QUOTE(!@#$%^ @ Oct 18 2020, 11:09 PM)

https://www.theedgemarkets.com/article/mr-d...irport-operatordo you believe this??

all the shop inside mall no need paid rental???

MR DIY IPO

|

|

Oct 18 2020, 11:12 PM Oct 18 2020, 11:12 PM

|

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(!@#$%^ @ Oct 18 2020, 11:09 PM) https://www.theedgemarkets.com/article/mr-d...irport-operatordo you believe this?? all the shop inside mall no need paid rental??? |

|

|

|

|

|

Oct 18 2020, 11:14 PM Oct 18 2020, 11:14 PM

|

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(djhenry91 @ Oct 18 2020, 11:11 PM) knn..spam same thing by multi quote people MR DIY Group’s final retail price fixed at RM1.60u apply alot issit and now worry issit u quote me on january for wat? tht was draft from SC la even list still can download from bursa la.. 1st time ply ipo issit CORPORATE NEWS Thursday, 15 Oct 2020 11:58 AM MYT MR DIY raised RM1.5bil from the market based on the retail price of RM1.60 per IPO share. MR DIY outlet in Damen Mall, Subang Jaya. KUALA LUMPUR: The institutional price and final retail price for home improvement retailer MR D.I.Y. Group (M) Bhd’s initial public offer have been fixed at RM1.60 per share. In a statement to Bursa Malaysia, the company said the final price was fixed following the completion of the bookbuilding process under the institutional Offering on Wednesday. The retail offering closed at 5pm on Wednesday. It is scheduled to be listed on the Main Market on Oct 26. MR DIY raised RM1.5bil from the market based on the initial retail price of RM1.60 per IPO share. Its IPO comprised up to 941.49 million shares – an offer for sale of up to 753.09 million existing shares and a public issue of 188.40 million new shares. The public issue of 188.40 million new shares raised RM301.4mil for the company, of which RM276.1mil will be used to repay bank borrowings which will save the company RM15.2mil per year. The remaining RM25.3mil will be used to defray the estimated listing expenses. The 941.49 million shares, which represents 15% of the enlarged issued 6.28 billion shares, were allocated through a retail offering and an institutional offering. Hence, market capitalisation is approximately RM10bil based on the enlarged share capital. Notable institutional investors to this exercise include: Aberdeen Standard, AIA, BlackRock, FIL Investment Management, JPMorgan Asset Management and Pictet Asset Management. These cornerstone investors make up 76% of the institutional offering tranche.   https://www.theedgemarkets.com/article/mr-d...irport-operator how come mr.diy so powerful? many shoplot? This post has been edited by plouffle0789: Oct 18 2020, 11:15 PM |

|

|

Oct 18 2020, 11:16 PM Oct 18 2020, 11:16 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Oct 18 2020, 11:17 PM Oct 18 2020, 11:17 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

wtf...u quote us and ask back..

what u wan |

|

|

Oct 18 2020, 11:24 PM Oct 18 2020, 11:24 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Boon3 @ Oct 18 2020, 09:35 PM)  10 billion for a company that sells screw drivers that one can only use once? What a bloody farkin con!!! But who knows what will happen. Nowadays loss making companies can also have near RM1b valuation. Anything with the word "China", "tech" or "glove" also can shoot up despite making no profit. The sky's the limit. |

|

|

Oct 18 2020, 11:35 PM Oct 18 2020, 11:35 PM

Show posts by this member only | IPv6 | Post

#226

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

|

|

|

|

|

|

Oct 19 2020, 05:01 AM Oct 19 2020, 05:01 AM

|

Senior Member

2,265 posts Joined: May 2015 |

QUOTE(plouffle0789 @ Oct 18 2020, 11:14 PM) MR DIY Group’s final retail price fixed at RM1.60 CORPORATE NEWS Thursday, 15 Oct 2020 11:58 AM MYT MR DIY raised RM1.5bil from the market based on the retail price of RM1.60 per IPO share. MR DIY outlet in Damen Mall, Subang Jaya. KUALA LUMPUR: The institutional price and final retail price for home improvement retailer MR D.I.Y. Group (M) Bhd’s initial public offer have been fixed at RM1.60 per share. In a statement to Bursa Malaysia, the company said the final price was fixed following the completion of the bookbuilding process under the institutional Offering on Wednesday. The retail offering closed at 5pm on Wednesday. It is scheduled to be listed on the Main Market on Oct 26. MR DIY raised RM1.5bil from the market based on the initial retail price of RM1.60 per IPO share. Its IPO comprised up to 941.49 million shares – an offer for sale of up to 753.09 million existing shares and a public issue of 188.40 million new shares. The public issue of 188.40 million new shares raised RM301.4mil for the company, of which RM276.1mil will be used to repay bank borrowings which will save the company RM15.2mil per year. The remaining RM25.3mil will be used to defray the estimated listing expenses. The 941.49 million shares, which represents 15% of the enlarged issued 6.28 billion shares, were allocated through a retail offering and an institutional offering. Hence, market capitalisation is approximately RM10bil based on the enlarged share capital. Notable institutional investors to this exercise include: Aberdeen Standard, AIA, BlackRock, FIL Investment Management, JPMorgan Asset Management and Pictet Asset Management. These cornerstone investors make up 76% of the institutional offering tranche.   https://www.theedgemarkets.com/article/mr-d...irport-operator how come mr.diy so powerful? many shoplot? ## by SHAZNI ONG / pic by BLOOMBERG INTER-PACIFIC Research Sdn Bhd set a fair value (FV) of RM1.85 for Main Market-bound Mr DIY Group (M) Bhd, a premium to its IPO price of RM1.60, based on the group’s merits and its outperformance against its Asean peers. MR DIY SURE ONE $$$$$ PITY to SOUR GRAPE..Sob...Sob...Sobb This post has been edited by SURE ANGPOW: Oct 19 2020, 05:09 AM |

|

|

Oct 19 2020, 06:34 AM Oct 19 2020, 06:34 AM

|

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(SURE ANGPOW @ Oct 19 2020, 05:01 AM) ## by SHAZNI ONG / pic by BLOOMBERG INTER-PACIFIC Research Sdn Bhd set a fair value (FV) of RM1.85 for Main Market-bound Mr DIY Group (M) Bhd, a premium to its IPO price of RM1.60, based on the group’s merits and its outperformance against its Asean peers. MR DIY SURE ONE $$$$$ PITY to SOUR GRAPE..Sob...Sob...Sobb » Click to show Spoiler - click again to hide... «

|

|

|

Oct 19 2020, 08:35 AM Oct 19 2020, 08:35 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Yggdrasil @ Oct 18 2020, 11:24 PM) I think fair value should be around RM3b-5b. Your so kind to give those valuation.But who knows what will happen. Nowadays loss making companies can also have near RM1b valuation. Anything with the word "China", "tech" or "glove" also can shoot up despite making no profit. The sky's the limit. Seriously? I don't see how it is worth more than 500 million. No joke. Well, time is the enemy of the shitty business.... |

|

|

Oct 19 2020, 08:41 AM Oct 19 2020, 08:41 AM

|

Junior Member

78 posts Joined: Apr 2016 |

cant wait to see what price mrdiy will go after being listed

could go either way i think |

|

|

Oct 19 2020, 08:50 AM Oct 19 2020, 08:50 AM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

oh ya forgot to ask, diy got stabilizing manager?

|

|

|

Oct 19 2020, 08:56 AM Oct 19 2020, 08:56 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

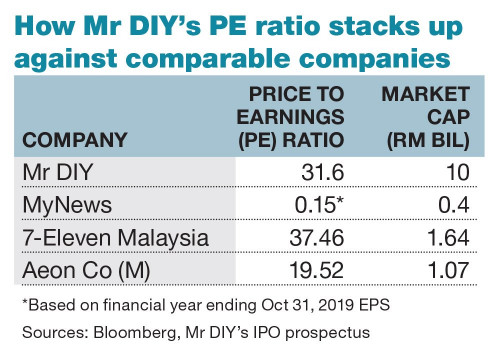

QUOTE(chen9 @ Oct 19 2020, 08:41 AM) Try to take out all the inside noises .... and be logical...simple question.... do you think the DIY shops should be more valuable than 711? me? no way in hell... everyone buys bits and bits of overpriced stuff at 711 ALL the time! the edge article... https://www.theedgemarkets.com/article/mr-d...irport-operator It compares DIY valuation vs 711 stores. 711 stores this morning is only worth 1.2billion. DIY at IPO prices, is worth 10 billion. That's a damn cluster farrrrk! how could it be worth that much for a store that sells ZERO QUALITY stuff? BTW Genting BHD is ONLY worth 11.5 billion. As much I dislike Genting, can any1 reason with me how DIY can be worth 10 billion? LOL! It is worth more than AMBank too since AMBank market value is some 8.8 billion. Ask yourself....DIY worth more than AMBank??? if this is not a con, what is? |

|

|

Oct 19 2020, 09:00 AM Oct 19 2020, 09:00 AM

|

Junior Member

78 posts Joined: Apr 2016 |

QUOTE(Boon3 @ Oct 19 2020, 08:56 AM) Try to take out all the inside noises .... and be logical... i have to agree with you here , simple question.... do you think the DIY shops should be more valuable than 711? me? no way in hell... everyone buys bits and bits of overpriced stuff at 711 ALL the time! the edge article... https://www.theedgemarkets.com/article/mr-d...irport-operator It compares DIY valuation vs 711 stores. 711 stores this morning is only worth 1.2billion. DIY at IPO prices, is worth 10 billion. That's a damn cluster farrrrk! how could it be worth that much for a store that sells ZERO QUALITY stuff? BTW Genting BHD is ONLY worth 11.5 billion. As much I dislike Genting, can any1 reason with me how DIY can be worth 10 billion? LOL! It is worth more than AMBank too since AMBank market value is some 8.8 billion. Ask yourself....DIY worth more than AMBank??? if this is not a con, what is? mrdiy has been expanding like crazy prior to this ipo ( not in a healthy way imo ) even my friend kampung also got one there 10bil valuation imo is way too high but price movement of a stock is not solely depending on its value thats why i say very interesting to see personally wouldnt buy this stock at this price |

|

|

|

|

|

Oct 19 2020, 09:07 AM Oct 19 2020, 09:07 AM

|

Senior Member

1,055 posts Joined: Jan 2003 From: Kajang | Cyberjaya |

|

|

|

Oct 19 2020, 09:56 AM Oct 19 2020, 09:56 AM

Show posts by this member only | IPv6 | Post

#235

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Oct 19 2020, 10:30 AM Oct 19 2020, 10:30 AM

|

All Stars

48,579 posts Joined: Sep 2014 From: REality |

QUOTE(plouffle0789 @ Oct 18 2020, 10:56 PM) singapore 10 stores is not in this MR D.I.Y. GROUP (M) BERHAD!!!! only malaysia and brunei stores right??? QUOTE(plouffle0789 @ Oct 18 2020, 11:02 PM) singapore 10 stores is not in this MR D.I.Y. GROUP (M) BERHAD!!!! only malaysia and brunei stores right??? QUOTE(plouffle0789 @ Oct 18 2020, 11:02 PM) singapore 10 stores is not in this MR D.I.Y. GROUP (M) BERHAD!!!! only malaysia and brunei stores right??? QUOTE(plouffle0789 @ Oct 18 2020, 11:04 PM) singapore 10 stores is not in this MR D.I.Y. GROUP (M) BERHAD!!!! Walao...only malaysia and brunei stores right??? Just chill... Why multiple post the same thing 🤣 |

|

|

Oct 19 2020, 10:45 AM Oct 19 2020, 10:45 AM

|

Senior Member

2,265 posts Joined: May 2015 |

|

|

|

Oct 19 2020, 11:32 AM Oct 19 2020, 11:32 AM

|

All Stars

48,579 posts Joined: Sep 2014 From: REality |

|

|

|

Oct 19 2020, 11:53 AM Oct 19 2020, 11:53 AM

|

Senior Member

3,037 posts Joined: Dec 2007 From: 6-feet under |

Whats the Price-sales/Growth ratio? PSG

|

|

|

Oct 19 2020, 01:25 PM Oct 19 2020, 01:25 PM

|

Senior Member

4,707 posts Joined: May 2008 |

Share alloted..gg?

|

| Change to: |  0.0223sec 0.0223sec

1.07 1.07

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 11:17 PM |