QUOTE(Rinth @ Aug 14 2024, 11:07 AM)

3.29% probably is flat rate, means effective rate 6%++

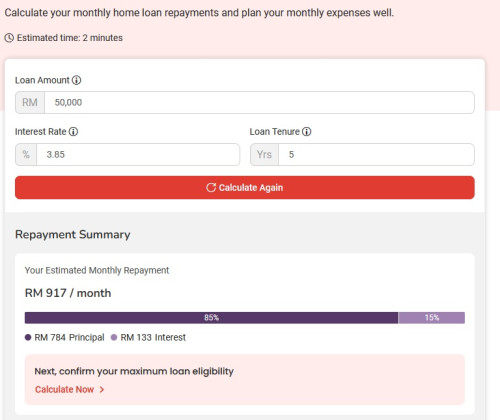

Property rates 3.85% is effective rate.

So which better? of course we're comparing rates now, not others such as legal fee, time consume for disbursement etc etc

QUOTE(victorian @ Aug 14 2024, 11:25 AM)

*Edit- typo

CC cash out is at fixed rate, housing loan is at effective rate. At this rate, interest for refinancing is cheaper. But judging by the legal incurred for refinancing, it will not be worth it either.

Better look for 0% cash advance or 0% BT

QUOTE(Pac Lease @ Aug 14 2024, 11:26 AM)

Hi, give me 5. you got my point.

QUOTE(victorian @ Aug 14 2024, 11:27 AM)

3.29% fixed rate pays more interest than 3.85% effective rate bro Both of you know what you guys are talking or not lol. You guys are confusing eveyone

ok you've edited...so now we know CC Fixed interest rate i3.29% s higher then refinancing 3.85%.

so TS why CC Cash out still better?

This post has been edited by Rinth: Aug 14 2024, 11:31 AM

Aug 14 2024, 11:16 AM

Aug 14 2024, 11:16 AM

Quote

Quote

0.0230sec

0.0230sec

0.69

0.69

5 queries

5 queries

GZIP Disabled

GZIP Disabled