QUOTE(Avangelice @ Oct 23 2023, 05:04 PM)

That's double exposure no? Both tracks s&p but Vwra has more exposure to Europe and EM. (60% still in S&P)

I see that many have answered your question, so no need to repeat. All the best in your journey.Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Oct 23 2023, 07:40 PM Oct 23 2023, 07:40 PM

Return to original view | Post

#21

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

|

|

|

Oct 23 2023, 07:57 PM Oct 23 2023, 07:57 PM

Return to original view | Post

#22

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(Avangelice @ Oct 23 2023, 07:50 PM) My boy is reaching three years of age coming January 2024 and I feel uncomfortable being heavy in Malaysia with my stock and epf plus asnb (non Muslims) so the horizon is 18 years from now. Nothing wrong with having some in Malaysia. If Malaysian bank stocks crash, I will buy Maybank and Public Bank (haven't seen Malaysian stocks for quite a while now, so no idea what's happening). But certainly good to diversify to other countries like USABonds. Now that's something I haven't delved into yet Bonds--understand the inverse relationship between price and interest b4 you delve in. Very important. Tons of info in the web. Just need to google it |

|

|

Oct 27 2023, 08:30 PM Oct 27 2023, 08:30 PM

Return to original view | Post

#23

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(TOS @ Oct 27 2023, 12:41 PM) For CHF investors: https://www.ft.com/content/f42dc58e-8e5f-43...4f-9f8aeaef6594 Thanks. Have always been interested in CHF due to its safe haven status & strong currency but mindful of the lower interest rate and the influence that Europe has over it. I remembered that time during covid when Switzerland had to devalue its currency as Euro has gone down vs CHF which cause unsustainable business pressure for Switzerland. (Use a paywall bypass plugin to read the article.) Surprised that this time around Swiss National Bank actually sold foreign currencies vs CHF (to curb exported inflation) as usually its SNB buying foreign currencies instead. Haven't been following CHF recently. Another news article on CHF https://www.reuters.com/markets/europe/snb-...urn-2023-03-21/ |

|

|

Nov 8 2023, 05:33 PM Nov 8 2023, 05:33 PM

Return to original view | Post

#24

|

Senior Member

2,379 posts Joined: Sep 2017 |

If one were to sell puts (be it in IBKR or other brokerages) and their cash is in auto-sweep account which earns interest, will the brokerages stop paying interest on the 'cash set aside in case our puts are called'?

|

|

|

Nov 9 2023, 03:41 PM Nov 9 2023, 03:41 PM

Return to original view | Post

#25

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Nov 10 2023, 02:35 PM Nov 10 2023, 02:35 PM

Return to original view | Post

#26

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

|

|

|

Nov 21 2023, 06:28 PM Nov 21 2023, 06:28 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,379 posts Joined: Sep 2017 |

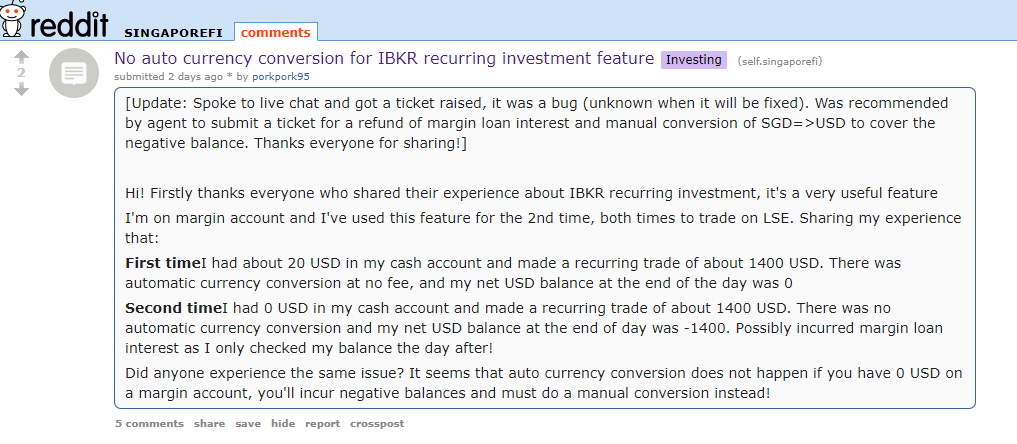

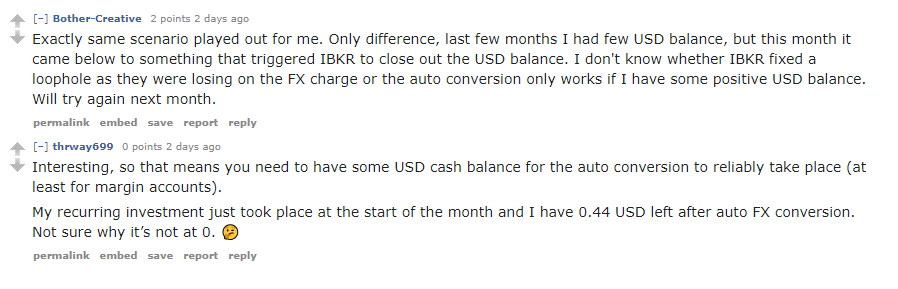

QUOTE(Medufsaid @ Oct 7 2023, 05:03 PM) possible bug on IBKR. even so, if u manually convert your currency, U$0.35 commission fees is still cheaper than 0.05% for LSE instruments Medufsaid 1) Is it really USD0.35 commission fees for US ETF like QQQ, VOO regardless of dollar amount invested?   2) If LSE commission is only 0.05%, then isn't it very cheap (cheaper than US0.35?) For eg: USD1000*0.05% =US0.5? |

|

|

Nov 22 2023, 06:31 PM Nov 22 2023, 06:31 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(Medufsaid @ Nov 22 2023, 03:07 PM) LSE minimum is $1.70, or 0.05%, whichever is larger. NYSE pricing can be found here https://thepoorswiss.com/ib-fixed-or-tiered-pricing/ Thanks. It seems that for small amount, NYSE is better but for larger amount, LSE is better |

|

|

Nov 22 2023, 06:44 PM Nov 22 2023, 06:44 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(Medufsaid @ Nov 22 2023, 06:37 PM) Medufsaid Oh, even for LSE etfs can get $0.35 fee? I was comparing the spread between SPY, VOO and VUAA. VUAA and SPY spread around $0.03 while VOO is $0.1. Expense ratio for SPY 0.09% while VOO and VUAA 0.03%. So if its really $0.35 fee for VUAA, its the clear winner |

| Change to: |  0.2429sec 0.2429sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 06:52 PM |