Hi sifus,

Sorry for the long post-

I'm new to insurance and I'm looking to get my first policy and been researching around:

Basic background, 24yo female, single, office job

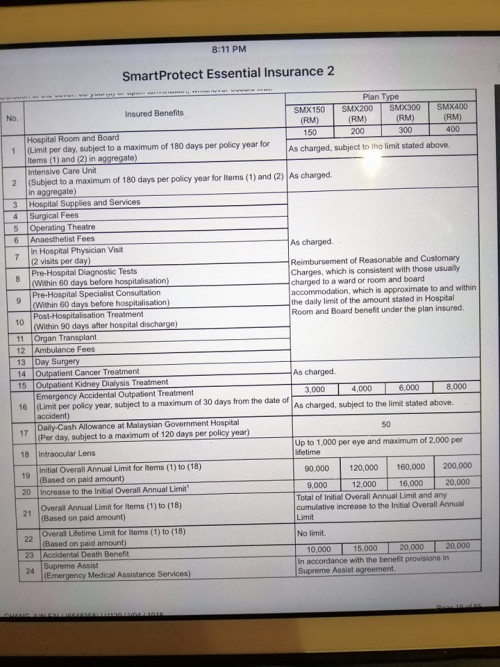

1. Currently focusing on medical with higher coverage as main concern as medical costs are increasing day by day.

can get a medical plan that increases it R&B and annual limit overtime. this allays your main concern.2. From what I understand, life is compulsory in all ILP plans so is it OK if I just get the minimum sum assured to stretch my ringgit? Is it necessary to get like 50k as per initial quotes by the agents(premiums of rm250/month)? Or maybe I can purchase separately in the future?

you can ask agent to quote you the minimal and top up in that same plan in the future.3. Is it necessary/important for me to get CI? I understand that it is to act as income replacement, if the amount is like 50k, I would probably have savings around that amount too, not sure whether I need this rider? Or I can purchase a standalone for higher coverage in the future?

perhaps say you want to prepare a buffer of cash of 4 to 5 years for transition/recuperation period, what is the amount you need. then contra that amount with the current savings you have. then that is the amount you need for CI in the insurance policy4. ILP are structured that cash value compensates the high COI in the future right? So if now I pay a larger portion of premium with less riders and more allocation into the fund, the higher acc value will sustain longer and I'm less likely to receive letter for topup next time? My dad's family history has long age and healthy, so I'm looking to cover up to at least 80 yo.

yes you are right. whatever quotation you got now from the agent, just check the policy sustainability age. Like what you prefer, normally i will recommend for policy to sustain to 80 years old. Your goal should be pay the least possible to get the coverage you need the most then whatever balance of cashflow you have, invest it for other purposes.5. Had a comparison with all big 3 agents which I have tweaked a little to exclude the CI first, budget is around rm150-200:

Prudential-rm160 annual 1.38m coverage deductible 300, life/tpd 20k, Ci 20k, sustainability 64-72yo

GE-rm180, 50k life/tpd, 50k CI, coverage 90+900k no deductible (why separate?), sustainability 99 yo

AIA-rm186, life/tpd 10k, coverage 1.5m deductible 300, sustainability 100 yo

among the 3 you stated here, i recommend you to take Prudential one. Reason being is the 200 R&B. of course if possible, see whether you can top up a bit to the Prudential plan and increase the Life/CI (depends how much you need).Appreciate if anyone could give some advice for my case.. Not sure whether I'm on the right track or I'm just cutting everything off to get the possible lowest premium lol...

Now on to my dad and sis... Haha...

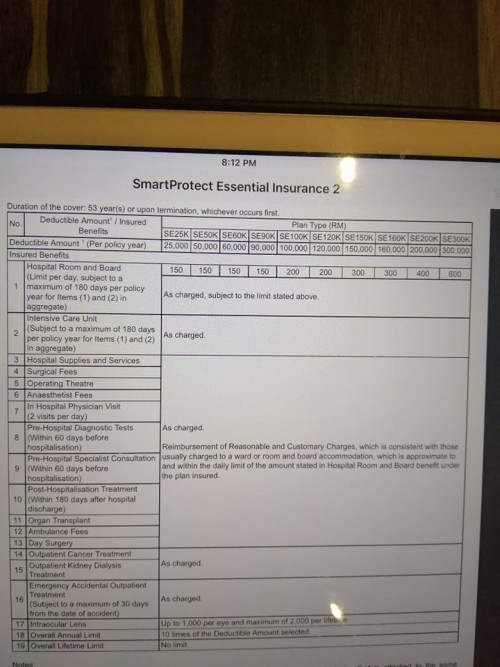

My dad is looking to upgrade his plan, 57yo, however he is pilot which is class 4 occupation quoted by all agents.

Current standalone plan is coverage 90k, 2k+/year, which will definitely increase up to 8k-10k+ in future.

He wants to get a medical card similar to mine, any ways to play around so he can get a lower quote? He has company insurance which is unlimited coverage currently and he wants to utilise personal insurance after retirement only. Health is definitely no problem also as their industry have very vigorous checkups half yearly and his family history is like very long age.

to purchase a plan for him now will cost around 8.2k or so. after he retires, then only change his occupation class. asides the standalone plan, what other life insurance that he has?For my sister, 19yo student, my mom intends to purchase a same medical as mine for her, however the concern is few years back then they went to KPJ for an xray because my sister's spine abit "senget", the doctor said 15 degrees and didn't suggest any treatment etc, just said 2yrs later can do a follow up which my sis nvr went back.. If want to buy now, need to declare? What are the risks? One agent suggested not to declare as it is small case only normal check up and if declare, they will definitely exclude spine related problems. My mom's concern is later if insurance company find out and reject her claims next time then my sis will not have insurance for the rest of her life..

recommend to declare with supporting documents *hoping* insurance companies accept with no exclusion

Appreciate the response on this long winded post..

Sorry and Thank you so much!

Mar 20 2019, 09:54 PM

Mar 20 2019, 09:54 PM

Quote

Quote

0.1220sec

0.1220sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled