QUOTE(DBHILUHDAQWISRTNJ @ Dec 4 2018, 11:42 PM)

Good to know u r still alive.

Few days no talk , your mouth sure very smelly like tong sampah .

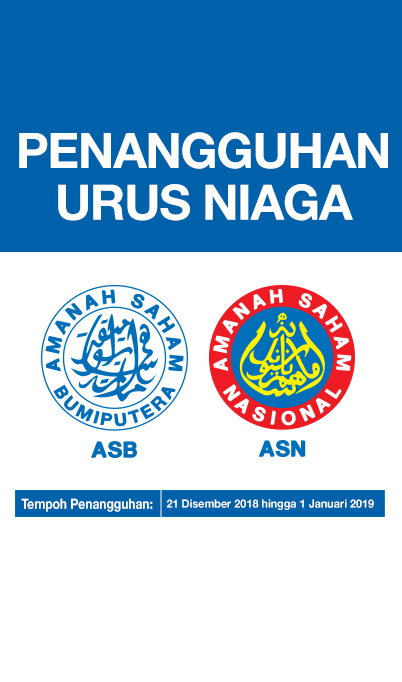

Recently I force my colleagues go bank to buy vp rm100 then force them withdraw fd all move to fp.

Sometimes I can feel thier helpless. Lol .

Wah, uncle's colleagues sure all millionaires. No wonder top up getting harder, a lot of whales in the same pool. Few days no talk , your mouth sure very smelly like tong sampah .

Recently I force my colleagues go bank to buy vp rm100 then force them withdraw fd all move to fp.

Sometimes I can feel thier helpless. Lol .

On a serious note, I would recommend, but not force people into asnb.

They wouldn't thanks you if getting stable 6%, but they may

Dec 4 2018, 11:49 PM

Dec 4 2018, 11:49 PM

Quote

Quote

0.2741sec

0.2741sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled