QUOTE(ah_suknat @ Jan 1 2020, 12:25 PM)

Can help do the math?

1k everymonth in fixed deposit

Vs

1k everymonth for 200k ASB finance 3.95

Both for 1 year, after 1 year, how much profit?

You can verify my calculations on your own using financial calculator:

1. ASBF: RM200,000, 27 years and 3 months at 3.95 p.a. to get the RM1000/m installment

After 12 months, the loan balance is RM195,829

Close the account, the certificate size is RM200,000, so you get RM4,171 cash in hand

As for your ASB distribution at 5.5%, you will get RM11,000

Total

cash in hand is RM15,171, with

RM12,000 capital outlay2. FD: RM1,000 a month for 12 months at 3.5%

Keep in mind that you do not start you investment with RM12,000. You deposit RM1,000 a month, each month, with the 3.5% return calculated on a pro-rated basis for each day's balance (daily rest)

FD is somewhat beneath what I need, so if I am mistaken with the calculation, FD fans can please help me ya. And 3.5% p.a. return is somewhat average right? I can change it to 4% and it would not change anything

So total

cash in hand is RM12,230, with

RM12,000 capital outlayQUOTE(redzaril @ Jan 1 2020, 12:26 PM)

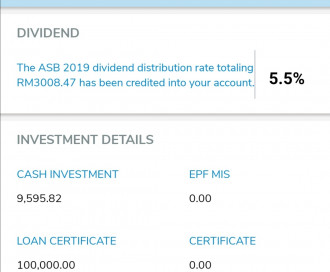

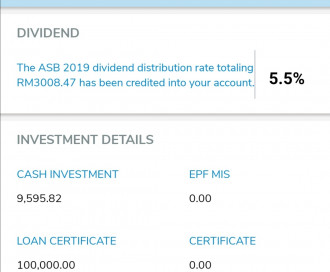

This is what i got. RM3.3k for rm100k investment.. The loan starts in June so that means only 6 month counted. Anual payback is RM7452 so for me ok la.. It already cover almost half. I assume next year if full 12months can cover the loan already then diam2 buat x tahu.. Boleh ke macam tu?

Yes, that is how it is supposed to be. You are supposed to save money each month anyways right? Do so through ASB financing, while you pay for you financing, the RM200k (or whatever you certificate size) will earn more than than the financing rate.

For my clients in the past year, they have been paying 4.70% p.a (due to changes in the BR) on a reducing balance of RM200,000 (this loan balance reduces as you pay your installments) while earning 5.50% p.a. as distribution on the RM200,000 certificate size. If that is not "free money" I do not know what it is

Dec 28 2019, 03:29 PM

Dec 28 2019, 03:29 PM

Quote

Quote

0.0248sec

0.0248sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled