Comments on competition among HK businesses and transparency disclosure for investors (no paywall): https://finance.mingpao.com/fin/instantf/20...%9a%ae%e9%9e%ad

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

|

|

Jul 5 2023, 09:10 PM Jul 5 2023, 09:10 PM

Return to original view | IPv6 | Post

#221

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Comments on competition among HK businesses and transparency disclosure for investors (no paywall): https://finance.mingpao.com/fin/instantf/20...%9a%ae%e9%9e%ad

|

|

|

|

|

|

Jul 8 2023, 10:08 AM Jul 8 2023, 10:08 AM

Return to original view | Post

#222

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Link REIT is performing badly... It's current share price of 41.95 HKD is even lower than its recent rights offering's subscription price of 44.2 HKD.

https://finance.mingpao.com/fin/daily/20230...%9d%90%e8%89%87 (no paywall) |

|

|

Jul 13 2023, 01:54 PM Jul 13 2023, 01:54 PM

Return to original view | IPv6 | Post

#223

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Jardine House, the first skyscraper in HK is now 50 years old.

https://finance.mingpao.com/fin/instantf/20...%a7%9f%e6%88%b6 It houses the Asia Pacific HQ of Invesco. Luxury good giant Richemont also has office there. 2/5 of tenants belong to local (HK) and international law firms, while financial service and luxury goods firms account for 18% of total floor area. This post has been edited by TOS: Jul 13 2023, 01:58 PM |

|

|

Jul 13 2023, 10:42 PM Jul 13 2023, 10:42 PM

Return to original view | IPv6 | Post

#224

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Frustrated with LinkedIn? Is it easy to find an i-bank job via LinkedIn? Headhunters?

Let's see what an experienced HK trader can tell you: https://finance.mingpao.com/fin/instantf/20...%b0%b4%e5%8f%b0 |

|

|

Jul 20 2023, 12:05 AM Jul 20 2023, 12:05 AM

Return to original view | Post

#225

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

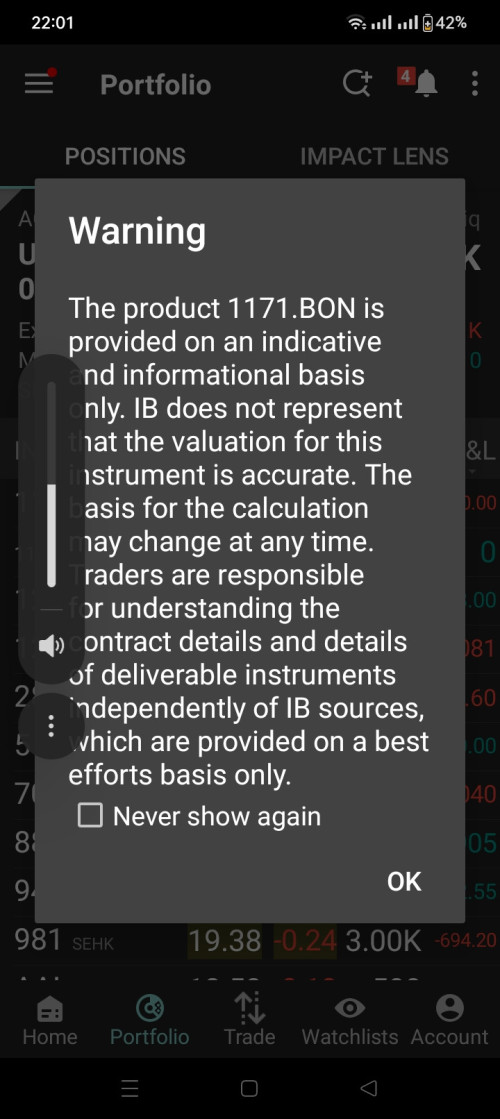

QUOTE(hedfi @ Jul 19 2023, 10:03 PM) Can anybody help me understand this. 1171.sehk(yankuang energy group) had a bonus issue 5:10 recently. What shows up at my IBKR is still the same number of shares that I own but there's another 1171.BON that does not seem to show value. 1171 is showing big loses without the bonus issue. Googled but found nothing on this. Tqvm That's normal. I received rights issued without price quotations before (and I can't sell due to odd lots...). After a few days, the rights are converted into shares and money is deducted from my IBKR's SGD cash account.  According to your company's filling with HKEX: https://www1.hkexnews.hk/listedco/listconew...23053100827.pdf "Despatch date of certificates for the bonus shares" is on the 04 August 2023 while "First date of dealing in the bonus shares" is on the 07 August 2023. Try to check back around the 4th-7th of August and see if your bonus shares are credited. |

|

|

Jul 20 2023, 12:03 PM Jul 20 2023, 12:03 PM

Return to original view | Post

#226

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(hedfi @ Jul 20 2023, 05:11 AM) Thank you so much, @TOS to the rescue again ,🙇 Bonus shares are shares distributed by a company to its current shareholders as fully paid shares free of charge. So you don't need to have any HKD in your IBKR account.Bonus issue is free right? The share price is already lowered from 20+ to less than 12. If need to subscribe mean I need to have HKD in IBKR? none there now It's sometimes called "stock dividends". In your company's case, it seems like management also pays out cash dividend of some 43 CNY for every 10 shares held. https://www.marketscreener.com/quote/stock/...ayout-43343742/ On the dividend ex-date, the stock price will drop to adjust for the cash outflow (cash dividends) and the enlarged share base due to the bonus share award (stock dividends). hedfi liked this post

|

|

|

|

|

|

Jul 20 2023, 12:18 PM Jul 20 2023, 12:18 PM

Return to original view | Post

#227

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

The HK government is redeveloping some old blocks in Wan Chai North.

The famous revenue tower and immigration tower (remember the iconic "Philips" advertisement sign?) will be redeveloped into a mixed-use space comprising MICE spaces, 500-room hotel and some Grade A office spaces. https://finance.mingpao.com/fin/dailyp/2023...%85%ad%e6%88%90 |

|

|

Jul 22 2023, 08:44 PM Jul 22 2023, 08:44 PM

Return to original view | Post

#228

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Alibaba fiscal year 2023 annual report filings were published yesterday:

SEC (20-F): https://data.alibabagroup.com/ecms-files/15...Year%202023.pdf HKEX: https://fis-yhq-data-service.oss-accelerate...R0Ksk2RfjWgo%3D |

|

|

Aug 8 2023, 11:55 PM Aug 8 2023, 11:55 PM

Return to original view | Post

#229

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

WSJ MARKETS: CREDIT MARKETS

Country Garden, China’s Largest Surviving Developer, Sinks Into Debt Crisis Company’s U.S. dollar bonds plunge after it misses interest payments https://www.wsj.com/articles/country-garden...share_permalink |

|

|

Aug 10 2023, 06:43 PM Aug 10 2023, 06:43 PM

Return to original view | Post

#230

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Alibaba results

HKEX announcement/press release: https://fis-yhq-data-service.oss-accelerate...Jya%2F7mrra4%3D Presentation slides: https://data.alibabagroup.com/ecms-files/15...3%20Results.pdf |

|

|

Aug 16 2023, 05:11 PM Aug 16 2023, 05:11 PM

Return to original view | Post

#231

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Tencent results

HKEX announcement: https://static.www.tencent.com/uploads/2023...4dc19a577e3.PDF Earnings release: https://static.www.tencent.com/uploads/2023...7a8e3d667ef.pdf Presentation slides: https://static.www.tencent.com/uploads/2023...be5889b6ba0.pdf This post has been edited by TOS: Aug 16 2023, 09:23 PM |

|

|

Aug 16 2023, 10:28 PM Aug 16 2023, 10:28 PM

Return to original view | Post

#232

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

WSJ MARKETS: HEARD ON THE STREET

China’s Shadow Banks Could Be Another Property Casualty Missed payments from a well-connected trust firm come as China’s property market sinks again—and banks step back https://www.wsj.com/articles/chinas-shadow-...share_permalink *There might be some biases against China whenever Chinese news are reported in Western media. Caveat lector. |

|

|

Aug 23 2023, 08:30 AM Aug 23 2023, 08:30 AM

Return to original view | Post

#233

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Beware of management's selective disclosure of company sales information prior to profit warnings.

From 香港明报: https://finance.mingpao.com/fin/daily/20230...%82%a1%e3%80%8d 徐風:小心業績「見光死」 避免博「績優股」 QUOTE  【明報專訊】又到8月底,港股上市公司中期業績密集發布。有部分投資者會嘗試捕捉「績優股」,趁這些發布企業盈喜預告前買入其股票,待發布公告後股價上升,可以短時間內賺錢離場。然而,由於盈利信息屬股價敏感資料,除非你有可靠的內幕消息,能夠在某上市公司發布業績前斷定其盈利狀况,一般投資者只能倚靠公開信息,估算上市公司的盈利能力,例如上市公司在披露易中發布的每月營運收益公告。 之前只披露交易額 最後要發盈警 利用披露易搜集上市公司表現的投資者,比大部分散戶都更用功,也對你們心儀及有意投資的目標上市公司有更多認識,在投資路上固然有優勢。然而,不能忽視的是,上市公司哪些資訊被公開披露,是由管理層決定,他們或多或少都有上市公司的認股權,或按公司的股價及業績表現分配花紅,所以在利益角度下,會運用「市值管理」及合法手段維持股價走高,包括選擇性披露對上市企業利好的資訊,推遲發布負面消息等,投資者做功課時不可不防。 以香港科技探索(1137)為例子,8月21日公司發盈警,指今年上半年錄得盈利介乎4500萬元至5000萬元之間,對比去年同期的1.28億元跌超過一半。公司解釋,業績轉差的原因包括去年2月及3月第五波新型冠狀病毒疫情引發的糧油雜貨需求激增,而今年則沒有出現有關情况,導致今年上半年訂單總商品交易額增長放緩、直銷商品毛利率下降、新項目初創期間錄得虧損等。 如果觀察公司今年7月6日發布的6月份營運表現,管理層則表示當月電子商貿業務「帶來穩定的營運表現」;8月7日發布的7月份營運表現,管理層更指「仍展現出備受稱讚的穩定性」。管理層着重提及企業營運表現穩定,但他們從未在任何一個月的營運表現公告中,提及過公司透過降低糧油雜貨等直銷商品的毛利率,以吸引用戶及提升交易總額。 事實上,管理層可以直接控制直銷商品的售價及毛利率,從而觀察用戶人數能否因價格更具競爭力而出現增長。也就是說,他們早已知道過去數月香港科技探索的毛利率已經下滑,但不作任何披露,只着力提及「電子商貿業務穩定」及「用戶人數持續增長」兩大利好的方向,這就是管理層選擇性披露的問題。 這種做法容易令投資者以為香港科技探索由5月份開始,總交易額(GMV)重新有雙位數字增長,以及用戶人數增加,對其利潤增長或有潛在幫助。結果當盈警公告出現,市場才發現香港科技探索的GMV增長並沒有帶動盈利,只要管理層降低貨品售價,毛利率下降,都會令盈利急跌,導致股價立即「見光死」,昨日股價急跌近17%。 目前大市走勢弱 易跌難升 由於管理層只提及GMV變化,但毛利率變動卻更影響股價表現,代表投資者判斷香港科技探索的入市時機時,必須在GMV及毛利率增長才有更大的勝算。 然而,除非你是專長「格價」的師奶,或是具有編程能力的IT專才,能夠將HKTVmall重點產品的價格變化每天記錄,並與超市相同產品的價格比較,才能更清晰地估算香港科技探索的毛利率變動,可謂費時失事。同時,目前大市走勢弱,易跌難升,內地與本港經濟也未見大幅反彈,博業績失敗的風險也會提升。 因此,要擺脫投資目標出業績「見光死」,還是「忍一時風平浪靜」,避免博業績乃最佳做法。 [徐風 隨風投資] This post has been edited by TOS: Aug 23 2023, 08:32 AM |

|

|

|

|

|

Aug 24 2023, 10:11 PM Aug 24 2023, 10:11 PM

Return to original view | Post

#234

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Let's hear what an insider from an HK i-bank's trading floor has to say about HK's stock stamp duty system.

https://finance.mingpao.com/fin/instantf/20...%b9%b3%e5%ae%89 |

|

|

Sep 11 2023, 10:20 PM Sep 11 2023, 10:20 PM

Return to original view | Post

#235

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

WSJ BUSINESS | RETAIL | HEARD ON THE STREET

The Alibaba Spinoff Trade Loses More Steam Recent hiccups probably won’t derail the firm’s restructuring, but the stock could struggle without further concrete signs of progress https://www.wsj.com/business/retail/the-ali...share_permalink |

|

|

Sep 27 2023, 07:55 PM Sep 27 2023, 07:55 PM

Return to original view | Post

#236

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Some commentary on the JPEX saga in Hong Kong: https://finance.mingpao.com/fin/instantf/20...%a4%a7%e6%b3%95

|

|

|

Oct 3 2023, 09:19 PM Oct 3 2023, 09:19 PM

Return to original view | Post

#237

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://finance.mingpao.com/fin/instantp/20...%b0%b4%e5%b9%b3

HK Grade A office building continue to be under pressure. The whole 23rd floor of Bank of America tower in Admiralty (plus 3 car park slots) is sold recently for 338 million HKD. The office unit is about 13,880 sqft, translating into 24,352 HKD per sqft. Data shows that the 15th floor of the tower (together with 4 car park slots) were sold for 308 million HKD in 2011 (22,190 HKD per sqft). Considering the different floors, the latest 23rd floor transaction is of the same price as that of 12 years ago... *For those who don't know, in HK, the higher the office tower floors, the more valuable will the price per sqft be (as you can see Victoria Harbour better from the top during work |

|

|

Oct 6 2023, 09:03 AM Oct 6 2023, 09:03 AM

Return to original view | Post

#238

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

WSJ FINANCE | STOCKS

Where Have the Traders Gone? A $4 Trillion Market Is Stuck in a Rut Hong Kong’s stock market has stalled, trading volumes are slumping and foreign investors are backing away https://www.wsj.com/finance/stocks/where-ha...share_permalink |

|

|

Oct 10 2023, 01:33 PM Oct 10 2023, 01:33 PM

Return to original view | Post

#239

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

WSJ BUSINESS | DEALS

Evergrande Investors Warn of ‘Uncontrollable Collapse’ The developer canceled a debt restructuring deal last month, leaving investors in limbo https://www.wsj.com/business/deals/evergran...share_permalink --------------------------------- WSJ FINANCE China’s Country Garden Succumbs to Debt Crisis After Sales Drop Property giant fails to repay a loan and warns that it is unlikely to pay off all its international debt obligations https://www.wsj.com/finance/chinas-country-...share_permalink |

|

|

Oct 24 2023, 11:37 PM Oct 24 2023, 11:37 PM

Return to original view | Post

#240

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Note to readers: Western media's reporting may be biased towards China/HK.

WSJ World | Asia The Corporate Retreat From Hong Kong Is Accelerating The commercial hub’s ties to mainland China, which global companies once considered an asset, have become a liability https://www.wsj.com/world/asia/hong-kong-ch...share_permalink ------------------------------- WSJ FINANCE | STOCKS China Shut the Door on Two Online Brokers. Then Their Stock Prices Boomed. Futu and Up Fintech have been unexpected beneficiaries of higher U.S. interest rates https://www.wsj.com/finance/stocks/china-sh...share_permalink |

| Change to: |  0.0636sec 0.0636sec

1.52 1.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 08:05 PM |