https://themalaysianreserve.com/2019/04/29/...ing-oil-prices/THE bulls have stormed the oil market as tightening supply and production disruptions coupled with renewed demand prospects have sent crude oil prices to six-month highs.

Brent oil rallied approximately 37% this year alone to above US$74 (RM303.40) per barrel, sending the much needed adrenalin to oil producers like Malaysia and pulling many oil and gas (O&G) players out of the doldrums.

Prior to the 2014 oil price rout, O&G firms capitalised on the high crude prices of above US$100 per barrel to expand, raising billions to finance more projects.

The subsequent rout which saw oil prices plunging 57.5% in just six months from June 2014 to January a year later, had trimmed spendings from major producers, leaving O&G companies saddled with billions of debts.

The prospects for the oil sector have improved significantly on OPEC-led production cuts and further bolstered by oil disruptions at a few major producers.

But risks continued to linger, especially questions about global economic growth, the key to higher oil consumption.

SPI Asset Management managing partner and head of trading Stephen Innes said there is a “technical overhang” from overextended bullish bets on both Brent and West Texas Intermediate oil contracts.

“Any breakdown on the technical or fundamental landscape can trigger a reasonably aggressive market response as weaker longs head for the exits,” he said in a research note last Friday.

While the Chinese economy — the world’s second-largest oil consumer — is showing signs of stabilising, the dovishness of central banks worldwide are indicating that the global economy could be due for a correction.

But, recession fears have largely been ruled out and presently there is sufficient support from the supply side of the market for crude oil to make further strides towards the US$80 per barrel mark in 2019.

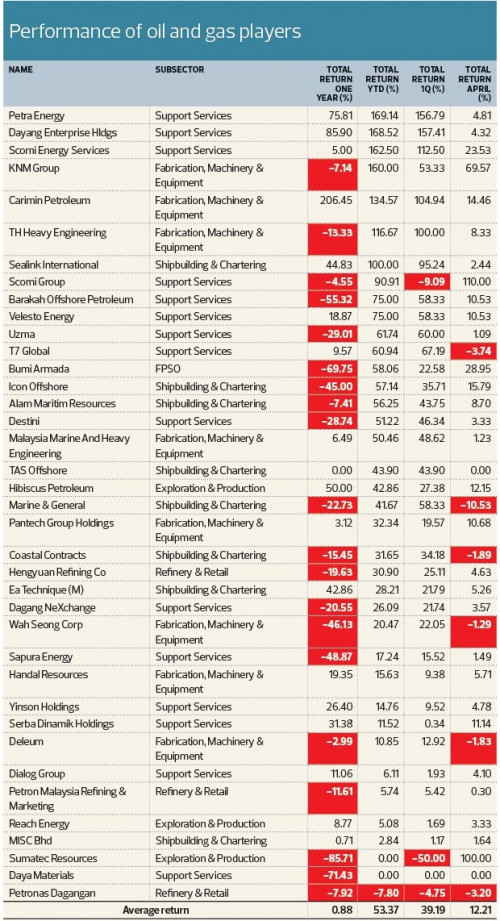

The Malaysian Reserve looks at benefactors from the higher oil prices and companies, which shiver with every US$1 increase of the commodity.

Govt Coffers Versus Consumer Pressures

The Malaysian government based its 2019 budget on an average Brent of US$70 per barrel for the year.

Crude oil only surpassed this threshold earlier this month, but it is estimated that the government will gain RM300 million in additional revenue for every US$1 increase above the US$70 per barrel average.

While the inverse also holds true, the additional income is a welcome relief to the current government who is working towards paring down its over RM1 trillion in debt.

Higher oil prices also bodes well for the ringgit, which performance is generally correlated to the movement of the commodity. The local unit remains bogged down by external risks, but such threats are being cushioned by the strengthening oil prices. The ringgit is expected to be on a stronger footing this year.

While high oil prices benefit the government, its subsidies for fuel will also rise in tandem. Any removal of the subsidies would impact the consumers at the pump and increase inflation.

Currently, retail fuel prices are determined by a weekly float mechanism with RON95 and diesel capped at RM2.08 and RM2.18 per litre respectively.

The system was introduced early in January this year. But, it could make way for a targeted petrol subsidy mechanism which could see the cap lifted for RON95.

Petronas’ Gain, Airlines’ Pain

The 2014-2015 oil crisis taught national oil companies a proverbial lesson: The need to be lean in managing cost, while avoiding exuberant spending amid a market that swings to a downturn as easily as it goes on a bull run.

Petroliam Nasional Bhd (Petronas) had emerged stronger and leaner from the 2014 oil rout and providing RM19 billion in impairments in 2015, eroding its profits that year.

Malaysia’s national energy company had reduced billions in spending and trimmed some 1,000 staff in 2016.

The leaner base allowed Petronas to announce its highest profit since 2013 when it grew its profit after tax by 22% year-on-year (YoY) to RM55.3 billion last year as revenue rose 12% to RM251 billion.

This allowed the company to allocate a higher upstream spend of RM30 billion in 2019 — half of which will be spent domestically. But, Petronas continues with a conservative outlook for the year with projects budgeted at a Brent of US$66 per barrel.

Crude oil trending above US$70 per barrel bodes well for the company’s upstream business, which is the main revenue generator of the state-owned company.

The higher margins will also help the company to meet its dividend commitments to the government — its sole shareholder — which totals RM54 billion in respect to its 2018 fiscal year.

However, airlines will incur additional costs as higher crude oil means higher fuel jet prices and will shave a sizeable amount from their profits. Malaysia Airlines Bhd, FlyFirefly Sdn Bhd, MASwings Sdn Bhd, AirAsia Group Bhd, AirAsia X Bhd and Malindo Airways Sdn Bhd will be feeling the pinch from the current oil rally. Listed AirAsia and AirAsia X recognised RM394.97 million and RM99.27 million in losses respectively, for the quarter ended Dec 31 last year on higher fuel and other expenses. Airlines are known to introduce a surcharge on fares or pass on the additional cost to passengers to protect their bottom line. However, this was historically done during peak oil price levels of above US$100 per barrel. At about US$74 per barrel today, Malaysian airline operators are expected to bear the additional costs rather than risk deterring passenger traffic due to higher fares.

The O&G Value Chain

The bulk of listed O&G companies in Malaysia are service providers who are engaged in the upstream sector and are predominantly dependent on Petronas for work.

This includes companies such as Dayang Enterprise Holdings Bhd, Uzma Bhd and Velesto Energy Bhd, while Sapura Energy Bhd and Serba Dinamik Holdings Bhd have an international base to support their domestic business.

Petronas upping its upstream expenditure to RM30 billion, coupled with a brighter activity outlook over the next three years, bodes well for local O&G service providers as a whole. The company foresees higher activities and demand for drilling, marine and maintenance works from 2019 to 2021 with double the capacity needed for jack-up rigs. An industry analyst said the latter will benefit rig owners such as

Velesto who recently secured RM432.33 million worth of contracts from Petronas Carigali Sdn Bhd — Petronas’ upstream vehicle — for jack-up drilling rig services. “The contracts will translate into better utilisation for Velesto’s assets, while service providers such as

Dayang are expected to see higher work orders this year,” said the industry analyst.

Meanwhile, global upstream activity will be supported by the development of new fields, particularly in the Middle East where the majority of the final investment decisions will be concentrated in, the source added. “This will benefit companies with larger international exposures such as

Sapura Energy and

Serba Dinamik,” said the analyst.

Hibiscus Petroleum Bhd and

Reach Energy Bhd are also set to profit with the current rise as they have a direct leverage on oil prices as pure-play exploration and production (E&P) players. E&P companies extract oil at a fixed or averaged operating expenditure per barrel, so higher oil means better averaged prices realised when sold. In contrast, rising crude oil means higher input costs for downstream players.

The industry source said this would have a downward impact on refineries’ margins, namely Hengyuan Refining Co Bhd and Petron Malaysia Refining and Marketing Bhd.

Petrochemical producer Lotte Chemical Titan Holding Bhd will also face cost pressure as feedstock prices (its main raw material cost) is positively correlated to crude oil prices. The South Korean-controlled company saw its net profit contract 25.8% YoY to RM786.23 million in 2018 on higher feedstock costs incurred and lower product prices recognised that year.

Some analysts have even predicted oil prices will hit US$80 this year, a scenario which will be applauded by some, but also a bane to others.

This post has been edited by changejob: Apr 30 2019, 11:43 AM

Apr 28 2019, 09:35 PM, updated 7y ago

Apr 28 2019, 09:35 PM, updated 7y ago

Quote

Quote

0.0216sec

0.0216sec

0.45

0.45

5 queries

5 queries

GZIP Disabled

GZIP Disabled