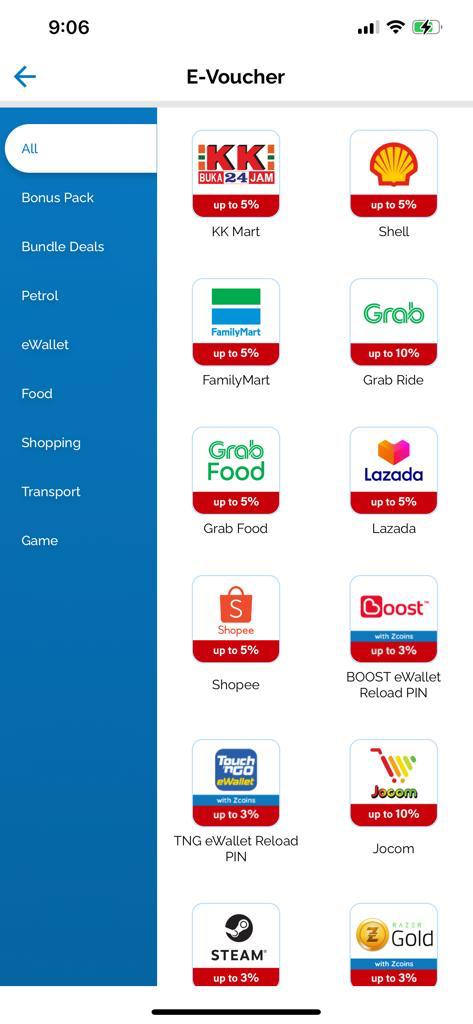

We’re fairly certain that other banks will follow suit, but for now the question on everyone’s lips is simple: what other credit cards can we use to reload e-wallets and still earn cashback and rewards points? The list compiled below, divided into cashback and air miles cards, will help.

Most e-wallet reloads are classified as online transactions, which means credit cards that offer cashback for online transactions are shortlisted; though some banks may exclude cashback from some e-wallet reloads (such as Public Bank Quantum & Visa Signature for Boost, and UOB YOLO for Boost and BigPay). We also added other cards that offered cashback for all retail transactions, as well as rewards cards that offered air miles conversion.

Those cards were then narrowed to the 5 cards in this list.

Cashback Credit Cards

Public Bank Quantum MastercardCashback: 5% on online and dining categories, capped at RM30 a month

Income requirements: RM36,000/year (RM3,000/month)

Annual fee: Free for life

One of the best cashback credit cards in this list, the Quantum Mastercard offers 5% cashback for online transactions with no minimum spend requirement. At a cap of RM30, you’ll earn cashback for up to RM600 in spending with this card.

Standard Chartered Liverpool FC Cashback CardCashback: Tiered, up to 5% capped at RM50 a month

Income requirements: RM36,000/year (RM3,000/month)

Annual fee: RM175

Besides the JustOne Platinum, StanChart’s rebranded cashback credit card is pretty good as well. You’ll need to spend at least RM1,500 to unlock the 5% rate, but the fact that cashback is awarded for all transactions except petrol and insurance means you’ll earn cashback for topping up any e-wallet in Malaysia.

Citibank Cash Back CardCashback: 10% on Grab, capped at RM10 a month

Income requirements: RM36,000/year (RM3,000/month)

Annual fee: RM120

Citibank’s revision for this card in January means it’s a decent card to earn RM40 in cashback every month with just RM100 in spending in each of the four categories: Petrol, Dining, Groceries, and Grab. Users have confirmed that topping up GrabPay wallet with this card earns 10% cashback – but be sure to spend at least RM500 on this card each month to unlock the 10% cashback. RM10 cashback may not sound like a lot, but given how reliant Malaysians have become to Grab’s suite of services, you’ll still be saving RM120 in a year.

Public Bank Visa SignatureCashback: 6% on online, dining, and groceries, capped at RM38 a month

Income requirements: RM80,000/year (RM6,667/month)

Annual fee: RM388, waived with 12x transactions a year

It’s rare for a high-tier card to offer cashback these days, but the Public Bank Visa Signature is one of the better ones. Think of it as a higher-end Quantum Mastercard, with slightly higher cashback rates and monthly cap. With its RM38 cashback cap per month, you’ll earn cashback for up to RM633.34 spent with this card.

Ambank TRUE Visa CardCashback: 3% on online category, capped at RM30 a month

Income requirements: RM36,000/year (RM3,000)

Annual fee: Free for life

Previously overlooked for other cards with higher cashback rates, Ambank’s TRUE Visa credit card is now a solid choice for e-wallet top-ups. 3% cashback for online transactions may not seem like much compared to other cards in this list, but its zero minimum spend requirement makes it useful if you don’t spend a lot. At a cap of RM30, this card gives cashback for up to RM1,000 in spending.

Jun 20 2019, 10:14 AM, updated 7y ago

Jun 20 2019, 10:14 AM, updated 7y ago

Quote

Quote

0.0352sec

0.0352sec

0.37

0.37

5 queries

5 queries

GZIP Disabled

GZIP Disabled