RHB Loan system is screwed up. Anyone working in RHB loan department?

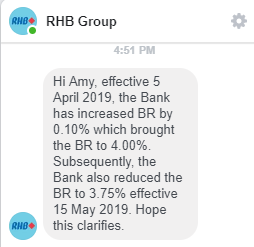

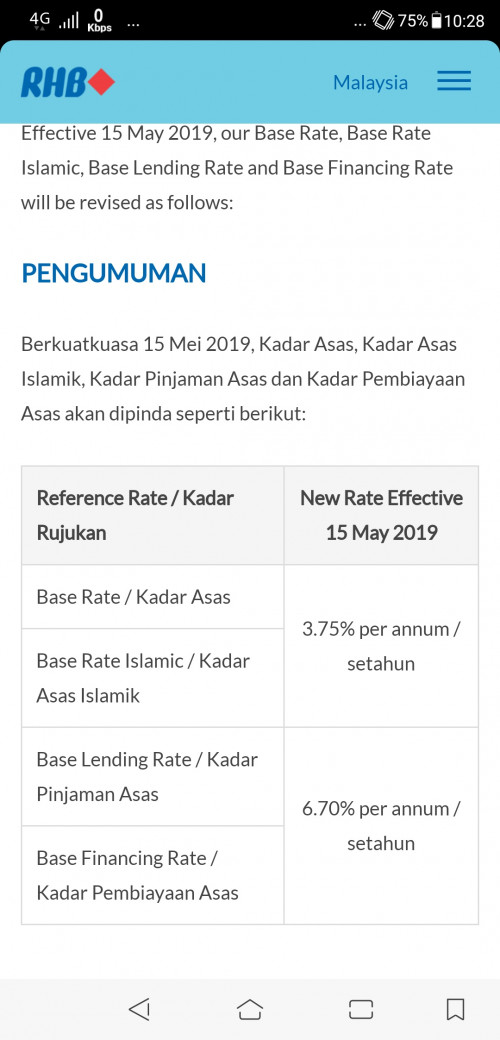

Not sure about car loan but mine is house loan. Everytime they revise the BLR, they will revise the monthly repayment amount too.

Anyone who need extra cash can try this method. But not advisable as it might bankrupt you by the end of the loan period but it's long long time away.

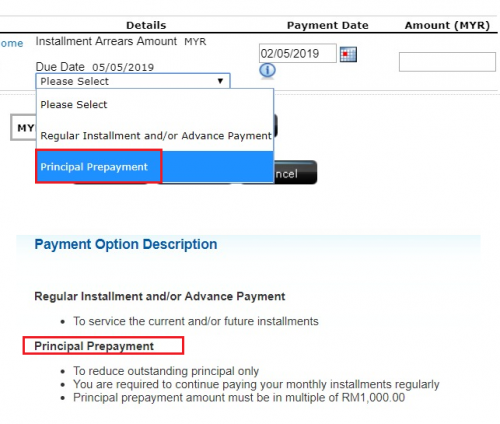

So I got a loan from them, before BLR revised (lowered). And my loan repayment amount is RM2k + monthly. But before they revised the BLR, I got some extra cash lying around so I inject into the loan account to offset the interest. I injected almost RM300k inside. What happen after really surprised me, at the revision date, my monthly repayment is only RM100+. And what's even more ridiculous is even after i take out the extra cash (300k) the repayment amount remained the same. I immediately realised something was wrong because if i left it till the last year of my loan i would still be paying less, and my amount outstanding would balloned. (I can still pay RM2k but anything extra goes to the extra account and does not reduce my loan amount).

I called their CS and explain this even the branch manager they said it's the system he also quite shocked by it actually. But say that's how they do it. They only revised the system during BLR revision. So essentially, anyone that got extra cash lying around, inject into the extra account. My repayment monthly now is RM70 after this latest increase because i put even more cash into the account before they revised it. Essentially I got more money to roll when I needed it because my monthly repayment is so low. I did tell the CS service to update the loophole but they say it's not worth it. The system been there for years. So I shall take advantage of it

There is a serious loophole anyone that using RHB house loan wish to know more can contact me.

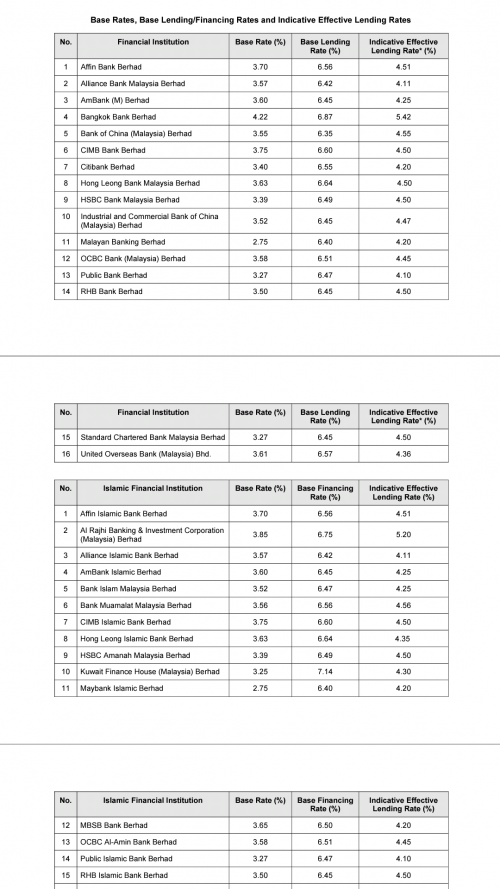

On a side note, is other bank house loan system like this? Hope to know more. Thanks.

Apr 8 2019, 03:27 PM, updated 5 months ago

Apr 8 2019, 03:27 PM, updated 5 months ago

Quote

Quote

0.6384sec

0.6384sec

0.83

0.83

6 queries

6 queries

GZIP Disabled

GZIP Disabled