Currently, I am taking RHB full flexi housing loan,

my house loan account is linked to my RHB saving account.

To pay from my RHB saving account, it has two payment methods,

"principle prepayment" and "regular installment"

From main office banker descriptions,

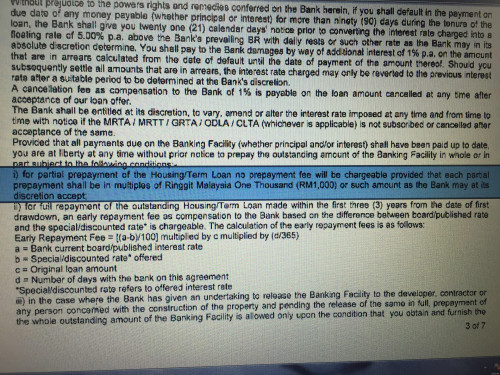

"principle prepayment" is reducing the principle, even you put money in "principle prepayment"

you are still required to pay "regular installment" every month.

From my agent descriptions, I am taking full flexi house loan, I should use "principle prepayment" to pay the installment.

short summary - "principle prepayment" can be used as "regular installment", and

if I pay to "principle prepayment" before the due date, I can enjoy the interest reduction.

from example, my loan is 500k, monthly installment is 3k,

if i paid 10 days earlier before due date, i am charged with 497k (500k - 3k) interest only for that 10 days,

when is the due date for payment, the 3k will be removed from "principle prepayment" and used as "regular installment".

I am confused

hope someone who is taking rhb bank house loan can help

Sep 17 2018, 04:38 PM, updated 7y ago

Sep 17 2018, 04:38 PM, updated 7y ago

Quote

Quote

0.0289sec

0.0289sec

0.97

0.97

6 queries

6 queries

GZIP Disabled

GZIP Disabled