I saw news that MR DIY is going public soon. Any news on how to apple for IPO?

MR DIY IPO

MR DIY IPO

|

|

Jan 6 2019, 02:45 PM, updated 7y ago Jan 6 2019, 02:45 PM, updated 7y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

205 posts Joined: Jan 2016 |

I saw news that MR DIY is going public soon. Any news on how to apple for IPO?

|

|

|

|

|

|

Jan 7 2019, 10:06 AM Jan 7 2019, 10:06 AM

Show posts by this member only | Post

#2

|

Senior Member

2,906 posts Joined: May 2015 |

Word is end of the year. Will have to wait and see how this will ply through.

|

|

|

Jan 7 2019, 11:43 AM Jan 7 2019, 11:43 AM

Show posts by this member only | Post

#3

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Huh..

If not mistaken.. Their listing pick is either Malaysia or HK market... My bet is HK.. More exposure.. Since the major shareholder is Venture Capital company.. Sure they want to sell later on premium pricing... |

|

|

Jan 7 2019, 12:45 PM Jan 7 2019, 12:45 PM

Show posts by this member only | Post

#4

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

|

|

|

Jan 9 2019, 11:41 AM Jan 9 2019, 11:41 AM

Show posts by this member only | Post

#5

|

Senior Member

2,033 posts Joined: Jul 2005 |

The proposal is for the Malaysia retail portion to be listed. This will exclude all other fast growing market in SEA. Mr DIY has around 330 stores in Malaysia which is slightly saturated. They are smart to exclude the rest of fast growing SEA countries where they are still in their initial expansion stage. Anyway it depends on its valuation to determined whether its worth to buy.

I have come out with a Fair P/E Malaysia only - 18x Whole group - 25x |

|

|

Jan 25 2019, 08:37 AM Jan 25 2019, 08:37 AM

Show posts by this member only | Post

#6

|

Newbie

9 posts Joined: Nov 2016 |

|

|

|

|

|

|

Jan 25 2019, 08:41 AM Jan 25 2019, 08:41 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

128 posts Joined: Jan 2008 From: Somewhere in Earth 2nd Dimension |

Wow...saw it as a rumor and nothing mote. Even nonone discussing it. Well park here. Need more info~

|

|

|

Jan 25 2019, 08:20 PM Jan 25 2019, 08:20 PM

Show posts by this member only | Post

#8

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Oct 21 2019, 10:33 AM Oct 21 2019, 10:33 AM

Show posts by this member only | Post

#9

|

Junior Member

254 posts Joined: May 2014 From: Selangor |

Last time I heard it will go listed around November. still true now?

|

|

|

Oct 21 2019, 02:45 PM Oct 21 2019, 02:45 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

nothing so far

if really listing in Nov, then by now should be listed in SC website under Prospectus Exposure |

|

|

Oct 22 2019, 12:43 PM Oct 22 2019, 12:43 PM

|

Junior Member

124 posts Joined: Jul 2013 |

I wait till my neck become so long ady, still don have any news from them..lol

|

|

|

Oct 22 2019, 02:03 PM Oct 22 2019, 02:03 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Keep waiting until hair become white lor

I think they looking other than Bursa Malaysia for maximum valuation & future easy exit (if the price is right) 🤑 |

|

|

Oct 29 2019, 01:36 AM Oct 29 2019, 01:36 AM

|

Senior Member

2,210 posts Joined: Jan 2018 |

For those who haven't heard: Newsbreak: Mr DIY’s listing moved to 2020

This post has been edited by Yggdrasil: Oct 29 2019, 01:37 AM |

|

|

|

|

|

Oct 29 2019, 03:00 PM Oct 29 2019, 03:00 PM

|

Junior Member

124 posts Joined: Jul 2013 |

QUOTE(Yggdrasil @ Oct 29 2019, 01:36 AM) Thanks for the info~ |

|

|

Nov 5 2019, 10:20 AM Nov 5 2019, 10:20 AM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

317 posts Joined: Oct 2012 |

QUOTE(Yggdrasil @ Oct 29 2019, 01:36 AM) Really good news.I am really looking forward for DIY ipo next year. |

|

|

Nov 5 2019, 12:11 PM Nov 5 2019, 12:11 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Ahh thanks .

Now I know they defer the listing... Just hope it's not overpriced listing with unreasonable premium like all the IPOs 😑😒 |

|

|

Dec 6 2019, 09:50 PM Dec 6 2019, 09:50 PM

|

Junior Member

153 posts Joined: Jul 2014 |

Farm Fresh IPO coming soon?

|

|

|

Dec 6 2019, 11:06 PM Dec 6 2019, 11:06 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Dec 6 2019, 11:46 PM Dec 6 2019, 11:46 PM

|

Junior Member

153 posts Joined: Jul 2014 |

QUOTE(nexona88 @ Dec 6 2019, 11:06 PM) Nope, please do bit of research https://www.hmetro.com.my/bisnes/2019/12/52...akal-terbit-ipo |

|

|

Dec 7 2019, 10:38 AM Dec 7 2019, 10:38 AM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

QUOTE(haidar.mh8 @ Dec 6 2019, 11:46 PM) Ooh okay...Well listing expected November 2020.. Still long way.. Anything can happen.. As long not in SC website.. With all the draft IPO details like Shares offered, Financial information & dividends policy.. Then I don't considered as upcoming listing... Just like UMobile, Axiata Tower & among others.. Tcss only.. Until now No concrete listing plan... |

|

|

Dec 9 2019, 08:49 PM Dec 9 2019, 08:49 PM

|

Junior Member

46 posts Joined: Dec 2019 From: Kuala Lumpur |

More IPO comings on 2020

|

|

|

Dec 9 2019, 10:18 PM Dec 9 2019, 10:18 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Dec 23 2019, 12:06 AM Dec 23 2019, 12:06 AM

Show posts by this member only | IPv6 | Post

#23

|

Senior Member

2,033 posts Joined: Jul 2005 |

|

|

|

Jan 5 2020, 11:43 PM Jan 5 2020, 11:43 PM

|

Junior Member

153 posts Joined: Jul 2014 |

|

|

|

Jan 6 2020, 03:59 PM Jan 6 2020, 03:59 PM

|

Senior Member

968 posts Joined: Aug 2012 From: Subang Jaya |

|

|

|

Jan 7 2020, 09:06 AM Jan 7 2020, 09:06 AM

Show posts by this member only | IPv6 | Post

#26

|

Senior Member

5,529 posts Joined: Oct 2007 |

why farm fresh in mr diy thread eh...

|

|

|

Jan 7 2020, 12:54 PM Jan 7 2020, 12:54 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 9 2020, 09:19 PM Jan 9 2020, 09:19 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

mr diy ar..oh dear..so many adviser ar..

cimb ar maybank ar credit suisse ar JP morgan ar rhb ar ubs ar share issue so many ar |

|

|

Jan 11 2020, 12:54 PM Jan 11 2020, 12:54 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

QUOTE(djhenry91 @ Jan 9 2020, 09:19 PM) mr diy ar..oh dear..so many adviser ar.. Now I wonder what the pricing would be??cimb ar maybank ar credit suisse ar JP morgan ar rhb ar ubs ar share issue so many ar Also its managed to get some kind of exception from bursa... Only 15% public float yo 👍💪 vs normally 25%... |

|

|

Jan 11 2020, 02:06 PM Jan 11 2020, 02:06 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

since so many adviser and joint adviser

i think is above Rm1 |

|

|

Jan 11 2020, 06:19 PM Jan 11 2020, 06:19 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 11 2020, 08:49 PM Jan 11 2020, 08:49 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Jan 12 2020, 11:39 AM Jan 12 2020, 11:39 AM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Jan 12 2020, 11:41 AM Jan 12 2020, 11:41 AM

|

Junior Member

708 posts Joined: Jul 2012 |

After IPO, all items increase price. Mr. DIY - > Mr. DIU

|

|

|

Jan 12 2020, 11:43 AM Jan 12 2020, 11:43 AM

|

Junior Member

156 posts Joined: Sep 2004 |

parking

|

|

|

Jan 12 2020, 02:51 PM Jan 12 2020, 02:51 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 13 2020, 09:18 AM Jan 13 2020, 09:18 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(nexona88 @ Jan 12 2020, 02:51 PM) How about others?? depends on valuation i think. if the valuation is too high, doubt there would be much takerLike those insurance companies? They also not keen to subscribe? 😒 Locals fund should be natural.. since any high profile IPO.. somehow sure would want pie... |

|

|

Jan 15 2020, 07:54 AM Jan 15 2020, 07:54 AM

Show posts by this member only | IPv6 | Post

#38

|

Junior Member

686 posts Joined: Jul 2010 |

When is the IPO open to subcribe and IPO initial price?

|

|

|

Jan 15 2020, 07:22 PM Jan 15 2020, 07:22 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Jan 16 2020, 06:15 PM Jan 16 2020, 06:15 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 16 2020, 08:26 PM Jan 16 2020, 08:26 PM

|

Senior Member

5,363 posts Joined: Apr 2005 From: กรุงเทพมหานคร BKK |

|

|

|

Jan 22 2020, 02:46 AM Jan 22 2020, 02:46 AM

Show posts by this member only | IPv6 | Post

#42

|

Probation

28 posts Joined: Jan 2020 |

Cimb and maybank are their adviser. 👍👍

|

|

|

Jan 22 2020, 08:28 AM Jan 22 2020, 08:28 AM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Jan 22 2020, 07:10 PM Jan 22 2020, 07:10 PM

Show posts by this member only | IPv6 | Post

#44

|

Probation

28 posts Joined: Jan 2020 |

|

|

|

Jan 22 2020, 08:49 PM Jan 22 2020, 08:49 PM

Show posts by this member only | IPv6 | Post

#45

|

All Stars

10,536 posts Joined: Jul 2008 |

Better apply for it soon before it runs out 😅

|

|

|

Jan 23 2020, 09:25 AM Jan 23 2020, 09:25 AM

Show posts by this member only | IPv6 | Post

#46

|

Junior Member

317 posts Joined: Oct 2012 |

|

|

|

Jan 23 2020, 10:53 AM Jan 23 2020, 10:53 AM

|

Probation

28 posts Joined: Jan 2020 |

|

|

|

Jan 23 2020, 11:59 AM Jan 23 2020, 11:59 AM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 23 2020, 02:05 PM Jan 23 2020, 02:05 PM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

317 posts Joined: Oct 2012 |

QUOTE(Muse Zack @ Jan 23 2020, 10:53 AM) Value 37 times more than historical price. at I means 500 lots only.If it costs RM 1 ,its only RM 500k.A ciput amount.4.19sen Say FV is rm2 per unit 500000 lot x 100 50millon unit x rm2 100 mil in cash Damn, you r super rich. 👍👍👍👍 Of course will not get that quantity.Maybe max 200lots. |

|

|

Jan 23 2020, 03:01 PM Jan 23 2020, 03:01 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 23 2020, 10:06 PM Jan 23 2020, 10:06 PM

Show posts by this member only | IPv6 | Post

#51

|

Junior Member

317 posts Joined: Oct 2012 |

|

|

|

Jan 24 2020, 08:10 AM Jan 24 2020, 08:10 AM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 24 2020, 08:11 AM Jan 24 2020, 08:11 AM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 28 2020, 08:42 PM Jan 28 2020, 08:42 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 28 2020, 08:45 PM Jan 28 2020, 08:45 PM

Show posts by this member only | IPv6 | Post

#55

|

Junior Member

224 posts Joined: Jun 2013 |

|

|

|

Jan 28 2020, 09:10 PM Jan 28 2020, 09:10 PM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

i already got SC version prospectus

|

|

|

Jan 28 2020, 11:28 PM Jan 28 2020, 11:28 PM

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

QUOTE(whytwocare @ Jan 28 2020, 09:22 PM) doesnt say much |

|

|

Jan 29 2020, 11:22 AM Jan 29 2020, 11:22 AM

Show posts by this member only | IPv6 | Post

#58

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Jan 29 2020, 11:53 AM Jan 29 2020, 11:53 AM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

still available to download before taken down

|

|

|

Jan 29 2020, 08:16 PM Jan 29 2020, 08:16 PM

Show posts by this member only | IPv6 | Post

#60

|

Probation

8 posts Joined: Jan 2020 |

Previous mega ipo don't perform well when the share offer is so huge

|

|

|

Jan 30 2020, 11:12 PM Jan 30 2020, 11:12 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Jan 31 2020, 07:39 AM Jan 31 2020, 07:39 AM

Show posts by this member only | IPv6 | Post

#62

|

Junior Member

317 posts Joined: Oct 2012 |

|

|

|

Jan 31 2020, 08:53 AM Jan 31 2020, 08:53 AM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Bigger share issues hard to goreng...

Hard to move big... |

|

|

Feb 27 2020, 04:57 PM Feb 27 2020, 04:57 PM

Show posts by this member only | IPv6 | Post

#64

|

Junior Member

216 posts Joined: Jun 2014 |

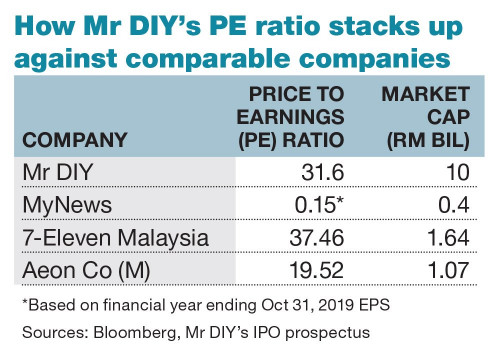

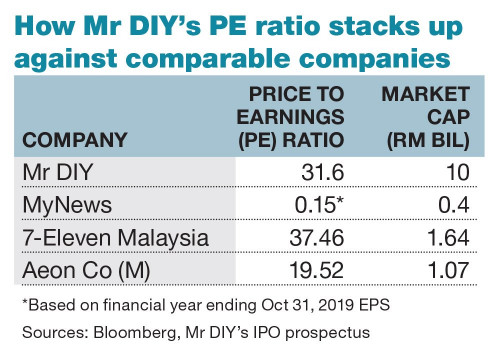

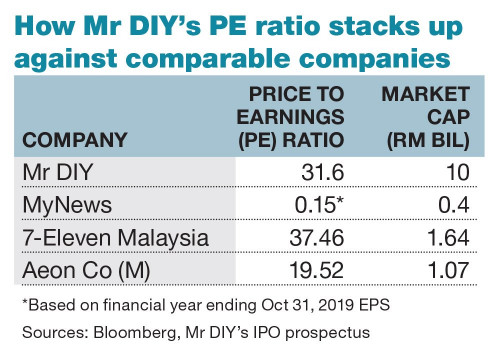

Growth slows significantly in 2019 yet intended PE is 37 times, doesn't sound promising, right?

|

|

|

Feb 27 2020, 11:04 PM Feb 27 2020, 11:04 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

When open for non-bumi? Don't tell me close already

|

|

|

Feb 28 2020, 02:53 PM Feb 28 2020, 02:53 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

maybe end of march lsit i think

|

|

|

Feb 28 2020, 03:37 PM Feb 28 2020, 03:37 PM

Show posts by this member only | IPv6 | Post

#67

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Yggdrasil @ Feb 27 2020, 11:04 PM) You want meh? Side kopi talk.. The stuff they sell is so siiiity :x Use one time... that's it. (Ai am not a returning customer It feels like a Chinese hardware stall that is simply mushrooming left, right, center, front and belakang... Do they really make money or they simply doing the numbers game...? LOL.... Ignore me.. No one cares about these stuff during ipo This post has been edited by Boon3: Feb 28 2020, 03:38 PM |

|

|

Feb 28 2020, 03:48 PM Feb 28 2020, 03:48 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Boon3 @ Feb 28 2020, 03:37 PM) Recession coming means people flock to cheap inferior goods.For example, fast food companies do well generally during recession. (Not referring to Malaysia because some Malaysians can't even afford to eat McDonalds No harm applying RM1000 to try luck. QUOTE(Boon3 @ Feb 28 2020, 03:37 PM) Side kopi talk.. The stuff they sell is so siiiity :x Siitty you means shitty is it? Shitty stuff that spoil easily because Made in China is gooding. This means its planned obsolescence so consumers will buy more when it breaks Use one time... that's it. (Ai am not a returning customer QUOTE(Boon3 @ Feb 28 2020, 03:37 PM) It feels like a Chinese hardware stall that is simply mushrooming left, right, center, front and belakang... Do they really make money or they simply doing the numbers game...? Sure make one. Even Chinese products in Pakistan can make money. Now no supply due to virus, price shoot up |

|

|

Feb 28 2020, 03:54 PM Feb 28 2020, 03:54 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Yggdrasil @ Feb 28 2020, 03:48 PM) Recession coming means people flock to cheap inferior goods. For example, fast food companies do well generally during recession. (Not referring to Malaysia because some Malaysians can't even afford to eat McDonalds No harm applying RM1000 to try luck. Siitty you means shitty is it? Shitty stuff that spoil easily because Made in China is gooding. This means its planned obsolescence so consumers will buy more when it breaks Sure make one. Even Chinese products in Pakistan can make money. Now no supply due to virus, price shoot up Nah... I won't be buying from that shop ever... There are China products and then there are those China products.. Lol Ps... Ipo forum thread La... no one really cares one... Lol |

|

|

Mar 2 2020, 06:31 PM Mar 2 2020, 06:31 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Mr DIY Group is considering postponing its planned initial public offering after the country’s equities market tumbled on political uncertainty

https://www.theedgemarkets.com/article/mr-d...litical-turmoil |

|

|

Mar 2 2020, 10:07 PM Mar 2 2020, 10:07 PM

Show posts by this member only | IPv6 | Post

#71

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

QUOTE(nexona88 @ Mar 2 2020, 06:31 PM) Mr DIY Group is considering postponing its planned initial public offering after the country’s equities market tumbled on political uncertainty patut la last friday postpone nihttps://www.theedgemarkets.com/article/mr-d...litical-turmoil |

|

|

Mar 2 2020, 10:27 PM Mar 2 2020, 10:27 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 2 2020, 10:44 PM Mar 2 2020, 10:44 PM

Show posts by this member only | IPv6 | Post

#73

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Mar 2 2020, 11:38 PM Mar 2 2020, 11:38 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 5 2020, 09:54 PM Mar 5 2020, 09:54 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Apr 13 2020, 08:45 PM Apr 13 2020, 08:45 PM

Show posts by this member only | IPv6 | Post

#76

|

Junior Member

469 posts Joined: Jan 2013 |

esok mr.diy open as usual back ?? inside those mall ??

|

|

|

Apr 14 2020, 09:49 AM Apr 14 2020, 09:49 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Aug 13 2020, 10:13 AM Aug 13 2020, 10:13 AM

|

Junior Member

650 posts Joined: Jun 2020 |

Malaysian Retailer Mr DIY Revives $500 Million IPO Plan

Sos: Bloomberg Malaysia’s Mr DIY Group is reviving its initial public offering plan after postponing it in March when the Covid-19 pandemic worsened, according to people with knowledge of the matter. The country’s biggest home improvement retailer aims to restart marketing to gauge investors’ interest next month, the people said. The company aims to raise about $500 million in the share sale, which could begin as early as October, the people said, asking not to be named as the information is private. Mr DIY’s sales surged to a record in May and June, after the government partially lifted coronavirus-driven restrictions in order to resuscitate the economy, the people said. The share sale by the company, which is backed by private equity firm Creador, would be the biggest IPO in Malaysia since Lotte Chemical Titan Holding Bhd. raked in $849 million in 2017, according to data compiled by Bloomberg. The potential deal will give a boost to the Malaysian stock market, which has only seen $70.7 million worth of IPOs so far this year, the slowest in more than a decade. Despite the political turmoil in the country, the benchmark FTSE Bursa Malaysia KLCI Index has rebounded nearly 30% from its March low. Deliberations on the plan are still ongoing and there is no certainty the company will proceed, said the people. Representatives for Creador and Mr DIY declined to comment. Mr DIY opened its first store in Malaysia in 2005 and now operates more than 622 outlets across the country, according to its website. The company sells over 14,000 types of products in ten categories including furniture, computer accessories, hardware and toys. It counts Tesco Plc and Aeon Co. among its business partners, according to the site. This post has been edited by Ziet Inv: Aug 13 2020, 10:15 AM |

|

|

Aug 16 2020, 01:43 PM Aug 16 2020, 01:43 PM

|

Junior Member

195 posts Joined: Apr 2019 |

Faster start IPO I wanna bet my money

|

|

|

Aug 16 2020, 03:58 PM Aug 16 2020, 03:58 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(zxcv96 @ Aug 16 2020, 01:43 PM) Logically, if business profitable, people rather keep it private.If business unprofitable, people want to fast fast IPO to get out. However, if business profitable and want to take risk to expand to try to become more profitable but don't have money now, they go IPO too. But now if expansion not suitable due to economic environment, they rather keep it private or until market recovers. Red flag if they die die want IPO |

|

|

Aug 17 2020, 10:55 PM Aug 17 2020, 10:55 PM

|

Senior Member

1,203 posts Joined: Dec 2008 |

QUOTE(Yggdrasil @ Aug 16 2020, 03:58 PM) Logically, if business profitable, people rather keep it private. So what is your view on MR DIY if there go Public ?If business unprofitable, people want to fast fast IPO to get out. However, if business profitable and want to take risk to expand to try to become more profitable but don't have money now, they go IPO too. But now if expansion not suitable due to economic environment, they rather keep it private or until market recovers. Red flag if they die die want IPO |

|

|

Aug 17 2020, 11:09 PM Aug 17 2020, 11:09 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(aoisky @ Aug 17 2020, 10:55 PM) I think they honestly want to expand and not cash out.But now economy uncertain. Also, prospectus probably needs to be revised with latest figures. Figures probably not good because of MCO Must be embarrassing if the IPO not oversubscribed. yehlai liked this post

|

|

|

Aug 19 2020, 12:48 AM Aug 19 2020, 12:48 AM

Show posts by this member only | IPv6 | Post

#83

|

Junior Member

650 posts Joined: Jun 2020 |

True thou, somehow something feels fishy, it just doesn't feel right.

I wonder their IPO is to cash out & cabut, or expand more retail stores? Don't really see where they can grow to be honest |

|

|

Sep 24 2020, 02:26 PM Sep 24 2020, 02:26 PM

|

Junior Member

650 posts Joined: Jun 2020 |

Main Market-bound Mr DIY to issue 941.49 million IPO shares

Source: TheEdge Markets KUALA LUMPUR (Sept 24): Mr DIY Group (M) Bhd, which plans to list on the Main Market of Bursa Malaysia, will issue 941.49 million new and existing ordinary shares as part of its initial public offering (IPO), it said in a statement today. The retailer will be offering 470.75 million IPO shares to bumiputera investors approved by the Ministry of International Trade and Industry, and 309.21 million existing ordinary shares to Malaysian institutional and selected investors, foreign institutional and selected investors outside the US, and qualified institutional buyers in the US. Meanwhile, its retail offering comprises 36 million new ordinary shares to directors and employees of the company as well as eligible individuals who have “contributed to Mr DIY’s success”, and 125.53 million new ordinary shares to the public. “This event is a major milestone for Mr DIY and brings us one step closer to becoming a publicly-listed company. Although markets have been severely impacted by the Covid-19 pandemic over the past few months, we have persevered as a group and are pleased to have this opportunity to embark on our next phase of growth,” said Mr DIY’s chief executive officer Adrian Ong. “Tapping into the capital markets will help accelerate our growth plans, as we continue to scale our store network to capitalise on the under-penetrated home improvement retail sector in Malaysia. This should further entrench Mr DIY’s position as Malaysia’s largest home improvement retailer,” he added. Sources have told The Edge that the listing could take place as soon as in the fourth quarter of this year, thanks to its V-shaped recovery from the pandemic-induced Movement Control Order (MCO) that had hit retailers. According to Bloomberg, the IPO aims to raise about US$500 million (RM2.1 billion). It was postponed twice — late last year and in the first half of this year, due to the MCO. According to Mr DIY, it operates 640 stores across Malaysia and four stores in Brunei under the Mr DIY brand as at Sept 6. It also operates the Mr Toy chain of stores offering affordable toys and products for children and babies, and Mr Dollar, which sells F&B and household goods at either RM2 or RM5. The group has signed an underwriting agreement with CIMB Investment Bank, Maybank Investment Bank, RHB Investment Bank, AmInvestment Bank, Hong Leong Investment Bank and Kenanga Investment Bank. CIMB IB, Maybank IB and RHB IB are the joint managing underwriters and joint underwriters while AmInvestment, Hong Leong IB and Kenanga IB are the joint underwriters for this IPO exercise. CIMB IB and Maybank IB are also the joint principal advisers, joint global coordinators and joint bookrunners, while RHB IB is also the joint global coordinator and joint bookrunner. Meanwhile, Credit Suisse Securities (Malaysia) Sdn Bhd, Credit Suisse (Singapore) Ltd, J.P. Morgan Securities plc and JPMorgan Securities (Malaysia) Sdn Bhd are the joint global coordinators and joint bookrunners, and UBS Securities Malaysia Sdn Bhd and UBS AG, Singapore Branch are the joint bookrunners. |

|

|

Sep 28 2020, 11:24 PM Sep 28 2020, 11:24 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Maybe can buy @ apply few shares...

|

|

|

Sep 29 2020, 09:53 AM Sep 29 2020, 09:53 AM

|

Junior Member

650 posts Joined: Jun 2020 |

|

|

|

Sep 29 2020, 10:38 AM Sep 29 2020, 10:38 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Ziet Inv @ Aug 19 2020, 12:48 AM) True thou, somehow something feels fishy, it just doesn't feel right. All I know is that their products is I wonder their IPO is to cash out & cabut, or expand more retail stores? Don't really see where they can grow to be honest Buy a screw driver... turn it harder... the screw driver head breaks! Screw turned about 3 times only.... So the screw driver... used ... 0 times? Buy a spade... the handles come off the spade..... Buy 2 items... both items ..... koyak. Damn lousy made in China products!!!! Buy IPO? |

|

|

Sep 29 2020, 10:51 AM Sep 29 2020, 10:51 AM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 29 2020, 10:55 AM Sep 29 2020, 10:55 AM

|

Senior Member

1,534 posts Joined: Jul 2006 |

QUOTE(Boon3 @ Sep 29 2020, 11:38 AM) All I know is that their products is bro...look at the screwdriver's price...Buy a screw driver... turn it harder... the screw driver head breaks! Screw turned about 3 times only.... So the screw driver... used ... 0 times? Buy a spade... the handles come off the spade..... Buy 2 items... both items ..... koyak. Damn lousy made in China products!!!! Buy IPO? |

|

|

Sep 29 2020, 12:37 PM Sep 29 2020, 12:37 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(sunami @ Sep 29 2020, 10:55 AM) Guilty as hell!!! Yes, it's so damn super cheap but ......... in this case ..... how will the shop get returning customers? Me? I am not returning ever as a customer..... so who loses? See the bad impression the company has given me? Want to IPO? LOL! Clearly their IPO strategy is to open up as many stores as possible in the country.... and then you look at some older Mr.DIY shops... like swatting lalat only...... |

|

|

Sep 29 2020, 03:24 PM Sep 29 2020, 03:24 PM

|

Senior Member

1,534 posts Joined: Jul 2006 |

QUOTE(Boon3 @ Sep 29 2020, 01:37 PM) Guilty as hell!!! Yes, it's so damn super cheap but ......... in this case ..... how will the shop get returning customers? Me? I am not returning ever as a customer..... so who loses? See the bad impression the company has given me? Want to IPO? LOL! Clearly their IPO strategy is to open up as many stores as possible in the country.... and then you look at some older Mr.DIY shops... like swatting lalat only...... I do shop alot at diy...found that the same things selling in supermarket and diy...is alot cheaper thr... |

|

|

Sep 29 2020, 07:44 PM Sep 29 2020, 07:44 PM

|

Junior Member

569 posts Joined: Aug 2020 |

QUOTE(Boon3 @ Sep 29 2020, 10:38 AM) All I know is that their products is its a good way as it break then customer will come back and buy again which give diy more moneyBuy a screw driver... turn it harder... the screw driver head breaks! Screw turned about 3 times only.... So the screw driver... used ... 0 times? Buy a spade... the handles come off the spade..... Buy 2 items... both items ..... koyak. Damn lousy made in China products!!!! Buy IPO? |

|

|

Sep 30 2020, 10:08 PM Sep 30 2020, 10:08 PM

Show posts by this member only | IPv6 | Post

#93

|

Probation

8 posts Joined: Jan 2020 |

RM 1.60..... Maybe undersubscrib

|

|

|

Oct 1 2020, 09:00 AM Oct 1 2020, 09:00 AM

Show posts by this member only | IPv6 | Post

#94

|

Junior Member

317 posts Joined: Oct 2012 |

|

|

|

Oct 1 2020, 11:31 AM Oct 1 2020, 11:31 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Oct 1 2020, 05:21 PM Oct 1 2020, 05:21 PM

Show posts by this member only | IPv6 | Post

#96

|

Junior Member

317 posts Joined: Oct 2012 |

|

|

|

Oct 1 2020, 06:10 PM Oct 1 2020, 06:10 PM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Oct 1 2020, 06:51 PM Oct 1 2020, 06:51 PM

Show posts by this member only | IPv6 | Post

#98

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

PE 37 that is like Top Glove, Supermx level

good luck |

|

|

Oct 1 2020, 09:16 PM Oct 1 2020, 09:16 PM

|

Senior Member

773 posts Joined: Oct 2008 |

how to subscribe?

|

|

|

Oct 1 2020, 10:32 PM Oct 1 2020, 10:32 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Boon3 @ Sep 29 2020, 12:37 PM) Guilty as hell!!! Yes, it's so damn super cheap but ......... in this case ..... how will the shop get returning customers? Me? I am not returning ever as a customer..... so who loses? See the bad impression the company has given me? Want to IPO? LOL! Clearly their IPO strategy is to open up as many stores as possible in the country.... and then you look at some older Mr.DIY shops... like swatting lalat only...... Customers return because the tool is cheap that it breaks lol. That's built in planned obsolescence. We might not use those low quality crap but many renovation contractor usually buy these cheap stuff to cut cost. Even the company which came to install a custom made wardrobe used some el cheapo elephant glue I know a guy who runs an events company and he also goes there to buy stuff. There definitely is a market but maybe targeting lower income. Might do well in a recession. I haven't looked at the financials yet. This post has been edited by Yggdrasil: Oct 1 2020, 10:33 PM |

|

|

Oct 2 2020, 11:44 AM Oct 2 2020, 11:44 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Yggdrasil @ Oct 1 2020, 10:32 PM) Mr. DIY quality is meant for use and throw not use and keep. Customers return because the tool is cheap that it breaks lol. That's built in planned obsolescence. We might not use those low quality crap but many renovation contractor usually buy these cheap stuff to cut cost. Even the company which came to install a custom made wardrobe used some el cheapo elephant glue I know a guy who runs an events company and he also goes there to buy stuff. There definitely is a market but maybe targeting lower income. Might do well in a recession. I haven't looked at the financials yet. Well.... Excatly. I believe that you have describe a fly by night type of business.... so good it lasts maybe 1 time usage. You and I know what it is.... el cheapo China hardware store... which is banking on the number of store growth strategy to boost profits..... All I know.... this company once listed .... will die in the future.... no competitive edge ... inferior or 'useless' products.... |

|

|

Oct 2 2020, 09:02 PM Oct 2 2020, 09:02 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Seems like got strategic international cornerstone investors involved....

So to give some sense of security to the IPO 🤭 |

|

|

Oct 3 2020, 07:40 PM Oct 3 2020, 07:40 PM

|

Junior Member

702 posts Joined: Jan 2006 |

listing for this will still be nov? the deadline of payment under the MITI scheme is on 12 oct.

since shoutern deadline in on the 29 sept (miti), 6 oct (public) and listing will be on 16 oct. will mrdiy be the same too? |

|

|

Oct 5 2020, 10:27 AM Oct 5 2020, 10:27 AM

Show posts by this member only | IPv6 | Post

#104

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Oct 6 2020, 01:25 PM Oct 6 2020, 01:25 PM

|

Junior Member

595 posts Joined: May 2010 |

OPENING OF THEAPPLICATION PERIOD: 10.00 A.M., 6 OCTOBER2020.

CLOSING OF THE APPLICATION PERIOD: 5.00 P.M., 14OCTOBER2020. https://www.bursamalaysia.com/market_inform...?ann_id=3093885 |

|

|

Oct 6 2020, 02:23 PM Oct 6 2020, 02:23 PM

|

Senior Member

1,537 posts Joined: Jul 2008 |

doesnt seem like a good deal for investors

|

|

|

Oct 6 2020, 02:25 PM Oct 6 2020, 02:25 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

|

|

|

Oct 6 2020, 03:42 PM Oct 6 2020, 03:42 PM

|

Senior Member

981 posts Joined: Jan 2008 From: Taiping / Sungai Petani / Butterworth |

isaham rating 1/4

|

|

|

Oct 6 2020, 04:12 PM Oct 6 2020, 04:12 PM

Show posts by this member only | IPv6 | Post

#109

|

Senior Member

2,934 posts Joined: May 2017 From: Labuan Federal Territory |

logged in to m2u, dont see Mr DIY appear in eIPO. Anyone else?

|

|

|

Oct 6 2020, 04:14 PM Oct 6 2020, 04:14 PM

|

Junior Member

595 posts Joined: May 2010 |

|

|

|

Oct 6 2020, 04:22 PM Oct 6 2020, 04:22 PM

Show posts by this member only | IPv6 | Post

#111

|

Senior Member

2,934 posts Joined: May 2017 From: Labuan Federal Territory |

|

|

|

Oct 6 2020, 04:32 PM Oct 6 2020, 04:32 PM

|

Junior Member

595 posts Joined: May 2010 |

|

|

|

Oct 6 2020, 04:33 PM Oct 6 2020, 04:33 PM

Show posts by this member only | IPv6 | Post

#113

|

Senior Member

2,934 posts Joined: May 2017 From: Labuan Federal Territory |

|

|

|

Oct 6 2020, 04:34 PM Oct 6 2020, 04:34 PM

|

Junior Member

595 posts Joined: May 2010 |

KahiSun liked this post

|

|

|

Oct 6 2020, 06:13 PM Oct 6 2020, 06:13 PM

Show posts by this member only | IPv6 | Post

#115

|

Senior Member

5,529 posts Joined: Oct 2007 |

commenting on this as i browse the prospectus. damn have to f the printer/advisers for not using the ocr version, make our life more difficult to read.

got 2 issues probably need to raise to the SC for their rationale. would share later after the SC replies. would just put my notation in point form below yeah: 1. Declining SSSG which is very alarming. The only way for the company to grow is via non-organic growth, which there would be a limit. 2. GP, EBITDA, PBT and PAT margins looks fine. 3. Debts are piling up but I think manageable with 0.74x as at FPE June2020. 4. Pre-IPO restructuring, issuing 60 million new shares for RM100k? then subdividing them into 100 from one. 5. Quite a lot to form the OFS portion which I don’t really like. 6. PER of 31.6x whoaaa…… for this valuation I probably stick with glove stocks for a while. 7. Revenue CAGR quite good, but this wasn’t attributable by the SSSG, negated. 8. Fuhhhh a whooping 93% of dilution to the new shareholders. No wonder the existing shareholders die die also want to push for IPO lahhhh, if me I Die also want to IPO as well. 9. RM20 million professional fees, shoik nyer the IBs bonus 9 9 yoh~ 10. Actually we all know that the shareholders are potentially looking to cash out via the ipo exercise also. Please see page section 5.4.4 of the prospectus, you have been warned. 11. Estimated capex of RM160m for 100 new stores each year for 2020 and 2021. With 70 new stores already opened up to the LPD and 30 more by the end of this year. P/S: anyone know who this Hyptis is? |

|

|

Oct 6 2020, 06:22 PM Oct 6 2020, 06:22 PM

|

Senior Member

644 posts Joined: Apr 2007 |

And why are the use of proceeds as such? And ya, that PER

|

|

|

Oct 6 2020, 06:42 PM Oct 6 2020, 06:42 PM

Show posts by this member only | IPv6 | Post

#117

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(sembilan @ Oct 6 2020, 06:22 PM) you can read section 4.6 for the utilisation of proceeds.but i find something funny here. maybe you can share your thoughts with us after reading. i think i spent too much time reading this prospectus just now already. will skip this IPO. |

|

|

Oct 6 2020, 06:48 PM Oct 6 2020, 06:48 PM

|

Senior Member

644 posts Joined: Apr 2007 |

QUOTE(tehoice @ Oct 6 2020, 06:42 PM) you can read section 4.6 for the utilisation of proceeds. Ya. Repayment of bank borrowings and listing expenses? The funny part is the dividend part in the same section? but i find something funny here. maybe you can share your thoughts with us after reading. i think i spent too much time reading this prospectus just now already. will skip this IPO. Will skip too, plenty of IPOs this month This post has been edited by sembilan: Oct 6 2020, 07:01 PM |

|

|

Oct 6 2020, 06:58 PM Oct 6 2020, 06:58 PM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

937 posts Joined: Apr 2020 |

this stock is linked to Brahmal iirc.... and brahmal linked stocks need to becareful one hehe

|

|

|

Oct 7 2020, 01:29 AM Oct 7 2020, 01:29 AM

Show posts by this member only | IPv6 | Post

#120

|

Junior Member

153 posts Joined: Feb 2015 |

IPO Price of RM1.60, they are pricing in 22.5% YOY EPS for the next 5 years... hard pass. If drop to RM0.85 territory instead maybe will pick up

This post has been edited by HolyAssasin4444: Oct 7 2020, 01:31 AM |

|

|

Oct 7 2020, 08:26 AM Oct 7 2020, 08:26 AM

|

Junior Member

200 posts Joined: Jul 2008 From: Selangor |

most of the money from ipo is to pay back loan. not applying

|

|

|

Oct 7 2020, 09:49 AM Oct 7 2020, 09:49 AM

|

Newbie

25 posts Joined: Jul 2016 |

Reminds me long time ago Old Town Kopitiam. It was a blast back then and IF they went for IPO, that should lure alot of retailers like uncle & aunties.

Lucky they didn't go for IPO. Mr.DIY IPO? You can buy with your hand-earned money and then DIY with your left hand in toilet later when it drop to RM0.16 |

|

|

Oct 7 2020, 10:15 AM Oct 7 2020, 10:15 AM

Show posts by this member only | IPv6 | Post

#123

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(sembilan @ Oct 6 2020, 06:48 PM) Ya. Repayment of bank borrowings and listing expenses? The funny part is the dividend part in the same section? yeah, would put into the other 3 ipos instead of this one. Will skip too, plenty of IPOs this month really don't like the pre-ipo restructuring they did and the dilute the new shareholders by 90%++ plus the high valuation. really not sure how those corner stones investors can stomach this eh..... |

|

|

Oct 7 2020, 10:16 AM Oct 7 2020, 10:16 AM

Show posts by this member only | IPv6 | Post

#124

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(james.6831 @ Oct 6 2020, 06:58 PM) what's the story with this creador dude? i dont know anything about him though. only worked with his macai before. EDIT: I think the pre-ipo restructuring and the crazily high valuation are partly pushed by brahmal and co, right? They as a PE firm, would definitely have to maximise their investments for sure. doubt the original founder/shareholders would push to this kind of limit. Unless they are pure businessman/conglomerate. This post has been edited by tehoice: Oct 7 2020, 10:20 AM |

|

|

Oct 7 2020, 10:18 AM Oct 7 2020, 10:18 AM

Show posts by this member only | IPv6 | Post

#125

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(vergeofcollapse @ Oct 7 2020, 09:49 AM) Reminds me long time ago Old Town Kopitiam. It was a blast back then and IF they went for IPO, that should lure alot of retailers like uncle & aunties. this kind of mega IPO will surely be talk of the town 1.....Lucky they didn't go for IPO. Mr.DIY IPO? You can buy with your hand-earned money and then DIY with your left hand in toilet later when it drop to RM0.16 this is the largest IPO since Lotte Chemical Titan in 2017 or something. so definitely the market need this kind of mega IPO once in a blue moon geh..... |

|

|

Oct 7 2020, 10:20 AM Oct 7 2020, 10:20 AM

|

Senior Member

2,175 posts Joined: Mar 2016 |

QUOTE(tehoice @ Oct 7 2020, 10:18 AM) this kind of mega IPO will surely be talk of the town 1..... Yeah, and we know how LCTITAN performed, this 1 feels more like an exit for existing investorsthis is the largest IPO since Lotte Chemical Titan in 2017 or something. so definitely the market need this kind of mega IPO once in a blue moon geh..... |

|

|

Oct 7 2020, 10:21 AM Oct 7 2020, 10:21 AM

|

Senior Member

2,256 posts Joined: Feb 2012 |

not a potential company.

A timebomb. |

|

|

Oct 7 2020, 10:26 AM Oct 7 2020, 10:26 AM

Show posts by this member only | IPv6 | Post

#128

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Krv23490 @ Oct 7 2020, 10:20 AM) yeah, i have also cited my reason above for this IPO, we all know who is behind it and who is pushing for this kind of crazy valuations.affirmed my decision > to stay out of this IPO but will get a bag of popcorn on its IPO day QUOTE(ifourtos @ Oct 7 2020, 10:21 AM) corrected: i think is a potential timebomb. |

|

|

Oct 7 2020, 10:37 AM Oct 7 2020, 10:37 AM

Show posts by this member only | IPv6 | Post

#129

|

Senior Member

2,256 posts Joined: Feb 2012 |

QUOTE(tehoice @ Oct 7 2020, 10:26 AM) yeah, i have also cited my reason above for this IPO, we all know who is behind it and who is pushing for this kind of crazy valuations. true. affirmed my decision > to stay out of this IPO but will get a bag of popcorn on its IPO day corrected: i think is a potential timebomb. is just a nothing company selling low quality stuff 1000 branch? this is the timebomb |

|

|

Oct 7 2020, 10:39 AM Oct 7 2020, 10:39 AM

|

Senior Member

3,389 posts Joined: Sep 2019 |

No need IPO. Wait price drop and buy for goreng bull candle. johoreanguy and Krv23490 liked this post

|

|

|

Oct 7 2020, 02:05 PM Oct 7 2020, 02:05 PM

|

Junior Member

67 posts Joined: May 2015 |

QUOTE(ifourtos @ Oct 7 2020, 10:37 AM) but they aim to open 300++ by end of next year oo.. why do u say that this is a timebomb? https://www.theedgemarkets.com/article/mr-d...et-share-growth This post has been edited by hollyweed: Oct 7 2020, 02:05 PM |

|

|

Oct 7 2020, 02:25 PM Oct 7 2020, 02:25 PM

Show posts by this member only | IPv6 | Post

#132

|

Senior Member

2,256 posts Joined: Feb 2012 |

QUOTE(hollyweed @ Oct 7 2020, 02:05 PM) but they aim to open 300++ by end of next year oo.. sure is timebomb lahwhy do u say that this is a timebomb? https://www.theedgemarkets.com/article/mr-d...et-share-growth now is retail 2.0 moving to 3.0 traditional retail is dying |

|

|

Oct 7 2020, 02:47 PM Oct 7 2020, 02:47 PM

|

Junior Member

67 posts Joined: May 2015 |

|

|

|

Oct 7 2020, 02:55 PM Oct 7 2020, 02:55 PM

Show posts by this member only | IPv6 | Post

#134

|

Senior Member

2,256 posts Joined: Feb 2012 |

QUOTE(hollyweed @ Oct 7 2020, 02:47 PM) but they are moving towards online platform as well too. u think those 1200+ store running cost is free?? Lazada shopee all have their flagship store. They even have their own webUI to purchase directly from them also many retail giant dead because overweight they are not focus in retail they are more focus in publicity (gaining momentum for investor money maybe) u look at the core of MR DIY what u see? own product line that got potential? NO mostly taobao item...... many branch? for what? check family mart. is convinient store, but they got own product that not available elsewhere, they got strong identity. |

|

|

Oct 7 2020, 03:02 PM Oct 7 2020, 03:02 PM

|

Junior Member

67 posts Joined: May 2015 |

QUOTE(ifourtos @ Oct 7 2020, 02:55 PM) u think those 1200+ store running cost is free?? Okay now I do understand why you said it is a time bomb. many retail giant dead because overweight they are not focus in retail they are more focus in publicity (gaining momentum for investor money maybe) u look at the core of MR DIY what u see? own product line that got potential? NO mostly taobao item...... many branch? for what? check family mart. is convinient store, but they got own product that not available elsewhere, they got strong identity. Yes you are right they more focus to publicity. But IMO, they don't need own product line, like blackndecker etc because their targeted customer is B40 M40... these 2 groups will opt to cheapest item with minimal quality. |

|

|

Oct 7 2020, 03:11 PM Oct 7 2020, 03:11 PM

Show posts by this member only | IPv6 | Post

#136

|

Senior Member

2,256 posts Joined: Feb 2012 |

QUOTE(hollyweed @ Oct 7 2020, 03:02 PM) Okay now I do understand why you said it is a time bomb. no matter who u target.. Yes you are right they more focus to publicity. But IMO, they don't need own product line, like blackndecker etc because their targeted customer is B40 M40... these 2 groups will opt to cheapest item with minimal quality. u need something u see what thay actually "offer" u know who they are targeting. they are building profile building look good aura building number but not value |

|

|

Oct 7 2020, 11:25 PM Oct 7 2020, 11:25 PM

|

Senior Member

1,203 posts Joined: Dec 2008 |

overvalue Joshua_0718 liked this post

|

|

|

Oct 8 2020, 09:17 AM Oct 8 2020, 09:17 AM

|

Senior Member

2,265 posts Joined: May 2015 |

QUOTE(aoisky @ Oct 7 2020, 11:25 PM) Daeiii.....there is a refund policy....why woli ?the IPO price is not finally determined....it may end up as RM 1.20 as IPO price meaning a refund of 40 sen....this is a fair policy + some credible corner stone @ batu penjuru . understand Daeiii...? # Daeiii = Hello ( in tamil ) ! |

|

|

Oct 8 2020, 09:29 AM Oct 8 2020, 09:29 AM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

