QUOTE(wira1979 @ Sep 29 2025, 01:36 PM)

Wonder why there's not been more debate/discussion on this? If anything, it's offering less flexibility to Malaysians to manage their own wealth.

Maybe it's because most Malaysians have more than RM1.5m in their accounts so this will not impact them. If that's the case, excuse me while I cry due to how poor I am.

We knew of this around Dec 2024 IINM, and there was debate. But the thing is, we talk kosong. Nothing really happens.

By now since it is already damn late in the game, I was only

lamenting about the quality of our journalism. Imagine the editor and the journalist who published the news article in Malay Mail. He / she either has no conscience or is asleep or no logic. Much like how we teach school kids to repeat the fakta fakta without any amount of critical thinking.

Now if you think about journalism in a well educated country, there must be a big stink on the first page, because :

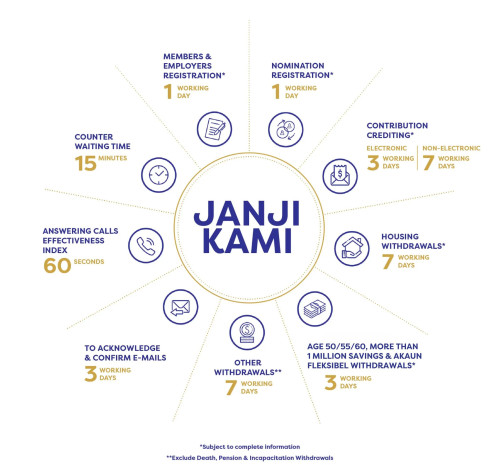

We were misled to dump money into EPF based on the initial premise of unrestricted withdrawal of any amount exceeding RM1,000,000.00 only for them to update the limits (with 100k increments every year mind you).

So how come ? There is only a lament. If you pay attention to history and events ;

QUOTE

First they came for the Communists

And I did not speak out

Because I was not a Communist

Then they came for the Socialists

And I did not speak out

Because I was not a Socialist

Then they came for the trade unionists

And I did not speak out

Because I was not a trade unionist

Then they came for the Jews

And I did not speak out

Because I was not a Jew

Then they came for me

And there was no one left

To speak out for me

The media is our 4th estate but it is now the state's estate instead. Wow what a pun. Ok back to work.

This post has been edited by lee82gx: Sep 29 2025, 04:29 PM

Apr 16 2024, 09:03 PM

Apr 16 2024, 09:03 PM

Quote

Quote

0.0212sec

0.0212sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled