Easy. The accumulation of your distribution.

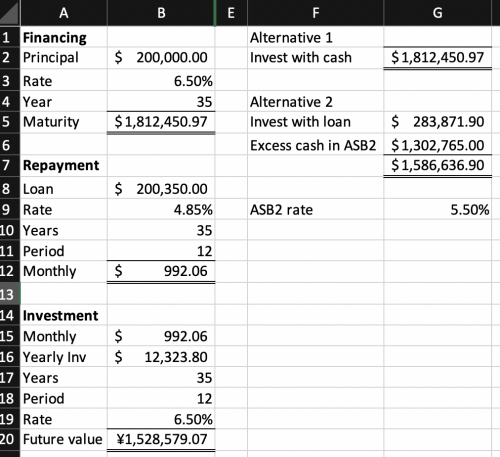

1. For example, you opened your ASB account in Dec 2018, you got an ASBF for RM200,000 and it was deposited into you account on Dec 2018

2. You won't get any distribution for Jan 2019 because of the monthly-minimum balance of Dec 2018 being 0

3. In Jan 2020, you will be getting RM11,000 as your distribution. Your softcap has increased by RM11,000 now and will not reduce even if you withdraw the RM11,000 you have just earned

4. Throughout 2020, you have been leaving RM211,000 in your ASB account. In Jan 2021, the distribution was announced at 6%. You earn RM12,660. Now you softcap has further been increased by RM12,660, thus bringing your total softcap to RM23,660.

5. Your balance in now RM223,660. Suppose you withdraw RM23,660 form the account. Your balance is now RM200,000. Your

softcap remains at RM23,660, which means you can deposit this much money into your account in the future if you want to

As i suspected so. This softcap is only useful for withdrawal and plan for re investment in future.

But for those who intend to keep the cash inside, then the softcap doesnt mean anything.

May 2 2019, 04:19 PM

May 2 2019, 04:19 PM

Quote

Quote

0.0152sec

0.0152sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled