Outline ·

[ Standard ] ·

Linear+

Credit Cards Maybankard 2 Gold & Platinum Cards V20, 5% M2 Amex on weekend spending (NOT ALL)

|

jefftan4888

|

Apr 6 2019, 11:12 AM Apr 6 2019, 11:12 AM

|

|

QUOTE(YH1234 @ Apr 6 2019, 09:35 AM) i read many review n comment saying that "maybankard 2 gold & platinum cards" is one of the best cb card around, seem better than mbb fcb, however the former require swipe on weekend, cap at 50 n amex have limited usage compare with visa master, i am still quite puzzle it is better in what context, perhaps only the 5x treat point? 1) 5% Weekend Cashback when spend RM1,000: RM1,000 x 5% = RM50 or 5% per month for 12 months 2) 5x TreatsPoints for spend RM1,000: RM1,000 x 5TP = 5,000TP = RM10 or 1% per month for 12 months Total Cash Back = RM60 or 6% per month or RM720 or 6% per year Maybank FC Barcelona Visa Signature

1) 2% Cash back (except May & August) when spend RM2,500: RM2,500 x 2% = RM50 per month for 10 months

2) 10% Cash back (May & August) when spend RM1,000: RM1,000 x 10% = RM100 per month for 2 months

Total Cash Back = RM58.33 or 2.59% per month or RM700 or 2.59% per year

Maybank 2 Amex Gold/Platinum versus Maybank FC Barcelona Visa SignatureAnnual Return: 6% versus 2.59% annual return, which is better?Annual Spending: RM12,000 versus RM27,000, which is better? |

|

|

|

|

|

jefftan4888

|

Apr 6 2019, 11:47 AM Apr 6 2019, 11:47 AM

|

|

QUOTE(jefftan4888 @ Apr 6 2019, 11:12 AM) Maybank 2 Amex Gold/Platinum1) 5% Weekend Cashback when spend RM1,000: RM1,000 x 5% = RM50 or 5% per month for 12 months 2) 5x TreatsPoints for spend RM1,000: RM1,000 x 5TP = 5,000TP = RM10 or 1% per month for 12 months Total Cash Back = RM60 or 6% per month or RM720 or 6% per year Maybank FC Barcelona Visa Signature

1) 2% Cash back (except May & August) when spend RM2,500: RM2,500 x 2% = RM50 per month for 10 months

2) 10% Cash back (May & August) when spend RM1,000: RM1,000 x 10% = RM100 per month for 2 months

Total Cash Back = RM58.33 or 2.59% per month or RM700 or 2.59% per year

Maybank 2 Amex Gold/Platinum versus Maybank FC Barcelona Visa SignatureAnnual Return: 6% versus 2.59% annual return, which is better?Annual Spending: RM12,000 versus RM27,000, which is better? In addition, Maybank 2 Amex Gold/Platinum - Unlimited 1% of TreatsPoints or RM10 Cash Back per month Maybank FC Barcelona Visa Signature - TreatsPoints is not eligible for this card |

|

|

|

|

|

jefftan4888

|

Apr 12 2019, 06:28 PM Apr 12 2019, 06:28 PM

|

|

Currently holding Maybank 2 Platinum Card. Applied Maybank FC Barcelona Visa Signature online on 10 April 2018. Only submitted IC. Today see the below. Approval process is fast. Attached thumbnail(s)

|

|

|

|

|

|

jefftan4888

|

Apr 15 2019, 05:45 PM Apr 15 2019, 05:45 PM

|

|

QUOTE(jefftan4888 @ Apr 12 2019, 06:28 PM) Currently holding Maybank 2 Platinum Card. Applied Maybank FC Barcelona Visa Signature online on 10 April 2018. Only submitted IC. Today see the below. Approval process is fast. Received card in the afternoon today. That's fast. |

|

|

|

|

|

jefftan4888

|

May 10 2019, 11:39 PM May 10 2019, 11:39 PM

|

|

QUOTE(kart @ May 10 2019, 10:21 PM) After 1 June 2019, for Maybank 2 Card Amex, we will not obtain any TreatsPoints for weekend transactions. It is quite undesirable for us, especially for some of us who need to accumulate 10000 TreatsPoints to offset RM 25 of card service tax. Let’s assume that a person, who has only Maybank 2 Card Amex, is short of a thousand TreatsPoints or so, in getting the required 10000 TreatsPoints. What should this person do? a) Pay RM 25 of card service tax with his or her own cash, or; b) Intentionally uses Maybank 2 Card Amex during weekdays to achieve the required 10000 TreatsPoints, forfeiting the 5 % weekend cashback. Either method is not ideal for this person. Accumulating TreatsPoints in lieu of 5 % cashback is not worthwhile, since TreatsPoints is just worth 0.2 % cashback. It is tough time ahead of us.  Top up Boost using Amex during weekdays will earn you 17.5k TP /month. That's is more than enough for your SST 10k TP.  |

|

|

|

|

|

jefftan4888

|

May 11 2019, 09:11 PM May 11 2019, 09:11 PM

|

|

QUOTE(chemistry @ May 11 2019, 05:46 PM) I foresee MBB will soon include e-wallet reload transaction into non-cashback category. Why worry? Enjoy while you still can enjoy.  |

|

|

|

|

|

jefftan4888

|

May 11 2019, 11:18 PM May 11 2019, 11:18 PM

|

|

QUOTE(beebee1314 @ May 11 2019, 11:14 PM) I thought withdrawal and payments shares the same limit of total 4500 transaction a month. No? Spend 4,500 + Cash out 4,500 = 9,000 Can reach almost 100k TP within 2 months  This post has been edited by jefftan4888: May 11 2019, 11:18 PM This post has been edited by jefftan4888: May 11 2019, 11:18 PM |

|

|

|

|

|

jefftan4888

|

May 12 2019, 09:11 AM May 12 2019, 09:11 AM

|

|

QUOTE(beebee1314 @ May 12 2019, 08:30 AM) ahhhhh I didn't know. thought they share the same 4500. it's actually separated. nice. I shall go do withdrawal now. how many days it takes for the withdrawal. last time I did it, took 1 week. My experiences https://forum.lowyat.net/index.php?showtopi...post&p=92640771  |

|

|

|

|

|

jefftan4888

|

May 17 2019, 01:38 PM May 17 2019, 01:38 PM

|

|

QUOTE(kyu85 @ May 17 2019, 12:16 AM) any alternative of CC that have cash back for paying PTPTN? also from next month, paying utilities bills like tnb, unifi still can get the cash back on weekend? TNB - Use other CB CC top up BP then use BP to pay Unifi - Use Amex top up Boost then use Boost to pay |

|

|

|

|

|

jefftan4888

|

May 17 2019, 01:43 PM May 17 2019, 01:43 PM

|

|

QUOTE(hikarireika @ May 17 2019, 01:04 PM) Hello, sorry if this is a silly question, but I'm finding it kinda hard to find this information. I currently have Maybank 2 Card Gold, and it's about to expire next month. However, I am now within the income bracket to apply for M2C Platinum. My questions are: 1. Is it a good idea to upgrade to Platinum simply because I am within the income bracket to apply? I'm happy with the Gold, and I don't forsee my credit card habits changing. I only use it to pay for monthly deductions for insurance, maybe for some bills in the future, and some one-off purchases once in a while. 2. If I were to upgrade to Platinum, would there be any major differences that I need to look out for or be wary about? (Besides Platinum's Travel Insurance) Thanks in advance  Have you got cards like FCB, PB Signature, PB Quantum, JOP, LFC, etc.? If not, let focus on getting these to get more CB. |

|

|

|

|

|

jefftan4888

|

May 17 2019, 02:08 PM May 17 2019, 02:08 PM

|

|

QUOTE(talexeh @ May 17 2019, 01:56 PM) What does your suggestions have to do with the questions he's posting? He has clearly stated that he's comfortable with his spending habit.  Just provide some options for him to select. Sharing is caring.  |

|

|

|

|

|

jefftan4888

|

May 17 2019, 10:23 PM May 17 2019, 10:23 PM

|

|

QUOTE(kyu85 @ May 17 2019, 10:06 PM) Sry, wat is BP? Use Amex to top up boost can get cash back? Boost >> https://forum.lowyat.net/topic/4698581 |

|

|

|

|

|

jefftan4888

|

May 18 2019, 02:59 PM May 18 2019, 02:59 PM

|

|

QUOTE(beebee1314 @ May 18 2019, 07:36 AM) Higher credit limit means ctos prettier meh? I thought higher credit limit means it'll eat into your financial commitments. Higher credit limit, I believe will affect the ability for you to borrow loan later for your house. This is because, even if you don't utilise upto the limit for your monthly spending, it is already committed for you. Hmmm. I always call banks to reduce my limit. Like affinbhp at 1.5k, public bank at 3k and etc. Higher credit limit means you have high income, high value of assets such as properties, shares and FD to be pledged. Banks will offer you more credit limit based on additional assets. |

|

|

|

|

|

jefftan4888

|

May 18 2019, 05:03 PM May 18 2019, 05:03 PM

|

|

QUOTE(beyond86 @ May 18 2019, 04:40 PM) Using Amex about 10 years. From Amex Gold to M2cards, is time to cancel already. Maybank credit cards good benefits & simple, as long as can swipe, then can enjoy the benefits. But as other people said, good things not last long. Maybank also like other credit card, not so direct & simple. Also, Visa or MC can use paywave or contactless, very convenient; while Amex really troublesome. Getting more & more restaurants not accepting Amex anymore which last time they used to. I still think that M2 Amex is one of the best CC in the market. |

|

|

|

|

|

jefftan4888

|

May 18 2019, 06:24 PM May 18 2019, 06:24 PM

|

|

QUOTE(beyond86 @ May 18 2019, 06:11 PM) Current practice is weekday using FCB while weekend M2Card Amex. Thus, June 2019 onwards, no chance to earn TP anymore because won’t use Amex during weekday. TP also increased 500TP = RM1 Weekend for me less chance to spend. Just now want use Amex at Chili’s restaurant, duno y failed. Not first time anyway. Will redeem TP before cancel the card & SST being charged. However, just FCB 1 card not sufficient, May & Aug max spend RM1k only & other months RM2.5k. Further no meaningful. Still need another Visa / MC. Considering CIMB CR which cancelled long time ago, now got 0.2% unlimited cash back. You can explore combination of M2 Amex + Boost. Top up Boost 1k during weekend to get CB 50. You can utilise the 1k any day you like. It’s a waste to cancel M2 Amex. |

|

|

|

|

|

jefftan4888

|

Jun 17 2019, 02:57 PM Jun 17 2019, 02:57 PM

|

|

Good things never last. So enjoy to maximum while still can. 😉

|

|

|

|

|

|

jefftan4888

|

Jun 22 2019, 07:46 PM Jun 22 2019, 07:46 PM

|

|

|

|

|

|

|

|

jefftan4888

|

Jun 22 2019, 07:48 PM Jun 22 2019, 07:48 PM

|

|

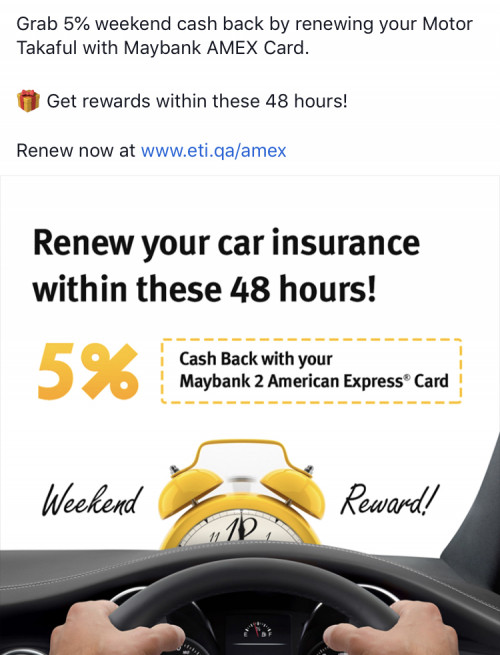

QUOTE(WIS9000 @ Jun 22 2019, 02:22 PM) Tried searching the forum but cannot find a definitive answer, so here goes. Planning to renew my motor insurance via Etiqa that accepts AMEX, will i be eligible for 5% cash back if i do it over the weekend? I do know there's only 1X TP if this is done on weekdays, under the recent revisions on the AMEX terms, but not sure about insurance cash back. Appreciate the advise. See the above. |

|

|

|

|

|

jefftan4888

|

Jun 26 2019, 11:51 AM Jun 26 2019, 11:51 AM

|

|

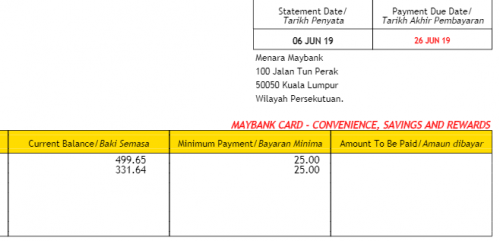

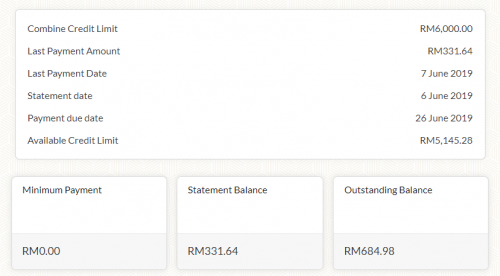

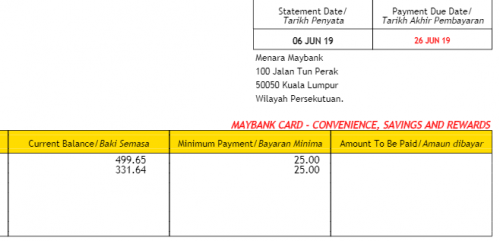

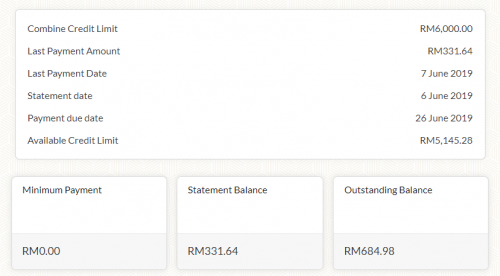

QUOTE(persona93 @ Jun 26 2019, 10:42 AM) hi, good morning i'm a lil confused » Click to show Spoiler - click again to hide... «  the above is my statement, i've paid both amount on the 7th of June below is my Amex balances. does this mean, i have to pay 684.98 by today (since dd is 26/6) or wait for new statement to generate?  i'm really sorry if noob  You are so good boy, never take advantage of weekend RM50 & RM4,500 cash out by Boost.  |

|

|

|

|

|

jefftan4888

|

Jun 29 2019, 01:36 PM Jun 29 2019, 01:36 PM

|

|

Currently I have Maybank 0% EzyPay Instalment Plan with MB 2 Visa, balance is 10/24 instalments, last instalment will be 18 Apr 20. However, card anniversary is Mar 20. MB charged this year service tax on 1 Apr.

Can I transfer the balance of MB 2 Visa to MB FCB so that I can cancel the MB 2 Visa before 1 Apr 20? I'm member since 2011.

|

|

|

|

|

Apr 6 2019, 11:12 AM

Apr 6 2019, 11:12 AM

Quote

Quote

0.0331sec

0.0331sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled