QUOTE(Win Win Inspiration @ Aug 24 2020, 04:52 PM)

Keep praying that day comes sooner than later... Want to vroom life while I still can at 100%... QUOTE(chidori @ Oct 1 2020, 12:52 PM)

Dear sifus,

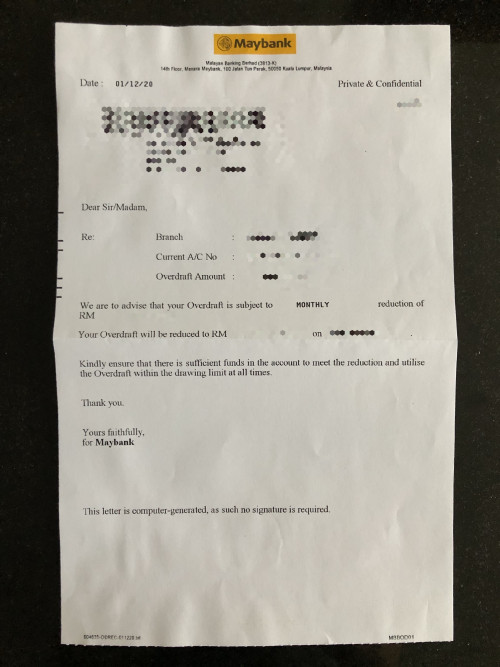

Would like to seek your advice regarding Maybank house bank loan.

Mortgage loan package: Maybank conventional loan

Loan details (Date: 30 Sept 2020)

Outstanding loan: 200,000

Advanced payment: 10,000

Monthly payment: 800

After checking today (Date:1 Oct 2020)

Interest charged: 600

Outstanding loan: 200,600

Advanced payment: 9,200

From my understanding, should the outstanding loan (principle) reduced to 199,800 since the interest charged is 600? Because 800 was deducted from advanced payment.

Hope to get some clarification before contacting bank.

Have a nice day!

Hmm, logically yeah it should be 199,800. Typical interest charged and loan repayment deduction for the month. Hmmm, perhaps it's still some post-moratorium glitch their system is ironing out? If by end of Monday or Tuesday it's still as is. and you are sure no repayments were skipped during the moratorium period? Just check loan transactions history for dates, etc (checked and the past 6 months is displayed as default)... I suggest you give HQ a call to hear what they have to say about it. HQ yeah and not going to some smaller branch to ask. Did that recently just to be sure that all is in order and the consultant told me they don't have access to check "intimate details" about one's account. Only HQ can.Would like to seek your advice regarding Maybank house bank loan.

Mortgage loan package: Maybank conventional loan

Loan details (Date: 30 Sept 2020)

Outstanding loan: 200,000

Advanced payment: 10,000

Monthly payment: 800

After checking today (Date:1 Oct 2020)

Interest charged: 600

Outstanding loan: 200,600

Advanced payment: 9,200

From my understanding, should the outstanding loan (principle) reduced to 199,800 since the interest charged is 600? Because 800 was deducted from advanced payment.

Hope to get some clarification before contacting bank.

Have a nice day!

This post has been edited by voncrane: Oct 2 2020, 04:16 PM

Oct 2 2020, 04:15 PM

Oct 2 2020, 04:15 PM

Quote

Quote

0.0340sec

0.0340sec

0.62

0.62

6 queries

6 queries

GZIP Disabled

GZIP Disabled