For Chinese investors and those who understand Mandarin:

https://www.mpfinance.com/fin/columnist2.ph...&issue=20200903

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

|

|

Sep 3 2020, 10:21 AM Sep 3 2020, 10:21 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

For Chinese investors and those who understand Mandarin:

https://www.mpfinance.com/fin/columnist2.ph...&issue=20200903 |

|

|

|

|

|

Oct 13 2020, 03:45 PM Oct 13 2020, 03:45 PM

Return to original view | Post

#22

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 3 2020, 11:36 PM Nov 3 2020, 11:36 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Cubalagi @ Nov 3 2020, 10:28 PM) Expected. Even if the listing goes on. Some time later the duopoly for mobile payment market will be hammered by regulators. Profit cannot be sustained anymore... Kind of pity those leveraged 20 times waiting to see the pop on first day of listing. Now let the bubble burst! https://www.mpfinance.com/fin/instantf2.php...&issue=20201103 https://www.mpfinance.com/fin/instantf2.php...&issue=20201103 https://www.mpfinance.com/fin/instantf2.php...&issue=20201103 https://www.mpfinance.com/fin/instantf2.php...&issue=20201103 Navigating Chinese politics is not reserved for the faint-hearted. I suppose Chinese state-owned banks lobbied the regulators to control this behemoth behind closed doors. Since Ant's most direct competitor is them, naturally I suspect them first. Alibaba ADR dropped 6% in New York session now. This post has been edited by TOS: Nov 3 2020, 11:40 PM |

|

|

Nov 5 2020, 10:45 AM Nov 5 2020, 10:45 AM

Return to original view | Post

#24

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Some lessons from investment pros in Hong Kong on Ant. First one is a stock trader, second is a Grade A office expert, third article was written by a professional trader working in the trading floor at an investment bank in HK.

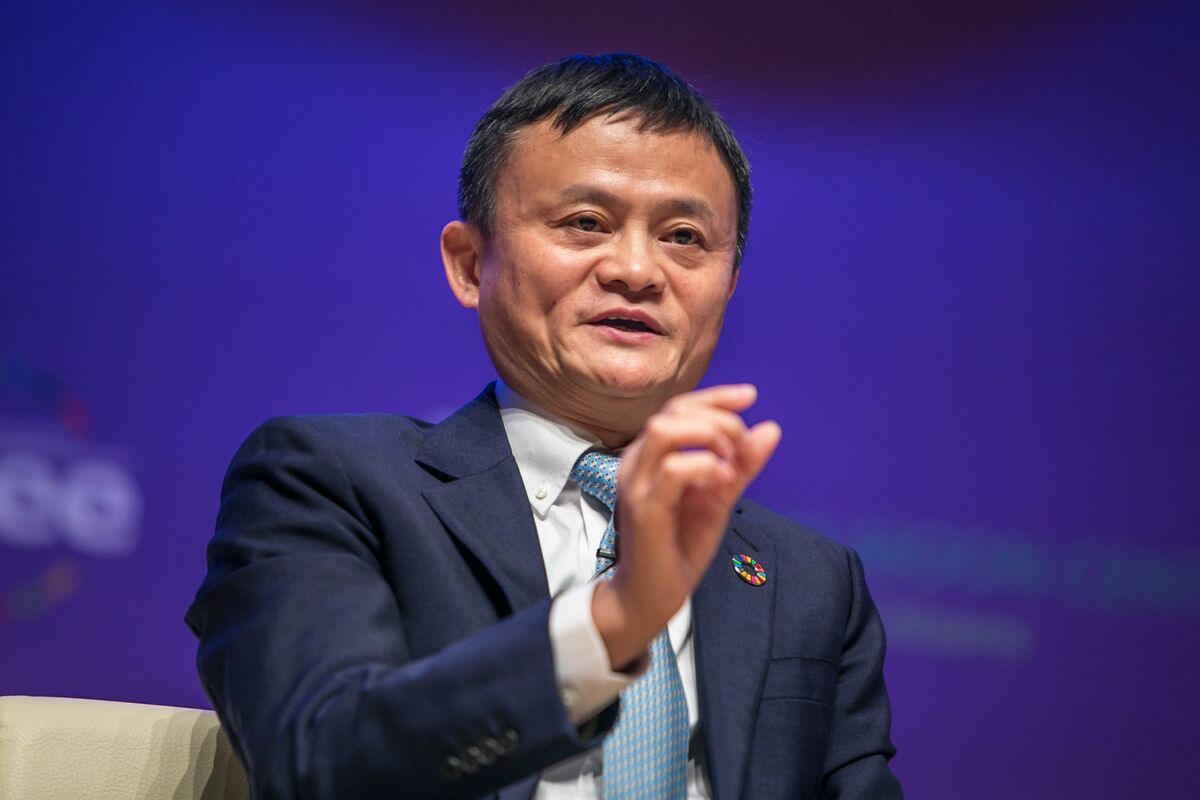

https://www.mpfinance.com/fin/columnist2.ph...&issue=20201105 https://www.mpfinance.com/fin/columnist2.ph...&issue=20201105 https://www.mpfinance.com/fin/columnist2.ph...&issue=20201105 (Hong Kong has one of the highest density of stock traders per capital in this world. 1/3 of HK adult has some form of share investment.) Bloomberg article: https://www.bloomberg.com/opinion/articles/...lio-s-nightmare  More beanstalk than golden egg. Photographer: Jean Chung/Bloomberg QUOTE Nov. 3 was a sad, sad day for China. Not because America’s election changes anything about its hawkish stance toward Beijing — that’s bipartisan — but because China lost a golden investment opportunity by shooting itself in the foot. Looking purely at the numbers, China is in a sweet spot right now. Its bonds are attractive, as the yield differential with U.S. Treasuries hovers near a five-year high. Beijing’s virus-containment strategy is working, and the economy has bounced back. Meanwhile, President Xi Jinping’s latest five-year economic blueprint, which favors innovation and domestic consumption, is a win for tech companies — exactly the kind of growth stocks investors love. Foreigners have been buying the China story this year, even as President Donald Trump threatened to sanction and delist mainland companies. They are crowding into Beijing’s sovereign issues at a record pace, promising to overtake domestic city commercial banks as the second largest purchasing bloc. Global investors need to have “a significant portion” of their portfolios in Chinese assets, both for diversification and short-term tactical gains, said Bridgewater Associates LP founder Ray Dalio. The Shanghai Stock Exchange’s surprise suspension of Ant Group’s record-breaking initial public offering Tuesday night changed the landscape entirely. Two weeks earlier, the company’s billionaire founder Jack Ma made a sensational speech, saying China’s financial system and regulatory framework are broken. On Monday, Beijing’s top financial watchdogs summoned Ma and dressed him down. Then they issued new draft rules to rein in Ant’s lucrative consumer loan business. It’s episodes like this that remind us how capricious and thin-skinned Beijing’s policy makers can be. Regulators have been debating whether to allow online microlenders to act as simple matchmakers (rather than traditional lenders, which require capital buffers), for a good two years. Why the sudden change of heart two days before Ant’s much-anticipated trading debut? The fintech giant had already raised at least $34.5 billion from its dual listing in Hong Kong and Shanghai. Now, it has to return billions of dollars to its IPO subscribers. Somehow, Beijing has proved Ma’s point: China’s bureaucrats don’t know what they’re doing. To govern well, you can’t pick and choose when and how hard to regulate; the secret sauce is consistency. Beijing is looking as childish and moody as Trump on the day of the U.S. election. While Jack Ma’s botched IPO is the big story, there are plenty of obscure examples that also matter to long-term investors. Consider instead the so-called keepwell clause. This “gentlemen’s agreement” is a common feature of China’s $790 billion dollar bond market, and in theory protects investors in the event of default. In September, a Beijing court rejected the recognition of the keepwell deed for a conglomerate’s dollar bond. Two months later, a court in Shanghai ruled to accept this provision for an energy trader. China’s stance on keepwell is anyone’s guess. This is the problem with investing in China. First, assumed rules can be broken at whim, especially when policy makers fear they are losing face. Second, after Ma’s troubles, what billionaire executive will want to speak up? It’s much better to be supplicant, keep quiet and busy yourself making money. Sure, China has many attractive traits, but you’d better be prepared to stay in perpetual crisis mode. Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. She previously wrote on markets for Barron's, following a career as an investment banker, and is a CFA charterholder. This post has been edited by TOS: Nov 5 2020, 12:09 PM |

|

|

Nov 5 2020, 07:53 PM Nov 5 2020, 07:53 PM

Return to original view | Post

#25

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Alibaba Quarterly Result: https://www.alibabagroup.com/en/ir/earnings

|

|

|

Nov 12 2020, 10:05 AM Nov 12 2020, 10:05 AM

Return to original view | Post

#26

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Insider news about Ant's regulation:

https://www.mpfinance.com/fin/columnist2.ph...&issue=20201112 (In traditional Chinese, I can help translate if any assistance is needed. Other members can help translate to.) This post has been edited by TOS: Nov 12 2020, 10:05 AM |

|

|

|

|

|

Nov 14 2020, 11:31 PM Nov 14 2020, 11:31 PM

Return to original view | Post

#27

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Cubalagi @ Nov 14 2020, 09:03 PM) If u think from last year to now.. we had Trade War, HK unrest, Covid, all scary stuff. But tech stocks are still showing quite strong performance. Look at Tencent most recent quarter. The key things here is market structure. Tencent is monopolistic-like in their pricing, and they have huge market power (like Alibaba, they build products branching out of their "ecosystem" exactly why Grab start off with less-profitable car-hailing then venture into fintech and other high margin stuff), only competitors with the scale as large as Alibaba can challenge it. Of course, the share prices can be volatile, and if u are a good market timer, maybe can go in and out. I tried that, but I find that just sit still and top up a bit when there are dips are probably give better results with much less work and stress. If the PRC government insists to break up the monopoly/duopoly/oligopoly, the resulting company will still lose its market power, not unlike what happened to Rockefeller and AT&T. These days, governments give too much leniency to tech firms, added with their low-cost business model, making them rising very fast and gaining huge market share. It's only time when break-ups will happen. (Of course also depends on political lobbying). Don't be too naive to think quarterly result looks good. In fact the more profitable the company, this will arouse more suspicion from the top-level government officials. (Remember what happened to game addiction due to the frenzy over Honor of Kings?) You never know what will happen tomorrow, more so in communist China. It's certainly not the CCP's wish to see extreme inequality in the society. Profits don't simple arise in economics. If producing something is profitable, someone else would enter into the business and cut the margin. This is not happening in oligopolistic and monopolistic market, which is I believe what the CCP is looking at. I certainly agree with the sit-still and top-up when drop strategy, works well for long-term investors in their early phase of their financial goal. This post has been edited by TOS: Nov 14 2020, 11:33 PM |

|

|

Nov 16 2020, 05:09 PM Nov 16 2020, 05:09 PM

Return to original view | Post

#28

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Anyone here bought Hang Seng Bank's stock? It's long regarded as the yield darling apart form its parent HSBC. Now we have this:

https://www.mpfinance.com/fin/instantf2.php...&issue=20201116 Competition between virtual banks and brick-and-mortar banks are heating up! But unless they raise their interest rate, it's hard to compete with virtual banks though. Polarbearz sicne you have HKID, have you tried out any virtual banks in HK yet? QUOTE(Cubalagi @ Nov 16 2020, 09:26 AM) Already western countries want to kill Huawei. CCP want to kill the like of Baba and Tencent? I don't think CCP so stupid. And tech is the future of their competition with USA for global leadership. Of course they won't kill. But there is a chance that they will split things up. Having said that there are alwaus many bad possibilities in investing, that's called risk. But so far buying the dips have worked well for tech. Anyways, I'm pretty diversified when it comes to my exposure to China tech as I invest indirectly via ETFs only. 0829EA on Bursa and 3173 in HK. Combined, that's about 370 Chinesenee economy companies (not all tech though) in HK, US ADRs, Shanghai and Shenzen. Nice exposure via ETFs. |

|

|

Nov 20 2020, 09:52 AM Nov 20 2020, 09:52 AM

Return to original view | Post

#29

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(polarzbearz @ Nov 18 2020, 03:25 PM) You ping-Ed the wrong person How much interest does HSBC pay you? 0.001% p.a.? So far I hasn't explored virtual banks yet - mainly because HSBC is meeting my needs so far (with their recent fee waiver / minimum balance waiver since last year), plus it links to my HSBC Malaysia account Not sure if you know virtual banks pay you 1% p.a.? Maybe you are large customer, if so might need to retain large sum of cash balance then entitled to some benefits. I remember need something like 250k for global transfers between all HSBC accounts around the world. If so, then it's fine. |

|

|

Nov 20 2020, 12:07 PM Nov 20 2020, 12:07 PM

Return to original view | Post

#30

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(polarzbearz @ Nov 20 2020, 11:58 AM) Actually I'm not even sure about HSBC interest lol, but I recall it was close to zero Since you are not for interest that's fine then. Back then I had to maintain 5000HKD inside the bank account to avoid below balance fee charges but decided it was worth the "opportunity cost" since its so damn hard to open an account in Hong Kong, aside from being there physically with valid passes / justifications. On a monthly basis I was getting about HKD 0.50 interest on approx ~5100 HKD balance. So I'm guessing approx 0.0012% per annum. Didn't bothered much as interest wasn't my main reason of keeping the account. Now that they've removed the below balance fee I moved all my funds out to investments and use it purely as transit bank for funding HKD into my IBKR account Also according to HSBC HK's standard I'm basically a tiny (or non existent) customer. From HSBC HK I cannot see my Malaysia accounts. In Malaysia I'm HSBC Advance customer (Perks@Work) hence my account is automatically linked to global counterparts and I can see my HK balance from Malaysia. Tho, not much usage for me tbh. HSBC Bank in general is my global bank (since they have presence almost everywhere) and that's about it. I personally find virtual banks good for making money out of idle funds. 1% versus 0.00 something percent is 1000 times higher, and close to market risk-free rate (10-year UST yields 0.8-0.9% p.a.), so it's very appealing for me. |

|

|

Dec 18 2020, 02:16 PM Dec 18 2020, 02:16 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

-Deleted-

This post has been edited by TOS: Dec 18 2020, 07:29 PM |

|

|

Dec 24 2020, 11:21 AM Dec 24 2020, 11:21 AM

Return to original view | IPv6 | Post

#32

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Baba got hit again.

https://www.bloomberg.com/news/articles/202...oly-allegations 7-8% drop, 5-month-low now. |

|

|

Dec 24 2020, 02:48 PM Dec 24 2020, 02:48 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Kjk014 @ Dec 24 2020, 01:46 PM) It's the chilly season. The day before Xmas. QUOTE Merry Christmas HKEX’s Hong Kong markets will be closed for the afternoon trading session on 24 December and remain closed all day on 25 December. The market will re-open as usual on 28 December. From HKEX website. Oh, and Merry Christmas everyone. |

|

|

|

|

|

Dec 24 2020, 06:40 PM Dec 24 2020, 06:40 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Cubalagi @ Dec 24 2020, 06:30 PM) QUOTE(Cubalagi @ Nov 16 2020, 09:26 AM) Already western countries want to kill Huawei. CCP want to kill the like of Baba and Tencent? I don't think CCP so stupid. And tech is the future of their competition with USA for global leadership. So, do you think CCP wanna kill Baba now? Having said that there are alwaus many bad possibilities in investing, that's called risk. But so far buying the dips have worked well for tech. Anyways, I'm pretty diversified when it comes to my exposure to China tech as I invest indirectly via ETFs only. 0829EA on Bursa and 3173 in HK. Combined, that's about 370 Chinesenee economy companies (not all tech though) in HK, US ADRs, Shanghai and Shenzen. |

|

|

Dec 26 2020, 09:55 PM Dec 26 2020, 09:55 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Jan 6 2021, 11:26 PM Jan 6 2021, 11:26 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ Jan 6 2021, 10:33 PM) Bros,... sorry,... I just received an update that the NYSE WILL DELIST THE THREE CHINA TELECOM COMPANIES. Not your fault lol. They keep changing their policy and decisions. Sorry abt what I said this morning in an earlier post of mine today ! |

|

|

Jan 15 2021, 11:19 AM Jan 15 2021, 11:19 AM

Return to original view | IPv6 | Post

#37

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Jan 15 2021, 02:55 PM Jan 15 2021, 02:55 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(foofoosasa @ Jan 15 2021, 11:42 AM) hmm i quite lack confident of this stock lol Haha, indeed baba and tencent are still the kings. better stick to 9988 , 0700 , 9618 QUOTE(abcn1n @ Jan 15 2021, 02:46 PM) Came here after reading about Xiaomi's ban. I am not too sure about Xiaomi's growth prospect, so although a 11% drop might seem tempting, but I think unless its Aapl, other handphone prospects might not be that good. You planning to get any? No, I don't invest directly in China, be they A-shares of H-shares. Corporate governance is a serious issue, even with blue chips, not to mention regulatory risks.I leave it to funds to handle. At least they have far more negotiation rights than us "mini" retailers when things go south. If you can read in traditional Chinese, this is something to note about Baba and those "secondary-listed" H-shares. https://www.mpfinance.com/fin/instantf2.php...&issue=20210104 |

|

|

Jan 15 2021, 05:25 PM Jan 15 2021, 05:25 PM

Return to original view | IPv6 | Post

#39

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(abcn1n @ Jan 15 2021, 03:52 PM) What fund you buy for China then? Was supposed to look up a China fund the last week but forgot all about it (currently only have TA global tech). Sorry, can't read Chinese. My fund is a mix of Chindia equities and Malaysia bonds, Eastspring Investments Asia Select Income Fund. I bought via FSM.https://www.eastspring.com/my/funds-and-sol...s?fundcode=E017 The Chindia equity is invested via a SG mutual fund called Dragon Peacock Fund, also by Eastspring (so it's a fund-of-fund). The MY bonds are managed by the Malaysia Eastspring managers themselves. https://www.eastspring.com/sg/funds/fund-pr...20%E2%80%93%20A As for the Chinese article, Google translate will help you to some extent. I am not a good translator, nor a lawyer (consult lawyer Hansel if in doubt). Here's my translated article: QUOTE Looking at last year's IPO market, Chinese shares are in the investment spotlight, pioneered by JD.com (9618) and Netease (9999), the whole year saw 9 stocks return to HK for listing, attracting a combined 130 billion HKD capital. Regulators are giving the green light to Chinese shares. However, Ming Pao understood that HKIFA (HK Investment Funds Association), upon studying the industry's views and opinions, would like to suggest HKEX to provide more information on protection rules in place to safeguard investors under the secondary-listing system. One notable issue is that Chinese stocks already have lose regulations in their US listing, but many regulatory disclosure are still exempted in the HK listing. Under the current system. Greater China issuers conduct secondary listing in HK under Chapter 19C of the Listing Rules and enjoy automatic exemptions of up to 78 clauses and appendices. According to the document, HKIFA reckons that Chinese shares receiving the exemptions pertaining to related-parties transactions and major transactions disclosure, acquisition rules, and corporate governance rules are exactly those that are easily involved in conflicts of interest, especially related-parties transactions, which is used frequently to infringe the rights of minority shareholders. (https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Listing-Rules-Contingency/Main-Board-Listing-Rules/Equity-Securities/chapter_19c.pdf?la=en) - This Chapter 19C URL is my own addition HKIFA states that the main reason HKEX takes a soft stand is because current Chinese shares' regulations rely on their IPO exchange and corresponding regulators; well-recognized exchanges like NYSE and NASDAQ are mature markets. However, HKIFA suggests that those Chinese shares listed in the primary exchange are already considered Foreign Private Issuer (FPI), whose regulations are already lax compared to domestic US companies, and the exemption given by HKEX gives rise to "double exemption" treatment for these companies. Looking into SFC information, FPIs are not required to abide by "Regulation FD" (Fair Disclosure), and that regulation is supposed to prohibit companies to reveal part of important information to investors and analysts before announcing it to the public. Also, companies are not required to issue quarterly reports, unless it is released outside of US market. Other "benefits" include, managers who hold 10% or more of their company's shares are not required to disclose to SFC their company's shares transaction. Norton Rose Fullbright (a law firm) reported that FPI's disclosure requirement can be fulfilled easily. HKIFA's CEO Sally Wong replied to Ming Pao and asserts that Chinese shares' regulation are lax in mainland China, and they are exempted from more regulations in HK, more so given a majority of their shares are of different voting rights (following the WVR structure), resulting in high governance risk for such companies, yet HKEX never points out the issue. She welcomed investment opportunities in Chinese shares, but suggested that HKEX should significantly reduce the amount of exemptions given under the Listing Rules, and solid rationales should be given for those that are exempted. The public should also be educated about the real risk of investing in Chinese shares. When asked whether they would be worried about governance risk of Chinese shares, large international fund Franklin Templeton's spokesperson replied to Ming Pao that HKEX and SC (HK Securities Commission) documents have listed all Listing Rules-related exemptions, investors can do their due diligence if they need to. Franklin Templeton's Emerging Markets Head of Trading, George Molina says that funds under Franklin Templeton will consider ESG factors when researching companies. He also further elaborates that HKEX's secondary listing is one of the most effective means to allow Asian investors to invest Alibaba-like overseas listed Chinese stocks. Took an hour to finish haha. Forgive me for errors. (I am not a law or finance guy). This post has been edited by TOS: Jan 15 2021, 05:33 PM |

|

|

Jan 20 2021, 03:48 PM Jan 20 2021, 03:48 PM

Return to original view | IPv6 | Post

#40

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Cubalagi @ Jan 20 2021, 11:08 AM) Jack Ma appeared so Baba surged and sentiment overflows to other counters lol propertyfeature liked this post

|

| Change to: |  0.0745sec 0.0745sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 12:31 PM |