QUOTE(cheezzzz @ Dec 17 2020, 02:53 PM)

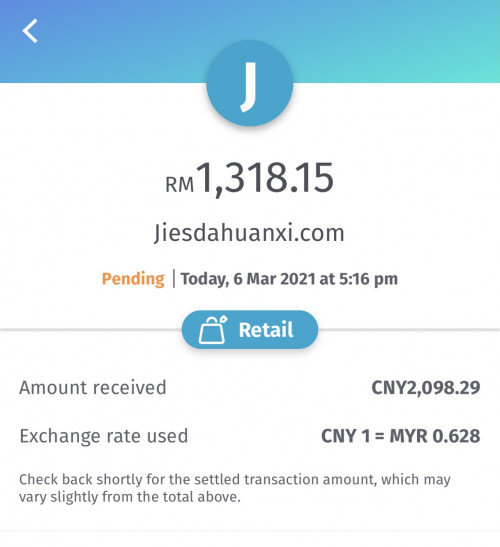

Paypal has a fee and exchange rate when transfer direct to local bank.

So, im thinking - would it be possible to link BigPay debit to PayPal, and then transfer for zero fees - and then withdraw from ATM using bigPay for minimum fees?

Anyone else have any idea on this?

Many years ago, I linked my Paypal to PB Visa Electron (I guess it falls under Debit Card category too).So, im thinking - would it be possible to link BigPay debit to PayPal, and then transfer for zero fees - and then withdraw from ATM using bigPay for minimum fees?

Anyone else have any idea on this?

I have no problem to transfer from Paypal to PB Visa Electron and then withdraw through PB ATM machine (with no charge).

If you transfer more than RM400, it's free.

PS: I'm not sure if Paypal has updated their T&C, as I never withdraw again after 2019/2020.

If anyone has experience with BigPay, please update here. I would like to know too :-)

UPDATE: Please note that not all Debit Card can linked to Paypal. I can't remember exactly, but some of my Debit Card (with Visa/ MasterCard logo) been rejected. I didn't know the reason, as I never asked the bank.

This post has been edited by joetiew: Dec 17 2020, 10:02 PM

Dec 17 2020, 10:00 PM

Dec 17 2020, 10:00 PM

Quote

Quote

0.0697sec

0.0697sec

1.15

1.15

7 queries

7 queries

GZIP Disabled

GZIP Disabled