Hi TS Pac Lease, I have question regard top up vs re-finance

Details:

1) Property cost at RM370k (2012 value) and haven't done any valuation yet since then.

2) Effective Rate - BLR - 2.4% = 4.25%

3) Loan amount : RM252k

4) Outstanding loan : RM44k

5) Monthly repayment : Rm2.2k (roughly left 1 year + can finish as sometime i pay extra)

What's the pro of Top-Up if compare to refinance?

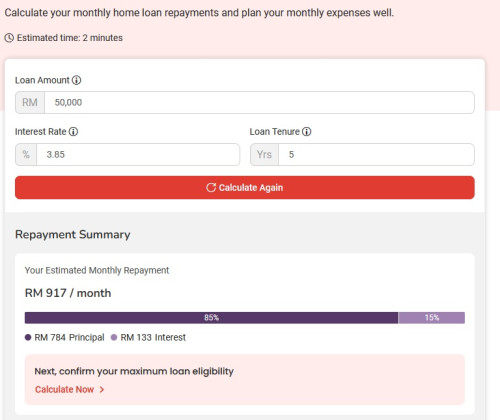

Judging that i might just wan to loan maybe 70k~100k for 5 years.

how does refinance work, refinance

Aug 7 2024, 02:56 PM

Aug 7 2024, 02:56 PM

Quote

Quote

0.0194sec

0.0194sec

0.58

0.58

6 queries

6 queries

GZIP Disabled

GZIP Disabled