QUOTE(cherroy @ Mar 26 2019, 11:49 AM)

For sure.

The new monthly repayment amount and schedule will be based on the 700K loan.

When interest rate is low.

Eg.

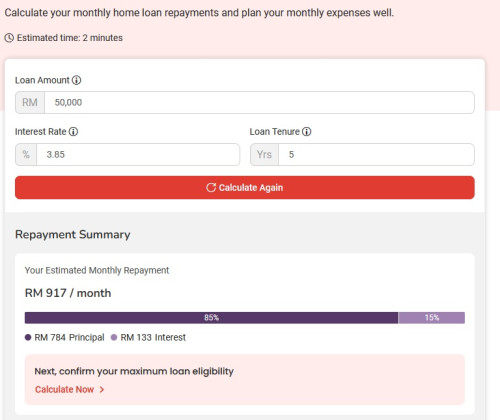

Last time you sign up a housing loan of fixed 7% interest rate.

Now interest rate is 5%, you refinance it, to repay all the old loan of 7%, and start a new one at fixed 5%.

The 2% interest cost saving can mean a lot over the long term.

Refinancing may incur additional documentation fee, range from lawyer fee, admin fee, or old loan penalty charges etc.

I want to ask..... if lets say the person apply loan that time salary is 5K, Now his property market rate is 700K and he wanted to refinance. Lets say 2 years difference and his salary is 6K only....

my question is, is the bank going to re-evaluate base on his debt service ration?

QUOTE(Pac Lease @ Mar 26 2019, 12:49 PM)

the best time to refinance is when your property market value is increase. Also, now is the best time to refiance cash out for standby.

now subsales property market also slow down alot. When the owner wanna sell their property but no buyer wanna buy due to some reason :

1. down payment for deposit

when you buy subsales, you need to pay 10% downpayment from your own pokcet. Nowadays many people prefer to buy under construction project because some developer give discount, so no need use own money and can save it for renovation or buy furniture.

2. house defect

old house surely will have some defect because the age of property is old, so need to folk out money to do renovation.

3. owner sell higher than market value

when the house owner facing the problem above, they can't sell their property, so what they will do? refinance their property cash out first then standby for future use.

How do we know our property value has increased? check from Iproperty? But iProperty seems not accurate one....

please advise.

QUOTE(Pac Lease @ Mar 26 2019, 01:03 PM)

thanks for your sharing your idea.

another reason of refinance your house is for restructure of your current financial debts.

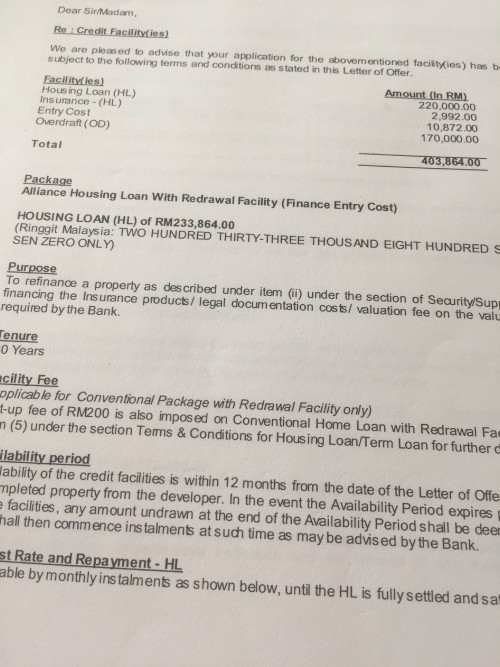

this is real case from my client,

his salary worker and earning RM 6k per month and his current commitment show as below:

1. housing loan 1k

2. credit card outstanding 100k

for bank calculate of his debt service ratio will be 100k x 5% = 5k

so his current commitment is 6k per month.

Now he is very suffer because high commitment. So i offer him an option to refinance his property.

after refinance, he paid 1k to his housing loan and serve the interest payment only of his 100k ( 594) per month.

so compare the cash flow , he got additional of 4406 cash on hand and he can be relax at this moment.

however, he still have to repay back the 100k in time of reach his age 60.

I dont really get you of the 4406 cash and 594 per month.

could you please explain?

Mar 26 2019, 09:40 AM, updated 2y ago

Mar 26 2019, 09:40 AM, updated 2y ago

Quote

Quote

0.0430sec

0.0430sec

1.41

1.41

5 queries

5 queries

GZIP Disabled

GZIP Disabled