Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

backspace66

|

Jan 9 2023, 08:19 PM Jan 9 2023, 08:19 PM

|

|

Just do a self contribution on epf i-akaun APP. It will tell you the remaining amount that you can contribute for that year.

Another thing i noticed, if you transfer through the APP, date of contribution will follow the same date as transaction even on a public holiday. If i used M2U, the transaction date is not captured on the same date inside EPF.

|

|

|

|

|

|

backspace66

|

Feb 24 2023, 07:08 PM Feb 24 2023, 07:08 PM

|

|

Good news, time to move away from pnb fixed priced fund

|

|

|

|

|

|

backspace66

|

Feb 25 2023, 11:21 AM Feb 25 2023, 11:21 AM

|

|

QUOTE(confusedway @ Feb 25 2023, 11:16 AM) • KWSP o Kajian semula pelepasan cukai bagi caruman mandotari/sukarela kepada skim yang diluluskan/ KWSP dan premium insurans nyawa atau takaful hayat atau caruman sukarela tambahan kepada KWSP o Menaikkan had caruman sukarela KWSP daripada RM60,000 kepada RM100,000 setahun https://budget.mof.gov.my/pdf/belanjawan202...-touchpoint.pdfFrom MOF and the link mention is Budget 2023 (24 Feb 2023) thus i belief you can trust this... Search KWSP... Hopefully it is approved, the government need it more than most of us. Or else who gonna buy the MGS and sukuk |

|

|

|

|

|

backspace66

|

Mar 26 2023, 08:50 PM Mar 26 2023, 08:50 PM

|

|

Something is definitely brewing inside the shariah fund, i speculate that the total amount coming out in the next few years exceed the amount coming in.

This is of course excarbated since the conventional is the default fund, so any new contributor will be under conventional unless opt out.

|

|

|

|

|

|

backspace66

|

Apr 10 2023, 12:52 PM Apr 10 2023, 12:52 PM

|

|

I am a bit concern if more and more people treat epf as a high interest saving account for those people that exceed 1 mil. If too many reach 1 mil and do this, epf might raised the bar further to 2 mil . 1 mil is achievable in near future but 2 mil, might as well i wait for retirement.

It would be too risky for me to transfer from my ASX if the rule is revised further to 2 mil. A lot of my fund would be locked out and out of reach for significant amount of time.

This post has been edited by backspace66: Apr 10 2023, 12:53 PM

|

|

|

|

|

|

backspace66

|

Apr 11 2023, 07:55 AM Apr 11 2023, 07:55 AM

|

|

QUOTE(gooroojee @ Apr 10 2023, 01:02 PM) EPF governance is about ensuring sufficient funds for retirement which has a target of below 1M in EPF savings. Their job is not to police how much you should keep in EPF beyond that target. We have enough fear mongering in Malaysia already. Think about the impact of withdrawal, IIRC, right now there is about 70k member with more than 1 million in epf. To make it easy let say 100k member in the future remove at least 100k. Since this can be put back easily. Of course nobody take out in one shot and the withdrawal amount could be more or less. The point is the impact of the withdrawal in epf ability to do a longer term investment. Another thing is remember a lot of people consider tier dividend as a posibility as well which might lead to this. The thirst to satify the majority is there for political gain. |

|

|

|

|

|

backspace66

|

Apr 11 2023, 09:22 AM Apr 11 2023, 09:22 AM

|

|

QUOTE(Super2047 @ Apr 11 2023, 08:21 AM) If M40/B40 push for tiered dividend, they are the one who will lose out because T20 will withdraw as much as they can, and wouldn't want to top up anymore. When that happen, epf fund size will become much smaller and same for their return. End up who getting less dividend from epf? Which is why epf might revise the limit to control outflow? Do u get my point? Top up? Dont think top up is a major source of inflow for epf, most of it is made up Mandatory contribution which you and i have no choice. This post has been edited by backspace66: Apr 11 2023, 09:27 AM |

|

|

|

|

|

backspace66

|

Apr 11 2023, 10:04 AM Apr 11 2023, 10:04 AM

|

|

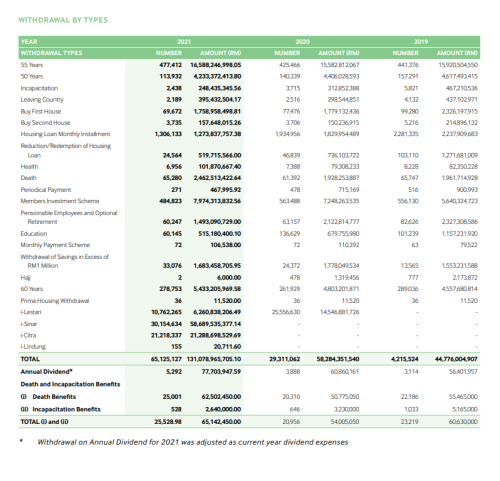

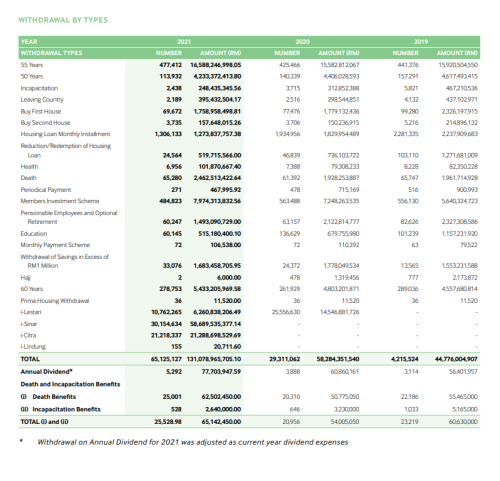

QUOTE(Rinth @ Apr 11 2023, 09:36 AM)  erm in 2021, Exceed 1 million withdrawal is total RM 1.6b.... Compared to other withdrwal type it seems insignificants..... Fun Fact : Buy 1st house withdrawal is RM 1.7b..I-sinar have 30mil ppl perform the withdrawal    it seems that 1 ppl can perform multiple withdrawal for all the I-series Ya sure, u compare a situation without implementation of tier dividen. Fun fact Average saving above 1 mil is 1.6 million and this is old data and we have 70k contributer exceeding that 1 mil.again old data. 70k X 0.6 million is like 42 billion. These are potential for outflow |

|

|

|

|

Jan 9 2023, 08:19 PM

Jan 9 2023, 08:19 PM

Quote

Quote

0.0256sec

0.0256sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled