QUOTE(SURE ANGPOW @ Oct 10 2020, 04:08 PM)

We think its IPO price of RM1.60 is at fair value. The reference price multiples as at Last Twelve Months ended 30 June 2020 are as follows:

LTM PE of 36x

LTM Proforma EV/EBITDA of 23x

LTM P/FCF of 28x

For a business with a fantastic flywheel model and economics, MR D.I.Y. deserves the premium in valuation. RM1.60 is a fair entry price to subscribe to the IPO shares .

The expected target price (TP) is RM 2.50

DIY has achieved stellar growth for the last 3 years; the compounded annual growth rate CAGR from FY2017 to FY2019 (2 years period):

Revenue – 36.06%

Net Profits – 22.98%

Store Openings – 29.43%

These are very impressive growth rates when it is even considering Mr Toy and Mr Dollar stores in future. Lets not forget its upcoming warehousing capacity which will support the store expansion and reduce costs as well.

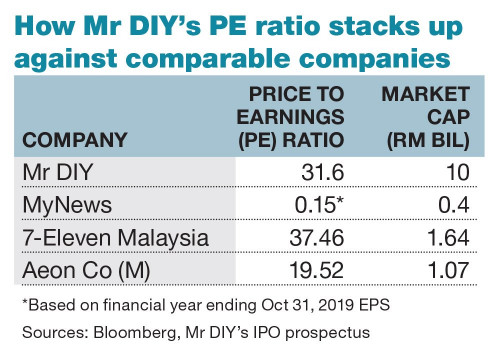

All in all, Mr. DIY looks fairly valued at 31x P/E with ~23% profits annual growth.

If rm2.5 tp is realistic, IPO price should be about rm2.1 else ill advised by I.b.LTM PE of 36x

LTM Proforma EV/EBITDA of 23x

LTM P/FCF of 28x

For a business with a fantastic flywheel model and economics, MR D.I.Y. deserves the premium in valuation. RM1.60 is a fair entry price to subscribe to the IPO shares .

The expected target price (TP) is RM 2.50

DIY has achieved stellar growth for the last 3 years; the compounded annual growth rate CAGR from FY2017 to FY2019 (2 years period):

Revenue – 36.06%

Net Profits – 22.98%

Store Openings – 29.43%

These are very impressive growth rates when it is even considering Mr Toy and Mr Dollar stores in future. Lets not forget its upcoming warehousing capacity which will support the store expansion and reduce costs as well.

All in all, Mr. DIY looks fairly valued at 31x P/E with ~23% profits annual growth.

This post has been edited by icemanfx: Oct 10 2020, 06:31 PM

Oct 10 2020, 06:30 PM

Oct 10 2020, 06:30 PM

Quote

Quote

0.0433sec

0.0433sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled