Outline ·

[ Standard ] ·

Linear+

LHDN Tax filing

|

aizielectreon

|

Apr 3 2019, 12:52 PM Apr 3 2019, 12:52 PM

|

|

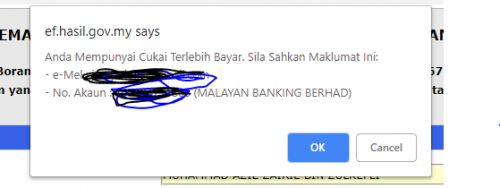

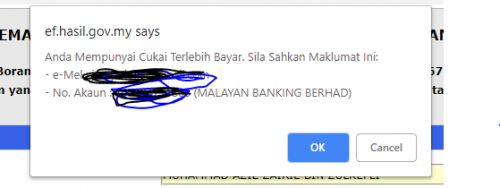

hello guys, i bought three smartphones in 2016 (for my wife) 2017 for me 2018 for me can i claim back? first time i want to claim. i just start paying my tax in 2017. first time wants to claim here.. i just re did my tax..and i got this..  does this mean they gonna pay me back in full amount or is there any reduction? This post has been edited by aizielectreon: Apr 3 2019, 04:23 PM |

|

|

|

|

|

aizielectreon

|

Apr 3 2019, 10:13 PM Apr 3 2019, 10:13 PM

|

|

QUOTE(pisces88 @ Apr 3 2019, 09:59 PM) They will refund your extra payments. Looks like u got pcb deduction every month? So u get back some refund lo Yeah i got deduction every month from my pay... I noticed that if gave pocket money to parents also can get tax relief.. But for parents more than 60 years old. My single mom just turns sweet 53 this year Btw i maxed out the lifestyles tax relief. Rm2500. Bought phone last year. This post has been edited by aizielectreon: Apr 3 2019, 10:14 PM |

|

|

|

|

|

aizielectreon

|

Apr 4 2019, 11:02 AM Apr 4 2019, 11:02 AM

|

|

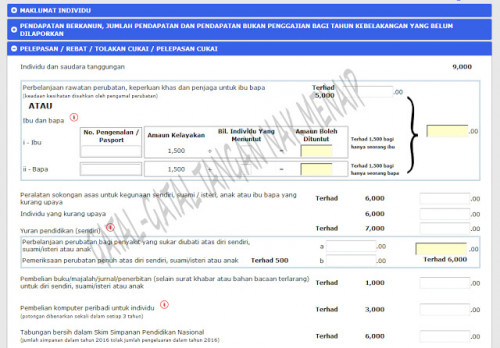

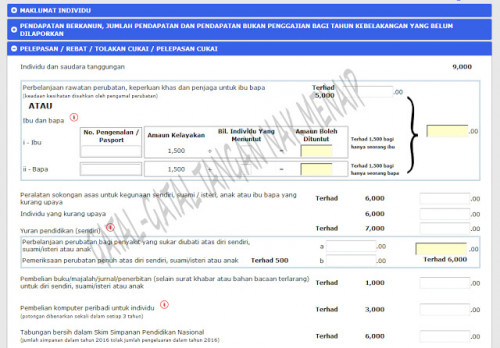

QUOTE(Sean77 @ Apr 4 2019, 12:56 AM) But how to prove the pocket money given? Resit? Lol And this pocket money under what exemption bro? Here..  idk about you, but i online transfer every month.. should have kept the payment slip as proof. but only >60 years old parents! |

|

|

|

|

|

aizielectreon

|

Apr 4 2019, 04:26 PM Apr 4 2019, 04:26 PM

|

|

QUOTE(Level 60 Wizard @ Apr 4 2019, 01:57 PM) i have been wanting to ask this as well the RM1.5k per mum/dad each...i think is not limited to medical-related stuffs i think one can jst claim if their parent more than 60yrs old...it's kind of like...yearly expenses for them but i could be wrong..so anyone can verify/clarify that? inb4 call aje LHDN hotline Yes you can..ln layman term, pocket money to mom and dad plus medical expenses for them |

|

|

|

|

|

aizielectreon

|

Apr 4 2019, 05:16 PM Apr 4 2019, 05:16 PM

|

|

QUOTE(fuzzy @ Apr 4 2019, 05:11 PM) I was refering to "Yes you can..ln layman term, pocket money to mom and dad plus medical expenses for them" There is no plus, it's either pocket money 3k or medical 5k. oooo ok..thanks  |

|

|

|

|

|

aizielectreon

|

Apr 4 2019, 11:38 PM Apr 4 2019, 11:38 PM

|

|

QUOTE(Bensonc @ Apr 4 2019, 06:08 PM) Hi, can I claim tax under lifestyle for my Digi infinite 100 plan? can |

|

|

|

|

|

aizielectreon

|

Apr 4 2019, 11:39 PM Apr 4 2019, 11:39 PM

|

|

QUOTE(Sean77 @ Apr 4 2019, 05:34 PM) Hv u claimed before this? I believe these are for old parents medicals and special support tools, need bills, not those usual monthly pocket money nope..my mom still young. 53 years old |

|

|

|

|

|

aizielectreon

|

Apr 10 2019, 03:32 PM Apr 10 2019, 03:32 PM

|

|

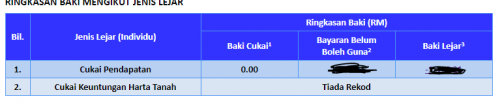

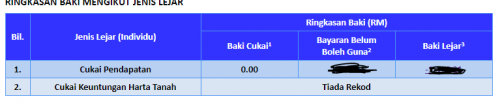

what is the meaning of negative value in e-lejar, under baki lejar^3? i owe them or they or me? lmao last week i submitted..seems like the owe me RM1k something.  |

|

|

|

|

|

aizielectreon

|

Apr 10 2019, 03:53 PM Apr 10 2019, 03:53 PM

|

|

QUOTE(meteoraniac @ Apr 10 2019, 03:33 PM) they owe u but this is for 2019 not 2018 uh..so they gonna pay me back next year or what? haha because i have this Pengesahan Penerimaan e-BE bagi tahun taksiran 2018 > Lebihan Bayaran Taksiran 2018 = RM1,231.32 |

|

|

|

|

|

aizielectreon

|

Mar 21 2022, 04:49 PM Mar 21 2022, 04:49 PM

|

|

i need to pay RM5.45. wtf

thought tax relief i got some extra cash but have to fork out 5 henggettttt

This post has been edited by aizielectreon: Mar 21 2022, 04:50 PM

|

|

|

|

|

|

aizielectreon

|

Mar 16 2023, 08:52 PM Mar 16 2023, 08:52 PM

|

|

dash cam can claim or not? lol..

|

|

|

|

|

|

aizielectreon

|

Mar 12 2024, 10:12 AM Mar 12 2024, 10:12 AM

|

|

guys i worked in 3 companies so how to declare?

total all income?

This post has been edited by aizielectreon: Mar 12 2024, 10:13 AM

|

|

|

|

|

|

aizielectreon

|

Mar 12 2024, 11:19 AM Mar 12 2024, 11:19 AM

|

|

QUOTE(miaopurr @ Mar 12 2024, 10:23 AM) last time i add up all income je ok QUOTE(nelson969 @ Mar 12 2024, 10:23 AM) 1. u got 3 EA form ? if no do your best to calculate with the payslip if u have any , if lhdn suka suka audit u u better come up with evidence. 2. yes your number of employer is 3 , add up all the gross salary ( salary+ bonus + benefit + benefit in kind etc at the Total ) 3. topkek , pay more tax, thank u for contribution to nation 1. ya i got 2 now waiting for the last one. but only 1 got PCB. 2. ok add up all 3. you are welcome. now i can brag how much tax i paid.  |

|

|

|

|

|

aizielectreon

|

Mar 15 2024, 01:12 PM Mar 15 2024, 01:12 PM

|

|

QUOTE(fazlythewarrior @ Mar 14 2024, 11:02 AM) Speaker dah hantar borang BE and ada lebihan. Dekat mana nak request refund? auto xpyh request kalau ada lebihan |

|

|

|

|

|

aizielectreon

|

Mar 15 2024, 01:14 PM Mar 15 2024, 01:14 PM

|

|

bros..

i worked 3 companies

1. as director

2. normal employee for the other two

director no gaji only fee

so i just add up all and total only right?

|

|

|

|

|

|

aizielectreon

|

Mar 15 2024, 01:32 PM Mar 15 2024, 01:32 PM

|

|

QUOTE(Avangelice @ Mar 15 2024, 01:25 PM) Don't tell me your companies don't have accountant to help fill ur EA? i got all 3 ea forms just i thought off adding all up |

|

|

|

|

|

aizielectreon

|

Mar 15 2024, 01:41 PM Mar 15 2024, 01:41 PM

|

|

i bought house but need clarification how to calculate the "Perbelanjaan faedah atas pinjaman yang dilakukan semata-mata untuk menghasilkan pendapatan sewa tersebut" need to count interest out of the loan per month? there is no interest charged stated in the bank transaction. only AUTOMATED LOAN PYMT TO XXXXXXXXX AT PJO X,XXXX.XX do i just add up how much loan i paid last year? just called public bank hais i need to email them to know how much interest paid for last year  This post has been edited by aizielectreon: Mar 15 2024, 02:03 PM This post has been edited by aizielectreon: Mar 15 2024, 02:03 PM |

|

|

|

|

|

aizielectreon

|

Apr 1 2024, 04:37 PM Apr 1 2024, 04:37 PM

|

|

oh man.

i sent and paid the tax.

i forgot to declare the HOUSE..how laa

|

|

|

|

|

|

aizielectreon

|

Apr 2 2024, 10:36 AM Apr 2 2024, 10:36 AM

|

|

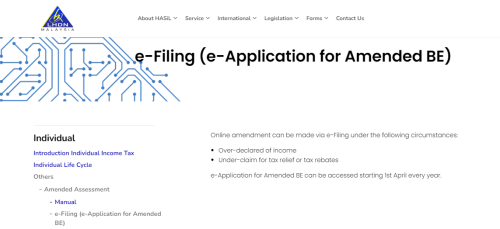

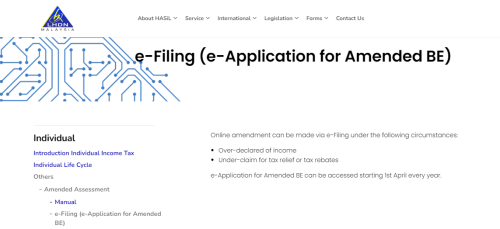

QUOTE(nelson969 @ Apr 2 2024, 09:07 AM) your only choice is to go lhdn department and amend it, but this will cause likely to be audit, be prepare. You cannot do online due to not following any 2 point mention below.  haiz..lhdn dept here i come.. ok i have been audited once in 2019.. |

|

|

|

|

Apr 3 2019, 12:52 PM

Apr 3 2019, 12:52 PM

Quote

Quote

0.1426sec

0.1426sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled