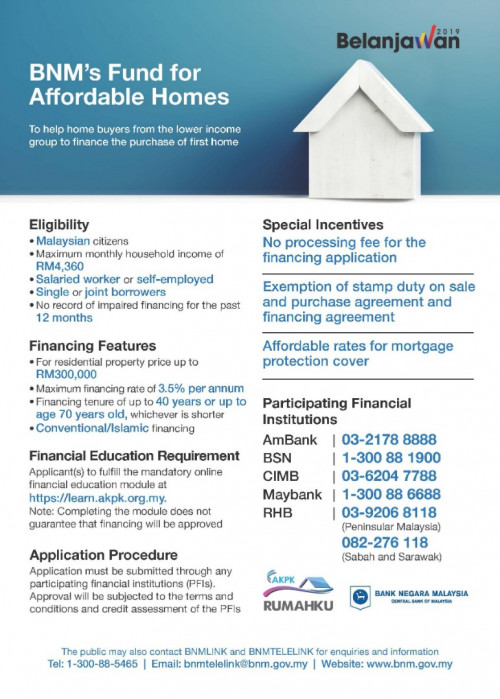

QUOTE(indramerlin @ Aug 24 2019, 03:15 PM)

If u know how to calculate there is almost no advantage

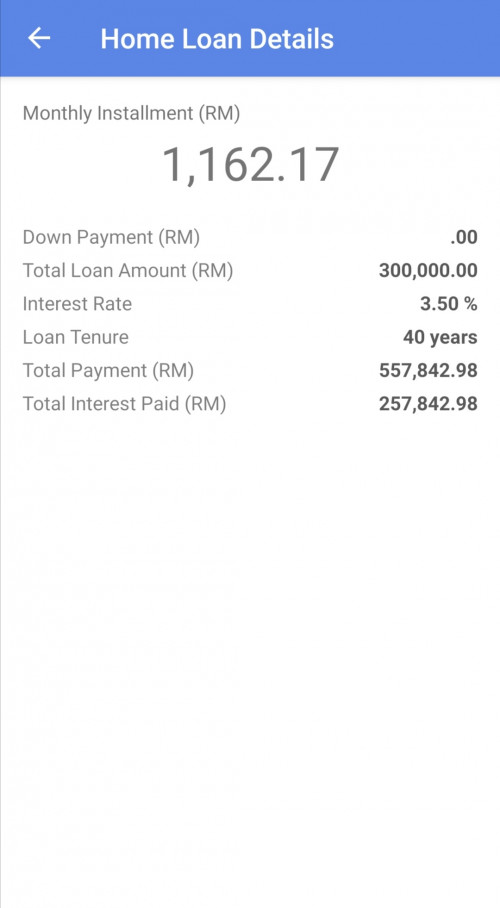

If loan 40 years, monthly repayment RM1162.17,

(let said bank rate fix.. 3.5 percent for 40 years.. Which is unsure yet,

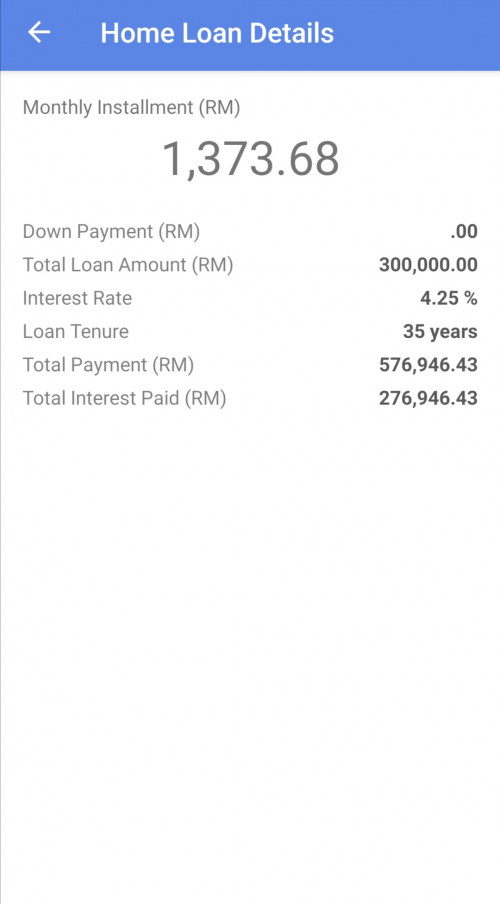

If loan 35 years, monthly repayment RM1373.68, 4.25 % currently cimb let said

If u minus this both.....

Net difference RM 211.00

Any this all exclude maintaince cost, cukai taksiran (if they rent perhaps they no need to prepare extra costing for this both) lower risk to bankruptcy

Exclude renovation, electricity bill, water bill n other hidden cost

RM 211 / RM 6.00 per meals can save 35 meals....The whole advantage is 11 days meals (3 meals) for B40 grp

Perhaps...

Anyway... Rm 200 ++👀 in KL living... Emmm

This post has been edited by dave1987: Aug 24 2019, 08:41 PM

Aug 24 2019, 08:39 PM

Aug 24 2019, 08:39 PM

Quote

Quote 0.0234sec

0.0234sec

0.98

0.98

6 queries

6 queries

GZIP Disabled

GZIP Disabled