a similar term). This post has been edited by TOS: Mar 30 2022, 10:11 PM |

|

|

Mar 31 2022, 10:11 AM Mar 31 2022, 10:11 AM

Return to original view | Post

#346

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Mar 31 2022, 01:09 PM Mar 31 2022, 01:09 PM

Return to original view | Post

#347

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 1 2022, 12:44 PM Apr 1 2022, 12:44 PM

Return to original view | Post

#348

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 1 2022, 12:46 PM Apr 1 2022, 12:46 PM

Return to original view | Post

#349

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 2 2022, 01:23 PM Apr 2 2022, 01:23 PM

Return to original view | Post

#350

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 2 2022, 01:27 PM Apr 2 2022, 01:27 PM

Return to original view | Post

#351

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(AthrunIJ @ Apr 2 2022, 01:04 PM) Just want to confirm. As I am planning to buy VUAA and I checked the opening time of LSE is 8am GMT Europe just adjusted their summer time not long ago. Switzerland, France, UK etc. all changed their clocks 1 hour earlier. So, the market should open at 3pm Malaysia time for Swiss, LSE, Euronext Paris, Deutsche Borse etc.So Malaysia time is 1600 GMT+8 right? AthrunIJ You can refer to this too: https://www.tradinghours.com/markets/lse/hours This post has been edited by TOS: Apr 2 2022, 02:25 PM AthrunIJ liked this post

|

|

|

Apr 2 2022, 02:45 PM Apr 2 2022, 02:45 PM

Return to original view | Post

#352

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hoshiyuu @ Apr 2 2022, 02:10 PM) Now, market maker try to keep these value as close as possible, to minimize what we call tracking errors. Or as far as possible, but not until it scares long-term investors away. This is what most passive ETF investors who like "low-cost" funds actually miss out. One source of profit for the fund managers like Vanguard and Blackrock has been the spread between the true underlying NAV and the ETF market value. It's still a very oligopolistic market for the fund management industry, so the tracking errors will sustain for some time until more players come in and bring it down (slightly) due to competition. QUOTE Finally, the ETF industry has a strong incentive to promote these products over traditional mutual funds. It is not that their stated fee structures are materially higher than those of open-ended mutual funds, but there are opportunities to trade profitably around the management of fund shares that generate large and steady streams of revenue. The process can be contrasted to the creation of shares in an open-ended mutual fund. In the traditional fund, the manager receives indication of new investments or redemptions over the course of the day. If there is net flow in it is the manager’s job to buy underlying shares of stock at as close to the final net asset value as possible so that the newly created fund shares match up well with the underlying assets. In general, any improvement in the price at which the underlying stocks are acquired accrues to the benefit of all the other fund participants as the new assets go into the pool at less than the end of day NAV. Net redemptions are simply the mirror image of this process on the sell side. New ETF shares are created whenever the market demand exceeds the existing supply available for sale. At such times an Authorized Participant (AP) goes about acquiring the underlying stocks in the ETF and packaging them into new ETF shares. The shares are registered with the sponsor and become part of the float. Again, the process of redeeming shares is identical on the other side. The key distinction, however, is that the AP does not act until there is some indication of excess demand for the ETF shares. That indication is the price of the ETF rising above the NAV of the underlying shares. This is an activity that gives rise to an arbitrage opportunity for the AP. Once the ETF price is high enough, the AP buys the lower priced securities and sells the new shares of the ETF, locking in a trading profit. This activity is essentially the same kind of arbitrage that has gone on between stock index futures and baskets of stocks since the 1980s. In the case of stock index arbitrage-using futures, it is a highly competitive open market and long ago any excess profits were competed out of the system. It is somewhat different with ETFs. While there are many authorized participants operating across literally hundreds of ETFs, there is not complete and open competition for these services. The arbitrage spreads are not egregiously large, but they are attractive enough to encourage institutional ETF participants to promote more business. This brings us to where we are today. The ETF market has grown to become a major force in all major equity markets around the world, with steadily expanding volumes. The lion’s share of the business is concentrated in a relatively small number of major index ETFs, but new entries appear regularly. Each of the new products is trying to reach critical mass that will support the operations of the ETF and the trading opportunities of the associated authorized participants. Few people know before the fact which of the new products will become blockbusters, or in fact have any success at all. But the economics of the marketplace are such that there are many incentives to continue to create new products. Fortunately for investors the benefits of ETFs are attractive enough to justify the different layers of modest cost. It is debatable whether anyone really needs equity ETFs given the vast array of other alternatives available, but it seems without question that they are a product that is here to stay Page 388-389, from this book: https://forum.lowyat.net/index.php?showtopi...ost&p=103481709 This post has been edited by TOS: Apr 2 2022, 02:45 PM AthrunIJ liked this post

|

|

|

Apr 4 2022, 01:23 PM Apr 4 2022, 01:23 PM

Return to original view | Post

#353

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Apr 5 2022, 08:54 AM Apr 5 2022, 08:54 AM

Return to original view | Post

#354

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Credit Suisse Details More Failings From Greensill Collapse

The bank also faced a setback in its recovery efforts when insurer Tokio Marine said it would fight paying out claims alleging Greensill perpetrated fraud https://www.wsj.com/articles/credit-suisse-...share_permalink |

|

|

Apr 6 2022, 12:38 PM Apr 6 2022, 12:38 PM

Return to original view | Post

#355

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 7 2022, 12:43 PM Apr 7 2022, 12:43 PM

Return to original view | Post

#356

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 8 2022, 12:24 PM Apr 8 2022, 12:24 PM

Return to original view | Post

#357

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Apr 9 2022, 06:45 PM Apr 9 2022, 06:45 PM

Return to original view | Post

#358

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

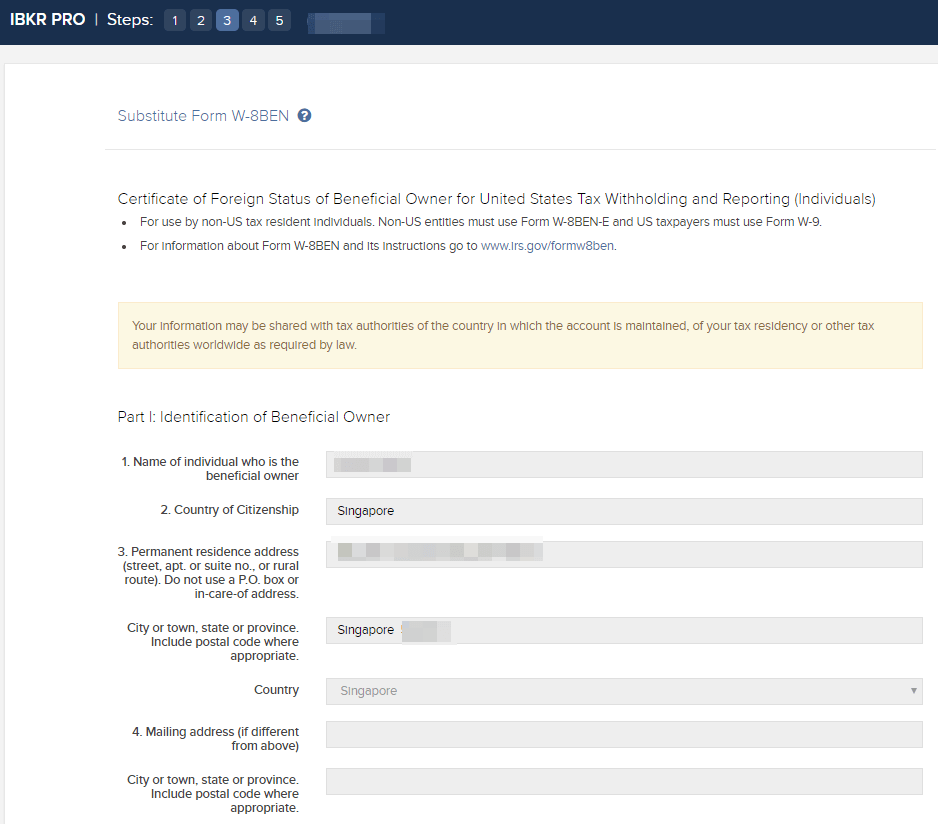

QUOTE(potatobanana @ Apr 9 2022, 06:31 PM) Hi guys, Assuming you are MY tax resident:Recently I received letter with label "Important Tax Return Document Enclosed". It is now officially one year using IBKR. However this will be the first time I am dealing with tax stuff outside of Malaysia. Please correct my understanding below: - Profits and dividend is subjected to tax in the US market - The profit or dividend will be automatically deducted for tax Do we need to declare the profit or dividend to US gov or MY gov? Is there anything else we should do? Looking forward to have some advise on the above For US, you should have signed the W-8BEN form (when you open your IB account). So 30% WHT is already automatically deducted by IBKR before the dividend is credited to your IB cash balance. You don't need to declare any capital gains and dividend incomes (whether in the form of stocks or cash) to MY government. This post has been edited by TOS: Apr 9 2022, 07:37 PM potatobanana liked this post

|

|

|

Apr 9 2022, 09:15 PM Apr 9 2022, 09:15 PM

Return to original view | Post

#359

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(potatobanana @ Apr 9 2022, 09:01 PM) I am residing in Malaysia and also a MY tax resident. Yup, it should look something like step 5 shown in the website (URL link) when you opened your IB account: https://investmentmoats.com/money/easy-step...e-brokers-ibkr/Since the form been signed; which means the form is the only action from us. Happy and glad with the straightforward procedure Here is the screenshot capture from the webpage:  This post has been edited by TOS: Apr 9 2022, 09:19 PM potatobanana liked this post

|

|

|

Apr 11 2022, 01:41 PM Apr 11 2022, 01:41 PM

Return to original view | Post

#360

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

| Change to: |  0.2472sec 0.2472sec

1.09 1.09

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 08:11 PM |