QUOTE(SURE ANGPOW @ Oct 8 2020, 09:17 AM) Daeiii.....there is a refund policy....why woli ? i dont think so will revise ipo price the IPO price is not finally determined....it may end up as RM 1.20 as IPO price meaning a refund of 40 sen....this is a fair policy + some credible corner stone @ batu penjuru . understand Daeiii...? # Daeiii = Hello ( in tamil ) ! |

|

|

Oct 8 2020, 05:10 PM Oct 8 2020, 05:10 PM

Show posts by this member only | IPv6 | Post

#140

|

Junior Member

19 posts Joined: Sep 2016 |

Have a look at our latest IPO post...

We felt Mr DIY is on the expensive side. See our estimates as well for 2020 https://www.facebook.com/omightycap/posts/1736710136492646  |

|

|

Oct 9 2020, 09:43 AM Oct 9 2020, 09:43 AM

Show posts by this member only | IPv6 | Post

#141

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(SURE ANGPOW @ Oct 8 2020, 09:17 AM) Daeiii.....there is a refund policy....why woli ? lol. as usual. you will appear in every IPO thread. with no whatsoever backing up you statement.the IPO price is not finally determined....it may end up as RM 1.20 as IPO price meaning a refund of 40 sen....this is a fair policy + some credible corner stone @ batu penjuru . understand Daeiii...? # Daeiii = Hello ( in tamil ) ! you will call for so called TP and entice ppl to subscribe, then you disappear from that thread. |

|

|

Oct 9 2020, 03:56 PM Oct 9 2020, 03:56 PM

|

Junior Member

311 posts Joined: Apr 2019 |

typical pump n dump sop from big kaki

its growth has peaked |

|

|

Oct 9 2020, 06:21 PM Oct 9 2020, 06:21 PM

|

Senior Member

2,265 posts Joined: May 2015 |

TP RM 2.50......

This post has been edited by SURE ANGPOW: Oct 9 2020, 06:22 PM |

|

|

Oct 9 2020, 09:03 PM Oct 9 2020, 09:03 PM

Show posts by this member only | IPv6 | Post

#144

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

QUOTE(SURE ANGPOW @ Feb 15 2020, 02:06 PM) My TP of RM 1.18 remained this is the target price ...surely can't hit on the 1st day based on the trend of open LOW lately to TRICK many # may hit on the 2nd day ?... QUOTE(SURE ANGPOW @ Oct 9 2020, 06:21 PM) this blow waster guy reminds me of innature apieh23 liked this post

|

|

|

Oct 10 2020, 04:08 PM Oct 10 2020, 04:08 PM

|

Senior Member

2,265 posts Joined: May 2015 |

We think its IPO price of RM1.60 is at fair value. The reference price multiples as at Last Twelve Months ended 30 June 2020 are as follows:

LTM PE of 36x LTM Proforma EV/EBITDA of 23x LTM P/FCF of 28x For a business with a fantastic flywheel model and economics, MR D.I.Y. deserves the premium in valuation. RM1.60 is a fair entry price to subscribe to the IPO shares . The expected target price (TP) is RM 2.50 DIY has achieved stellar growth for the last 3 years; the compounded annual growth rate CAGR from FY2017 to FY2019 (2 years period): Revenue – 36.06% Net Profits – 22.98% Store Openings – 29.43% These are very impressive growth rates when it is even considering Mr Toy and Mr Dollar stores in future. Lets not forget its upcoming warehousing capacity which will support the store expansion and reduce costs as well. All in all, Mr. DIY looks fairly valued at 31x P/E with ~23% profits annual growth. This post has been edited by SURE ANGPOW: Oct 10 2020, 04:17 PM |

|

|

Oct 10 2020, 05:53 PM Oct 10 2020, 05:53 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Damn...

2.50 TP? Sure ooh 😃😁 Me feels like hard to goreng too... But looking at some counters... Endless possibilities 🤑💰 |

|

|

Oct 10 2020, 06:17 PM Oct 10 2020, 06:17 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

haha maybank also advisor mean

no eye see |

|

|

Oct 10 2020, 06:30 PM Oct 10 2020, 06:30 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(SURE ANGPOW @ Oct 10 2020, 04:08 PM) We think its IPO price of RM1.60 is at fair value. The reference price multiples as at Last Twelve Months ended 30 June 2020 are as follows: If rm2.5 tp is realistic, IPO price should be about rm2.1 else ill advised by I.b.LTM PE of 36x LTM Proforma EV/EBITDA of 23x LTM P/FCF of 28x For a business with a fantastic flywheel model and economics, MR D.I.Y. deserves the premium in valuation. RM1.60 is a fair entry price to subscribe to the IPO shares . The expected target price (TP) is RM 2.50 DIY has achieved stellar growth for the last 3 years; the compounded annual growth rate CAGR from FY2017 to FY2019 (2 years period): Revenue – 36.06% Net Profits – 22.98% Store Openings – 29.43% These are very impressive growth rates when it is even considering Mr Toy and Mr Dollar stores in future. Lets not forget its upcoming warehousing capacity which will support the store expansion and reduce costs as well. All in all, Mr. DIY looks fairly valued at 31x P/E with ~23% profits annual growth. This post has been edited by icemanfx: Oct 10 2020, 06:31 PM |

|

|

Oct 10 2020, 07:05 PM Oct 10 2020, 07:05 PM

|

Senior Member

1,367 posts Joined: Jan 2003 |

Dont listen to him.

Avoid this ipo if u dont want get con. |

|

|

Oct 10 2020, 07:29 PM Oct 10 2020, 07:29 PM

Show posts by this member only | IPv6 | Post

#150

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

Oct 10 2020, 08:21 PM Oct 10 2020, 08:21 PM

|

Senior Member

1,367 posts Joined: Jan 2003 |

|

|

|

Oct 10 2020, 08:52 PM Oct 10 2020, 08:52 PM

|

Senior Member

2,265 posts Joined: May 2015 |

QUOTE(nexona88 @ Oct 10 2020, 05:53 PM) Damn... Why not...after all RM 2.50 is merely 56 % . 2.50 TP? Sure ooh 😃😁 Me feels like hard to goreng too... But looking at some counters... Endless possibilities 🤑💰 it's far below the limit up RM 1.60 X 5 = RM 8.00 ( 400 % ) The IB got reason for that TP of RM 2.50 # seems that sour grape This post has been edited by SURE ANGPOW: Oct 10 2020, 10:02 PM |

|

|

Oct 10 2020, 10:34 PM Oct 10 2020, 10:34 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

QUOTE(SURE ANGPOW @ Oct 10 2020, 08:52 PM) Why not...after all RM 2.50 is merely 56 % . Well as long got 💰💰 to be made...it's far below the limit up RM 1.60 X 5 = RM 8.00 ( 400 % ) The IB got reason for that TP of RM 2.50 # seems that sour grape Everyone happy... |

|

|

Oct 14 2020, 09:52 AM Oct 14 2020, 09:52 AM

|

Junior Member

595 posts Joined: May 2010 |

Today is last day to apply MrDIY IPO.

I just applied. |

|

|

Oct 14 2020, 11:22 AM Oct 14 2020, 11:22 AM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 14 2020, 11:38 AM Oct 14 2020, 11:38 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(SURE ANGPOW @ Oct 10 2020, 04:08 PM) We think its IPO price of RM1.60 is at fair value. The reference price multiples as at Last Twelve Months ended 30 June 2020 are as follows: 23 times ev/ebitda is a fair value. LOLOL. i think this guy can talk kok better than trump eh. hahahahhahahaLTM PE of 36x LTM Proforma EV/EBITDA of 23x LTM P/FCF of 28x For a business with a fantastic flywheel model and economics, MR D.I.Y. deserves the premium in valuation. RM1.60 is a fair entry price to subscribe to the IPO shares . The expected target price (TP) is RM 2.50 DIY has achieved stellar growth for the last 3 years; the compounded annual growth rate CAGR from FY2017 to FY2019 (2 years period): Revenue – 36.06% Net Profits – 22.98% Store Openings – 29.43% These are very impressive growth rates when it is even considering Mr Toy and Mr Dollar stores in future. Lets not forget its upcoming warehousing capacity which will support the store expansion and reduce costs as well. All in all, Mr. DIY looks fairly valued at 31x P/E with ~23% profits annual growth. |

|

|

Oct 14 2020, 01:11 PM Oct 14 2020, 01:11 PM

|

Senior Member

2,265 posts Joined: May 2015 |

QUOTE(tehoice @ Oct 14 2020, 11:38 AM) 23 times ev/ebitda is a fair value. LOLOL. i think this guy can talk kok better than trump eh. hahahahhahaha what talk kok.....at least you read this , Ponda* by SHAZNI ONG / pic by BLOOMBERG INTER-PACIFIC Research Sdn Bhd set a fair value (FV) of for Main Market-bound Mr DIY Group (M) Bhd, a premium to its IPO price of RM1.60, based on the group’s merits and its outperformance against its Asean peers. This post has been edited by SURE ANGPOW: Oct 14 2020, 01:12 PM |

|

|

Oct 14 2020, 02:36 PM Oct 14 2020, 02:36 PM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(SURE ANGPOW @ Oct 14 2020, 01:11 PM) what talk kok.....at least you read this , Ponda* hahahaha okby SHAZNI ONG / pic by BLOOMBERG INTER-PACIFIC Research Sdn Bhd set a fair value (FV) of for Main Market-bound Mr DIY Group (M) Bhd, a premium to its IPO price of RM1.60, based on the group’s merits and its outperformance against its Asean peers. so where does your 2.50 that came about? |

|

|

Oct 14 2020, 09:33 PM Oct 14 2020, 09:33 PM

|

Junior Member

95 posts Joined: Sep 2020 From: Kuala Lumpur |

i am quite amazed that Mr DIY has diversified into toy selling.

|

|

|

Oct 14 2020, 10:27 PM Oct 14 2020, 10:27 PM

Show posts by this member only | IPv6 | Post

#160

|

All Stars

21,457 posts Joined: Jul 2012 |

Historically, most IPO price is overvalued.

|

|

|

Oct 15 2020, 09:23 AM Oct 15 2020, 09:23 AM

Show posts by this member only | IPv6 | Post

#161

|

Junior Member

298 posts Joined: May 2020 |

So, who in? ckuanglim liked this post

|

|

|

Oct 15 2020, 07:31 PM Oct 15 2020, 07:31 PM

Show posts by this member only | IPv6 | Post

#162

|

Junior Member

638 posts Joined: Feb 2020 From: Kuala Lumpur |

|

|

|

Oct 16 2020, 10:57 AM Oct 16 2020, 10:57 AM

Show posts by this member only | IPv6 | Post

#163

|

Senior Member

2,265 posts Joined: May 2015 |

What slim.... all will get all 🤔

|

|

|

Oct 16 2020, 11:28 AM Oct 16 2020, 11:28 AM

Show posts by this member only | IPv6 | Post

#164

|

Senior Member

976 posts Joined: Jan 2008 From: Batu Pahat |

|

|

|

Oct 16 2020, 04:37 PM Oct 16 2020, 04:37 PM

|

Senior Member

2,832 posts Joined: Apr 2011 |

not suprise open at ipo price, after that ......

|

|

|

Oct 16 2020, 06:42 PM Oct 16 2020, 06:42 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 16 2020, 08:31 PM Oct 16 2020, 08:31 PM

|

Junior Member

396 posts Joined: Jun 2011 |

based on balloting results.. most of those who applied, for sure will get this IPO...

Congratz!! |

|

|

Oct 16 2020, 08:52 PM Oct 16 2020, 08:52 PM

Show posts by this member only | IPv6 | Post

#168

|

Senior Member

7,353 posts Joined: Aug 2015 |

Nobody apply this IPO? OMG almost 100% chance get.

|

|

|

Oct 16 2020, 08:57 PM Oct 16 2020, 08:57 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

QUOTE(_kilakila_ @ Oct 15 2020, 07:31 PM) good luck buddy! sure dapat https://www.tiih.com.my/content/press_relea...isAllotment.pdf |

|

|

Oct 16 2020, 08:57 PM Oct 16 2020, 08:57 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

That 1 person who applied 25 mil shares , i think he will lose abit of sleep till listing date

|

|

|

Oct 16 2020, 09:07 PM Oct 16 2020, 09:07 PM

|

Junior Member

474 posts Joined: Oct 2011 |

Due diligence told me to avoid this, looking at the ballot results, I'm glad I did. But who knows, I may be wrong, shall get my popcorn ready on listing date

|

|

|

Oct 16 2020, 09:10 PM Oct 16 2020, 09:10 PM

|

Junior Member

474 posts Joined: Oct 2011 |

|

|

|

Oct 16 2020, 09:15 PM Oct 16 2020, 09:15 PM

Show posts by this member only | IPv6 | Post

#173

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

sure angpow or sure tapau, we shall see.

|

|

|

Oct 16 2020, 09:25 PM Oct 16 2020, 09:25 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

|

|

|

Oct 16 2020, 09:41 PM Oct 16 2020, 09:41 PM

Show posts by this member only | IPv6 | Post

#175

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 16 2020, 09:50 PM Oct 16 2020, 09:50 PM

Show posts by this member only | IPv6 | Post

#176

|

Junior Member

638 posts Joined: Feb 2020 From: Kuala Lumpur |

QUOTE(Krv23490 @ Oct 16 2020, 08:57 PM) After southern cable today ipo, i quite disappointed on the price..so i didnt have high hope for DIY just dont fall below ipo then im glad already😭 |

|

|

Oct 17 2020, 12:12 AM Oct 17 2020, 12:12 AM

Show posts by this member only | IPv6 | Post

#177

|

Junior Member

638 posts Joined: Feb 2020 From: Kuala Lumpur |

QUOTE(Fortezan @ Oct 16 2020, 09:07 PM) Due diligence told me to avoid this, looking at the ballot results, I'm glad I did. But who knows, I may be wrong, shall get my popcorn ready on listing date yeah my friend working inside also ask me to avoid but i already applied before asking him so.. icemanfx liked this post

|

|

|

Oct 17 2020, 12:18 AM Oct 17 2020, 12:18 AM

Show posts by this member only | IPv6 | Post

#178

|

Senior Member

1,324 posts Joined: May 2009 |

|

|

|

Oct 17 2020, 12:20 AM Oct 17 2020, 12:20 AM

Show posts by this member only | IPv6 | Post

#179

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

Just calculate market cap/outlets number

also walk in s few shops to see the business then you will have ideas |

|

|

Oct 17 2020, 03:46 AM Oct 17 2020, 03:46 AM

Show posts by this member only | IPv6 | Post

#180

|

Junior Member

687 posts Joined: Jan 2020 |

This ipo is as bad as a scam. They borrowed alot of money before listing and pay out a huge sum of dividends to themselves. You are practically paying off their loan for no reason. Bought Brunei business for RM 90 million (according to sharetisfy.com, they studied the prospectus) , a very small market with very poor prospects. They only have 4 stores in Brunei, digest this. New shares worth nothing issued directly to individual founders before listing. And these shares will be worth RM 1.60 each on the market. Each of them receive like 1.5% to 1.6% of the enlarged market cap. (if i didnt read the prospectus wrongly) That was the first round. Second round is after listing. A few of their major shareholders do not have a moratorium imposed on them. Including hypis, creador. PE 30 attempting to justify by opening another 200 Mr DIY and dozens of Mr DOLLAR and MR Toy. They only have like one or two dollar/toy shops. Completely unproven. They already have 600 over Mr DIY stores, what make them think the next 200 can offer the same profit margin. Even if it goes exactly as they planned which i say is impossible, PE 30 already price in the growth for the next 10 years. Who the heck in their right mind is willing to pay extra for 10 years worth of profits for a stock that before listing already been milked for money like nobody's business? Sad to say, it is fully subscribed. From what I see, this stock should not be worth more than half the ipo price at all. This is just my opinion, which I think many people share. johoreanguy, yehlai, and 1 other liked this post

|

|

|

Oct 17 2020, 04:11 AM Oct 17 2020, 04:11 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(Solar Calendar @ Oct 17 2020, 03:46 AM) This ipo is as bad as a scam. They borrowed alot of money before listing and pay out a huge sum of dividends to themselves. You are practically paying off their loan for no reason. Those who knows the background won't touch even at pole length. However, current market is frenzy with retailers, hence fully subscribed.Bought Brunei business for RM 90 million (according to sharetisfy.com, they studied the prospectus) , a very small market with very poor prospects. They only have 4 stores in Brunei, digest this. New shares worth nothing issued directly to individual founders before listing. And these shares will be worth RM 1.60 each on the market. Each of them receive like 1.5% to 1.6% of the enlarged market cap. (if i didnt read the prospectus wrongly) That was the first round. Second round is after listing. A few of their major shareholders do not have a moratorium imposed on them. Including hypis, creador. PE 30 attempting to justify by opening another 200 Mr DIY and dozens of Mr DOLLAR and MR Toy. They only have like one or two dollar/toy shops. Completely unproven. They already have 600 over Mr DIY stores, what make them think the next 200 can offer the same profit margin. Even if it goes exactly as they planned which i say is impossible, PE 30 already price in the growth for the next 10 years. Who the heck in their right mind is willing to pay extra for 10 years worth of profits for a stock that before listing already been milked for money like nobody's business? Sad to say, it is fully subscribed. From what I see, this stock should not be worth more than half the ipo price at all. This is just my opinion, which I think many people share. Those allocated or bought pre IPO, sell at IPO price is significant gain. Interesting to see how many shares they will sell at IPO. Those 250 unsuccessful IPO applicants are likely to celebrate. Bursa is a known croc pond for reasons. This post has been edited by icemanfx: Oct 17 2020, 04:19 AM Solar Calendar liked this post

|

|

|

Oct 17 2020, 10:11 AM Oct 17 2020, 10:11 AM

Show posts by this member only | IPv6 | Post

#182

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 17 2020, 10:40 AM Oct 17 2020, 10:40 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(SURE ANGPOW @ Oct 17 2020, 10:11 AM) QUOTE(icemanfx @ Oct 17 2020, 07:29 AM) For reasons the herd will end in either slaughterhouse or over cliff. Listing is next week, only a few days to goes. BE. GREEEEEEEDY WHEN OTHERS IN SHIVERINGG🤔👌👍 This post has been edited by icemanfx: Oct 17 2020, 10:41 AM |

|

|

Oct 17 2020, 12:20 PM Oct 17 2020, 12:20 PM

|

All Stars

48,540 posts Joined: Sep 2014 From: REality |

Got some vibe @ feels that the performance won't be so good... Maybe just few cents premium & later ended up below IPO 🤔

|

|

|

Oct 17 2020, 04:46 PM Oct 17 2020, 04:46 PM

Show posts by this member only | IPv6 | Post

#185

|

Junior Member

638 posts Joined: Feb 2020 From: Kuala Lumpur |

Oh god wish my application was not successful...

|

|

|

Oct 17 2020, 05:08 PM Oct 17 2020, 05:08 PM

|

Junior Member

474 posts Joined: Oct 2011 |

https://www.thestar.com.my/business/busines...t-for-red-flags

I think many of the points mentioned by the author are indirectly calling out Mr DIY |

|

|

Oct 17 2020, 05:27 PM Oct 17 2020, 05:27 PM

|

Senior Member

2,265 posts Joined: May 2015 |

QUOTE(_kilakila_ @ Oct 17 2020, 04:46 PM) what a joke... what an anti climax...are you OK ? and this will make you in JOVIAL MODE >> ## by SHAZNI ONG / pic by BLOOMBERG INTER-PACIFIC Research Sdn Bhd set a fair value (FV) of RM1.85 for Main Market-bound Mr DIY Group (M) Bhd, a premium to its IPO price of RM1.60, based on the group’s merits and its outperformance against its Asean peers. # Long term TP @Sure Angpow >> RM 2.50 ** Note : Warrant Buffett >> BE GREEEEEEEDY This post has been edited by SURE ANGPOW: Oct 17 2020, 05:40 PM |

|

|

Oct 17 2020, 05:36 PM Oct 17 2020, 05:36 PM

|

Senior Member

3,037 posts Joined: Dec 2007 From: 6-feet under |

What's the target price and offer price for big fishes?

|

|

|

Oct 17 2020, 05:41 PM Oct 17 2020, 05:41 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 17 2020, 05:53 PM Oct 17 2020, 05:53 PM

|

Senior Member

3,037 posts Joined: Dec 2007 From: 6-feet under |

|

|

|

Oct 17 2020, 06:07 PM Oct 17 2020, 06:07 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

wow..the edge weekly put a big title Mr Dont Invest Yet

|

|

|

Oct 17 2020, 06:31 PM Oct 17 2020, 06:31 PM

Show posts by this member only | IPv6 | Post

#192

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

|

|

|

Oct 17 2020, 09:37 PM Oct 17 2020, 09:37 PM

|

Senior Member

2,265 posts Joined: May 2015 |

BEWARE....

According to the SC, providing investment advice without a licence is an offence under securities laws and may, upon conviction, attract punishment of a fine not exceeding RM10 million or jail not exceeding 10 years “The provision of investment advice, whether through formal channels such as analyst reports or social media Anyone conducting such activities will need to have a valid licence issued by the SC,” says the regulator in an email response to questions from The Edge. While it continues to actively monitor such activities, the SC points out that it is a challenging task .....Prrgghhhhh This post has been edited by SURE ANGPOW: Oct 17 2020, 10:00 PM |

|

|

Oct 17 2020, 10:35 PM Oct 17 2020, 10:35 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

QUOTE(SURE ANGPOW @ Oct 17 2020, 09:37 PM) BEWARE.... you just realize today?According to the SC, providing investment advice without a licence is an offence under securities laws and may, upon conviction, attract punishment of a fine not exceeding RM10 million or jail not exceeding 10 years “The provision of investment advice, whether through formal channels such as analyst reports or social media Anyone conducting such activities will need to have a valid licence issued by the SC,” says the regulator in an email response to questions from The Edge. While it continues to actively monitor such activities, the SC points out that it is a challenging task .....Prrgghhhhh |

|

|

Oct 17 2020, 11:27 PM Oct 17 2020, 11:27 PM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 18 2020, 02:50 PM Oct 18 2020, 02:50 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 18 2020, 04:23 PM Oct 18 2020, 04:23 PM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 18 2020, 04:26 PM Oct 18 2020, 04:26 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 18 2020, 04:34 PM Oct 18 2020, 04:34 PM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 18 2020, 04:51 PM Oct 18 2020, 04:51 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 18 2020, 05:48 PM Oct 18 2020, 05:48 PM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 18 2020, 05:54 PM Oct 18 2020, 05:54 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Oct 18 2020, 06:12 PM Oct 18 2020, 06:12 PM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 18 2020, 08:11 PM Oct 18 2020, 08:11 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(SURE ANGPOW @ Oct 18 2020, 05:48 PM) Risk averse Sour Grape >> >> ... U better GRAB grandma old fashioned FD@Fixed Deposit for a never failed QUOTE(SURE ANGPOW @ Oct 18 2020, 06:12 PM) for reasons, there are only about 4% of adults in this country have over us$100k net worth.historically, at end of every bull run, a generation of investors is washed out. This post has been edited by icemanfx: Oct 18 2020, 08:13 PM |

|

|

Oct 18 2020, 08:49 PM Oct 18 2020, 08:49 PM

|

Senior Member

3,037 posts Joined: Dec 2007 From: 6-feet under |

if its so good the big investors would have bought all, wouldnt leave scraps for retail investors no?

|

|

|

Oct 18 2020, 09:16 PM Oct 18 2020, 09:16 PM

|

Senior Member

2,265 posts Joined: May 2015 |

QUOTE(C-Note @ Oct 18 2020, 08:49 PM) if its so good the big investors would have bought all, wouldnt leave scraps for retail investors no? Daeiiii ( Hello in Tamil ).....there is SC / Security Comission ruling...certain portion by retail , institutional , employee & what not.....! Take note my frens that this DIY is oversubscribed what,,,,so NO need to crawl back the allocation to institutional laaa daeiii . We think its IPO price of RM1.60 is at fair value. The reference price multiples as at Last Twelve Months ended 30 June 2020 are as follows: LTM PE of 36x LTM Proforma EV/EBITDA of 23x LTM P/FCF of 28x For a business with a fantastic flywheel model and economics, MR D.I.Y. deserves the premium in valuation. RM1.60 is a fair entry price to subscribe to the IPO shares . The expected target price (TP) is RM 2.50 DIY has achieved stellar growth for the last 3 years; the compounded annual growth rate CAGR from FY2017 to FY2019 (2 years period): Revenue – 36.06% Net Profits – 22.98% Store Openings – 29.43% These are very impressive growth rates when it is even considering Mr Toy and Mr Dollar stores in future. Lets not forget its upcoming warehousing capacity which will support the store expansion and reduce costs as well. All in all, Mr. DIY looks fairly valued at 31x P/E with ~23% profits annual growth. ---------------------------------------------------------------------------------------------------------------------- ## by SHAZNI ONG / pic by BLOOMBERG INTER-PACIFIC Research Sdn Bhd set a fair value (FV) of RM1.85 for Main Market-bound Mr DIY Group (M) Bhd, a premium to its IPO price of RM1.60, based on the group’s merits and its outperformance against its Asean peers. This post has been edited by SURE ANGPOW: Oct 18 2020, 09:19 PM |

|

|

Oct 18 2020, 09:35 PM Oct 18 2020, 09:35 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Yggdrasil @ Oct 1 2020, 10:32 PM) Mr. DIY quality is meant for use and throw not use and keep. Customers return because the tool is cheap that it breaks lol. That's built in planned obsolescence. We might not use those low quality crap but many renovation contractor usually buy these cheap stuff to cut cost. Even the company which came to install a custom made wardrobe used some el cheapo elephant glue I know a guy who runs an events company and he also goes there to buy stuff. There definitely is a market but maybe targeting lower income. Might do well in a recession. I haven't looked at the financials yet.  10 billion for a company that sells screw drivers that one can only use once? What a bloody farkin con!!! |

|

|

Oct 18 2020, 10:10 PM Oct 18 2020, 10:10 PM

Show posts by this member only | IPv6 | Post

#208

|

Junior Member

119 posts Joined: Apr 2006 |