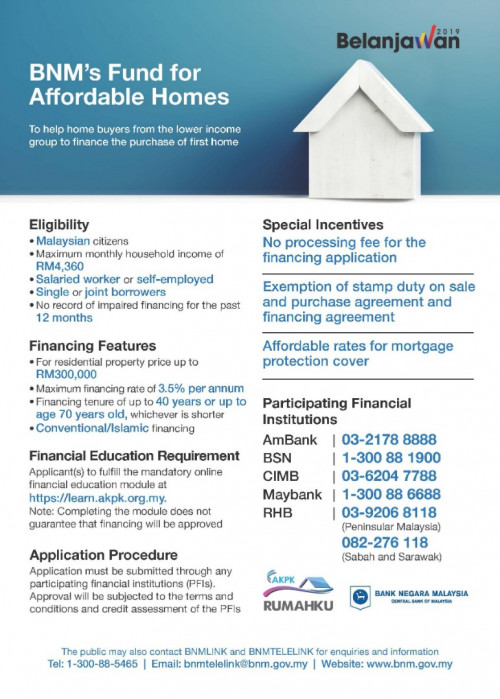

Good news for Malaysian who want to buy their first property !

BNM Housing Loan Assisstance, Income req. revised to RM4360 monthly !!

|

|

Aug 24 2019, 03:15 PM, updated 7y ago Aug 24 2019, 03:15 PM, updated 7y ago

Show posts by this member only | Post

#1

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

|

|

|

Aug 24 2019, 07:25 PM Aug 24 2019, 07:25 PM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

Damn 3.5%

|

|

|

Aug 24 2019, 07:58 PM Aug 24 2019, 07:58 PM

Show posts by this member only | Post

#3

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Aug 24 2019, 08:02 PM Aug 24 2019, 08:02 PM

Show posts by this member only | IPv6 | Post

#4

|

All Stars

13,761 posts Joined: Jun 2011 |

|

|

|

Aug 24 2019, 08:04 PM Aug 24 2019, 08:04 PM

Show posts by this member only | Post

#5

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Aug 24 2019, 08:07 PM Aug 24 2019, 08:07 PM

Show posts by this member only | IPv6 | Post

#6

|

All Stars

13,761 posts Joined: Jun 2011 |

|

|

|

|

|

|

Aug 24 2019, 08:14 PM Aug 24 2019, 08:14 PM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

|

|

|

Aug 24 2019, 08:39 PM Aug 24 2019, 08:39 PM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

779 posts Joined: Apr 2012 |

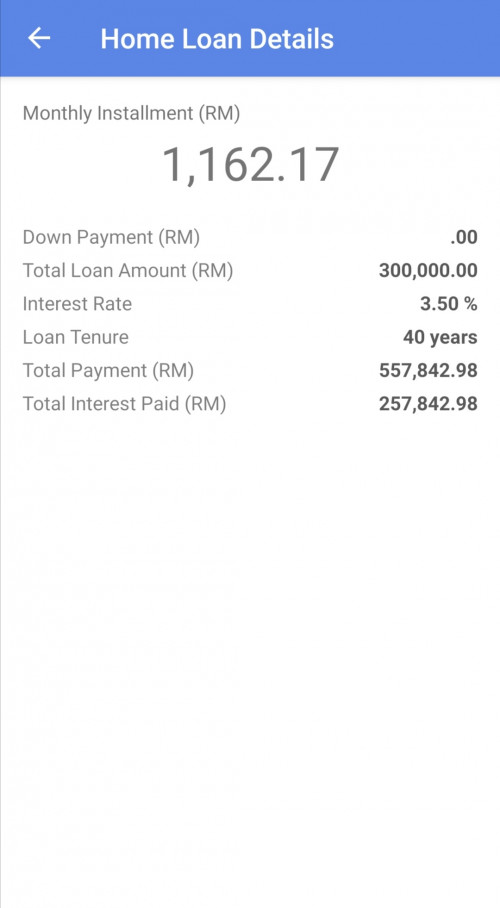

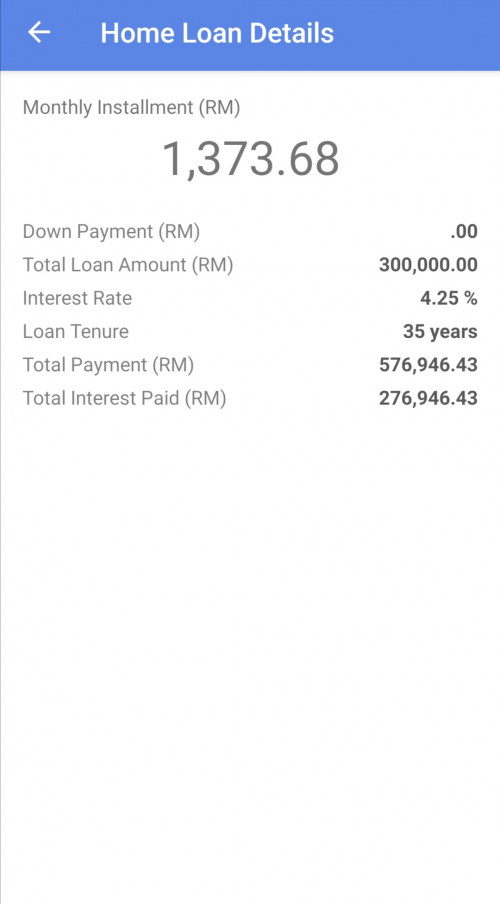

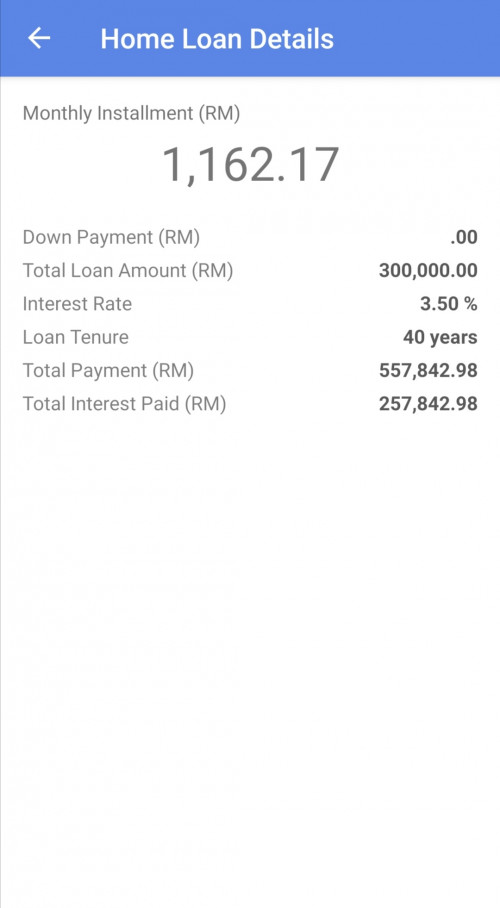

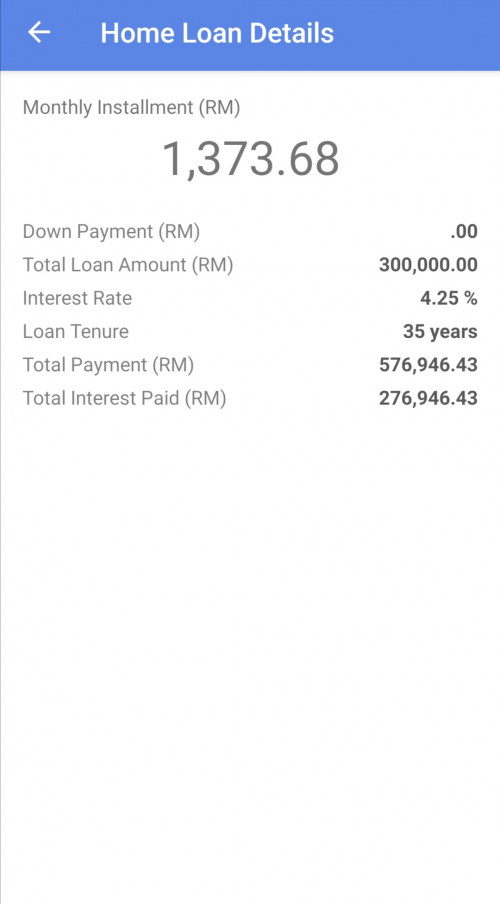

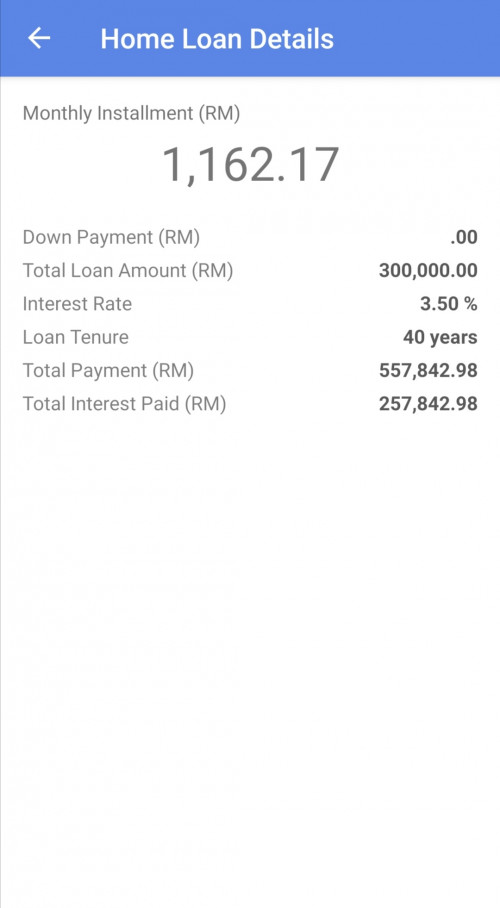

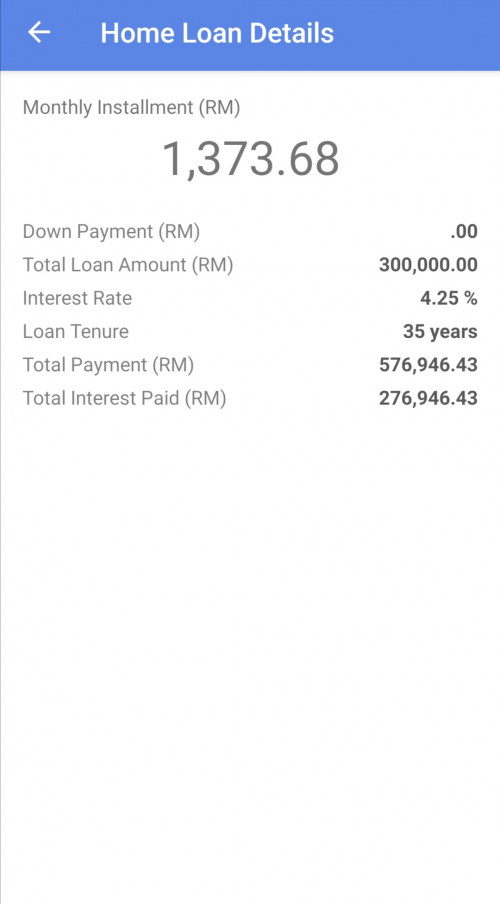

QUOTE(indramerlin @ Aug 24 2019, 03:15 PM)   If u know how to calculate there is almost no advantage If loan 40 years, monthly repayment RM1162.17, (let said bank rate fix.. 3.5 percent for 40 years.. Which is unsure yet, If loan 35 years, monthly repayment RM1373.68, 4.25 % currently cimb let said If u minus this both..... Net difference RM 211.00 Any this all exclude maintaince cost, cukai taksiran (if they rent perhaps they no need to prepare extra costing for this both) lower risk to bankruptcy Exclude renovation, electricity bill, water bill n other hidden cost RM 211 / RM 6.00 per meals can save 35 meals....The whole advantage is 11 days meals (3 meals) for B40 grp Perhaps... Anyway... Rm 200 ++👀 in KL living... Emmm This post has been edited by dave1987: Aug 24 2019, 08:41 PM |

|

|

Aug 24 2019, 09:49 PM Aug 24 2019, 09:49 PM

Show posts by this member only | Post

#9

|

Senior Member

1,309 posts Joined: Sep 2018 |

QUOTE(dave1987 @ Aug 24 2019, 08:39 PM)   If u know how to calculate there is almost no advantage If loan 40 years, monthly repayment RM1162.17, (let said bank rate fix.. 3.5 percent for 40 years.. Which is unsure yet, If loan 35 years, monthly repayment RM1373.68, 4.25 % currently cimb let said If u minus this both..... Net difference RM 211.00 Any this all exclude maintaince cost, cukai taksiran (if they rent perhaps they no need to prepare extra costing for this both) lower risk to bankruptcy Exclude renovation, electricity bill, water bill n other hidden cost RM 211 / RM 6.00 per meals can save 35 meals....The whole advantage is 11 days meals (3 meals) for B40 grp Perhaps... Anyway... Rm 200 ++👀 in KL living... Emmm |

|

|

Aug 24 2019, 11:46 PM Aug 24 2019, 11:46 PM

|

Senior Member

3,312 posts Joined: Dec 2010 |

|

|

|

Aug 25 2019, 09:55 AM Aug 25 2019, 09:55 AM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Aug 25 2019, 09:58 AM Aug 25 2019, 09:58 AM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

779 posts Joined: Apr 2012 |

QUOTE(indramerlin @ Aug 24 2019, 09:49 PM) Fresh grad salary RM3-4 now can enjoy lower interest rate bro.. big booster i guess.. If this BNM aid come earlier, it will more easier for me to sell off Kiara Kasih rumawip.. haha Oni extra rm 200 pocket money, already can help to sell off ur condo 🤣This post has been edited by dave1987: Aug 25 2019, 10:00 AM |

|

|

Aug 25 2019, 10:00 AM Aug 25 2019, 10:00 AM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

|

|

|

Aug 25 2019, 02:50 PM Aug 25 2019, 02:50 PM

|

All Stars

48,551 posts Joined: Sep 2014 From: REality |

nowadays every ringgit counted...

so it's actually good news |

|

|

Aug 26 2019, 02:51 PM Aug 26 2019, 02:51 PM

|

Junior Member

13 posts Joined: Dec 2011 |

Can I know the 4360 is based on net income or gross income ? Because I think the BNM got introduced before the loan approval is based on net income instead of gross income

|

|

|

Aug 26 2019, 03:39 PM Aug 26 2019, 03:39 PM

Show posts by this member only | IPv6 | Post

#16

|

Junior Member

779 posts Joined: Apr 2012 |

|

|

|

Aug 26 2019, 04:39 PM Aug 26 2019, 04:39 PM

|

Senior Member

9,616 posts Joined: Dec 2013 |

Extra 200 also not good?

Wow 1 year 2.4k 35 years = 84k This post has been edited by heavensea: Aug 26 2019, 04:40 PM |

|

|

Aug 26 2019, 04:40 PM Aug 26 2019, 04:40 PM

|

Junior Member

148 posts Joined: Mar 2009 |

Can apply as single borrower although I am married?

|

|

|

Aug 26 2019, 07:21 PM Aug 26 2019, 07:21 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 9 2019, 09:33 PM Sep 9 2019, 09:33 PM

|

Senior Member

9,616 posts Joined: Dec 2013 |

|

|

|

Sep 10 2019, 07:34 AM Sep 10 2019, 07:34 AM

Show posts by this member only | IPv6 | Post

#21

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 10 2019, 04:16 PM Sep 10 2019, 04:16 PM

Show posts by this member only | IPv6 | Post

#22

|

Junior Member

779 posts Joined: Apr 2012 |

|

|

|

Sep 10 2019, 04:44 PM Sep 10 2019, 04:44 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 10 2019, 05:07 PM Sep 10 2019, 05:07 PM

|

Senior Member

1,383 posts Joined: Sep 2012 |

|

|

|

Sep 10 2019, 05:23 PM Sep 10 2019, 05:23 PM

|

Junior Member

203 posts Joined: Aug 2014 |

|

|

|

Sep 10 2019, 06:14 PM Sep 10 2019, 06:14 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 10 2019, 07:02 PM Sep 10 2019, 07:02 PM

|

Junior Member

203 posts Joined: Aug 2014 |

|

|

|

Sep 10 2019, 07:17 PM Sep 10 2019, 07:17 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 10 2019, 08:25 PM Sep 10 2019, 08:25 PM

|

Junior Member

203 posts Joined: Aug 2014 |

|

|

|

Sep 11 2019, 01:08 PM Sep 11 2019, 01:08 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

From Bella Leana FB..

Household Income - BNM Funded Affordable Skim Soalan:- Bella, suami dah ada rumah tapi isteri belum ada.. kalau isteri nak beli rumah guna BNM affordable skim tu (Rate 3.5% 100% Margin) masih layak ke? Jawapan:- Isteri masih layak sebab tiada rumah lagi. Soalan:- Loan macam mana? 1 nama ke 2 nama? Jawapan:- 1 nama sahaja sebab suami dah tak layak.. Soalan:- Kalai gaji isteri tak cukup? Sebab komitmen dah tinggi? Jawapan:- Tak boleh lah apply skim ni.. DSR dan NDI still applicable.. Soalan:- Gaji Isteri RM2,000 Gaji Suami RM3,000 Boleh tak nak apply skim ni atas nama isteri sahaja? Jawapan:- Tak boleh. Sebab household income untuk skim BNM ni RM4,360 sahaja Soalan:- Tapi yang nak apply loan Isteri sahaja.. Jawapan:- Walaupun sorang je yang nak apply loan, tapi slip gaji pasangan yang terkini juga perlu di hantar sebab syarat nya Household Income.. Ooooooooo... Gaiss! Walaupun nak apply tu nama seorang sahaja, tetapi dari segi income tetap kena submit both payslip ya.. sebab household income.. Soalan:- Boleh tak nak tipu cakap single walaupun sebenarnya dah kawen?? Jawapan:- 😱😱😱 Love, Bella #BNMFundedAffordableSkim #BellaDanFinancing |

|

|

Sep 11 2019, 01:09 PM Sep 11 2019, 01:09 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 21 2019, 11:35 PM Sep 21 2019, 11:35 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

Maximum effective interest rate 3.50%.

Under this initiative, someone managed to get 2.90% from CIMB for a rumah selangorku project (100k price apartment). 40 years tenure (480 months). Here's the offer letter:  Best ever deal. Unbeatable. Grab it if you are first home owner. |

|

|

Sep 21 2019, 11:49 PM Sep 21 2019, 11:49 PM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

1,309 posts Joined: Sep 2018 |

QUOTE(AskarPerang @ Sep 21 2019, 11:35 PM) Maximum effective interest rate 3.50%. Huhu.. yeah.. rugi if not grab it.. the best deal of century..Under this initiative, someone managed to get 2.90% from CIMB for a rumah selangorku project (100k price apartment). 40 years tenure (480 months). Here's the offer letter:  Best ever deal. Unbeatable. Grab it if you are first home owner. |

|

|

Sep 22 2019, 12:15 AM Sep 22 2019, 12:15 AM

|

Junior Member

758 posts Joined: May 2019 |

QUOTE(AskarPerang @ Sep 21 2019, 11:35 PM) Maximum effective interest rate 3.50%. Why is the legal fee so high? Over 3% of the loan amount. This is ridiculous- the facility agreement is a standard document. Under this initiative, someone managed to get 2.90% from CIMB for a rumah selangorku project (100k price apartment). 40 years tenure (480 months). Here's the offer letter:  Best ever deal. Unbeatable. Grab it if you are first home owner. It’s beyond exorbitant |

|

|

Sep 22 2019, 12:16 AM Sep 22 2019, 12:16 AM

|

Junior Member

758 posts Joined: May 2019 |

Must it be a new project or can applicants apply for the loan for sub sale too

Thanks |

|

|

Sep 22 2019, 10:39 AM Sep 22 2019, 10:39 AM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 22 2019, 12:30 PM Sep 22 2019, 12:30 PM

|

Junior Member

758 posts Joined: May 2019 |

|

|

|

Sep 22 2019, 12:41 PM Sep 22 2019, 12:41 PM

Show posts by this member only | IPv6 | Post

#38

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 22 2019, 12:52 PM Sep 22 2019, 12:52 PM

|

Junior Member

758 posts Joined: May 2019 |

|

|

|

Sep 22 2019, 02:09 PM Sep 22 2019, 02:09 PM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 22 2019, 02:17 PM Sep 22 2019, 02:17 PM

|

Junior Member

502 posts Joined: Dec 2006 |

is it possible to apply for this if let's say income is from overseas?

anyone did this before? |

|

|

Sep 23 2019, 02:45 PM Sep 23 2019, 02:45 PM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

is this flexi or fixed?

This post has been edited by Pain4UrsinZ: Sep 23 2019, 02:46 PM |

|

|

Sep 23 2019, 04:28 PM Sep 23 2019, 04:28 PM

|

Junior Member

85 posts Joined: Aug 2019 |

|

|

|

Sep 23 2019, 05:13 PM Sep 23 2019, 05:13 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 26 2019, 04:54 PM Sep 26 2019, 04:54 PM

Show posts by this member only | IPv6 | Post

#45

|

Junior Member

812 posts Joined: May 2012 |

|

|

|

Sep 26 2019, 04:58 PM Sep 26 2019, 04:58 PM

Show posts by this member only | IPv6 | Post

#46

|

Junior Member

812 posts Joined: May 2012 |

QUOTE(AskarPerang @ Sep 21 2019, 11:35 PM) Maximum effective interest rate 3.50%. oh yes, i also wanted to ask, usually the 'Legal Fee' (sometimes called 'Valuation Fee') is how much ya?Under this initiative, someone managed to get 2.90% from CIMB for a rumah selangorku project (100k price apartment). 40 years tenure (480 months). Here's the offer letter:  Best ever deal. Unbeatable. Grab it if you are first home owner. Say for example a RM500k high rise property in KL. |

|

|

Sep 26 2019, 05:24 PM Sep 26 2019, 05:24 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 26 2019, 05:25 PM Sep 26 2019, 05:25 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Sep 26 2019, 05:27 PM Sep 26 2019, 05:27 PM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

812 posts Joined: May 2012 |

|

|

|

Sep 26 2019, 05:39 PM Sep 26 2019, 05:39 PM

|

Junior Member

566 posts Joined: Oct 2012 |

|

|

|

Sep 27 2019, 09:43 PM Sep 27 2019, 09:43 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

Another example. Someone got it for PPA1M project priced at 240k.

RHB bank. 100% loan. Can include legal fees & MRTT inside. Best deal ever.   |

|

|

Sep 28 2019, 01:43 AM Sep 28 2019, 01:43 AM

Show posts by this member only | IPv6 | Post

#52

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

QUOTE(AskarPerang @ Sep 27 2019, 09:43 PM) Another example. Someone got it for PPA1M project priced at 240k. Very tempting. Rm995 only per month. Which ppa1m project is this?RHB bank. 100% loan. Can include legal fees & MRTT inside. Best deal ever.   I got one ppam mercu jalil price Rm245k. Thinking gonna do the same. |

|

|

Sep 28 2019, 06:36 AM Sep 28 2019, 06:36 AM

Show posts by this member only | IPv6 | Post

#53

|

Junior Member

458 posts Joined: Mar 2010 |

|

|

|

Sep 28 2019, 08:57 AM Sep 28 2019, 08:57 AM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

|

|

|

Sep 28 2019, 10:10 AM Sep 28 2019, 10:10 AM

Show posts by this member only | IPv6 | Post

#55

|

Senior Member

1,309 posts Joined: Sep 2018 |

QUOTE(AskarPerang @ Sep 27 2019, 09:43 PM) Another example. Someone got it for PPA1M project priced at 240k. 3.5% very high.. now Cimb got 2.9% promo.. if he smart, he choose cimb..RHB bank. 100% loan. Can include legal fees & MRTT inside. Best deal ever.   https://www.cimbbank.com.my/en/personal/pre...able-homes.html |

|

|

Sep 28 2019, 07:01 PM Sep 28 2019, 07:01 PM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

|

|

|

Sep 28 2019, 07:56 PM Sep 28 2019, 07:56 PM

|

Newbie

27 posts Joined: Jul 2018 |

I'm applying for this scheme with mbb. Trying my luck!

|

|

|

Oct 10 2019, 02:22 PM Oct 10 2019, 02:22 PM

Show posts by this member only | IPv6 | Post

#58

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

For those who apply for this scheme, how long does it takes for bank to approved your application?

|

|

|

Oct 17 2019, 12:30 AM Oct 17 2019, 12:30 AM

Show posts by this member only | IPv6 | Post

#59

|

Junior Member

441 posts Joined: Nov 2011 |

QUOTE(indramerlin @ Sep 28 2019, 10:10 AM) 3.5% very high.. now Cimb got 2.9% promo.. if he smart, he choose cimb.. Was told that the 2.9 was their base rate. On top of that they impose a variable rate which can go up to, but not exceed total 3.50%. All the same tbh.https://www.cimbbank.com.my/en/personal/pre...able-homes.html |

|

|

Oct 18 2019, 07:27 AM Oct 18 2019, 07:27 AM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Oct 18 2019, 07:55 AM Oct 18 2019, 07:55 AM

Show posts by this member only | IPv6 | Post

#61

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(dave1987 @ Aug 24 2019, 08:39 PM)   If u know how to calculate there is almost no advantage If loan 40 years, monthly repayment RM1162.17, (let said bank rate fix.. 3.5 percent for 40 years.. Which is unsure yet, If loan 35 years, monthly repayment RM1373.68, 4.25 % currently cimb let said If u minus this both..... Net difference RM 211.00 Any this all exclude maintaince cost, cukai taksiran (if they rent perhaps they no need to prepare extra costing for this both) lower risk to bankruptcy Exclude renovation, electricity bill, water bill n other hidden cost RM 211 / RM 6.00 per meals can save 35 meals....The whole advantage is 11 days meals (3 meals) for B40 grp Perhaps... Anyway... Rm 200 ++👀 in KL living... Emmm The rest of the calculations are irrelevant whether buyer takes BNM HL Assist or normal loan. I would be happy if someone gives me RM211 every month to help settle my loan. This post has been edited by mini orchard: Oct 18 2019, 08:51 AM |

|

|

Oct 18 2019, 08:59 AM Oct 18 2019, 08:59 AM

Show posts by this member only | IPv6 | Post

#62

|

Junior Member

779 posts Joined: Apr 2012 |

QUOTE(mini orchard @ Oct 18 2019, 07:55 AM) RM211 is already a saving. maintaince cost is more than 211 for sure.. Basically still no differenceThe rest of the calculations are irrelevant whether buyer takes BNM HL Assist or normal loan. I would be happy if someone gives me RM211 every month to help settle my loan. |

|

|

Oct 18 2019, 09:29 AM Oct 18 2019, 09:29 AM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

|

|

|

Oct 18 2019, 09:48 AM Oct 18 2019, 09:48 AM

|

All Stars

14,511 posts Joined: Sep 2017 |

|

|

|

Oct 18 2019, 09:51 AM Oct 18 2019, 09:51 AM

Show posts by this member only | IPv6 | Post

#65

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

|

|

|

Oct 18 2019, 10:28 AM Oct 18 2019, 10:28 AM

|

Junior Member

232 posts Joined: Dec 2006 |

Who says RM 211 does not make a difference!? You are living in M40 life, you will NEVER know how much this RM211 can help them!

IF you do the math, RM 211 is 15% of RM 1373. THAT'S A LOT. ! I have witness myself, colleague in my company (KL) cook and bring their lunch to work everyday which cost like RM3-5? Rice + vege + meat. People really dont appreciate how govt helps them. what you expect? RM 1300 monthly instalment become RM650? 50% reduction? |

|

|

Oct 18 2019, 11:38 AM Oct 18 2019, 11:38 AM

Show posts by this member only | IPv6 | Post

#67

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

QUOTE(FirstNoob @ Oct 18 2019, 10:28 AM) Who says RM 211 does not make a difference!? You are living in M40 life, you will NEVER know how much this RM211 can help them! Haha so true. Rm211 is alot. 211 x 35 then do your maths.IF you do the math, RM 211 is 15% of RM 1373. THAT'S A LOT. ! I have witness myself, colleague in my company (KL) cook and bring their lunch to work everyday which cost like RM3-5? Rice + vege + meat. People really dont appreciate how govt helps them. what you expect? RM 1300 monthly instalment become RM650? 50% reduction? |

|

|

Oct 18 2019, 11:39 AM Oct 18 2019, 11:39 AM

Show posts by this member only | IPv6 | Post

#68

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

I got offer from rhb

RHB approved under Islamic Loan Loan amount = RM198,000 MRTT= RM13,004 Legal Fee=RM3,960 Total = RM214,964 Tenure=39 years Interest Rate=3.5% Monthly Instalment= RM843 Why the mrtt is so high? Im 31 years old btw. Plan to go for 35 years only. |

|

|

Oct 18 2019, 11:42 AM Oct 18 2019, 11:42 AM

|

Junior Member

232 posts Joined: Dec 2006 |

never heard of MRTT, is it same as MRTA? If yes, this is very expensive.. I would opt for MRTA for your case, cheapest out there

|

|

|

Oct 18 2019, 12:10 PM Oct 18 2019, 12:10 PM

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(FirstNoob @ Oct 18 2019, 10:28 AM) Who says RM 211 does not make a difference!? You are living in M40 life, you will NEVER know how much this RM211 can help them! RM211 for T20 of course no feel.IF you do the math, RM 211 is 15% of RM 1373. THAT'S A LOT. ! I have witness myself, colleague in my company (KL) cook and bring their lunch to work everyday which cost like RM3-5? Rice + vege + meat. People really dont appreciate how govt helps them. what you expect? RM 1300 monthly instalment become RM650? 50% reduction? |

|

|

Oct 18 2019, 01:20 PM Oct 18 2019, 01:20 PM

|

Senior Member

3,797 posts Joined: May 2009 |

|

|

|

Oct 18 2019, 01:39 PM Oct 18 2019, 01:39 PM

Show posts by this member only | IPv6 | Post

#72

|

Junior Member

779 posts Joined: Apr 2012 |

I mean u see.. If you rent house.... U no need to pay maintenance of rm211

Becoz of u owing the house... Yes.. You got a cheaper rate.. Rm 211... But the maintenance cost is a must costing to pay... For the owner of the house.. It actually killing n risky for those in bottom line of salary n miscalculated this portion Owning = maintainance cost Renting = no maintainance cost |

|

|

Oct 18 2019, 01:44 PM Oct 18 2019, 01:44 PM

Show posts by this member only | IPv6 | Post

#73

|

Junior Member

779 posts Joined: Apr 2012 |

|

|

|

Oct 18 2019, 03:18 PM Oct 18 2019, 03:18 PM

Show posts by this member only | IPv6 | Post

#74

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(dave1987 @ Oct 18 2019, 01:39 PM) I mean u see.. If you rent house.... U no need to pay maintenance of rm211 Then why show the calculations for the two different type of loan?Becoz of u owing the house... Yes.. You got a cheaper rate.. Rm 211... But the maintenance cost is a must costing to pay... For the owner of the house.. It actually killing n risky for those in bottom line of salary n miscalculated this portion Owning = maintainance cost Renting = no maintainance cost Straight away say not wise to own house because of maintainance. Better to rent ... no maintainance. To be squatter is better ... No need to pay at all ! This post has been edited by mini orchard: Oct 18 2019, 04:25 PM |

|

|

Oct 18 2019, 06:55 PM Oct 18 2019, 06:55 PM

Show posts by this member only | IPv6 | Post

#75

|

Junior Member

779 posts Joined: Apr 2012 |

QUOTE(mini orchard @ Oct 18 2019, 03:18 PM) Then why show the calculations for the two different type of loan? Lol.. If don't show the calculations n hidden costs involved, scare people don't get the meaning, posting become no value..Straight away say not wise to own house because of maintainance. Better to rent ... no maintainance. To be squatter is better ... No need to pay at all ! |

|

|

Oct 18 2019, 07:30 PM Oct 18 2019, 07:30 PM

|

All Stars

14,511 posts Joined: Sep 2017 |

|

|

|

Oct 18 2019, 07:34 PM Oct 18 2019, 07:34 PM

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

|

|

|

Oct 18 2019, 11:29 PM Oct 18 2019, 11:29 PM

Show posts by this member only | IPv6 | Post

#78

|

Senior Member

1,309 posts Joined: Sep 2018 |

If got the BNM loan, just take it.. Govt spend RM1 billion to pay for you.. definitely better loh.. My cousin got 2.9%, cimb, 35years, 300K rumawip inspiria, pay only rm1200++ per month.. so good.

|

|

|

Oct 19 2019, 06:45 AM Oct 19 2019, 06:45 AM

Show posts by this member only | IPv6 | Post

#79

|

Junior Member

232 posts Joined: Dec 2006 |

QUOTE(dave1987 @ Oct 18 2019, 01:44 PM) Perhaps u can do aso the math for maintenance cost also, if u owing a house... That’s the price of owning a house. U are telling people that rm211 not worth because it has no impact on monthly savings.. but you are so wrong. Maintaince cost x 12 month x 40 years .. Maintainance cost increase every 2 to 3 years.. He gets to own a house for commiting monthly ! And you sounds like renting a house don’t cost him money. Try rent a a 3 bedder in Klang valley, easily cost u 1.5k for a decent condo. |

|

|

Oct 26 2019, 12:54 PM Oct 26 2019, 12:54 PM

|

Junior Member

779 posts Joined: Apr 2012 |

https://www.iproperty.com.my/guides/critica...n-overlook-ctr/

Maybe this one will be more details with self explanatory Let’s assume you bought a really good condominium, something where the mortgage is lower than the rent. Your monthly mortgage payment is RM2,500 but your rental income is RM3,200. That’s a profit of RM700. Surely this is great right? Not likely because you’ve forgotten about other costs. Here are just some of the other costs you may have overlooked: 1. Taxes (assessment and quick rent) 2. Joint Management Body fees (for strata property) 3. Annual improvements & maintenance (repainting, replacing furniture, repairs, etc) 4. Memorandum of Transfer (MOT) on stamp duty (for new purchases) 5. Mortgage Insurance If these costs work out to an additional RM700 per month, your net income is zero, which is still good. However, if they exceed RM700, then you’re negatively geared.. Copywright to writer This post has been edited by dave1987: Oct 26 2019, 12:55 PM |

|

|

Oct 26 2019, 01:43 PM Oct 26 2019, 01:43 PM

Show posts by this member only | IPv6 | Post

#81

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(dave1987 @ Oct 26 2019, 12:54 PM) https://www.iproperty.com.my/guides/critica...n-overlook-ctr/ This topic is about BNM Assist Housing Loan.Maybe this one will be more details with self explanatory Let’s assume you bought a really good condominium, something where the mortgage is lower than the rent. Your monthly mortgage payment is RM2,500 but your rental income is RM3,200. That’s a profit of RM700. Surely this is great right? Not likely because you’ve forgotten about other costs. Here are just some of the other costs you may have overlooked: 1. Taxes (assessment and quick rent) 2. Joint Management Body fees (for strata property) 3. Annual improvements & maintenance (repainting, replacing furniture, repairs, etc) 4. Memorandum of Transfer (MOT) on stamp duty (for new purchases) 5. Mortgage Insurance If these costs work out to an additional RM700 per month, your net income is zero, which is still good. However, if they exceed RM700, then you’re negatively geared.. Copywright to writer NOTHING to do with cost of owning a home. Open a new thread and you can write till sunset. This post has been edited by mini orchard: Oct 26 2019, 01:44 PM |

|

|

Oct 26 2019, 07:15 PM Oct 26 2019, 07:15 PM

Show posts by this member only | IPv6 | Post

#82

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

Stick back to the topic please.

Anyway, I have already accept the RHB offer for BNM affordable housing scheme, will sign the offer letter by next week. This is the rate : Loan amount = RM198,000 MRTT = RM9,153 Legal Fee = RM3,960 Total = RM211,113 Tenure = 30 years Interest Rate = 3.5% Monthly Instalment = RM948 I'm going for 30 year only even they offer 39 years. If 39 years = RM843 Monthly. I'm okay with anything less than 1k per month. |

|

|

Nov 13 2019, 04:02 PM Nov 13 2019, 04:02 PM

Show posts by this member only | IPv6 | Post

#83

|

Newbie

8 posts Joined: Dec 2012 |

Hi,

Anyone know if MRTT is compulsory for the BNM first home loan 3.5% for Home financing? |

|

|

Nov 22 2019, 10:21 PM Nov 22 2019, 10:21 PM

Show posts by this member only | IPv6 | Post

#84

|

Junior Member

441 posts Joined: Nov 2011 |

QUOTE(boonyu @ Nov 13 2019, 04:02 PM) Not stated anywhere under BNM FAQ that its compulsory but banks will most likely make it mandatory.Anyway my Islamic BNM fund loan with RHB just got approved RHB (Step Up Payment) Home Value= RM300,000.00 Legal Fee Finance Limit: RM5,600 Full Mortgage Reducing Term Takaful: RM16,529 Total Financing Amount: RM322,129.00 Financing rate: Fixed 3.50%p.a. Financing Tenure: 40 years First 5 Years Monthly Instalment: RM958 6th Year Onwards Monthly Instalment: RM1,332 |

|

|

Nov 22 2019, 10:24 PM Nov 22 2019, 10:24 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

QUOTE(zack.gap @ Nov 22 2019, 10:21 PM) Not stated anywhere under BNM FAQ that its compulsory but banks will most likely make it mandatory. Why is there a big jump 1st 5 years 900++Anyway my Islamic BNM fund loan with RHB just got approved RHB (Step Up Payment) Home Value= RM300,000.00 Legal Fee Finance Limit: RM5,600 Full Mortgage Reducing Term Takaful: RM16,529 Total Financing Amount: RM322,129.00 Financing rate: Fixed 3.50%p.a. Financing Tenure: 40 years First 5 Years Monthly Instalment: RM958 6th Year Onwards Monthly Instalment: RM1,332 To 6th year till 40 year = RM1300++ That's a big increase. Something is not right here. |

|

|

Nov 22 2019, 10:34 PM Nov 22 2019, 10:34 PM

Show posts by this member only | IPv6 | Post

#86

|

Junior Member

441 posts Joined: Nov 2011 |

QUOTE(AskarPerang @ Nov 22 2019, 10:24 PM) Why is there a big jump 1st 5 years 900++ Yup it was intentional on my end. Was offered the 'standard' package which is basically flat rate for the entire tenure but I went for the alternative 'step up' package for personal reasons.To 6th year till 40 year = RM1300++ That's a big increase. Something is not right here. For this package first 5 years basically all goes into interest payment (which is why its soo low) and 6th year onwards is when principal deduction gradually increases (which is when monthly payment picks up). |

|

|

Nov 22 2019, 11:17 PM Nov 22 2019, 11:17 PM

Show posts by this member only | IPv6 | Post

#87

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

QUOTE(zack.gap @ Nov 22 2019, 10:21 PM) Not stated anywhere under BNM FAQ that its compulsory but banks will most likely make it mandatory. Never know can opt for step up payment. I think it's very good choice. The first 5 years is less than 1k only for 300k house. If I know about this earlier, i will apply for 300k house (skyawani iv).Anyway my Islamic BNM fund loan with RHB just got approved RHB (Step Up Payment) Home Value= RM300,000.00 Legal Fee Finance Limit: RM5,600 Full Mortgage Reducing Term Takaful: RM16,529 Total Financing Amount: RM322,129.00 Financing rate: Fixed 3.50%p.a. Financing Tenure: 40 years First 5 Years Monthly Instalment: RM958 6th Year Onwards Monthly Instalment: RM1,332 |

|

|

Nov 23 2019, 09:21 AM Nov 23 2019, 09:21 AM

|

Junior Member

153 posts Joined: Jul 2019 |

how to convert to step up payment??

|

|

|

Nov 24 2019, 04:44 PM Nov 24 2019, 04:44 PM

Show posts by this member only | IPv6 | Post

#89

|

Junior Member

41 posts Joined: Jun 2008 |

QUOTE(.:zep:. @ Oct 26 2019, 07:15 PM) Stick back to the topic please. hi can i know that your RHB loan is Term loan or Semi Flexi or Full Flexi loan ?Anyway, I have already accept the RHB offer for BNM affordable housing scheme, will sign the offer letter by next week. This is the rate : Loan amount = RM198,000 MRTT = RM9,153 Legal Fee = RM3,960 Total = RM211,113 Tenure = 30 years Interest Rate = 3.5% Monthly Instalment = RM948 I'm going for 30 year only even they offer 39 years. If 39 years = RM843 Monthly. I'm okay with anything less than 1k per month. |

|

|

Nov 24 2019, 09:00 PM Nov 24 2019, 09:00 PM

Show posts by this member only | IPv6 | Post

#90

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

|

|

|

Nov 24 2019, 09:01 PM Nov 24 2019, 09:01 PM

Show posts by this member only | IPv6 | Post

#91

|

Senior Member

1,120 posts Joined: Jan 2003 From: Dato' Keramat KL Status : Online |

|

|

|

Nov 25 2019, 08:39 AM Nov 25 2019, 08:39 AM

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Nov 25 2019, 05:20 PM Nov 25 2019, 05:20 PM

Show posts by this member only | IPv6 | Post

#93

|

Junior Member

41 posts Joined: Jun 2008 |

Do you guys think if 4.3% semi flexi compare with 3.5% term fixed loan , if 4.3% early settlement can save more interest than 3.5% term fixed loan?

|

|

|

Nov 25 2019, 11:44 PM Nov 25 2019, 11:44 PM

Show posts by this member only | IPv6 | Post

#94

|

Senior Member

1,309 posts Joined: Sep 2018 |

QUOTE(kelvin234 @ Nov 25 2019, 05:20 PM) Do you guys think if 4.3% semi flexi compare with 3.5% term fixed loan , if 4.3% early settlement can save more interest than 3.5% term fixed loan? 3.5% is very low bro... 3 5% term loan win.. no brainer.. better put your money in FD rather than early settlement. |

|

|

Nov 26 2019, 12:22 AM Nov 26 2019, 12:22 AM

Show posts by this member only | IPv6 | Post

#95

|

Senior Member

5,637 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(.:zep:. @ Nov 24 2019, 09:01 PM) QUOTE(kelvin234 @ Nov 25 2019, 05:20 PM) Do you guys think if 4.3% semi flexi compare with 3.5% term fixed loan , if 4.3% early settlement can save more interest than 3.5% term fixed loan? 3.5% is fixed term loan ah? Which means if BNM lowers the OPR it won’t change ? |

|

|

Nov 26 2019, 07:13 AM Nov 26 2019, 07:13 AM

Show posts by this member only | IPv6 | Post

#96

|

Senior Member

1,309 posts Joined: Sep 2018 |

|

|

|

Dec 4 2019, 02:03 PM Dec 4 2019, 02:03 PM

|

Senior Member

1,309 posts Joined: Sep 2018 |

Latest info from Banker..

BNM's fund finished.. |

|

|

Dec 5 2019, 05:39 PM Dec 5 2019, 05:39 PM

|

Junior Member

51 posts Joined: Jul 2018 |

QUOTE(indramerlin @ Dec 4 2019, 02:03 PM) Yes. I heard the same news.. so bad, I just plan to buy a house but suddenly without any news the fund fully subscribed. Why they don't release news about fund almost finished.. hmmmm.. I have to postpone my plan... |

| Change to: |  0.0470sec 0.0470sec

0.38 0.38

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 03:04 AM |