Likely asking price is unrealistically high, that's why few if any are interested.

-- Closed --

-- Closed --

|

|

Jul 20 2019, 01:18 PM Jul 20 2019, 01:18 PM

Return to original view | Post

#1

|

All Stars

21,456 posts Joined: Jul 2012 |

Likely asking price is unrealistically high, that's why few if any are interested.

|

|

|

|

|

|

Jul 20 2019, 02:11 PM Jul 20 2019, 02:11 PM

Return to original view | Post

#2

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(geekystef @ Jul 20 2019, 01:22 PM) Oh... If I may ask, how to know if the price is unrealistic? If the market price is consistent with jpph data (from brickz), is it still unreasonable? Or has the price declined for condos lately? How much loan interest, maintenance fees has incurred since you put up for sale? How much loan interest, maintenance fees you prepare to pay before it is sold?If no one ask mean no buyer is interested e.g price too high. This post has been edited by icemanfx: Jul 20 2019, 02:14 PM |

|

|

Jul 20 2019, 02:57 PM Jul 20 2019, 02:57 PM

Return to original view | Post

#3

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(vckc @ Jul 20 2019, 02:22 PM) Unfortunately, I hate to tell you that there is no bubble at this point in time. Property is illiquid, price takes years to bottom. Until property overhang is reduced substantially, price remain depressed. Subsale overhang is believed to be >3 times of developers/primary market.This is a normal market cycle which goes up and down. The long term trend is always up. If you can hold on, hold longer. A lot of people feel that a bubble has formed because of the rapid growth of property prices from 2009 - 2013. But property prices have more than doubled since the financial crisis in 98. What if let's say this theoretical "bubble" pops. How much of correction are we looking at? 10%? 20%? Will this be overnight? Realistically, this will not happen. Since 2014 - 2019 there has been a drop in prices of about 20% but that is a slow gradual landing. (Mostly in the secondary market). Because anything more than 30% drop will cause a recession in Malaysia that will take many years to get out of. BNM and the government in charge will intervene and drop interest rates to keep the economy growing and get it out of the rut (so to speak). If you really observe, developers are selling at more affordable prices now (We are seeing 3xxk, 4xxk launches, the norm in 2014 was about 5xxk and above) but that comes with a cost of higher density and smaller sizes. There is a softer demand for sub-sale properties because of the HOC. There is, of course, plenty of deals now in the secondary market because of this. If you are selling, I recommend you hold your horses and wait it out. My 2 cents. As most bought property with bank loan and is incurring loan interest daily; price need not drop e.g stagnant to incur financial losses. Many may not able to sustain monthly negative cash flow. For ownstay, whether home price rise or drop has no material effect. Gomen and bnm have no obligation to protect subsale vendors. Subsale property price dropped by over 30% wouldn't cause economic recession as people buy cars and regularly depreciate by 50%. |

|

|

Jul 20 2019, 03:07 PM Jul 20 2019, 03:07 PM

Return to original view | Post

#4

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(vckc @ Jul 20 2019, 02:55 PM) Not likely, over the middle, long term input costs will go up. My guesstimate would be that it would be hard for the next 5 years or so. But the next boom will likely come after that. Rate cut mean negative economy outlook. How could negative outlook be good for property market?The world has gone crazy with the outlook that growth will be slower in the next few years. Central banks in the region and the United States (US talking about dropping interest rates by a quarter or half a point. ) have dropped their interest rates. This will stimulate a short term growth in spending by offering cheaper credit. Don't be surprised if we end up with another rate cut. Although that is only a bandaid and not the long term solution. In a healthy economic cycle, a recession must come every few years to sustain long term growth. Debt paydown occurs during recessions. What should be happening is that governments should encourage a recession to prevent a harder landing when it will hits. However, since central banks are lowering interest rates. They are essentially selling their "insurance policy" for when a recession hits. In these scenarios, don't be surprised if QE happens during the next recession (which might be a depression at the rate things are going). In simple terms, if banks print more money. Values will go up. Whether it will happen or not is anyone's guess. If you're not getting the desired price and not in a rush for money. Hold and collect rental income. Alternatively, you may wish to refinance for cash instead. Example, if you are collecting a rental of 1500, you can refinance about 330k). If anyone has got a more comprehensive view on the current situation feel free to chime in. I may be wrong as learning is a lifelong process. Cheers. By about 2030, Malaysia will become a ageing nation. Property price is more likely on long downtrend. Bank interest is normally rise and fall inline with inflation rate. Rise in inflation rate also mean higher loan interest rate. |

|

|

Jul 20 2019, 04:46 PM Jul 20 2019, 04:46 PM

Return to original view | Post

#5

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(vckc @ Jul 20 2019, 03:56 PM) You have to look at things from a bigger picture and from an economic point of view. I always look at macro economy. Construction industry constitutes about 10% gdp. Hoc is to assist developers as it contribute to aggregate economy. Subsale property doesn't add any value to aggregate economy. Price drop in subsale property only impact vendors.They have every interest to protect the property market as it affects the Malaysian economy as a whole. The property market can cause a huge ripple effect throughout the economy. Just look at USA in 2008. Understand it, then you tell me that the government has no interest or obligation to protect the property market. Edit: You may wish to read The Big Short by Michael Lewis for an in-depth account of the crisis. A lot can be learned from the US subprime mortgage crisis. Why do you think there are efforts to clear property overhang? Why bother with HOC? An interesting thing to note is that in Malaysia, there no easy access to credit, and no shadow banking system. Say what you will about the previous government but they did a good job picking lessons from the crisis to prevent an economic fallout/disaster. Funny you compare properties and cars.. I think the layperson can understand why they are not the same. In 2007 u.s subprime crisis, u.s gomen was helping and protecting banks, not subsale vendors. Loan compression has been rampant. If loan compression is not subprime, what is? QUOTE(vckc @ Jul 20 2019, 04:03 PM) It is because of slowing and a negative economic outlook as a whole that the rate cut occurs. If RM60 saving a month is critical mean borrower is overstretched. Similarly, if rate rise, borrower could end in foreclosure.A rate cut decreases the barrier to entry for a lot of buyers. It enables businesses to borrow more for less. And puts money in the hands of millions of Malaysians who are servicing loans. A 0.25% drop frees up on average of RM 60 for a mortgage loan of 400k. Multiply this and you can see exactly how powerful a rate cut is, the extra money will either be spent or reinvested breathing new life in the economy. The median age in Malaysia is 29 years old. This is an extremely healthy level. I used to think that Malaysia properties are doomed. But by the time I understand and learn more about the economy. The more I think otherwise. For a comprehensive education on the economic system, boom and busts and its intricacies. Read "Big Debt Crises" by Ray Dalio. household debt at about 83% of gdp is a bubble. When will property overhang be reduced substantially? This post has been edited by icemanfx: Jul 20 2019, 04:55 PM |

|

|

Jul 20 2019, 06:41 PM Jul 20 2019, 06:41 PM

Return to original view | Post

#6

|

All Stars

21,456 posts Joined: Jul 2012 |

Few foresaw current soft market yet most foresee strong up pick.

|

|

|

Jul 21 2019, 12:16 PM Jul 21 2019, 12:16 PM

Return to original view | Post

#7

|

All Stars

21,456 posts Joined: Jul 2012 |

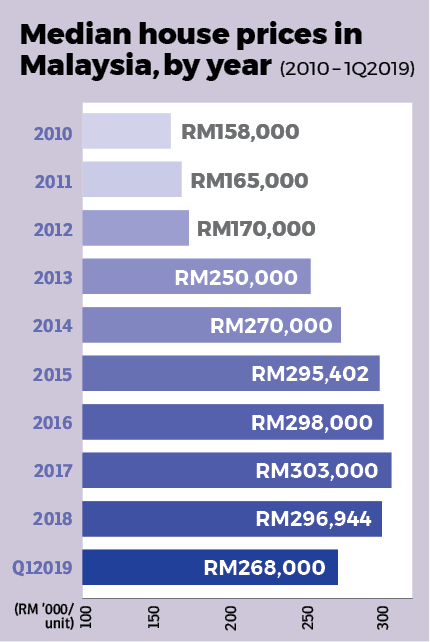

Cheaper than 5 years ago! Uuu wish came true, sell and buy back at cheaper price. This post has been edited by icemanfx: Jul 21 2019, 12:27 PM |

|

|

Jul 21 2019, 01:11 PM Jul 21 2019, 01:11 PM

Return to original view | Post

#8

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0138sec 0.0138sec

0.73 0.73

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 08:58 PM |