FI/RE - Financial Independence / Retire Early, Share your experience

|

|

Nov 22 2019, 08:21 PM Nov 22 2019, 08:21 PM

Return to original view | Post

#21

|

Junior Member

156 posts Joined: Sep 2019 |

[/quote] No medical specialist so free in the morning to respond a forumer from a nobody marginalised B40 person lah. He'll be making rounds, seeing patients, etc. The language used, the defence in the response all suggests otherwise, hardly reflect a successful person with estimated sgd 15-20million, to generate a sgd500k annualised passive income. He couldn't be getting 10% dividend, more likely 3-5% dividend. You really think a high calibre medical professionals, need to seek inputs from this Malaysia forum... To get acceptance from B40s, retirees, small time players, Malaysian millionaires, that he shud retire...Or a fake try to glorify his fantasies? Siao le!!! Fake lah!!! Take whole packet of salt lah,.. A pinch not enuf. |

|

|

|

|

|

Nov 23 2019, 11:54 AM Nov 23 2019, 11:54 AM

Return to original view | Post

#22

|

Junior Member

156 posts Joined: Sep 2019 |

[quote=Bora Prisoner,Nov 23 2019, 08:09 AM]

Your calculation could be right,... 20mil, could generate 500K per year at 2.5% return. That's why I need to see his portfolio too, observes how he segregates his instruments and how he diversifies. If he does not reply,... then too bad,.. maybe 'unreal' then. [/quote]  you all still layan ka? [/quote] Thanks, Bro. I close this specific subject. To me although a public forum, it's susceptible to online fraud. Evil wins when the good does nothing. Might not entice some people with higher EQ nor less naive, etc. But, if we allow such things to happen, will just embolden some criminals to impress others to join their 'investment' n trick some people. Hahaha, I no money to be trick. |

|

|

Nov 23 2019, 07:10 PM Nov 23 2019, 07:10 PM

Return to original view | Post

#23

|

Junior Member

156 posts Joined: Sep 2019 |

|

|

|

Nov 24 2019, 07:52 AM Nov 24 2019, 07:52 AM

Return to original view | Post

#24

|

Junior Member

156 posts Joined: Sep 2019 |

Sifu Master?

Morning. First lesson towards FI/RE is watch a 4 years ago movie... Hubris Of The Jedi? |

|

|

Nov 24 2019, 11:38 AM Nov 24 2019, 11:38 AM

Return to original view | Post

#25

|

Junior Member

156 posts Joined: Sep 2019 |

|

|

|

Nov 24 2019, 02:26 PM Nov 24 2019, 02:26 PM

Return to original view | Post

#26

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(Dd2318 @ Nov 24 2019, 11:38 AM) Sifu Master, Sifu Master, Family @ Shah Alam mall buy groceries. Next lessons to share? The psychology of birth cycles and impact on personalities. Apa Insecurity index? Thank you for sharing, got it... In order to learn FI/RE. I first must understand 3 important words. Hubris - Nemesis - Catharsis. |

|

|

|

|

|

Nov 25 2019, 07:40 AM Nov 25 2019, 07:40 AM

Return to original view | Post

#27

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(Dd2318 @ Nov 24 2019, 02:26 PM) Sifu Master, Sifu Master, Thank you for sharing, got it... In order to learn FI/RE. I first must understand 3 important words. Hubris - Nemesis - Catharsis. Sorry n pls accept my humble apologies. Going forward, will not doubt your wisdom. True to your words, after hubris comes nemesis. We then need to wait for the true leader to rise n show a path towards FI/RE. |

|

|

Nov 25 2019, 03:19 PM Nov 25 2019, 03:19 PM

Return to original view | Post

#28

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(Win Win Inspiration @ Nov 25 2019, 01:32 PM) Someday you will make it my friend. Yes Bro, Have faith in yourself, with diligence, discipline, and execution, you will reach where you want to be in life. Wishing you a great week ahead. I understand now focus on asnb fp n kwsp. For my category of people. I do follow thread on fd promotion. I got enuf on my plate... But interested how more successful people do next. Unless, the higher networth people also just focus on asnb fp n kwsp. Just to elaborate, if the high networth use kwsp n asnb as bedrock of investment. Otherwise, there will be many-many other investment types.... To repeat, what investment as Bedrock? This post has been edited by Dd2318: Nov 25 2019, 03:26 PM |

|

|

Nov 25 2019, 03:41 PM Nov 25 2019, 03:41 PM

Return to original view | Post

#29

|

Junior Member

156 posts Joined: Sep 2019 |

|

|

|

Nov 25 2019, 05:18 PM Nov 25 2019, 05:18 PM

Return to original view | Post

#30

|

Junior Member

156 posts Joined: Sep 2019 |

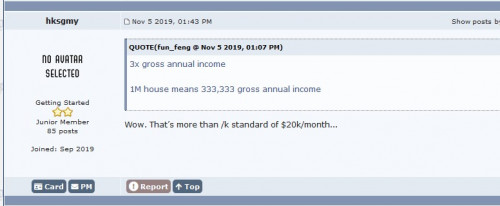

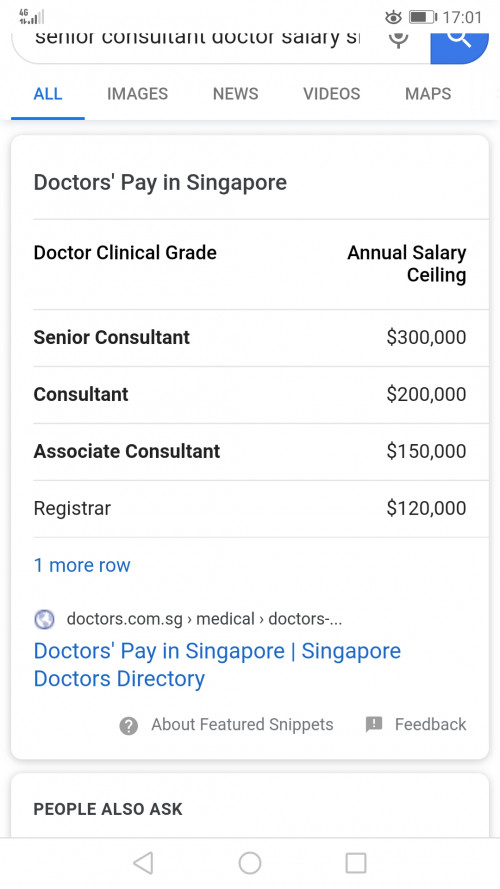

Assuming husband n wife annual income sgd600k, at their current peak earnings.

The wealth generated approx sgd30million, if likely from inheritance, Strike Toto, etc. Then, if made clear as such....Then no quarrels. His good karma. Enjoy! Otherwise, it takes 50 years to accumulate such amount...or 33 years, if based on sgd20million. I will accept. For me personally, not about hubris, nemesis, etc.. But I'm a sucker for hard facts. Docs in Sgp median pay is region sgd7-15k. If specialist, which hospital lah... TTS, Mt E, etc? VPs is Singtel n Dbs [Glassdoor] annual earning sgd250k-350k depending on performance bonus, etc.  |

|

|

Nov 25 2019, 09:16 PM Nov 25 2019, 09:16 PM

Return to original view | Post

#31

|

Junior Member

156 posts Joined: Sep 2019 |

Like guy3288 claimed, with SGD30Mil 'bullets in the warchest', just dumping that warchest into FD can earn 40K per mth. Then no need to talk much already,.. brute force this is, to bro aspartame's term,...

[/quote] Master Sifu, Hahaha, yes, lastly agree... I just had a bone to pick. If the author just started with a sgd30mil networth.... No quarrels. But, he started story of being a specialist etc, alluding to the build up of current wealth. I felt its was pure misinformation. Part of my stubborn attitude, limiting my career advancement. Peace! Here to learn about wealth creation not pick bones. Thank you Master Sifu for the patience. |

|

|

Nov 27 2019, 10:00 AM Nov 27 2019, 10:00 AM

Return to original view | Post

#32

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(LoTek @ Nov 27 2019, 09:06 AM) Yup.. Get ready, and be forewarned. Next, we're gonna compare length of chest hair, and correlate that to accumulated wealth n intelligence levels. But seriously, start by sharing the Bedrock of your investments,.. Asnb %, Kwsp %, Sgp Reits %, FAANG stocks %, etc. No need to disclose absolute $$.... As a reader n learner, I wud appreciate that. Thank you. This post has been edited by Dd2318: Nov 27 2019, 10:09 AM |

|

|

Nov 27 2019, 11:31 AM Nov 27 2019, 11:31 AM

Return to original view | Post

#33

|

Junior Member

156 posts Joined: Sep 2019 |

I'll go talk to akib_mullen abt buying AUDJPY then,...

[/quote] Master Sifu, For those forumers really concerned abt recession n run for safety asset like USD$. How do we go about it.. If a person wants to buy US$100 vs US$100K. Major consideration is minimize exchange loss, high integrity n quick processing time. Is it thru mamak currency exchange, banks or other instruments. Thank you. This post has been edited by Dd2318: Nov 27 2019, 11:33 AM |

|

|

|

|

|

Nov 27 2019, 11:41 AM Nov 27 2019, 11:41 AM

Return to original view | Post

#34

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(LoTek @ Nov 27 2019, 11:34 AM) Can we put all these behind us before another good thread gets sent to kopitiam? 🏅 Yes Bro LoTek, seen u active in now defunked asnb thread...thank you for the most helpful sharing. Asnb FP still very relevant. To answer Q above, I have 40% of liquid assets in Asnb, 55% in FD and a paltry 5% in UT. Own a couple of leveraged properties. P.s., D.o.b 199X. Hope to achieve true independence by 30 yrs old, more than 80% of income going towards investment or savings. Any experience to share on buying USD? |

|

|

Nov 27 2019, 07:36 PM Nov 27 2019, 07:36 PM

Return to original view | Post

#35

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(hksgmy @ Nov 27 2019, 06:24 PM) I apologize if feathers were ruffled (for reasons best known to those who got their knickers in a knot) by the thread I started in another section, and I appreciate the mature way in which the primary purpose of this discussion was brought back into focus. Awesome!!!! Enjoy Good karma! Anyway, to put a simple perspective into some of the finer aspects of what I said: I'm nearly 50 years old. I've been working in Singapore for more than 25 years, the last 15 years in private practice. The first 10 years as a doctor in the government service, and I rose to the rank of a consultant. Let's just focus on the last 15 years. As I've previously alluded, a consultant with the same seniority and experience in the same specialty (I'd rather keep that private & confidential) is expected to make about S$3,000,000 to S$4,000,000 gross per annum. Suffice to say, consultation fees make up only a modest portion of our earnings. Sure, we charge $150 to $200 for a standard consultation, but it's still only a small part of the overall income. Theatre fees/procedural fees/special medications make up a far larger bulk. These are obviously not medications you'd rock up to your local pharmacy to buy. Biologics, Immunotherapy drugs - these are highly specialized, extremely expensive medications that can and must only be dispensed by qualified professionals. As an example, just by adhering to a mark-up of 20% on the cost price as per guidelines, it’s a fair profit of at least $1,000 - $2,000 per injection (check out Xolair, Humira, Enbrel, Dupixent, Stelara just to quote you a few examples). Those are the kind of figures I'm referring to. Like I said, 一山比一山高. I’m not talking about a script for Panadol or Piriton here. The best paymasters are not the local Singaporeans, but my patients from Indonesia, Vietnam, Myanmar and even Malaysia (ironic). Multiply that with the last 10 (not even 15) years of private practice, and you'll figure out why a post-tax "war chest" of about S$30,000,000 is not actually that far off the mark (kudos to the person who worked it out backwards). Bear in mind also that my wife works as a chartered accountant, we have no children & we are both used to (as Malaysian Chinese) the culture of working twice as hard to receive half as much. We delay our need for gratification, and we don't feel the need to flaunt our income by way of expensive, branded items. I wear an Apple Series 4 watch (after my Apple Series 1's battery finally died), and she still wears the Tag Heuer I bought for her at her graduation in Australia. Our daily living expenses are already more than fully covered by her salary alone (she was previously with one of the big 4 in a senior role, she's now an in-house accountant for better hours), with change to spare. Also consider our attitude towards housing: despite owning private properties in Singapore (and Australia), we continued to live in our humble little HDB flat that we bought the minute we qualified as PRs back when we first came down to Singapore. The savings alone, in living a humble existence, is not something to scoff at. This arrangement continued until our neighbours whom we've gotten to know very well moved away & new ones came in. One of the new neighbours got into some trouble with loan sharks and his house was spray-painted & his shoe rack was set on fire. That was our cue to make like a bat out of hell, right out of the neighbourhood. We also don't drive flashy cars. She made do with our first car until the wheels fell off (a Honda City, then upgraded to a C-class which she's still driving), and I drive an S-class after the wheels fell off my old E-class (the W211 version). I know some of my colleagues or her friends of similar status would be zipping about town in their Ferraris and Porsches, and there’s absolutely nothing wrong with their automotive choice, but that's simply just not our style. My medical studies were also fully funded by the Colombo Commonwealth Plan scholarship, and included a very generous stipend. So, upon graduation, I had no debt and I’ve worked very hard all my life to avoid debt. My wife’s 1st year in her accountancy degree was initially paid for by my parents, but she applied herself diligently and obtained a University scholarship that covered tuition fees and since we both studied in Australia, my stipend was more than enough for both our living expenses. In this sense, we already had an advantage compared to many of our peers – being debt free from right off the bat. So that’s a little bit on our background. In the spirit of this thread, I'll share with you my portfolio (obviously, no need for hard numbers, just %) 50% liquid investments - in SGD & AUD (10:5 ratio) 50% properties - in Singapore & Australia. We've consolidated our property portfolio. We used to have units in Auckland & KL, but sold those as there were too many tax jurisdictions to worry about, and I couldn't do this full time. Of the liquid assets, I have them split up as follows: 50% bonds (Senior subordinated, Tier 1 or Tier 2, rated - never junk grade) – bond issues from UOB, DBS, OCBC, Sembcorp Industries (not Marine), Credit Suisse, SIA, Wing Tai, Guocoland, SCB, HSBC, and in Australia, I favour Westpac, NAB, ANZ. As you can see, I'm heavily into banks. If they collapse, I'll probably jump from the proverbial 14th floor so beloved in /k. The average return ranges from 3.5% - 5%. If I were to sell off all of the bonds right now, the only 2 bonds that I would lose money on would be Sembcorp Industries & SIA. All the others are in positive territory. A lot of the bonds are also perpetual issues, with a call date some 10 years down the road. This does help with financial planning & stability somewhat. 10% in SGX blue chip stocks - the dividend yields are decent, if not overly exciting. I'd say they pay on average 5-6% returns. 20% in index-tracked stocks, with memory knock-out feature. Mainly in FMCG and consumer/entertainment stocks - like Starbucks, McD, VISA, Mastercard, Pepsi, Disney (by far my best investment so far) and Yum foods. These are slightly riskier assets, but they have paid 8-10% on average. I also have these in Pharma stocks, obviously, as I’m a little more attuned to potential sensitivities brewing in this industry. The key thing here is that I have no issues getting knocked in, should the share prices fall below the threshold, as these counters are also blue chips. I’ll just switch over from collecting the 8% to receiving the dividend payments instead. 20% in cold, hard cash (SGD & AUD). I'm lucky that I managed to lock in the bulk of my AUD savings in 60 - 80 month time deposits, so those are still paying nearly 8% in interest (non-compounded), but I'll have a major headache when those good deals run out in a couple of years' time. As for my SGD, because of my relationship with the bank, I get a special 2.25% return to keep my money with them. The rate is reviewed/renewed every quarter, but they've kept it more or less the same for a while now. Some may say that we’re quite silly to keep this portion in low returns of cash, but it does give us a bit of flexibility and there’s always emergencies that having a bit of money at hand would be helpful. We also have an annuity plan that will pay us a comfortable income upon official retirement ($10,000 per month in total). We bought ours from AIA. Of the 50% in properties, we have a mix of residential and commercial units. We are receiving at least 3 – 4% in rental returns. The relatively higher yield is from the fact that we own a couple of commercial shop houses, which are in quite good locations with good traffic footfall. In additional to residential properties in Australia, we also have a couple of medical suites bought in Australia, rented out to my classmates from University (oh, what a small world!) Those are paying quite good returns too – about 5% per annum. In my opinion, the crucial factors that some detractors might have missed in their initial scepticism are: 1. Us being totally debt free upon graduation 2. Singapore’s meritocratic system being a haven for talent – they do recognize & reward performance 3. Singapore’s position as a regional medical hub (for me) & a regional headquarters for many MNCs (my wife) 4. The Singapore dollar being stable & relatively strong against major currencies 5. The Australia dollar peaking at 1.31 against the SGD some years ago – I liquidated ALL of my AUD and converted them into SGD at nearly the highest point (having accumulated AUD at an average buy in price of 1.02 – 1.03 over the preceding years leading to that spike) 6. My wife and I being debt free, and without obligations to our elders (my parents passed away many years ago, as has her dad, and she’s estranged from her gambler of a mother) 7. We have no children – so no need to plan for their education costs So, if you do your sums and add all of that up, you’ll realise that what I quoted, in terms of passive returns of $40,000 to $50,000 a month is easily achievable – and that’s honestly, me being on the conservative side. I will still be working full time in Singapore for the next 2 or 3 years, so I do expect to increase the portfolio significantly, before we make the move over to Sydney to retire. Thank you for the opportunity to clarify myself. Noble profession paying forward more good karma! |

|

|

Nov 28 2019, 04:51 AM Nov 28 2019, 04:51 AM

Return to original view | Post

#36

|

Junior Member

156 posts Joined: Sep 2019 |

|

|

|

Dec 1 2019, 08:44 PM Dec 1 2019, 08:44 PM

Return to original view | Post

#37

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(thesoothsayer @ Dec 1 2019, 07:42 PM) Well, they expect people without health problems to work up to 65. An extra 10 years of income and 20% savings translates to much more money after retirement. My wealthy Mgr tells me... Unless you have million-million in the bank, don't retire. If you were to retire at 55, your EPF may not be enough if you're not a high income earner. Nothing more depressing than having too much free time, but not enuf passive-replacement income. A better alternative is work, maintain 100% income lifestyle, till u drop dead. I hope to work till 60, 62, 65, 67...whichever later. |

|

|

Dec 3 2019, 09:52 AM Dec 3 2019, 09:52 AM

Return to original view | Post

#38

|

Junior Member

156 posts Joined: Sep 2019 |

QUOTE(magika @ Dec 3 2019, 09:44 AM) Its a really a matter of your earning capabilities. High income earners who can safely accumulate their retirement fund by their own earnings does not have to take any risk or should take any risk. Middle income earners with their projected savings who most likely could not meet their targeted amount should take more risk and worse to worse they will work until they drop. My farewell post to all respected contributors, Those who retired with acheived targetted fund should be very much risk averse in order to peacefully enjoy their retirement. Company approved my posting to Singapore. Gonna be foreign worker there by end Dec, n family stay back Malaysia. Thank you all for the sharing n daring. I wish everyone a safe n meaningful journey. |

|

Topic ClosedOptions

|

| Change to: |  0.1073sec 0.1073sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 07:36 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote