QUOTE(Calvin Seak @ Mar 25 2022, 06:59 AM)

Hi all,

I tried searching this thread but couldn't find any answer

Me and my fiance(Will be officially married by May2022) are planning to get a place and was wondering about EPF withdrawal for a home (Haven't purchased yet)

Here is the situation

She is currently servicing 1 loan for housing (Haven't withdrew from EPF) - 1 property

I have more than 2 housing loans (Withdrew from EPF for 1 of my unit) - More than 2 properties

The S&P and loan would only be under her name.

Will I be able to withdraw from my account 2?

Under

3. Proof of Relationship

Marriage Certificate

OR

Birth Certificate

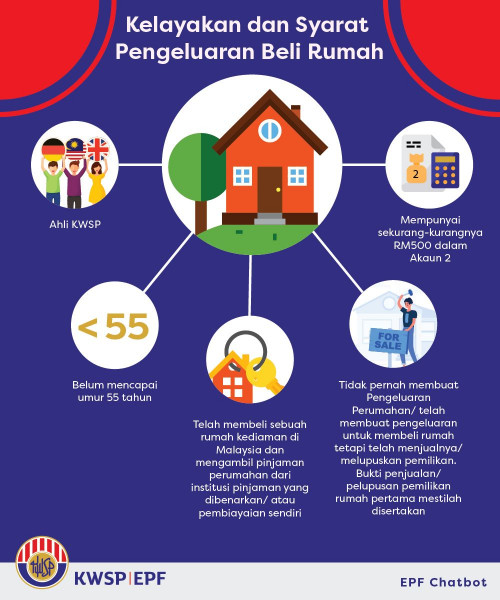

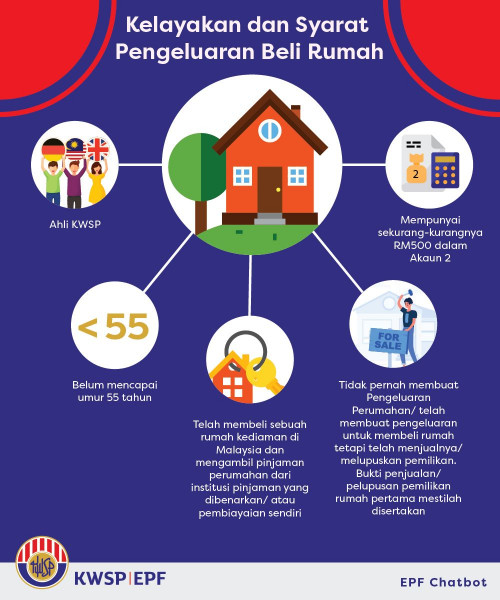

From my understanding, I am unable as I have made a pengeluaran once from EPF to purchase a home

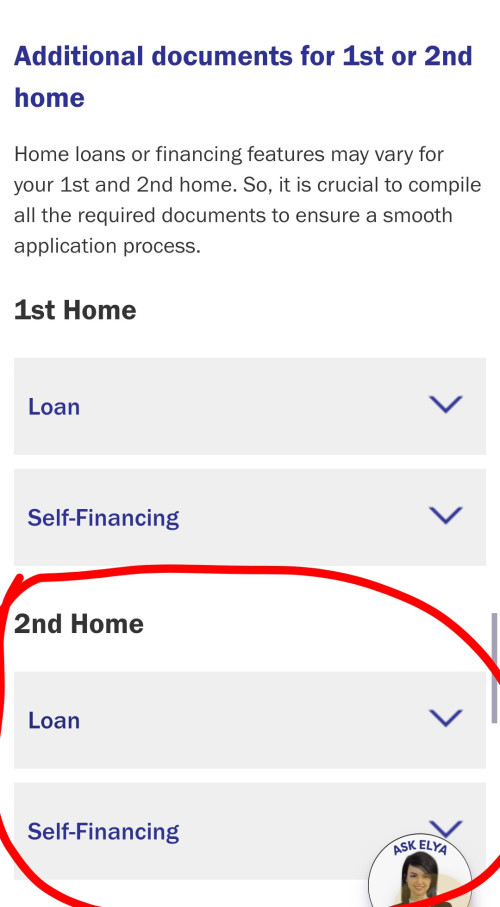

https://www.kwsp.gov.my/en/member/withdrawa...#newdevelopment

https://www.kwsp.gov.my/en/member/withdrawa...#newdevelopmentBut from their page above, is the pengeluaran allowed for 2 properties?

I hope I have made my self clear, thank you all so much for your time

If it's withdrawal to put downpayment for your new home (pengeluaran beli rumah)

you CANNOT withdraw from your account 2 (SPA not your name + you've withdrawn before), but your fiance can withdraw from her account 2 (since it's her first withdrawal)

What you CAN do to make use of your account 2 money is to make use of the "withdraw to reduce/redeem monthly instalment/home financing" option to withdraw from your account 2 to "repay" your wife (must be registered as married) loan. As EPF usually just deposits the money in your savings account, you can use it to top up your wife's EPF (subject to the maximum amount of top-up per year) or use it to pay the loan instalments.

Mar 23 2021, 08:38 PM

Mar 23 2021, 08:38 PM

Quote

Quote

0.0199sec

0.0199sec

1.00

1.00

7 queries

7 queries

GZIP Disabled

GZIP Disabled