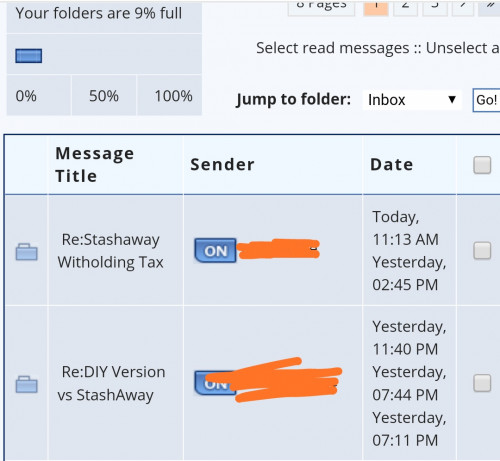

Inb4 ppl say this one is made up. Check time stamp. Check my timestamp of SA post see who troll.

Do a service by giving accurate answer. If not, don't spread misleading info.

StashAway MY, New instrument for Malaysian?

|

|

Mar 7 2019, 06:35 PM Mar 7 2019, 06:35 PM

Show posts by this member only | IPv6 | Post

#1321

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

|

|

|

Mar 7 2019, 06:48 PM Mar 7 2019, 06:48 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

|

|

|

Mar 7 2019, 08:26 PM Mar 7 2019, 08:26 PM

Show posts by this member only | IPv6 | Post

#1323

|

Junior Member

121 posts Joined: Mar 2005 |

QUOTE(alexkos @ Mar 7 2019, 06:22 PM) If asking for clarification of the previously claimed 30% confirm can claim back withholding tax is considered a troll, I'm amazed with the level of groupthink here. I think i have basically answered your question in my earlier post, not sure if you read it or not.And to further insult inquirers who pm me (mod can check my pm box), I have nothing more to add. Hence, for a conclusion, SA is only advantageous in the sense of allowing DCA, and no more. SA eats 0.8% platform fee raining or shining. All the best. Don't fight with money. Cost will kill you in the long run. Bye. QUOTE Just chipping in my 3 sen. I don't disagree with you and in fact agree with you about Stashaway being a relatively good option for ikan bilis investors such as myself. However, as you have pointed out, the 30% withholding taxes claimed back by Stashway/Saxo is only for ETFs that track securities/treasuries/bonds issued by the U.S. Treasury/Government, because such dividend payments are sourced from interest income which are eligible for exemption due to the US tax law on qualified interest income. Such exemption is not applicable for ETFs that track equities like SPY/US domiciled SP500 as mentioned by alexkos or VTSAX/VTWAX, since their dividend payments are sourced from profits of the underlying corporations held. So for ETFs that track equities, notwithstanding other advantages, Stashaway does not appear to have much relative advantage over hooting the ETFs directly in terms of the 30% withholding tax situation. Based on the information provided by Honsiong, Stashaway can and does help to claim back the 30% withholding taxes for ETFs that track securities/treasuries/bonds issued by the U.S. Treasury/Government. As far as I know, this is the only exemption for Msia citizens which have no tax treaty with the US. For ETFs that track equities like SPY/US domiciled SP500, whether you buy directly thru captrader or we hold them thru SA, the 30% withholding taxes cannot be claimed back due to our status as non-resident and non-us citizen aka alien. So you are right to point out that, in this aspect alone, irish domiciled ETFs with 15% withholding taxes are more cost efficient in the long run. I do agree with you that the people in this thread can get quite sensitive even when you raise a reasonable question about fees charged by SA. Nevertheless, no one here owes you any due diligence to check their info. If you want a reliable answer then SA customer support is the best choice you got. This post has been edited by pinan: Mar 7 2019, 08:29 PM |

|

|

Mar 7 2019, 08:31 PM Mar 7 2019, 08:31 PM

Show posts by this member only | IPv6 | Post

#1324

|

Senior Member

2,275 posts Joined: Jun 2010 |

ok case closed. SA don't have withholding tax dividend advantage. Hope everyone benefit.

|

|

|

Mar 7 2019, 08:49 PM Mar 7 2019, 08:49 PM

Show posts by this member only | IPv6 | Post

#1325

|

Senior Member

3,541 posts Joined: Mar 2015 |

QUOTE(Krv23490 @ Mar 7 2019, 06:48 PM) Thanks bro. No boss here, kuli only. Based on my answers to the questionairres and age group (I guess), I was given a risk index of 14. I also opened a second portfolio and manually adjusted the risk index to 18. So I can compare both portfolios in the future. |

|

|

Mar 7 2019, 09:00 PM Mar 7 2019, 09:00 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(Vanguard 2015 @ Mar 7 2019, 08:49 PM) Thanks bro. No boss here, kuli only. 14 and 18 not much diff I suppose.Based on my answers to the questionairres and age group (I guess), I was given a risk index of 14. I also opened a second portfolio and manually adjusted the risk index to 18. So I can compare both portfolios in the future. |

|

|

|

|

|

Mar 7 2019, 09:46 PM Mar 7 2019, 09:46 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

QUOTE(Vanguard 2015 @ Mar 7 2019, 08:49 PM) Thanks bro. No boss here, kuli only. Try 36 ? maybe can see the difference betterBased on my answers to the questionairres and age group (I guess), I was given a risk index of 14. I also opened a second portfolio and manually adjusted the risk index to 18. So I can compare both portfolios in the future. |

|

|

Mar 7 2019, 10:11 PM Mar 7 2019, 10:11 PM

Show posts by this member only | IPv6 | Post

#1328

|

Senior Member

2,839 posts Joined: Jan 2003 From: KL |

QUOTE(Vanguard 2015 @ Mar 7 2019, 08:49 PM) Thanks bro. No boss here, kuli only. The given risk index is just a recommendation am i right? U can always raise that to the max instead of creating another portfolio with almost near risk indexesBased on my answers to the questionairres and age group (I guess), I was given a risk index of 14. I also opened a second portfolio and manually adjusted the risk index to 18. So I can compare both portfolios in the future. |

|

|

Mar 7 2019, 11:41 PM Mar 7 2019, 11:41 PM

Show posts by this member only | IPv6 | Post

#1329

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

|

|

|

Mar 8 2019, 07:39 AM Mar 8 2019, 07:39 AM

Show posts by this member only | IPv6 | Post

#1330

|

Senior Member

3,541 posts Joined: Mar 2015 |

Thanks for the replies. I think you guys are right. Not much difference between risk index 14 and 18.

Maybe I should have 2 different portfolios with risk index 14 and 28-30. Then I can see the difference. |

|

|

Mar 8 2019, 07:55 AM Mar 8 2019, 07:55 AM

|

Senior Member

2,175 posts Joined: Mar 2016 |

|

|

|

Mar 8 2019, 07:56 AM Mar 8 2019, 07:56 AM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(Vanguard 2015 @ Mar 8 2019, 07:39 AM) Thanks for the replies. I think you guys are right. Not much difference between risk index 14 and 18. 36 for adventure 70%Maybe I should have 2 different portfolios with risk index 14 and 28-30. Then I can see the difference. 20 for core 30% This post has been edited by [Ancient]-XinG-: Mar 8 2019, 07:57 AM |

|

|

Mar 8 2019, 08:56 AM Mar 8 2019, 08:56 AM

|

Junior Member

527 posts Joined: Aug 2007 From: lost |

|

|

|

|

|

|

Mar 8 2019, 09:16 AM Mar 8 2019, 09:16 AM

|

Senior Member

5,752 posts Joined: Jan 2012 |

|

|

|

Mar 8 2019, 01:04 PM Mar 8 2019, 01:04 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

|

|

|

Mar 8 2019, 01:12 PM Mar 8 2019, 01:12 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

Guess it is time for new investor to go in now as the market dropping lately

|

|

|

Mar 8 2019, 01:26 PM Mar 8 2019, 01:26 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

QUOTE(Vanguard 2015 @ Mar 8 2019, 01:04 PM) Sorry I am lost. You don't have to follow other ppl, they make multiple portfolios to play around only. I also invest mainly in 36, then put a bit in 6.5 just to see what happens.Are you suggesting Risk Index 36 for 70% of my cash investment in Portfolio A and Risk Index 20 for the balance 20% cash in Portfolio B? |

|

|

Mar 8 2019, 01:41 PM Mar 8 2019, 01:41 PM

Show posts by this member only | IPv6 | Post

#1338

|

Senior Member

3,541 posts Joined: Mar 2015 |

|

|

|

Mar 8 2019, 01:57 PM Mar 8 2019, 01:57 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(Vanguard 2015 @ Mar 8 2019, 01:04 PM) Sorry I am lost. Eh sorry. Mistake. Are you suggesting Risk Index 36 for 70% of my cash investment in Portfolio A and Risk Index 20 for the balance 20% cash in Portfolio B? Is 70% in core 20 risk index. 30% in risk index 36. This should be ok. But fully depend on your risk appetite too. The percentages and risk index is all up to you |

|

|

Mar 8 2019, 01:59 PM Mar 8 2019, 01:59 PM

|

Senior Member

2,839 posts Joined: Jan 2003 From: KL |

|

|

Topic ClosedOptions

|

| Change to: |  0.0264sec 0.0264sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 08:40 AM |