QUOTE(AthrunIJ @ May 4 2025, 08:05 AM)

Paper gain went to 0 when trump unveils his tariffs and now back normal gain..

Roller coaster ride...

should be back to ATH pretty soon, with bitcoin reclaiming $100k. Just a month ago there were news from bond crash, USD losing confidence, gold rush (still high though). It does take a very different set of temperament to weather these economic news. Unless one deliberately shut off these news media and just let the investment work on itself.

On these economic worry is the exciting AI future we're going into. Generative AI, then Robotics AI. Usually innovation will take pace and create value far more than what the current system can offer. Think smartphone. It was a hardsell selling a phone for more than RM500 back then. Now RM6,999 is no problem, because of perceived usefulness and the digital economy that depends on it. No one walks out of their house without a smartphone these days.

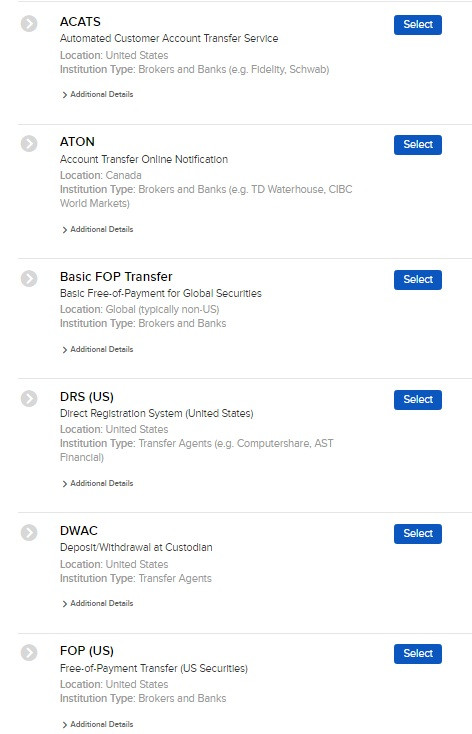

I'm glad that since this thread was started some 6 years ago, there is now very easily accessible ways for Malaysian to get exposure to passive instruments such as S&P500 (through SPY). Trading platforms like Moomoo is very smooth in terms of depositing RM, internal conversion to USD, and get index exposure from there.

May the passive investors stay on the course. Btw if you're a Bogleheads, pm me because I'm thinking of starting a passive investing local chapter in Malaysia soon =)

This post has been edited by alexkos: May 10 2025, 09:20 AM

Jun 14 2021, 11:27 AM

Jun 14 2021, 11:27 AM

Quote

Quote

0.0523sec

0.0523sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled