Outline ·

[ Standard ] ·

Linear+

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

moosset

|

Dec 13 2019, 08:25 PM Dec 13 2019, 08:25 PM

|

|

QUOTE(Ramjade @ Dec 13 2019, 10:29 AM) Very bad liquidity. You need to see domiciled of fund. Safest bet is still Ireland. Sometimes buying s&p500 etf say from HK also can kena 30% tax in dividend. ah, I see. Thanks! I forgot they can be domiciled elsewhere even though it's in SGX. |

|

|

|

|

|

moosset

|

Dec 13 2019, 08:26 PM Dec 13 2019, 08:26 PM

|

|

QUOTE(alexkos @ Dec 13 2019, 12:39 PM) Yes.. I got both sxr8 and cspx. Hoot whichever that is cheapest for u. why you buy both? so what's the conclusion? Which is better? |

|

|

|

|

|

moosset

|

Dec 13 2019, 10:09 PM Dec 13 2019, 10:09 PM

|

|

QUOTE(alexkos @ Dec 13 2019, 09:55 PM) Tradestation global rm7k hoot cspx cheapest But if got larger fund... 18k captrader hoot sxr8 cheapest I'm using Tradestation + SXR8 ....  anyway, I wanted to ask which has a better return, SXR8 or CSPX? This post has been edited by moosset: Dec 13 2019, 10:09 PM |

|

|

|

|

|

moosset

|

Dec 16 2019, 10:18 PM Dec 16 2019, 10:18 PM

|

|

QUOTE(zerolord @ Dec 16 2019, 06:47 PM) Not sure if I chose the correct SXR8...  Thanks! QUOTE(dwRK @ Dec 16 2019, 09:14 PM) they are the same share  oh yeah, I forgot. Just different currency. |

|

|

|

|

|

moosset

|

Dec 19 2019, 07:27 AM Dec 19 2019, 07:27 AM

|

|

I just noticed that SPYD (US) and SPYD (Europe) do not have the exact same holdings. Anyone holds these ETFs?

|

|

|

|

|

|

moosset

|

Dec 19 2019, 07:55 AM Dec 19 2019, 07:55 AM

|

|

QUOTE(dwRK @ Dec 18 2019, 06:46 PM) expecting spx pullback soon... get ready to liquidate, or top up... hahaha how soon? Almost time to top up for me. |

|

|

|

|

|

moosset

|

Dec 19 2019, 02:33 PM Dec 19 2019, 02:33 PM

|

|

QUOTE(dwRK @ Dec 19 2019, 10:05 AM) market quite extended... very irrational now...lol at the moment it's been 2 days flat waiting for trigger up or down yesterday's candle closed neutral...didn't give any direction bias... so back to holding pattern I'm giving it a 60:40 chance between tonight and next week...I may change my mind after tonight...  but stocks usually go up during year end, no? window dressing time? |

|

|

|

|

|

moosset

|

Dec 19 2019, 09:43 PM Dec 19 2019, 09:43 PM

|

|

QUOTE(moosset @ Dec 19 2019, 07:27 AM) I just noticed that SPYD (US) and SPYD (Europe) do not have the exact same holdings. Anyone holds these ETFs? eh, no one interested in SPYD?? |

|

|

|

|

|

moosset

|

Dec 20 2019, 09:07 PM Dec 20 2019, 09:07 PM

|

|

QUOTE(Cubalagi @ Dec 20 2019, 07:55 PM) Different index approach. The US one is a pure high DY approach. The Euro one is a dividend growth approach. Basically two different ETFs. oh...thanks! I thought they were their US counterpart, since they are both iShares and using the same ticker symbol. |

|

|

|

|

|

moosset

|

Jan 6 2020, 02:49 PM Jan 6 2020, 02:49 PM

|

|

when you guys transfer money via InstaRem, does it matter if you transfer 10k in one go or transfer 5k two times?

i.e. we don't save anything by transferring 10k in one go, right? It costs the same as transferring 5k twice?

|

|

|

|

|

|

moosset

|

Jan 8 2020, 10:12 AM Jan 8 2020, 10:12 AM

|

|

QUOTE(dwRK @ Jan 8 2020, 08:00 AM) futures dump back to levels this date liao...hahaha let's see when real market opens tonight... thanks! Will be waiting.  |

|

|

|

|

|

moosset

|

Jan 8 2020, 05:47 PM Jan 8 2020, 05:47 PM

|

|

QUOTE(BlackNAGA @ Jan 8 2020, 04:32 PM) Is it better to buy US domiciled ETF if one is currently working in the Philippines ? I believe that US has tax treaty with the Philippines Yes, if the tax is less than 15%. |

|

|

|

|

|

moosset

|

Feb 2 2020, 02:07 AM Feb 2 2020, 02:07 AM

|

|

QUOTE(alexkos @ Feb 1 2020, 06:34 PM) define crash?? how many % drop per day, in how many consecutive/non-consecutive days? |

|

|

|

|

|

moosset

|

Feb 11 2020, 11:58 PM Feb 11 2020, 11:58 PM

|

|

QUOTE(Ramjade @ Feb 9 2020, 11:40 PM) 1. That's what I did. I think there is a rumour here that they don't accept Malaysian IC anymore. Cause something about our IC got signature which they thought was outs but actually belongs to Ketua JKN or something. I just give them my IC, bank statement, a picture of my signature, income tax statement. All cross out with application of trade station global except income tax as it's in PDF. Just make your the address match your IC. 2. Can forget about referral code. It's practically useless. QUOTE(kart @ Feb 11 2020, 10:12 PM) RamjadeThanks for your reply. So, your IC and bank statement are in the form of image file, right? Why did you submit your income tax statement? Wow! I didn't know can use IC. I only used passport. |

|

|

|

|

|

moosset

|

Feb 14 2020, 09:51 PM Feb 14 2020, 09:51 PM

|

|

QUOTE(MNet @ Feb 14 2020, 09:20 PM) I remember last time got somebody at etf thread mentioned its doabale for usd USD definitely not. You can check my post #312. https://forum.lowyat.net/topic/4843925/+300 |

|

|

|

|

|

moosset

|

Feb 16 2020, 08:06 PM Feb 16 2020, 08:06 PM

|

|

QUOTE(dwRK @ Feb 15 2020, 09:07 PM) eh... why those 2 don't trade? they don't have european ETF? |

|

|

|

|

|

moosset

|

Feb 16 2020, 08:12 PM Feb 16 2020, 08:12 PM

|

|

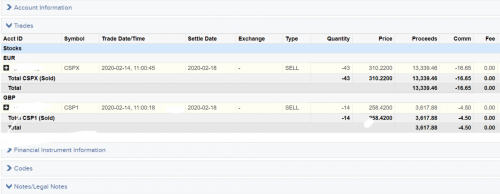

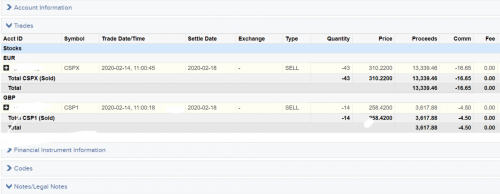

QUOTE(alexkos @ Feb 16 2020, 10:14 AM)  Example of transaction. Tradestation global eat 0.125% per way. I sold because of personal circumstance. Will be back sp500 once settle  wah ... commission 16€ ....!! So expensive! If you had US ETF, I think it's only $0.007 per share, min $1.50. |

|

|

|

|

|

moosset

|

Feb 19 2020, 06:22 PM Feb 19 2020, 06:22 PM

|

|

how to check if the ETF has accumulated its dividend??

|

|

|

|

|

|

moosset

|

Feb 19 2020, 06:47 PM Feb 19 2020, 06:47 PM

|

|

QUOTE(roarus @ Feb 19 2020, 06:38 PM) I assume you're asking for an ETF with accumulating class? It will be reported in the annual report. Yes, accumulating ETF. but can't we see any increase in our holdings? For example, before dividend I have 10 units. After dividend, I have 10.50 units. No?? How does accumulating ETF work? I thought they auto-invest the dividend? |

|

|

|

|

|

moosset

|

Feb 19 2020, 08:18 PM Feb 19 2020, 08:18 PM

|

|

QUOTE(roarus @ Feb 19 2020, 07:01 PM) The price increases instead of number of units in holdings. One 'lazy' way to find out how many % is to load both accumulating and distributing classes of the same ETF (e.g. VWRA and VWRD) on Bloomberg.com QUOTE(alexkos @ Feb 19 2020, 07:01 PM) Oh, I see. Thanks! but then, for distributing ETF, you can buy invest more before the ex-date right? for accumulating ETF, how? do they announce an ex-date? |

|

|

|

|

Dec 13 2019, 08:25 PM

Dec 13 2019, 08:25 PM

Quote

Quote

0.0591sec

0.0591sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled